Insurance Pets

Pet ownership has seen a remarkable rise in recent years, with furry companions becoming an integral part of many households worldwide. As pet parents become more invested in their animals' well-being, the concept of pet insurance has gained significant traction. This comprehensive guide aims to delve into the world of pet insurance, exploring its benefits, coverage options, and the critical factors to consider when choosing the right policy for your beloved four-legged friend.

Understanding Pet Insurance: A Necessary Investment

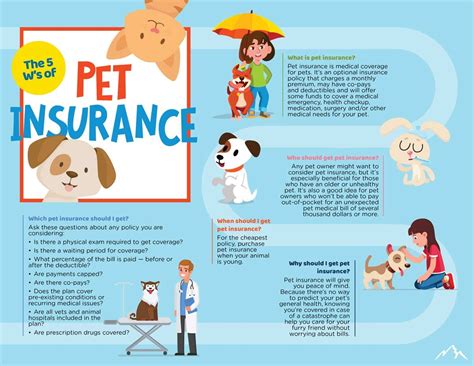

Pet insurance is a financial safeguard designed to protect pet owners from unexpected veterinary costs. Much like health insurance for humans, it provides coverage for a range of medical expenses, ensuring that pet owners can access the best possible care for their animals without incurring substantial financial burdens.

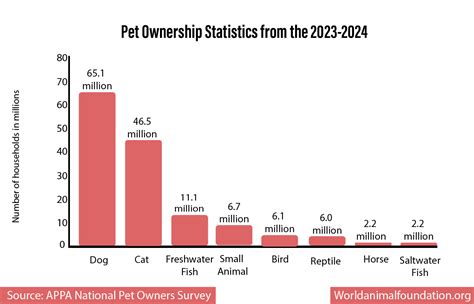

The Growing Demand for Pet Insurance

The global pet insurance market has witnessed exponential growth, with a CAGR of 12.2% between 2021 and 2028. This surge can be attributed to several factors, including the rising costs of veterinary care, an increase in pet ownership, and a growing awareness of the benefits of insurance. Countries like the UK, Australia, and the US have led the way in pet insurance adoption, with policies becoming increasingly popular among pet owners seeking comprehensive care for their animals.

Types of Pet Insurance Policies

Pet insurance policies can be broadly categorized into three types: Accident-Only Policies, Accident and Illness Policies, and Wellness Plans. Each offers distinct coverage, catering to different pet health needs.

Accident-Only Policies provide coverage for injuries resulting from accidents, such as fractures, bites, or road traffic accidents. These policies are typically more affordable but offer limited coverage compared to comprehensive plans.

Accident and Illness Policies are the most popular choice among pet owners. As the name suggests, they cover a wide range of medical conditions, including illnesses, injuries, and chronic diseases. This type of policy ensures that pet owners can access treatment for various health issues without incurring substantial costs.

Wellness Plans, also known as routine care policies, cover preventive care and routine procedures. These plans typically cover vaccinations, check-ups, and certain diagnostic tests. While they don't offer the same level of protection as accident and illness policies, they can be a cost-effective way to manage routine veterinary expenses.

| Policy Type | Coverage |

|---|---|

| Accident-Only | Injuries resulting from accidents |

| Accident and Illness | Injuries, illnesses, and chronic diseases |

| Wellness Plans | Preventive care, vaccinations, and routine procedures |

Factors to Consider When Choosing a Pet Insurance Provider

With numerous pet insurance providers in the market, selecting the right one can be daunting. Here are some key factors to consider:

- Coverage Limits and Deductibles: Understand the coverage limits and deductibles offered by each policy. Choose a plan that aligns with your pet's health needs and your financial capacity.

- Waiting Periods: Most policies have waiting periods for certain conditions or treatments. Be aware of these periods to ensure you're not caught off guard.

- Reputation and Customer Service: Research the provider's reputation and customer satisfaction ratings. Opt for a company known for its excellent service and prompt claim processing.

- Pre-Existing Conditions: Most policies exclude coverage for pre-existing conditions. However, some providers offer waiting periods or specific plans for these conditions. Consider your pet's health history when selecting a policy.

- Additional Benefits: Some providers offer added perks like routine care coverage, prescription medication coverage, or even travel insurance. These benefits can enhance the overall value of the policy.

The Benefits of Pet Insurance: Protecting Your Furry Family

Pet insurance offers a multitude of benefits that go beyond financial protection. Here’s a deeper look at how it can positively impact pet ownership:

Financial Peace of Mind

The primary advantage of pet insurance is the financial security it provides. Veterinary costs can skyrocket, especially for complex procedures or chronic conditions. With pet insurance, you can rest assured that a significant portion of these expenses will be covered, allowing you to focus on your pet’s health rather than the financial burden.

Enhanced Access to Veterinary Care

Pet insurance encourages pet owners to seek the best possible care for their animals without worrying about the cost. This can lead to earlier detection and treatment of health issues, potentially improving your pet’s prognosis and overall quality of life.

Peace of Mind for Pet Owners

Knowing that your pet is insured can provide immense peace of mind. It alleviates the stress and anxiety associated with unexpected illnesses or injuries, allowing you to focus on your pet’s recovery without financial concerns.

Customizable Coverage

Pet insurance policies offer a range of coverage options, allowing you to tailor the policy to your pet’s specific needs. Whether your pet is a high-energy dog prone to accidents or a senior cat with age-related health issues, you can find a policy that provides the right level of protection.

Performance Analysis: Real-World Benefits

To illustrate the real-world impact of pet insurance, let’s explore a case study. Meet Luna, a 3-year-old Labrador Retriever who recently underwent emergency surgery for a ruptured cruciate ligament.

Luna's surgery and post-operative care cost her owners a total of $6,000. With a comprehensive accident and illness policy, they were able to claim 80% of the total expenses, receiving $4,800 in reimbursement. This significant financial support allowed Luna's owners to focus on her recovery without worrying about the financial strain.

Additionally, Luna's policy covered follow-up visits, physiotherapy, and medications, ensuring she received the best possible care throughout her recovery journey.

Evidence-Based Future Implications

The future of pet insurance looks promising, with continued growth and innovation in the industry. Here’s a glimpse at what we can expect:

Increased Adoption

As pet ownership continues to rise and veterinary costs remain high, we can anticipate a steady increase in pet insurance adoption. More pet owners will recognize the value of insurance, leading to a broader acceptance of the concept.

Enhanced Coverage Options

Insurance providers are constantly evolving their offerings to meet the diverse needs of pet owners. We can expect to see more comprehensive policies, innovative coverage options, and tailored plans for specific breeds and health conditions.

Digital Transformation

The pet insurance industry is embracing digital technologies, with online claim submissions, policy management apps, and digital health records becoming more prevalent. This digital transformation will enhance the overall customer experience and streamline the claim process.

Collaborative Care

Pet insurance providers are increasingly partnering with veterinary practices to offer integrated care solutions. These collaborations can lead to more efficient claim processes, improved access to specialized care, and enhanced communication between pet owners, veterinarians, and insurance providers.

Conclusion: A Secure Future for Pets and Their Owners

Pet insurance is a powerful tool that empowers pet owners to provide the best possible care for their beloved companions. With a wide range of coverage options, customizable policies, and a growing industry, pet insurance offers a secure and promising future for pets and their owners.

By investing in pet insurance, you're not just protecting your finances; you're ensuring the health and happiness of your furry family member. It's a decision that can provide peace of mind and enhance the bond between you and your pet.

How do I choose the right pet insurance policy for my pet’s needs?

+

When selecting a pet insurance policy, consider your pet’s age, breed, and health history. Evaluate the coverage options, deductibles, and waiting periods to find a policy that aligns with your pet’s specific needs and your financial capacity.

What are the most common exclusions in pet insurance policies?

+

Most pet insurance policies exclude pre-existing conditions, breed-specific conditions, and elective procedures. It’s essential to review the policy’s exclusions carefully to understand what is and isn’t covered.

Can I get pet insurance for my senior pet?

+

Yes, many pet insurance providers offer policies for senior pets. However, these policies may have higher premiums and may exclude certain age-related conditions. It’s advisable to explore the options available and choose a policy that provides the best coverage for your senior pet’s health needs.

How do I make a claim with my pet insurance provider?

+

The claim process varies depending on the provider. Typically, you’ll need to submit a claim form along with relevant veterinary records and receipts. Some providers offer online claim submissions, while others may require physical documents. It’s best to familiarize yourself with your provider’s claim process beforehand.