Wedding Cancellation Insurance

Planning a wedding is an exciting journey filled with dreams and expectations. However, unforeseen circumstances can sometimes lead to the cancellation or postponement of this special day. This is where wedding cancellation insurance steps in as a valuable safeguard for couples, offering financial protection and peace of mind during an otherwise stressful time.

Understanding Wedding Cancellation Insurance

Wedding cancellation insurance, often referred to as wedding insurance, is a specialized form of coverage designed to protect engaged couples from financial losses resulting from the cancellation, postponement, or disruption of their wedding day. This type of insurance provides a safety net, ensuring that the financial investment made in planning the wedding is not entirely lost if unforeseen events occur.

The coverage offered by wedding cancellation insurance typically includes a range of scenarios. These can include severe weather conditions, such as hurricanes or floods, that make it impossible to hold the wedding as planned. It can also cover unexpected illnesses or injuries that prevent the couple or key participants from attending, as well as situations like venue closures or vendor bankruptcies.

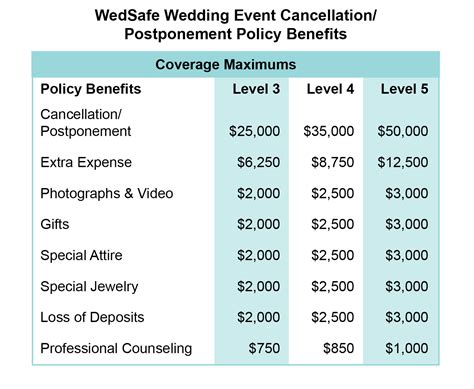

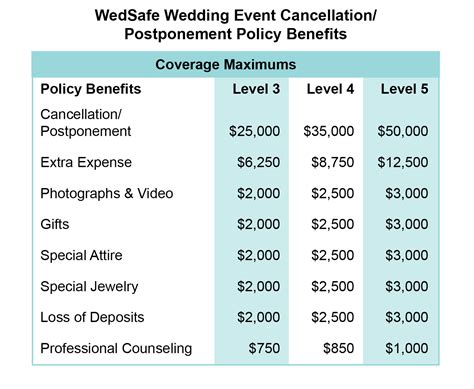

Key Benefits and Coverage Details

One of the primary benefits of wedding cancellation insurance is the protection it provides against non-refundable deposits and payments made to vendors. This can include fees for the venue, caterers, photographers, and other service providers. In the event of a cancellation, the insurance policy can help recoup these expenses, which can be a significant financial burden.

Additionally, wedding insurance often provides coverage for other related expenses. This might include the cost of rescheduling the wedding, additional printing costs for new invitations, or even the expense of rebooking travel arrangements for out-of-town guests. Some policies may also cover the cost of renting replacement wedding attire if the original garments are damaged or lost.

| Coverage Category | Description |

|---|---|

| Cancellation | Reimburses for non-refundable deposits and payments if the wedding is cancelled due to covered reasons. |

| Postponement | Provides coverage for additional expenses incurred when the wedding is postponed to a later date. |

| Vendor Bankruptcy | Protects against losses if a hired vendor goes bankrupt or fails to provide the agreed-upon services. |

| Natural Disasters | Covers cancellation or postponement due to natural disasters like hurricanes, floods, or earthquakes. |

| Medical Emergencies | Provides reimbursement if the wedding needs to be cancelled or postponed due to a serious illness or injury of the couple or immediate family members. |

Who Should Consider Wedding Cancellation Insurance

Wedding cancellation insurance is a wise investment for any couple planning a significant event, especially those with a substantial financial commitment and a desire to protect their investment. Here are a few scenarios where wedding insurance can be particularly beneficial:

- Large-Scale Events: If you're planning an elaborate wedding with numerous vendors and significant expenses, insurance can provide peace of mind against unforeseen circumstances.

- Destination Weddings: For weddings taking place in remote locations or foreign countries, insurance can cover potential disruptions due to travel issues, weather, or local emergencies.

- Seasonal Weather Concerns: If your wedding date falls during a season known for extreme weather conditions, insurance can protect against cancellations or postponements due to storms, hurricanes, or heavy snowfall.

- Medical Uncertainties: If either partner or a close family member has a health condition that could potentially lead to a last-minute cancellation, insurance can offer financial protection.

- Complex Logistics: If your wedding involves intricate logistics, such as multiple venues, intricate decorations, or complex travel arrangements, insurance can provide coverage for a wide range of potential issues.

Factors to Consider Before Purchasing

While wedding cancellation insurance is a valuable tool, it's essential to approach it with careful consideration. Here are some key factors to keep in mind:

- Policy Terms and Conditions: Carefully review the policy's fine print to understand what is and isn't covered. Ensure you're comfortable with the exclusions and limitations before purchasing.

- Cost vs. Coverage: Compare the cost of the insurance premium with the potential financial losses you could incur if something were to go wrong. Ensure the coverage provided is sufficient for your needs.

- Vendor Reliability: Before purchasing insurance, thoroughly research your vendors and their reputation for reliability. While insurance can provide peace of mind, it's always best to choose reputable professionals.

- Timing of Purchase: Most policies require that you purchase insurance within a certain timeframe after booking your venue or vendors. Ensure you're aware of these deadlines to avoid missing out on coverage.

Real-Life Examples of Wedding Insurance Claims

Understanding how wedding cancellation insurance works in real-life scenarios can provide valuable insights into its importance and benefits. Here are a few examples of how couples have utilized their insurance policies:

Hurricane Disruption

Imagine a couple planning their dream beach wedding in the Caribbean. They've invested a significant amount in deposits and payments, only to have their plans disrupted by a sudden hurricane warning a week before the wedding. With wedding cancellation insurance, they were able to recoup their losses and even received additional coverage to help with the cost of rescheduling the wedding for a later date.

Medical Emergency

In another instance, a groom-to-be suffered a severe injury just days before his wedding, requiring emergency surgery. The couple, faced with the difficult decision to postpone the wedding, was relieved to find that their insurance policy covered the additional costs of rescheduling, including new invitations and travel arrangements for their guests.

Vendor Bankruptcy

Unfortunately, vendor bankruptcies are not uncommon. A bride who had booked an esteemed photographer for her wedding day received a devastating call just weeks before the event, informing her that the photographer had filed for bankruptcy. With wedding insurance, she was able to claim the loss of her deposit and secure the services of a new photographer without financial strain.

Choosing the Right Wedding Insurance Provider

With numerous insurance providers offering wedding cancellation coverage, it's essential to choose a reputable and reliable company. Here are some tips to guide your selection process:

- Research: Start by researching different providers and reading online reviews. Look for companies with a solid reputation and a track record of prompt claim settlements.

- Compare Policies: Compare the coverage and limits offered by different providers. Ensure you understand the differences in what is covered and any potential exclusions.

- Check Financial Stability: Verify the financial stability of the insurance company. Look for providers with a strong financial rating from reputable agencies like AM Best or Standard & Poor's.

- Read the Fine Print: Carefully review the policy's terms and conditions. Ensure you're comfortable with the language and understand what you're agreeing to.

- Customer Service: Consider the level of customer service offered. Choose a provider with a responsive and helpful team, especially when it comes to guiding you through the claims process.

Key Considerations for Policy Selection

When selecting a wedding cancellation insurance policy, keep these key considerations in mind:

- Coverage Limits: Ensure the policy provides sufficient coverage for your needs. Consider the total cost of your wedding and the potential financial losses you could incur if something were to go wrong.

- Exclusions: Understand what the policy does not cover. Common exclusions include acts of war, terrorism, and pre-existing medical conditions. Ensure you're comfortable with any limitations.

- Additional Benefits: Some policies offer additional benefits, such as liability coverage for the wedding venue or coverage for wedding gifts. Consider if these benefits are relevant to your situation.

- Deductibles: Be aware of the deductible amount, which is the portion of the claim you must pay out of pocket. Choose a policy with a deductible that aligns with your financial comfort level.

The Claims Process: What to Expect

In the unfortunate event that you need to file a claim under your wedding cancellation insurance policy, it's important to understand the process and what to expect. Here's a step-by-step guide:

Step 1: Understand Your Policy

Before initiating a claim, carefully review your insurance policy to understand the specific circumstances under which you are covered. Ensure you're familiar with the documentation required to support your claim.

Step 2: Notify Your Insurer

Contact your insurance provider as soon as possible after the event that triggers your claim. Provide them with all the necessary details, including the reason for the cancellation or postponement and any supporting documentation.

Step 3: Gather Evidence

Collect and organize all relevant documents, including contracts, receipts, and any correspondence with vendors or service providers. This evidence will help support your claim and demonstrate the financial loss incurred.

Step 4: Complete the Claim Form

Your insurance provider will supply you with a claim form to complete. Ensure you fill it out accurately and provide all the required information. If you have any questions, don't hesitate to reach out to your insurer for guidance.

Step 5: Await the Decision

Once you've submitted your claim, it will be reviewed by the insurance provider. They will assess the validity of your claim based on the information and evidence provided. This process may take some time, so be patient and keep in touch with your insurer if you have any concerns.

Step 6: Receive Your Settlement

If your claim is approved, you will receive a settlement from your insurer. This will typically be paid out as a reimbursement for the covered expenses you've incurred. Ensure you understand the terms of the settlement and keep records of all transactions.

Future Implications and Industry Insights

As the wedding industry continues to evolve, the demand for wedding cancellation insurance is likely to increase. With couples investing more in their weddings and facing a range of potential disruptions, insurance providers are adapting their policies to meet these needs. Here are some insights into the future of wedding cancellation insurance:

Expanding Coverage

Insurance providers are expanding their coverage options to include a wider range of scenarios. This includes coverage for events like venue closures due to health and safety concerns, as well as coverage for mental health-related cancellations or postponements.

Digital Innovations

The insurance industry is embracing digital innovations to streamline the claims process. This includes the use of online platforms and mobile apps for easier claim submissions and tracking. These tools can also provide real-time updates and guidance to policyholders.

Collaborations with Wedding Planners

Insurance providers are increasingly partnering with wedding planners and event coordinators to offer comprehensive packages that include insurance coverage. This collaboration ensures that couples receive expert guidance on both their wedding planning and insurance needs.

Educational Initiatives

The industry is also focusing on educating couples about the importance of wedding cancellation insurance. This includes providing resources and tools to help couples understand their coverage options and make informed decisions.

Frequently Asked Questions

Can I purchase wedding cancellation insurance after my wedding date has passed?

+No, wedding cancellation insurance typically needs to be purchased before any potential issues arise. Most policies require purchase within a certain timeframe after booking your venue or vendors.

Does wedding cancellation insurance cover COVID-19-related disruptions?

+The coverage for COVID-19-related disruptions varies among insurance providers. Some policies may exclude pandemics or epidemics, while others may provide coverage for these scenarios. It’s essential to review the policy terms carefully.

Can I get a refund on my wedding insurance if I don’t end up needing to use it?

+Refund policies vary depending on the insurance provider. Some may offer a partial refund if the policy is canceled before the coverage period begins, while others may not provide any refund.

What happens if I cancel my wedding due to cold feet?

+Cold feet or change of heart is typically not covered by wedding cancellation insurance. Most policies require a legitimate and unforeseen event, such as severe weather or a medical emergency, to trigger coverage.

How soon after purchasing the policy can I file a claim?

+Most policies have a waiting period before you can file a claim. This waiting period can vary, so it’s important to review your policy’s terms and conditions to understand when you can initiate a claim.