Is Tricare Good Insurance

When it comes to health insurance options, one often overlooked yet highly valuable plan is Tricare. Specifically designed for the United States military community, Tricare offers comprehensive coverage and unique benefits that make it an attractive choice for those eligible. In this comprehensive guide, we'll delve into the intricacies of Tricare, exploring its coverage, costs, and how it stands out as a premier healthcare option for military families and retirees.

Understanding Tricare: Coverage and Eligibility

Tricare, previously known as the Civilian Health and Medical Program of the Uniformed Services (CHAMPUS), is a healthcare program tailored for active-duty service members, military retirees, and their families. It is administered by the Defense Health Agency (DHA) under the authority of the Department of Defense (DoD). The program’s primary goal is to ensure that military personnel and their dependents have access to quality healthcare services, regardless of their duty status or location.

Tricare Coverage Overview

Tricare offers a range of coverage options to cater to the diverse needs of its beneficiaries. These options include:

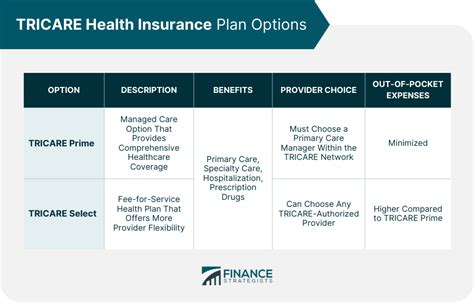

- Tricare Prime: This is a managed care option where members are assigned a primary care manager (PCM) who coordinates their healthcare needs. With Tricare Prime, beneficiaries typically have lower out-of-pocket costs and enjoy comprehensive coverage for most services. However, there may be some limitations on choice of providers and certain specialist referrals.

- Tricare Select: Tricare Select provides more flexibility in choosing healthcare providers. Beneficiaries can see any network provider without referrals, but they may incur higher out-of-pocket costs compared to Tricare Prime. This option is ideal for those who value the freedom to choose their healthcare professionals.

- Tricare Extra: Tricare Extra serves as a cost-saving option for those who prefer Tricare Select but want to save on out-of-pocket expenses. It works by combining the flexibility of Tricare Select with cost-sharing benefits, reducing the financial burden on beneficiaries.

- Tricare Standard: Tricare Standard is a fee-for-service option that offers beneficiaries the freedom to choose any provider, including those outside the Tricare network. While this option provides the most flexibility, beneficiaries are responsible for a larger portion of the costs.

- Tricare for Life (TFL): TFL is specifically designed for Medicare-eligible beneficiaries, including retirees and their dependents. It works alongside Medicare to provide comprehensive coverage, filling in the gaps left by Medicare Parts A and B. TFL ensures that beneficiaries receive the healthcare they need without facing significant financial burdens.

Eligibility and Enrollment

Tricare’s eligibility criteria are primarily based on the military status of the sponsor (the service member or retiree). The sponsor’s dependents, including spouses and children, are also eligible for Tricare coverage. Here’s a breakdown of the key eligibility categories:

- Active-Duty Service Members: Active-duty personnel and their families are automatically enrolled in Tricare Prime. This coverage ensures that they have access to healthcare services wherever they are stationed, providing a seamless healthcare experience.

- National Guard and Reserve Members: Members of the National Guard and Reserve are eligible for Tricare Reserve Select (TRS). TRS is a premium-based program that allows them and their families to maintain healthcare coverage during periods of inactivity. This option ensures continuity of care and provides peace of mind for those who may have civilian jobs outside of their military service.

- Retirees and Their Dependents: Military retirees and their dependents are eligible for Tricare coverage. The specific plan they enroll in depends on their preferences and the options available in their area. Retirees can choose from Tricare Prime, Tricare Select, or Tricare for Life, depending on their Medicare eligibility.

- Surviving Family Members: Surviving spouses and children of deceased service members are also eligible for Tricare coverage. This coverage provides essential healthcare support during a challenging time, ensuring that they have access to the medical services they need.

Tricare’s Unique Benefits

Tricare stands out from other health insurance plans due to its unique features and benefits, tailored to meet the specific needs of the military community. Here are some key advantages that make Tricare an attractive choice:

- Global Coverage: One of the most notable benefits of Tricare is its worldwide coverage. Active-duty service members and their families can access healthcare services wherever they are stationed, including overseas. This ensures that they have consistent access to quality care, regardless of their location.

- Specialist Referrals: Tricare Prime beneficiaries have access to a network of specialized healthcare providers. Their primary care manager can refer them to specialists within the Tricare network, ensuring that they receive the specialized care they need without excessive out-of-pocket expenses.

- Dental and Vision Coverage: Tricare offers dental and vision coverage, which is often an additional expense with other insurance plans. This comprehensive coverage ensures that beneficiaries can maintain good oral and eye health without worrying about separate dental or vision insurance policies.

- Pharmaceutical Benefits: Tricare beneficiaries have access to a robust pharmaceutical benefits program. The Tricare Pharmacy Program provides coverage for prescription medications, ensuring that beneficiaries can obtain the necessary drugs at affordable prices. Additionally, Tricare covers certain over-the-counter medications, making it even more cost-effective.

- Mental Health Services: Tricare recognizes the importance of mental health and provides comprehensive coverage for mental health services. Beneficiaries can access counseling, therapy, and psychiatric care without facing significant financial barriers. This aspect of Tricare’s coverage is particularly valuable, given the unique challenges faced by the military community.

- Family Support: Tricare goes beyond individual healthcare coverage by offering support for the entire family. This includes access to family counseling, parenting resources, and support groups. By addressing the well-being of the entire family unit, Tricare helps foster a healthy and resilient military community.

Tricare’s Cost Structure

While Tricare offers extensive coverage, it also comes with a cost structure that varies depending on the plan and the beneficiary’s eligibility category. Understanding these costs is crucial for making informed decisions about Tricare coverage.

Enrollment Fees and Premiums

Enrollment fees and premiums for Tricare plans can vary based on the beneficiary’s military status and the chosen plan. Here’s a breakdown of the typical cost structure:

- Active-Duty Service Members: Active-duty personnel and their families do not pay enrollment fees or premiums for Tricare Prime. This coverage is provided as part of their military benefits package.

- National Guard and Reserve Members: Members of the National Guard and Reserve are responsible for paying premiums for Tricare Reserve Select (TRS). The cost of TRS premiums varies based on the beneficiary’s age and family size. Typically, premiums are higher for those over 65 and for families with more members.

- Retirees and Their Dependents: Retirees and their dependents may have to pay enrollment fees and premiums for their chosen Tricare plan. The costs vary based on the plan selected and the beneficiary’s age. For example, Tricare Prime has no enrollment fees for retirees under 65, but those over 65 may have to pay a monthly premium.

- Surviving Family Members: Surviving spouses and children of deceased service members may be eligible for certain cost waivers or reduced premiums, depending on their circumstances.

Out-of-Pocket Costs

In addition to enrollment fees and premiums, beneficiaries may incur out-of-pocket costs when using Tricare services. These costs can include:

- Copayments: Copayments are fixed amounts that beneficiaries pay for certain services, such as office visits or prescriptions. The copayment amount varies depending on the service and the beneficiary’s plan.

- Coinsurance: Coinsurance is a percentage of the total cost of a service that the beneficiary pays. For example, if a service costs 100 and the coinsurance rate is 20%, the beneficiary would pay 20, while Tricare covers the remaining $80.

- Deductibles: Deductibles are the amounts beneficiaries must pay out of pocket before Tricare starts covering costs. Deductibles typically apply on an annual basis and vary based on the plan and the beneficiary’s age.

Tricare’s Performance and Satisfaction

Tricare’s performance and beneficiary satisfaction are crucial aspects to consider when evaluating its effectiveness as a healthcare plan. While it’s challenging to quantify satisfaction levels across such a diverse population, several key indicators suggest that Tricare is highly regarded within the military community.

Performance Metrics

The Defense Health Agency (DHA), which administers Tricare, regularly collects and analyzes performance data to ensure the program’s effectiveness. Key performance metrics include:

- Access to Care: Tricare strives to provide timely access to healthcare services for its beneficiaries. Performance metrics in this area focus on appointment wait times, emergency room wait times, and the availability of specialists within the Tricare network.

- Quality of Care: The quality of healthcare provided under Tricare is a top priority. DHA assesses the quality of care by tracking patient outcomes, satisfaction surveys, and clinical quality measures, such as adherence to best practices and treatment guidelines.

- Cost Efficiency: With healthcare costs rising across the board, Tricare aims to provide cost-effective coverage. Performance metrics in this area include the average cost per beneficiary, the cost of specific services compared to national averages, and the program’s overall financial sustainability.

Beneficiary Satisfaction Surveys

To gauge beneficiary satisfaction, the DHA conducts regular surveys among Tricare beneficiaries. These surveys cover various aspects of the healthcare experience, including:

- Provider Experience: Beneficiaries are asked to rate their satisfaction with their primary care providers, specialists, and other healthcare professionals within the Tricare network.

- Administrative Processes: Surveys assess the ease of enrollment, the clarity of explanations regarding coverage and costs, and the overall efficiency of administrative processes.

- Customer Service: Beneficiaries provide feedback on the responsiveness and helpfulness of Tricare’s customer service representatives.

- Overall Satisfaction: Participants in the surveys are asked to rate their overall satisfaction with Tricare’s coverage, costs, and the value it provides.

Tricare’s Future and Innovations

As the healthcare landscape continues to evolve, Tricare is adapting to meet the changing needs of the military community. The program is actively pursuing innovative solutions and strategic partnerships to enhance its services and improve the overall healthcare experience for beneficiaries.

Digital Health Initiatives

Tricare recognizes the potential of digital health technologies to improve access to care and enhance the patient experience. As such, it is investing in digital health initiatives, such as:

- Telehealth Services: Tricare is expanding its telehealth capabilities, allowing beneficiaries to access healthcare services remotely. This is particularly beneficial for those in remote locations or who have difficulty traveling to healthcare facilities.

- Mobile Apps and Online Portals: Tricare has developed mobile apps and online portals that provide beneficiaries with convenient access to their healthcare information, including appointment scheduling, prescription refills, and secure messaging with healthcare providers.

- Wearable Technology Integration: Tricare is exploring partnerships with wearable technology companies to integrate health tracking data into its systems. This integration can provide valuable insights into beneficiaries’ health status and help identify potential health issues early on.

Collaborative Partnerships

To enhance the quality and accessibility of healthcare services, Tricare is forging strategic partnerships with leading healthcare providers and organizations. These partnerships aim to:

- Expand Provider Networks: Tricare is working to expand its network of healthcare providers, particularly in areas where access to care may be limited. By partnering with reputable healthcare organizations, Tricare can ensure that beneficiaries have a wider range of high-quality providers to choose from.

- Improve Specialty Care: Tricare is collaborating with specialized healthcare centers to enhance access to advanced medical treatments and technologies. This includes partnerships with leading cancer centers, cardiovascular institutes, and other specialty care providers.

- Enhance Mental Health Services: Recognizing the importance of mental health support for the military community, Tricare is partnering with mental health organizations to expand its network of mental health providers and improve access to counseling, therapy, and other mental health services.

Conclusion: Tricare’s Value for the Military Community

Tricare is more than just a health insurance plan; it is a comprehensive healthcare system designed to support the unique needs of the military community. With its global coverage, specialized benefits, and focus on family support, Tricare stands out as a valuable asset for active-duty service members, retirees, and their families.

While there are costs associated with Tricare, the program’s benefits often outweigh the financial considerations. The peace of mind that comes with knowing you and your family have access to quality healthcare, regardless of your location or circumstances, is invaluable. Additionally, Tricare’s commitment to innovation and continuous improvement ensures that it remains a leading healthcare option for the military community.

As the military community continues to serve and protect our nation, Tricare stands ready to provide the healthcare support they deserve. Whether it’s accessing specialized care, maintaining good mental health, or simply having the freedom to choose the best healthcare providers, Tricare is dedicated to ensuring that military families receive the care they need, when and where they need it.

Can I use Tricare if I’m not stationed in the US?

+Yes, one of Tricare’s key advantages is its global coverage. Active-duty service members and their families can access healthcare services worldwide, ensuring they have consistent care regardless of their location.

Are there any age restrictions for Tricare coverage?

+Tricare coverage is available to eligible beneficiaries of all ages. However, costs and coverage options may vary based on the beneficiary’s age and the chosen Tricare plan.

How do I enroll in Tricare as a military retiree?

+Military retirees can enroll in Tricare by contacting their local Tricare Regional Office or visiting the Tricare website. They will need to provide proof of eligibility and choose the Tricare plan that best suits their needs.