How Much Does General Liability Insurance Cost

General liability insurance is an essential coverage for businesses across various industries, providing protection against potential financial risks and legal liabilities. Understanding the cost of this insurance is crucial for businesses, as it can vary significantly based on several factors. In this comprehensive guide, we will delve into the specifics of general liability insurance costs, exploring the key determinants, providing real-world examples, and offering insights to help businesses make informed decisions about their insurance coverage.

Understanding General Liability Insurance Costs

General liability insurance is designed to safeguard businesses from a wide range of potential risks, including property damage, bodily injury, and personal and advertising injury claims. The cost of this coverage can be influenced by several factors, each playing a unique role in determining the final premium. Let’s break down these factors and explore their impact on insurance costs.

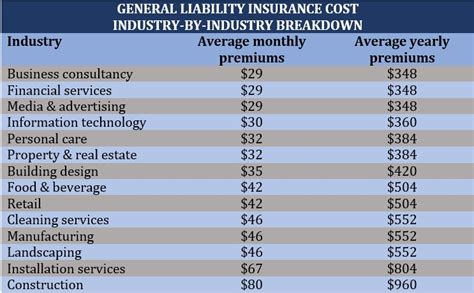

Business Type and Industry

One of the primary determinants of general liability insurance costs is the nature of the business and the industry it operates in. Different industries face varying levels of risk, and insurance companies assess these risks accordingly. For instance, a construction company will likely face higher premiums due to the inherently risky nature of construction work, while a consulting firm may have lower premiums as their operations are generally less hazardous.

Consider the case of ABC Construction, a medium-sized construction firm specializing in residential and commercial building projects. Given the physical nature of their work, which involves heavy machinery and potential hazards, their general liability insurance premiums are expected to be higher compared to other industries. On the other hand, XYZ Consulting, a management consulting firm, may enjoy lower premiums as their operations primarily involve office-based work and carry less physical risk.

Policy Coverage and Limits

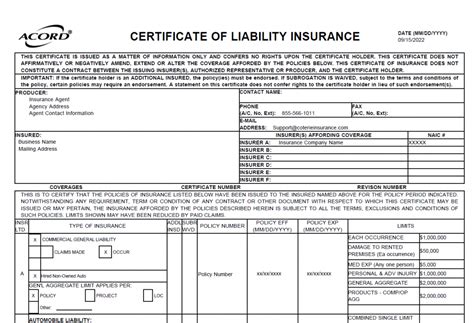

The scope and limits of coverage chosen by a business significantly impact the cost of general liability insurance. Policies can vary in terms of the specific risks they cover and the financial limits they provide. A business that opts for a more comprehensive policy with higher coverage limits will naturally pay a higher premium.

For instance, if a business chooses a policy with a bodily injury limit of $2 million and a property damage limit of $1 million, their premium will likely be higher compared to a business that opts for a policy with bodily injury and property damage limits of $1 million each. The increased coverage and higher limits provide greater financial protection, but they come at a cost.

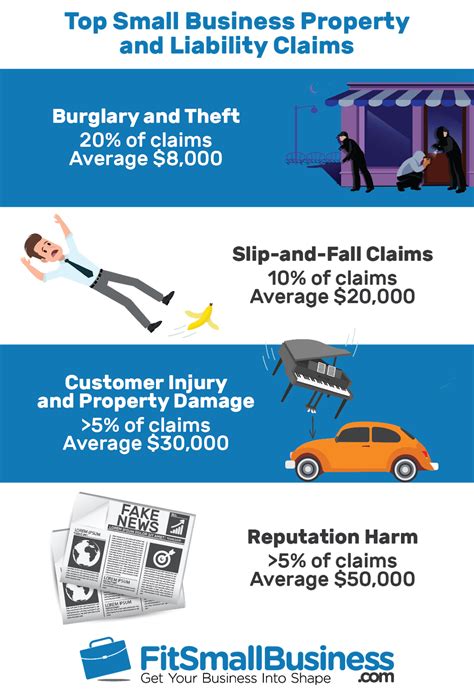

Claims History and Risk Assessment

Insurance companies carefully evaluate a business’s claims history and overall risk profile when determining insurance premiums. A business with a history of frequent claims or a high-risk profile may be considered a higher liability and face higher premiums as a result. On the other hand, businesses with a low-risk profile and a minimal claims history may benefit from more competitive rates.

Imagine a business, 123 Manufacturing, that has had several workplace accidents resulting in injury claims over the past few years. Given their claims history, their general liability insurance premiums are likely to be higher compared to a similar business with a spotless safety record. Conversely, a business like 456 Retail, which has an excellent safety record and minimal claims, may enjoy more favorable insurance rates.

Location and Business Size

The geographical location of a business and its size can also influence general liability insurance costs. Businesses operating in areas with higher crime rates, natural disaster risks, or higher litigation rates may face increased premiums. Additionally, larger businesses with more employees, revenue, or assets may require higher coverage limits, resulting in higher premiums.

For instance, a business located in an urban area with a high crime rate and frequent natural disasters may pay more for general liability insurance compared to a similar business in a rural area with lower risks. Similarly, a large corporation with extensive operations and thousands of employees may have significantly higher insurance costs compared to a small business with a handful of employees.

Deductibles and Policy Terms

The deductible chosen by a business can impact its general liability insurance costs. A higher deductible, where the business agrees to pay a larger portion of the claim before the insurance kicks in, can lead to lower premiums. Conversely, a lower deductible may result in higher premiums.

Consider a business that opts for a $5,000 deductible on their general liability insurance policy. This means that for any claim, they will be responsible for paying the first $5,000, with the insurance company covering the remainder. By agreeing to a higher deductible, the business may be able to negotiate lower premiums, as they are taking on more financial responsibility.

Real-World Examples and Case Studies

To better illustrate the impact of these factors on general liability insurance costs, let’s explore some real-world examples and case studies. These examples will provide concrete insights into how different businesses navigate the complexities of insurance coverage and costs.

Case Study: Small Business Start-up

Meet Emily, a recent graduate who has started her own graphic design business, Creative Designs. Emily’s business is small, with only a few employees, and she primarily works with local clients. Her operations are relatively low-risk, as most of her work is done remotely or at client locations.

When shopping for general liability insurance, Emily considers the following factors:

- Business Type: Graphic design is a low-risk industry with minimal physical hazards.

- Coverage Limits: Emily opts for a standard policy with $1 million in bodily injury and property damage limits, which is sufficient for her business needs.

- Claims History: As a new business, Emily has no claims history to consider.

- Location: Emily's business is located in a low-crime, suburban area with minimal natural disaster risks.

- Deductible: She chooses a $1,000 deductible, balancing the need for financial protection with her limited resources.

Based on these factors, Emily's general liability insurance premium comes out to $500 per year. This relatively low cost reflects the low-risk nature of her business and her prudent choices in coverage limits and deductible.

Case Study: Medium-Sized Retail Business

Let’s consider John, the owner of All-Star Sports, a medium-sized retail store specializing in sporting goods. John’s business has been in operation for several years and has a solid customer base. However, the nature of the retail industry, with its potential for customer injuries and property damage, means John needs robust general liability insurance coverage.

John evaluates his insurance options, considering the following factors:

- Business Type: Retail is a higher-risk industry due to the potential for customer accidents and property damage.

- Coverage Limits: John opts for a policy with $2 million in bodily injury limits and $1 million in property damage limits, providing ample coverage for his business.

- Claims History: John's business has had a few minor claims in the past, but nothing major. His claims history is relatively clean.

- Location: All-Star Sports is located in an urban area with moderate crime rates and occasional natural disasters.

- Deductible: John chooses a $2,500 deductible, striking a balance between financial protection and premium costs.

Given these factors, John's general liability insurance premium is $2,200 per year. While this is higher than Emily's premium, it reflects the increased risks and coverage needs of his business.

Case Study: Large Construction Firm

Now, let’s turn our attention to Michael, the CEO of BuildTech Construction, a large-scale construction firm with operations across multiple states. BuildTech handles complex projects, including high-rise buildings and infrastructure development, making general liability insurance a critical component of their risk management strategy.

Michael evaluates his insurance options, considering the following factors:

- Business Type: Construction is a high-risk industry, with a range of potential hazards and liabilities.

- Coverage Limits: Michael opts for a policy with $5 million in bodily injury limits and $3 million in property damage limits, given the scale and complexity of their projects.

- Claims History: BuildTech has had a few significant claims in the past, including a major accident on one of their construction sites. This history influences their insurance premiums.

- Location: BuildTech operates in various locations, including urban areas with high crime rates and natural disaster risks.

- Deductible: Michael chooses a $10,000 deductible, recognizing the need for significant financial protection in their high-risk industry.

Due to the high-risk nature of their business, the extensive coverage limits, and their claims history, BuildTech's general liability insurance premium is $15,000 per year. This premium reflects the reality of operating a large construction firm in a high-risk industry.

Factors Influencing General Liability Insurance Costs: A Summary

The cost of general liability insurance is influenced by a range of factors, each playing a unique role in determining the final premium. These factors include the nature of the business and its industry, the scope and limits of coverage chosen, the claims history and risk assessment of the business, its location, size, and the deductible selected.

By understanding these factors and how they interact, businesses can make informed decisions about their insurance coverage. It's essential to strike a balance between adequate financial protection and manageable insurance costs, ensuring that the business is well-equipped to handle potential liabilities without straining its financial resources.

The Importance of Insurance Shopping and Comparison

When it comes to general liability insurance, shopping around and comparing quotes from different insurance providers is crucial. Insurance rates can vary significantly between providers, even for similar coverage and businesses. By obtaining multiple quotes, businesses can ensure they are getting the best value for their insurance dollar.

It's also important to work with reputable insurance brokers or agents who can provide guidance and expertise in navigating the complex world of insurance. These professionals can help businesses understand their options, tailor coverage to their specific needs, and secure the most competitive rates.

Future Implications and Trends in General Liability Insurance

As the business landscape continues to evolve, so too does the world of insurance. General liability insurance is no exception, with ongoing trends and developments shaping the future of this coverage.

The Rise of Digital Insurance

The digital revolution has transformed the insurance industry, making it more accessible and efficient. Digital insurance platforms and online brokers are becoming increasingly popular, offering businesses a convenient way to compare quotes, purchase coverage, and manage their policies.

These digital platforms often provide real-time quotes, allowing businesses to quickly assess their options and make informed decisions. Additionally, digital insurance often comes with streamlined claims processes, making it easier for businesses to navigate the complexities of filing and managing claims.

The Impact of Technology and Innovation

Advancements in technology and innovation are also shaping the future of general liability insurance. From data analytics to artificial intelligence, these technologies are being leveraged to enhance risk assessment and claims management.

Data analytics, for instance, can provide insurance companies with valuable insights into a business's risk profile, helping them offer more accurate and tailored coverage. Artificial intelligence can streamline the claims process, making it faster and more efficient for both insurance companies and policyholders.

The Role of Cyber Liability Insurance

With the increasing reliance on digital technologies and the ever-present threat of cyberattacks, cyber liability insurance is becoming an essential component of a business’s insurance portfolio. General liability insurance often does not cover cyber-related risks, leaving businesses vulnerable to potential financial losses.

As such, many businesses are now opting for standalone cyber liability insurance policies or bundling them with their general liability coverage. This ensures that they have comprehensive protection against a wide range of potential risks, including cyber threats.

Conclusion

Understanding the cost of general liability insurance is a critical aspect of running a successful business. By considering the various factors that influence insurance costs and shopping around for the best rates, businesses can secure the financial protection they need without straining their resources. As the insurance landscape continues to evolve, staying informed and adaptable is key to navigating the complexities of insurance coverage.

Whether you're a small business start-up, a medium-sized retailer, or a large-scale construction firm, general liability insurance is an essential tool in your risk management arsenal. With the right coverage and a prudent approach to insurance, businesses can focus on their core operations, knowing they are protected against potential liabilities.

How often should I review my general liability insurance policy?

+It is recommended to review your general liability insurance policy annually or whenever significant changes occur in your business. This ensures that your coverage remains adequate and aligned with your evolving needs.

Can I negotiate my general liability insurance premiums?

+Yes, you can negotiate your premiums with your insurance provider. Factors such as your claims history, safety record, and loyalty to the provider can influence your negotiation power. It’s always worth discussing options with your insurer.

What are some common exclusions in general liability insurance policies?

+Common exclusions in general liability insurance policies include professional services, contractual liabilities, and employee-related claims. It’s important to review your policy’s exclusions carefully to understand what is and isn’t covered.

How can I reduce my general liability insurance costs?

+You can reduce your general liability insurance costs by improving your risk management practices, maintaining a clean claims history, and shopping around for competitive rates. Additionally, consider higher deductibles to lower your premiums.

Is general liability insurance required by law for all businesses?

+While general liability insurance is not federally mandated for all businesses, certain industries and jurisdictions may require it. Additionally, many clients and partners expect businesses to carry general liability insurance as a sign of financial responsibility.