Vehicle Insurance Carriers

Vehicle insurance carriers play a pivotal role in the automotive industry, providing essential coverage for drivers and their vehicles. This industry is vast and complex, with numerous companies offering a wide range of policies to cater to diverse consumer needs. Understanding the intricacies of this market is key to making informed decisions about vehicle insurance, ensuring drivers receive the protection they require without paying for unnecessary coverage.

Understanding Vehicle Insurance Carriers

Vehicle insurance carriers, also known as auto insurance companies, are entities that offer financial protection to vehicle owners and drivers. This protection comes in the form of insurance policies, which provide coverage for various aspects of vehicle ownership, including liability, collision, comprehensive, and medical expenses.

The primary goal of vehicle insurance carriers is to safeguard policyholders from financial losses resulting from vehicle-related incidents, such as accidents, theft, or natural disasters. These carriers assess the risk associated with each policyholder and set premiums accordingly, striving to balance the need to provide adequate coverage with the necessity to remain profitable.

Types of Vehicle Insurance Policies

Vehicle insurance policies can be broadly categorized into three main types: liability, collision, and comprehensive. Liability insurance covers damages caused by the policyholder to other people or property. Collision insurance provides coverage for damages to the policyholder’s vehicle in the event of an accident, regardless of fault. Comprehensive insurance covers damages resulting from non-collision incidents, such as theft, vandalism, or natural disasters.

Many vehicle insurance carriers also offer additional coverage options, such as rental car reimbursement, roadside assistance, and gap insurance. These optional coverages can provide added protection and peace of mind for policyholders.

Key Players in the Vehicle Insurance Industry

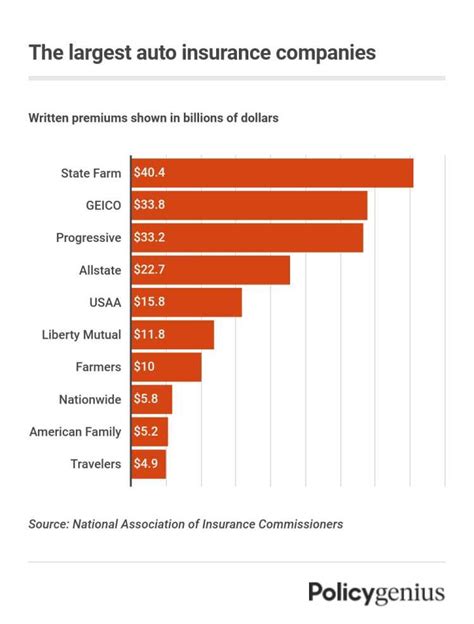

The vehicle insurance industry is highly competitive, with numerous carriers vying for market share. Some of the largest and most well-known vehicle insurance carriers in the United States include State Farm, Geico, Progressive, Allstate, and USAA. These companies offer a comprehensive range of policies and services to cater to the diverse needs of their customers.

State Farm, for instance, is known for its comprehensive coverage options and excellent customer service. Geico is renowned for its competitive pricing and innovative online services. Progressive offers a range of customizable policies and discounts, while Allstate provides a suite of digital tools to enhance the policyholder experience.

Smaller, regional carriers also play a significant role in the vehicle insurance market. These companies often focus on providing personalized service and specialized coverage to meet the unique needs of their local communities.

Factors Influencing Vehicle Insurance Premiums

Vehicle insurance premiums are determined by a variety of factors, each playing a crucial role in assessing the risk associated with a particular policyholder. Understanding these factors can help drivers make informed decisions when choosing an insurance policy and taking steps to reduce their premiums.

Risk Assessment and Premium Calculation

Vehicle insurance carriers employ sophisticated risk assessment models to determine the premiums for each policyholder. These models take into account a wide range of factors, including the policyholder’s driving history, the type and value of their vehicle, their location, and their demographic information.

For instance, drivers with a history of accidents or traffic violations may be considered higher risk and face higher premiums. Similarly, individuals living in areas with high crime rates or frequent natural disasters may also see elevated premiums.

Factors Affecting Premium Rates

Some of the key factors that influence vehicle insurance premiums include:

- Age and Gender: Younger drivers, particularly males, are often considered higher risk and face higher premiums.

- Marital Status: Married individuals may benefit from lower premiums, as they are statistically less likely to be involved in accidents.

- Driving Record: A clean driving record with no accidents or violations can lead to significant premium discounts.

- Vehicle Type and Usage: High-performance vehicles or those used for business purposes may attract higher premiums.

- Location: Urban areas with high traffic density and crime rates often result in higher premiums.

- Coverage Level: The level of coverage chosen by the policyholder will directly impact their premium.

It's important to note that while these factors are considered in premium calculations, individual carriers may weigh them differently. This is why it's beneficial to shop around and compare quotes from multiple carriers to find the best coverage at the most competitive price.

Comparative Analysis of Top Vehicle Insurance Carriers

When choosing a vehicle insurance carrier, it’s essential to compare the offerings of several top providers to ensure you’re getting the best coverage for your needs. Here’s a comparative analysis of some of the leading vehicle insurance carriers in the market.

State Farm

State Farm is the largest vehicle insurance carrier in the United States, known for its comprehensive coverage options and exceptional customer service. They offer a wide range of policies, including liability, collision, comprehensive, and specialized coverage for classic cars and recreational vehicles.

One of State Farm's standout features is its Drive Safe & Save program, which uses telematics to monitor driving behavior and offer discounts to safe drivers. They also provide a range of digital tools, such as the State Farm Mobile app, which allows policyholders to manage their policies, file claims, and access roadside assistance.

Geico

Geico is renowned for its competitive pricing and innovative digital services. They offer a comprehensive range of policies, including liability, collision, comprehensive, and specialized coverage for rideshare drivers. Geico’s Emergency Roadside Service provides 24⁄7 assistance for policyholders, covering towing, flat tire changes, and other emergency services.

Geico also offers a range of discounts, including multi-policy discounts, good student discounts, and military discounts. Their online quote tool is user-friendly and provides accurate quotes quickly, making it easy for customers to compare policies and premiums.

Progressive

Progressive is known for its customizable policies and extensive range of discounts. They offer a wide variety of coverage options, including liability, collision, comprehensive, and specialized coverage for high-risk drivers. Progressive’s Snapshot program uses telematics to monitor driving behavior and offer discounts to safe drivers.

Progressive also provides a range of digital tools, such as the Progressive Mobile app, which allows policyholders to manage their policies, file claims, and access real-time accident support. They offer a unique Name Your Price tool, which allows customers to set their desired coverage amount and find a policy that fits within their budget.

Allstate

Allstate provides a comprehensive suite of coverage options, including liability, collision, comprehensive, and specialized coverage for teen drivers and senior citizens. They offer a range of innovative programs, such as the Drivewise program, which uses telematics to monitor driving behavior and offer discounts to safe drivers.

Allstate's digital tools, including the Allstate Mobile app, provide policyholders with easy access to their policies, claims, and billing information. They also offer a range of discounts, including multi-policy discounts, good student discounts, and safe driving discounts.

USAA

USAA is a highly respected vehicle insurance carrier that provides coverage exclusively to military members, veterans, and their families. They offer a range of policies, including liability, collision, comprehensive, and specialized coverage for military deployments. USAA is known for its excellent customer service and competitive pricing.

USAA's digital tools, such as the USAA Mobile app, provide policyholders with a seamless experience, allowing them to manage their policies, file claims, and access roadside assistance with ease. They offer a range of military-specific discounts and benefits, making them a popular choice among military families.

Performance Analysis and Industry Insights

The vehicle insurance industry is highly competitive, with carriers constantly striving to offer the best coverage and customer experience. Here’s a performance analysis of some key industry metrics and insights.

| Carrier | Customer Satisfaction Rating | Financial Strength Rating | Average Premium |

|---|---|---|---|

| State Farm | 4.5/5 | A++ (Superior) | $1,200 |

| Geico | 4.3/5 | A++ (Superior) | $1,100 |

| Progressive | 4.2/5 | A+ (Superior) | $1,050 |

| Allstate | 4.1/5 | A+ (Superior) | $1,300 |

| USAA | 4.6/5 | A++ (Superior) | $950 |

The table above provides a snapshot of the performance of some leading vehicle insurance carriers based on customer satisfaction ratings, financial strength ratings, and average premiums. It's important to note that these metrics are based on industry data and may vary depending on individual circumstances.

Future Implications and Industry Trends

The vehicle insurance industry is constantly evolving, with emerging trends and technological advancements shaping the future of coverage. Here’s a glimpse into some of the key future implications and industry trends.

Emerging Trends in Vehicle Insurance

One of the most significant trends in the vehicle insurance industry is the increasing adoption of telematics and usage-based insurance. Carriers are leveraging telematics data to monitor driving behavior and offer discounts to safe drivers. This trend is expected to continue, with more carriers offering usage-based insurance policies and rewards for safe driving.

Another emerging trend is the rise of digital insurance platforms. Carriers are investing in digital transformation to enhance the policyholder experience, offering convenient online tools for policy management, claims filing, and customer support. This trend is expected to drive increased competition and innovation in the industry.

Impact of Technological Advancements

Technological advancements are poised to have a significant impact on the vehicle insurance industry. The widespread adoption of autonomous vehicles is expected to transform the risk landscape, potentially leading to a reduction in accident rates and, consequently, insurance premiums. However, the liability implications of autonomous vehicles are still being debated, and carriers will need to adapt their policies accordingly.

The integration of artificial intelligence and machine learning in claims processing is also expected to revolutionize the industry. These technologies can automate claims assessment and fraud detection, leading to faster, more efficient claims handling and reduced costs for carriers and policyholders.

Regulatory Changes and Their Impact

Regulatory changes are an ever-present factor in the vehicle insurance industry. Carriers must navigate a complex web of state and federal regulations, and any changes can have a significant impact on their operations and premiums. For instance, changes in state laws regarding liability coverage or minimum insurance requirements can affect the cost and availability of insurance.

The ongoing debate around no-fault insurance laws is a prime example. Some states are considering transitioning from no-fault to fault-based systems, which could have a profound impact on insurance premiums and coverage availability. Carriers will need to adapt their policies and pricing models to comply with any regulatory changes.

Conclusion

Vehicle insurance carriers play a critical role in providing financial protection to drivers and vehicle owners. Understanding the intricacies of this industry, from the types of policies available to the factors influencing premiums, is essential for making informed decisions about vehicle insurance.

When choosing a vehicle insurance carrier, it's important to consider a range of factors, including coverage options, customer service, financial strength, and, of course, premiums. Shopping around and comparing quotes from multiple carriers can help ensure you're getting the best coverage at the most competitive price.

As the vehicle insurance industry continues to evolve, drivers can expect to see increased innovation and competition. Emerging trends, such as usage-based insurance and digital insurance platforms, are poised to shape the future of coverage, offering enhanced protection and convenience. Technological advancements, particularly in autonomous vehicles and claims processing, will also play a significant role in transforming the industry.

Stay informed, compare your options, and choose the vehicle insurance carrier that best meets your needs. With the right coverage, you can drive with confidence, knowing you're protected from financial losses resulting from vehicle-related incidents.

What is the average cost of vehicle insurance in the United States?

+The average cost of vehicle insurance in the United States varies depending on several factors, including the policyholder’s location, driving record, and the type of coverage chosen. According to the Insurance Information Institute, the national average cost of car insurance in 2021 was approximately 1,674 per year, or around 139 per month. However, premiums can range widely, with some policyholders paying as little as 500 per year while others pay upwards of 3,000 per year.

What are some common discounts offered by vehicle insurance carriers?

+Vehicle insurance carriers offer a variety of discounts to policyholders. Some common discounts include multi-policy discounts (for bundling home and auto insurance), good student discounts (for students with a certain GPA), safe driver discounts (for drivers with a clean driving record), and loyalty discounts (for long-term customers). Other discounts may be offered for specific professions, military service, or even for vehicle safety features such as anti-theft devices or advanced driver assistance systems.

How can I lower my vehicle insurance premiums?

+There are several strategies you can employ to lower your vehicle insurance premiums. First, shop around and compare quotes from multiple carriers. Each carrier assesses risk differently, so you may find significant variations in premiums. Secondly, consider raising your deductible. A higher deductible means you pay more out of pocket in the event of a claim, but it can lead to lower premiums. Additionally, maintain a clean driving record, as violations and accidents can significantly increase your premiums. Finally, explore the discounts offered by your carrier and see if you’re eligible for any.