Best And Cheap Car Insurance

Finding the best and most affordable car insurance is a top priority for many drivers, as it provides financial protection and peace of mind on the road. With numerous insurance providers and a range of coverage options, it can be challenging to navigate the market and identify the ideal policy that offers excellent coverage at a reasonable price. This comprehensive guide aims to demystify the process, offering expert insights and practical tips to help you secure the best car insurance deal tailored to your specific needs.

Understanding Car Insurance: Coverage and Costs

Car insurance is a legal requirement in most regions, serving as a vital financial safety net in the event of accidents, theft, or other vehicle-related incidents. It offers protection against potential liabilities and covers the costs of repairs or replacements, ensuring you and other road users are safeguarded.

The cost of car insurance varies significantly, influenced by factors such as the driver's age, gender, driving record, and the type and value of the vehicle being insured. Additionally, the level of coverage chosen, including liability, collision, comprehensive, and optional add-ons, plays a pivotal role in determining the overall cost.

Factors Influencing Car Insurance Premiums

Understanding the key factors that impact insurance premiums is essential for making informed choices. Here’s a breakdown of some critical considerations:

- Driver Profile: Your age, gender, and driving history significantly affect your insurance rates. Younger drivers, especially males, often face higher premiums due to statistical risks associated with their demographic.

- Vehicle Type: The make, model, and age of your vehicle impact insurance costs. Sports cars and luxury vehicles typically attract higher premiums due to their higher repair and replacement costs.

- Coverage Selection: The level of coverage you choose directly affects your premium. Comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, is more expensive than basic liability coverage.

- Location: Where you live and drive your vehicle plays a role in determining insurance rates. Urban areas with higher traffic volumes and crime rates often result in higher premiums.

- Driving Record: A clean driving record with no accidents or violations is rewarded with lower insurance rates. Conversely, a history of accidents or traffic violations can significantly increase your premiums.

Types of Car Insurance Coverage

Car insurance policies typically offer a range of coverage options, allowing you to tailor your policy to your specific needs. Here’s a breakdown of the primary types of car insurance coverage:

- Liability Coverage: This is the most basic form of car insurance, covering the costs of injuries or damages you cause to others in an accident. It's legally required in most states and typically includes bodily injury liability and property damage liability.

- Collision Coverage: This optional coverage pays for the repair or replacement of your vehicle if it's damaged in an accident, regardless of fault. It's particularly valuable for newer or more expensive vehicles.

- Comprehensive Coverage: Comprehensive insurance covers damages to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or collisions with animals. It's often required for leased or financed vehicles.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of you and your passengers, regardless of who's at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Researching and Comparing Insurance Providers

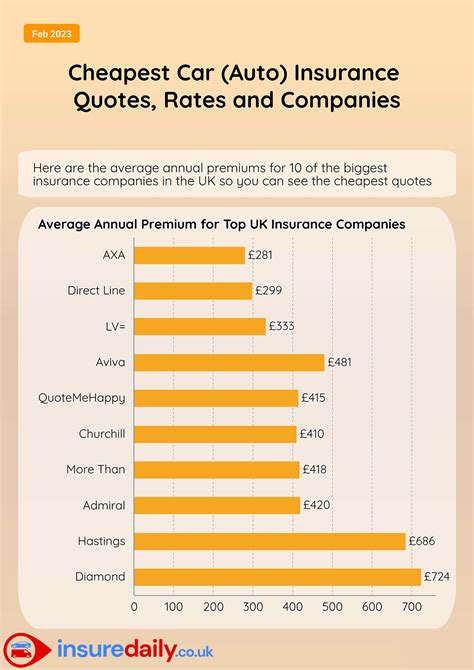

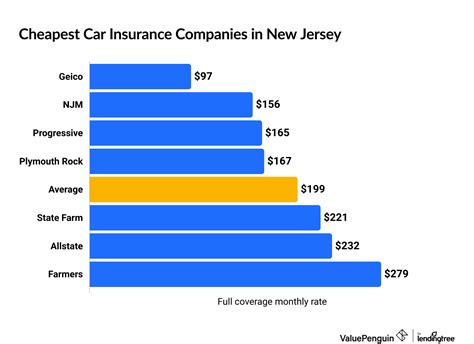

With a solid understanding of the factors influencing car insurance costs and the types of coverage available, the next step is to research and compare insurance providers to find the best deal.

Start by identifying reputable insurance companies in your area. Online reviews and ratings can provide valuable insights into customer satisfaction and claim experiences. Consider checking out industry rankings and financial stability ratings to ensure the providers you're considering are financially secure and reliable.

Online Quote Comparison

Utilize online quote comparison tools to get a snapshot of the insurance market. These tools allow you to input your details and vehicle information once, and then receive multiple quotes from different providers, making it easier to compare prices and coverage options side by side.

When comparing quotes, pay close attention to the level of coverage offered. Ensure that the policies you're considering provide the same or similar coverage limits and deductibles. This will help you make an apples-to-apples comparison and identify the best value for your money.

Bundle and Save

Consider bundling your car insurance with other types of insurance, such as homeowners or renters insurance, to potentially save money. Many insurance providers offer discounts when you purchase multiple policies from them.

Reviewing Policy Details

Before finalizing your decision, carefully review the policy details of the quotes you’ve received. Look for any exclusions or limitations that may impact your coverage. Ensure that the policy aligns with your specific needs and provides adequate protection for your circumstances.

Negotiating and Securing the Best Deal

Once you’ve narrowed down your options, it’s time to negotiate and secure the best deal. Here are some strategies to consider:

- Leverage Discounts: Insurance providers offer a variety of discounts, including safe driver discounts, good student discounts, loyalty discounts, and multi-policy discounts. Ask about the discounts you may be eligible for and negotiate to ensure you're getting the best rate.

- Raise Your Deductible: Increasing your deductible (the amount you pay out of pocket before your insurance kicks in) can significantly reduce your premium. However, it's essential to choose a deductible amount that you're comfortable paying if you need to make a claim.

- Explore Usage-Based Insurance: Some insurance providers offer usage-based insurance programs that track your driving habits and reward safe driving with lower premiums. If you're a cautious and cautious driver, this could be a great option to consider.

- Compare Add-Ons: Review the optional add-ons offered by different insurance providers. These can include rental car reimbursement, roadside assistance, and gap insurance. Assess which add-ons are valuable to you and negotiate to include them in your policy at a reasonable cost.

Managing Your Car Insurance Policy

Once you’ve secured your car insurance policy, it’s important to manage it effectively to ensure you’re getting the best value and coverage. Here are some tips to help you make the most of your policy:

Regularly Review and Update Your Policy

Life circumstances and your vehicle can change over time, impacting your insurance needs. Review your policy annually or whenever there’s a significant change, such as a new vehicle purchase, a move to a different location, or a change in your marital status.

Utilize Safe Driving Programs

Many insurance providers offer safe driving programs or apps that track your driving habits and provide feedback on areas where you can improve. These programs often come with discounts or rewards for maintaining good driving habits.

File Claims Wisely

While it’s essential to file claims when necessary, consider the long-term impact on your insurance rates. Minor claims, especially those with minimal damage or injuries, may not be worth filing, as they can lead to increased premiums down the line.

Stay Informed and Ask Questions

Stay updated on changes in the insurance market and be proactive in seeking out better deals. Don’t hesitate to ask your insurance provider questions about your policy, coverage limits, or any other concerns you may have.

Conclusion: The Best Car Insurance for Your Needs

Finding the best and most affordable car insurance requires a combination of research, comparison, and negotiation. By understanding the factors that influence insurance costs and the types of coverage available, you can make informed choices and secure a policy that provides excellent coverage at a reasonable price.

Remember, the cheapest policy isn't always the best, and it's essential to strike a balance between cost and coverage. By following the expert tips and strategies outlined in this guide, you'll be well-equipped to navigate the car insurance market and find a policy that meets your needs and budget.

FAQ

How can I get the best car insurance rates as a young driver?

+

As a young driver, you can improve your insurance rates by maintaining a clean driving record, considering usage-based insurance programs that reward safe driving, and exploring discounts for good students or young drivers with safety training.

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the US varies by state and can range from 500 to 2,000 per year. However, individual rates can vary significantly based on factors such as driving history, vehicle type, and coverage selected.

Can I switch car insurance providers mid-policy term?

+

Yes, you can switch insurance providers at any time. However, be aware of any cancellation fees or penalties that may apply. It’s essential to understand the terms of your current policy and any potential consequences before making a switch.

What are some common car insurance discounts I should look for?

+

Common car insurance discounts include safe driver discounts, multi-policy discounts, loyalty discounts, good student discounts, and discounts for vehicle safety features such as anti-theft devices or advanced driver-assistance systems.

How can I save money on car insurance without compromising coverage?

+

To save money without sacrificing coverage, consider increasing your deductible, exploring usage-based insurance programs, bundling multiple insurance policies, and regularly reviewing your policy for any unnecessary add-ons or coverage that can be adjusted to reduce costs.