Travelers Insurance

In the world of insurance, a trusted name stands out, offering comprehensive coverage and a legacy of excellence. Travelers Insurance, with its rich history and innovative approach, has become a cornerstone of the industry, providing peace of mind to individuals, families, and businesses across the globe. This article delves into the depths of Travelers Insurance, exploring its origins, the breadth of its services, and its impact on the modern insurance landscape.

A Legacy of Protection: The Story of Travelers Insurance

The tale of Travelers Insurance begins in the heart of America, in the bustling city of Hartford, Connecticut. It was here, in 1853, that a group of visionary entrepreneurs recognized the need for a new kind of insurance company. They aimed to create a business that would provide reliable protection against the uncertainties of life and commerce.

The company's founding fathers, including James G. Batterson and William H. Phelps, had a vision to offer comprehensive insurance solutions to a diverse range of clients. Their mission was to become a trusted partner, offering financial security and peace of mind to those who needed it most.

Over the years, Travelers Insurance has grown from a small, local enterprise to a global powerhouse. It has weathered the storms of economic downturns and technological revolutions, constantly adapting and innovating to meet the evolving needs of its customers.

A Historical Perspective

Travelers Insurance’s journey has been marked by significant milestones. In the late 19th century, the company played a pivotal role in insuring some of the nation’s most iconic structures, including the Brooklyn Bridge and the Statue of Liberty. These endeavors not only showcased the company’s financial strength but also its commitment to supporting America’s growth and development.

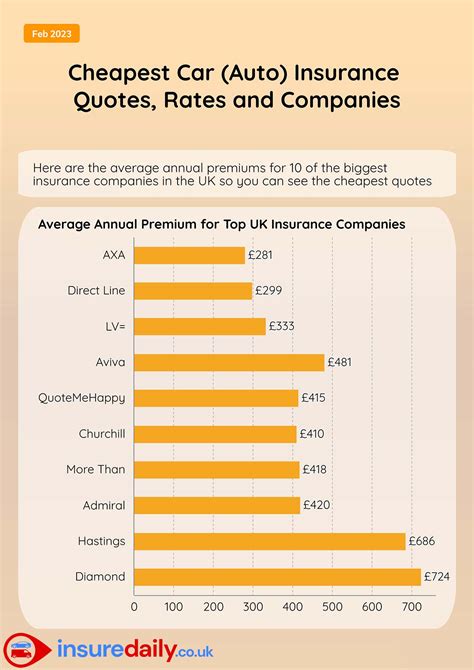

As the 20th century unfolded, Travelers expanded its reach, offering a wide array of insurance products. From auto and home insurance to business coverage and specialized plans for unique risks, Travelers became a one-stop shop for all insurance needs.

| Milestone | Historical Event |

|---|---|

| 1864 | Insured the Brooklyn Bridge during its construction |

| 1886 | Provided insurance for the dedication of the Statue of Liberty |

| 1911 | Offered the first automobile insurance policy |

| 1959 | Introduced the first credit insurance product |

| 1993 | Merged with The St. Paul Companies, expanding its business portfolio |

The company's ability to adapt and innovate has been a key factor in its success. In recent years, Travelers has embraced digital transformation, offering online platforms and mobile apps for policy management and claims processing, ensuring convenience and efficiency for its customers.

Comprehensive Services: A Look at Travelers’ Insurance Portfolio

Travelers Insurance offers an extensive range of insurance products tailored to meet the diverse needs of its clients. Whether it’s protecting personal assets or safeguarding business operations, Travelers has a solution.

Personal Insurance

For individuals and families, Travelers provides a comprehensive suite of personal insurance products. These include:

- Auto Insurance: Covering a wide range of vehicles, from cars and motorcycles to recreational vehicles, Travelers offers customizable policies to suit different lifestyles and driving needs.

- Home Insurance: Protecting homeowners and renters alike, Travelers’ home insurance plans provide coverage for property damage, theft, and liability, ensuring peace of mind for policyholders.

- Life Insurance: Travelers offers various life insurance plans, including term life, whole life, and universal life insurance, to help individuals and families secure their financial future.

- Health Insurance: With a range of health insurance plans, Travelers aims to provide accessible and affordable healthcare coverage, offering peace of mind in times of medical need.

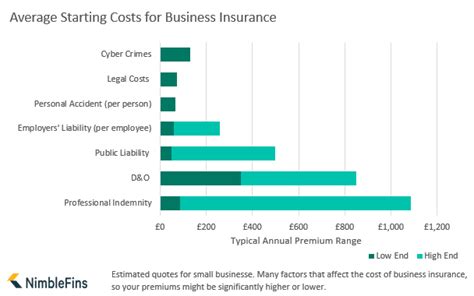

Business Insurance

For businesses of all sizes, Travelers offers a comprehensive business insurance portfolio. This includes:

- Commercial Property Insurance: Protecting businesses from property damage, theft, and natural disasters, Travelers’ commercial property insurance ensures that businesses can quickly recover and resume operations.

- Liability Insurance: With a range of liability insurance options, Travelers helps businesses mitigate the financial risks associated with lawsuits and claims, providing a crucial safety net.

- Business Owners Policy (BOP): A cost-effective solution for small businesses, BOP combines property and liability insurance, offering a comprehensive coverage package.

- Workers’ Compensation Insurance: Travelers’ workers’ comp insurance provides coverage for employees injured on the job, ensuring businesses can meet their legal obligations and support their workforce.

Specialized Insurance

In addition to its core insurance offerings, Travelers provides specialized insurance solutions for unique risks. These include:

- Flood Insurance: With the increasing risk of flooding due to climate change, Travelers offers flood insurance to protect properties in high-risk areas.

- Cyber Insurance: In the digital age, businesses face new risks. Travelers’ cyber insurance policies help protect against data breaches, cyber attacks, and other online threats.

- Umbrella Insurance: For individuals and businesses seeking additional liability coverage, Travelers’ umbrella insurance policies provide an extra layer of protection beyond standard policies.

Travelers' commitment to innovation is evident in its specialized insurance offerings, ensuring that it remains at the forefront of the industry, providing cutting-edge solutions to its clients.

Customer Experience: Travelers’ Approach to Service Excellence

At the heart of Travelers’ success is its unwavering commitment to delivering an exceptional customer experience. The company understands that insurance is not just about policies and premiums; it’s about providing peace of mind and support during life’s most challenging moments.

Claims Handling

Travelers’ claims handling process is renowned for its efficiency and empathy. The company employs a team of experienced claims adjusters who work diligently to process claims promptly and fairly. Whether it’s a fender-bender or a catastrophic loss, Travelers aims to provide swift and comprehensive support, helping customers get back on their feet.

The company's digital transformation has further enhanced its claims process. Policyholders can now file claims online or through the Travelers mobile app, providing a convenient and efficient way to initiate the claims process. Travelers also offers real-time claim tracking, allowing customers to stay informed throughout the process.

Customer Service

Travelers’ customer service team is dedicated to providing timely and knowledgeable assistance. Whether it’s answering policy questions, helping with coverage selections, or providing support during a claim, the team is trained to deliver a high level of service. Travelers’ commitment to continuous training ensures that its customer service representatives are equipped to handle a wide range of inquiries, providing accurate and helpful responses.

Community Engagement

Travelers believes in giving back to the communities it serves. The company is actively involved in various charitable initiatives and community development programs. From supporting local education initiatives to providing disaster relief, Travelers demonstrates its commitment to social responsibility.

This community-centric approach not only strengthens Travelers' connection with its customers but also fosters a culture of trust and goodwill. It is a testament to Travelers' belief that insurance is not just a transaction but a partnership built on mutual respect and shared values.

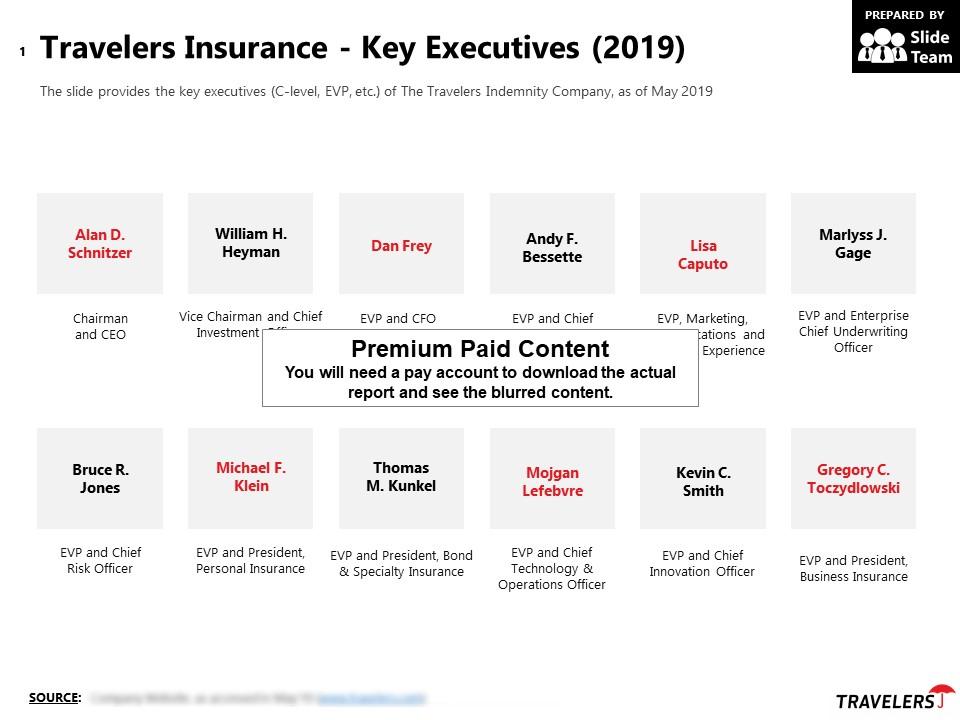

Industry Recognition and Awards

Travelers Insurance’s dedication to excellence has been recognized by numerous industry organizations and publications. The company consistently ranks among the top insurance providers in the United States and has received accolades for its financial strength, customer satisfaction, and innovative products.

Awards and Recognitions

Some of the notable awards and recognitions received by Travelers include:

- A+ (Superior) Financial Strength Rating from A.M. Best, one of the highest ratings an insurance company can achieve.

- Recognition as one of the “World’s Most Admired Companies” by Fortune magazine for multiple years.

- Named as one of the “100 Best Companies to Work For” by Fortune, highlighting Travelers’ commitment to employee satisfaction and development.

- Recipient of the J.D. Power Award for Excellence in Customer Service, recognizing Travelers’ dedication to delivering exceptional customer experiences.

These awards and recognitions are a testament to Travelers' commitment to its customers, employees, and communities. They reflect the company's unwavering dedication to providing quality insurance products and services, while also contributing to the betterment of society.

The Future of Insurance: Travelers’ Vision

As the insurance industry continues to evolve, Travelers remains at the forefront, embracing technological advancements and adapting to changing consumer needs. The company’s vision for the future is centered on innovation, sustainability, and a customer-centric approach.

Technological Innovations

Travelers recognizes the potential of technology to enhance the insurance experience. The company is investing in cutting-edge technologies, such as artificial intelligence and machine learning, to improve efficiency and accuracy in underwriting, claims handling, and customer service. By leveraging these technologies, Travelers aims to deliver faster, more personalized services to its customers.

Additionally, Travelers is exploring the potential of blockchain technology to enhance security and transparency in insurance transactions. By leveraging blockchain, the company aims to create a more secure and efficient ecosystem for insurance, benefiting both customers and business partners.

Sustainable Practices

With a growing focus on sustainability and environmental responsibility, Travelers is committed to reducing its environmental footprint. The company has implemented various initiatives to minimize waste, conserve energy, and promote sustainable practices within its operations and supply chain. Travelers’ goal is to create a more sustainable future, not just for the insurance industry, but for the planet as a whole.

Customer-Centric Approach

At the core of Travelers’ vision is a deep commitment to its customers. The company aims to continue delivering personalized insurance solutions that meet the unique needs of individuals and businesses. By understanding its customers’ evolving needs and preferences, Travelers strives to provide tailored coverage and exceptional service, ensuring peace of mind and financial security.

Travelers' customer-centric approach extends beyond its insurance products. The company is dedicated to empowering its customers with educational resources and tools to help them make informed insurance decisions. Whether it's through online resources, workshops, or one-on-one consultations, Travelers aims to provide the knowledge and support needed to navigate the complex world of insurance with confidence.

Frequently Asked Questions

What types of insurance does Travelers offer for businesses?

+

Travelers offers a comprehensive range of business insurance solutions, including commercial property insurance, liability insurance, business owners policies (BOP), workers’ compensation insurance, and specialized coverage for unique risks such as cyber threats and flood damage.

How does Travelers handle claims for auto accidents?

+

Travelers has a dedicated claims team that processes auto accident claims promptly and fairly. Policyholders can file claims online, through the Travelers mobile app, or by phone. The company provides real-time claim tracking and works closely with customers to ensure a smooth and efficient claims process.

What makes Travelers’ customer service stand out?

+

Travelers’ customer service team is known for its expertise and dedication. They provide timely assistance, offering accurate and helpful responses to policy inquiries and claims-related questions. The team is continuously trained to deliver a high level of service, ensuring a positive customer experience.

How does Travelers contribute to sustainability initiatives?

+

Travelers is committed to reducing its environmental impact through various sustainability initiatives. This includes minimizing waste, conserving energy, and promoting sustainable practices within its operations and supply chain. The company aims to lead by example, inspiring others in the industry to adopt more sustainable practices.

What sets Travelers apart from other insurance providers?

+

Travelers stands out for its commitment to innovation, customer service, and financial strength. The company continuously adapts to changing industry trends and consumer needs, offering cutting-edge insurance solutions. With a focus on delivering exceptional experiences, Travelers has earned a reputation as a trusted partner for individuals and businesses seeking comprehensive insurance coverage.