Car Insured

In today's fast-paced world, ensuring our vehicles is an essential aspect of responsible car ownership. The process of car insurance can seem daunting, but with the right knowledge and understanding, it becomes a straightforward and vital step towards safeguarding your financial well-being and peace of mind. This article aims to provide an in-depth exploration of car insurance, from the fundamentals to the intricacies, shedding light on its significance, how it works, and the various factors that influence it.

Understanding Car Insurance: A Comprehensive Overview

Car insurance is a contract between an individual (the policyholder) and an insurance company, wherein the insurer agrees to compensate the policyholder for specific losses related to their vehicle, subject to the terms and conditions outlined in the insurance policy.

This financial safeguard is designed to protect policyholders from incurring substantial costs resulting from unforeseen events such as accidents, theft, natural disasters, or other incidents that could damage or render their vehicles inoperable. The primary goal of car insurance is to mitigate the financial risks associated with vehicle ownership, providing a safety net that covers repair or replacement costs, medical expenses, and potential liability claims.

The Fundamentals of Car Insurance

At its core, car insurance operates on the principle of risk pooling. Policyholders pay a premium to the insurance company, which collects these premiums from a large number of individuals. This pool of funds is then used to compensate policyholders who suffer insured losses. The insurance company spreads the financial risk across its customer base, allowing individuals to manage their risks more effectively and affordably than if they were to bear the costs alone.

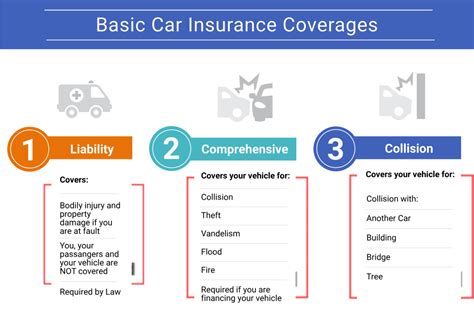

Car insurance policies typically cover a range of perils, including collision, comprehensive, liability, and personal injury protection (PIP) coverage. Collision coverage pays for repairs or replacements when your vehicle is involved in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damage or loss due to non-collision events like theft, vandalism, weather-related incidents, or collisions with animals.

Liability coverage is particularly important as it protects policyholders from financial ruin in the event they are found legally responsible for causing harm to others or their property in an accident. This coverage includes both bodily injury liability and property damage liability. Personal Injury Protection (PIP) or Medical Payments coverage provides compensation for medical expenses and sometimes lost wages for the policyholder and their passengers, regardless of fault.

Factors Influencing Car Insurance Rates

Car insurance rates are determined by a variety of factors, each contributing to the overall risk profile of the policyholder. These factors include:

- Age and Gender: Generally, younger drivers, especially males, are considered higher-risk due to their relative lack of driving experience and higher propensity for risky behavior. As a result, insurance rates for younger drivers tend to be higher.

- Driving History: A clean driving record is highly favorable in terms of insurance rates. Those with a history of accidents, traffic violations, or DUI/DWI convictions are likely to face higher premiums as they are considered higher-risk drivers.

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as how and where you use it, can significantly impact your insurance rates. Sports cars, luxury vehicles, and high-performance cars often attract higher premiums due to their increased risk of theft or costly repairs. Additionally, vehicles used for business purposes or as part of a fleet may also face higher insurance costs.

- Credit Score: In many states, insurance companies are permitted to use credit-based insurance scores when determining premiums. Generally, individuals with higher credit scores are considered lower-risk and may benefit from lower insurance rates.

- Location and Mileage: The geographic location where the vehicle is primarily driven and garaged plays a role in insurance rates. Areas with higher population densities, more traffic, and higher crime rates often result in higher premiums. Similarly, the number of miles driven annually can influence rates, as higher mileage typically indicates a greater risk of accidents.

- Marital Status and Education: Some insurance companies offer discounts to married individuals and those with higher education levels, as they are often seen as lower-risk drivers.

The Importance of Adequate Coverage

While car insurance is a legal requirement in most states, it is crucial to ensure that your coverage is adequate to protect your financial interests. Insufficient coverage can leave you vulnerable to significant out-of-pocket expenses in the event of an accident or other insured loss.

Choosing the Right Coverage Limits

When selecting car insurance, it is essential to choose coverage limits that align with your financial situation and potential risks. Here’s a breakdown of the different coverage types and recommended limits:

- Liability Coverage: This is arguably the most critical coverage, as it protects you from financial ruin in the event you are found legally responsible for causing harm to others or their property. It is recommended to carry the highest liability limits you can afford, as the minimum required by law in most states may not be sufficient to cover the full extent of damages in a serious accident.

- Collision and Comprehensive Coverage: These coverages protect your vehicle from damage or loss due to accidents, theft, vandalism, weather events, and other non-collision incidents. The recommended coverage limits should be based on the current value of your vehicle. If your vehicle is older and less valuable, you may consider carrying higher deductibles or even dropping these coverages if the cost of insurance exceeds the potential benefit.

- Personal Injury Protection (PIP) or Medical Payments Coverage: These coverages provide compensation for medical expenses and lost wages for you and your passengers, regardless of fault. It is advisable to carry the highest limits you can afford, especially if you or your family members have significant healthcare needs or high-risk occupations.

Understanding Deductibles

A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. It is essentially a cost-sharing mechanism between you and your insurance company. Higher deductibles result in lower premiums, as you are agreeing to bear more of the financial risk in the event of a claim. Conversely, lower deductibles mean you pay more in premiums but have less financial responsibility when filing a claim.

When choosing a deductible, consider your financial situation and ability to cover potential out-of-pocket expenses. It is generally advisable to select a deductible that you can comfortably afford in the event of an insured loss. Additionally, keep in mind that some insurance companies offer deductibles that vary based on the type of claim. For instance, you may have a separate deductible for collision claims and another for comprehensive claims.

Maximizing Savings on Car Insurance

Car insurance is a significant expense for many individuals and families. Fortunately, there are several strategies you can employ to reduce your insurance premiums and maximize your savings without compromising on adequate coverage.

Bundling Policies

Many insurance companies offer multi-policy discounts when you bundle your car insurance with other types of insurance, such as homeowners, renters, or life insurance. By doing so, you can often secure significant savings on your overall insurance costs. Additionally, bundling policies with the same insurer can simplify your insurance management and provide added convenience.

Safe Driving and Discounts

Maintaining a clean driving record is not only essential for keeping your insurance premiums low but also for ensuring your safety and the safety of others on the road. Most insurance companies offer discounts to policyholders who have a clean driving record, have completed defensive driving courses, or have installed safety devices in their vehicles. These discounts can significantly reduce your insurance costs over time.

Utilizing Telematics

Telematics is a technology that allows insurance companies to monitor your driving behavior and habits in real-time. By installing a telematics device in your vehicle or using a smartphone app, your insurer can collect data on your driving speed, acceleration, braking, and mileage. Based on this data, they can offer personalized insurance rates that reflect your actual driving behavior.

Telematics programs are particularly beneficial for safe drivers, as they can lead to substantial savings on insurance premiums. However, it's important to note that these programs may also reveal driving behaviors that could result in higher insurance rates for some individuals.

Exploring Other Discounts

Insurance companies often offer a variety of additional discounts to policyholders. These discounts may be based on factors such as your profession, educational background, vehicle safety features, or even your payment method. It’s worth exploring these discounts and taking advantage of those that apply to your situation to further reduce your insurance costs.

The Future of Car Insurance: Technological Innovations

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. These innovations are reshaping the way insurance is priced, sold, and delivered, offering new opportunities for policyholders to save money and enhance their coverage.

Usage-Based Insurance (UBI)

Usage-Based Insurance, often referred to as Pay-As-You-Drive (PAYD) or Pay-How-You-Drive (PHYD), is a type of insurance policy that bases premiums on how, when, and where a vehicle is driven. This approach to insurance pricing is made possible by telematics technology, which collects and analyzes data on driving behavior in real-time.

UBI policies can be particularly beneficial for low-mileage drivers, as they allow these individuals to pay insurance premiums that more accurately reflect their actual risk exposure. Additionally, UBI can encourage safer driving behaviors, as policyholders may receive discounts for driving safely and responsibly.

Connected Car Technology

Connected car technology is transforming the way vehicles interact with their surroundings and with insurance companies. This technology enables vehicles to communicate with other devices and systems, such as smartphones, home assistants, and even insurance company servers, providing real-time data on vehicle performance, maintenance needs, and driving behavior.

For insurance companies, connected car technology offers a wealth of data that can be used to more accurately assess risk and price insurance policies. This data can also be leveraged to provide policyholders with more personalized coverage options and tailored risk management advice.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the insurance industry, enabling more efficient and accurate risk assessment and pricing. These technologies can analyze vast amounts of data, including driving behavior, vehicle performance, and even social media data, to identify patterns and predict future risks with greater accuracy.

By leveraging AI and ML, insurance companies can offer more tailored insurance products and services, provide faster claims processing, and improve overall customer experience. These technologies also enable insurers to identify and mitigate fraud more effectively, further enhancing the efficiency and integrity of the insurance process.

Conclusion: Navigating the World of Car Insurance

Car insurance is a vital component of responsible vehicle ownership, offering financial protection and peace of mind in the face of unforeseen events. Understanding the intricacies of car insurance, from the types of coverage available to the factors influencing premiums, is essential for making informed decisions and ensuring your coverage is both adequate and affordable.

As the car insurance landscape continues to evolve with technological advancements, policyholders have an increasingly diverse range of options to choose from. By staying informed, comparing policies, and taking advantage of the latest innovations, you can navigate the world of car insurance with confidence, securing the coverage you need at a price that fits your budget.

What are the basic types of car insurance coverage available?

+There are several types of car insurance coverage, including liability coverage (for bodily injury and property damage caused to others), collision coverage (for damage to your own vehicle in an accident), comprehensive coverage (for non-collision events like theft or weather damage), personal injury protection (PIP) or medical payments coverage (for medical expenses and lost wages), and uninsured/underinsured motorist coverage (for accidents with drivers who have little or no insurance coverage).

How can I save money on my car insurance premiums?

+You can save money on car insurance premiums by shopping around and comparing quotes from multiple insurers, bundling your policies (such as car and home insurance), maintaining a clean driving record, taking advantage of discounts (for safe driving, good grades, loyalty, etc.), increasing your deductibles, and considering usage-based insurance (UBI) policies if you drive less than average.

What factors influence car insurance rates?

+Car insurance rates are influenced by various factors, including your age, gender, driving record, the type and make of your vehicle, your credit score, the geographic location where the vehicle is primarily driven and garaged, the number of miles driven annually, and your marital status and education level.

What is a deductible, and how does it work?

+A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. For example, if you have a 500 deductible and file a claim for 3,000 in damages, you would pay the first 500, and your insurance company would pay the remaining 2,500. Higher deductibles mean lower premiums, while lower deductibles mean higher premiums.