Reviews For Progressive Insurance

Progressive Insurance: An In-Depth Review and Analysis

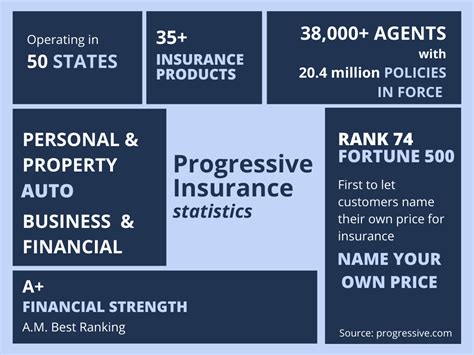

In the world of insurance, Progressive Insurance has established itself as a prominent player, offering a wide range of coverage options and innovative approaches to meet the diverse needs of policyholders. This article aims to provide a comprehensive review of Progressive Insurance, delving into its history, products, customer satisfaction, and unique features, while also exploring the company’s performance and reputation within the industry.

Progressive’s Journey and Market Presence

Progressive Insurance was founded in 1937 by Joseph Lewis and Jack Green, pioneers in the insurance industry who envisioned a company that would provide customers with affordable and accessible auto insurance. Over the decades, Progressive has grown exponentially, becoming one of the largest auto insurance providers in the United States. Its market presence extends beyond auto insurance, with offerings in home, life, business, and specialty insurance lines.

A Comprehensive Range of Insurance Products

One of Progressive’s strengths lies in its diverse product portfolio. The company offers a comprehensive suite of insurance products to cater to various consumer needs:

Auto Insurance: Progressive’s flagship product, auto insurance, provides coverage for a wide range of vehicles, including cars, motorcycles, RVs, and classic cars. Policyholders can choose from various coverage levels, including liability, collision, comprehensive, and personalized plans tailored to their specific needs.

Home Insurance: Progressive’s home insurance policies protect homeowners and renters alike. Coverage options include structures, personal property, liability, and additional living expenses. The company also offers discounts for bundled policies, combining auto and home insurance for cost savings.

Life Insurance: Progressive offers term life insurance policies, providing financial protection for policyholders and their families. These policies offer flexibility in coverage amounts and terms, ensuring customers can find a plan that aligns with their budget and needs.

Business Insurance: Progressive’s business insurance solutions cater to small and medium-sized enterprises. The company provides coverage for general liability, commercial auto, workers’ compensation, and professional liability, helping businesses mitigate risks and protect their operations.

Specialty Insurance: Progressive also offers specialty insurance products, such as pet insurance, boat insurance, and umbrella insurance. These policies provide additional coverage for specific needs, ensuring comprehensive protection for policyholders.

Customer Satisfaction and Claims Experience

Progressive has invested significantly in enhancing the customer experience, and its efforts have been well-received by policyholders. The company boasts a strong reputation for customer satisfaction, with numerous positive reviews highlighting its efficient claims process, responsive customer service, and competitive pricing.

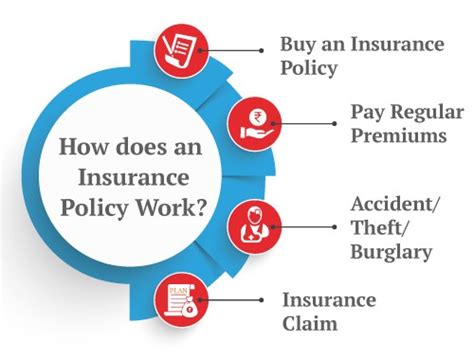

Progressive’s claims process is designed to be streamlined and convenient. Policyholders can file claims online, via phone, or through the company’s mobile app, ensuring quick and efficient resolution. Progressive’s claims adjusters are known for their expertise and dedication to resolving claims fairly and promptly.

Unique Features and Digital Innovations

Progressive has embraced digital transformation, leveraging technology to enhance the customer experience and streamline processes. Here are some of the company’s notable features and innovations:

Name Your Price® Tool: Progressive’s Name Your Price® tool allows customers to input their desired monthly premium and receive personalized coverage options based on their budget. This innovative feature empowers customers to take control of their insurance costs while ensuring they receive adequate coverage.

Snapshot® Program: The Snapshot® program utilizes telematics technology to track driving behavior and offer personalized insurance rates. Policyholders who drive safely and responsibly can benefit from discounted rates, as the program rewards good driving habits.

Mobile App: Progressive’s mobile app offers a convenient and user-friendly interface for policyholders. Customers can access their policy information, file claims, pay bills, and receive real-time updates on their claims status, all from the palm of their hand.

Online Quoting and Policy Management: Progressive’s online platform enables customers to obtain quotes, purchase policies, and manage their insurance needs entirely online. This digital approach enhances convenience and efficiency, allowing policyholders to take control of their insurance journey.

Financial Performance and Industry Reputation

Progressive Insurance has consistently demonstrated strong financial performance, solidifying its position as a stable and reliable insurance provider. The company’s financial strength is evidenced by its A+ rating from AM Best, a leading insurance rating agency. Progressive’s solid financial foundation ensures policyholders can rely on the company’s long-term stability and ability to meet its obligations.

In terms of industry reputation, Progressive has earned recognition for its innovative approaches and customer-centric focus. The company has been lauded for its commitment to digital transformation, leveraging technology to enhance the customer experience and streamline processes. Progressive’s reputation for fairness and transparency in claims handling has also contributed to its positive standing within the industry.

Table: Progressive’s Financial Highlights

| Financial Metric | Value |

|---|---|

| Total Assets (2022) | $107.8 Billion |

| Net Income (2022) | $2.7 Billion |

| Return on Equity (2022) | 16.6% |

| AM Best Rating | A+ (Superior) |

Expert Insights and Comparative Analysis

Progressive Insurance stands out for its comprehensive product offerings, customer-centric approach, and commitment to innovation. The company’s financial strength and reputation for fair claims handling make it a reliable choice for policyholders seeking peace of mind.

When comparing Progressive to other insurance providers, several key differentiators emerge:

Progressive offers a wider range of insurance products, allowing customers to bundle policies and receive discounts. This comprehensive approach simplifies the insurance journey and provides cost savings.

The company’s digital innovations, such as the Name Your Price® tool and Snapshot® program, set it apart by empowering customers to take control of their insurance experience and receive personalized coverage options.

Progressive’s focus on customer satisfaction and its responsive claims process have earned it a strong reputation, ensuring policyholders can rely on the company for efficient and fair claims handling.

Conclusion: A Trusted Insurance Partner

Progressive Insurance has solidified its position as a trusted insurance provider, offering a comprehensive suite of products, innovative features, and a strong focus on customer satisfaction. The company’s financial stability, coupled with its commitment to digital transformation, positions it as a reliable and forward-thinking partner for policyholders seeking insurance solutions.

As Progressive continues to innovate and adapt to the evolving insurance landscape, it remains a top choice for individuals and businesses seeking affordable, accessible, and personalized insurance coverage.

FAQ

How does Progressive’s pricing compare to other insurance providers?

+Progressive offers competitive pricing, often providing discounts for bundled policies and through its innovative programs like Snapshot®. While pricing can vary based on individual factors, Progressive’s focus on personalized coverage options ensures customers receive value for their insurance needs.

What sets Progressive apart from other insurance companies in terms of customer service?

+Progressive’s commitment to customer satisfaction is evident through its responsive claims process and digital innovations. The company’s focus on providing a seamless and convenient experience, coupled with its fair claims handling, sets it apart from competitors.

How can I save money on my Progressive insurance policy?

+There are several ways to save on your Progressive insurance policy. Bundling your auto and home insurance can provide significant discounts. Additionally, utilizing Progressive’s Name Your Price® tool and maintaining good driving habits through the Snapshot® program can lead to lower premiums.