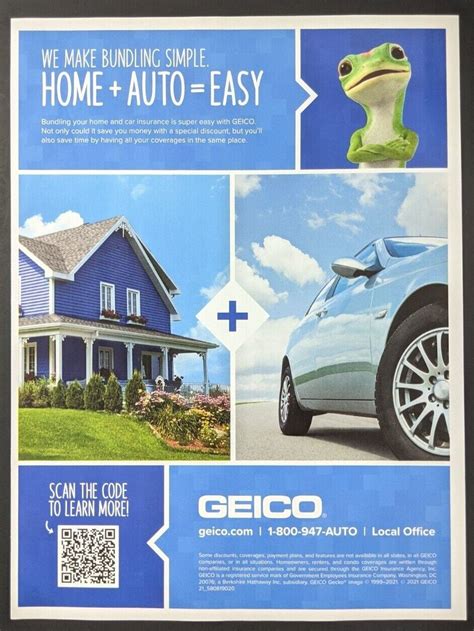

Geico Home Auto Insurance

GEICO: A Comprehensive Guide to Their Home and Auto Insurance Services

GEICO, an acronym for Government Employees Insurance Company, has been a trusted name in the insurance industry for over 80 years. With a focus on providing quality coverage and exceptional customer service, GEICO has grown to become one of the largest auto insurers in the United States. However, their expertise extends beyond auto insurance, offering a range of home insurance policies to protect homeowners and renters alike. In this comprehensive guide, we will delve into GEICO's home and auto insurance offerings, exploring the benefits, coverage options, and why GEICO is a top choice for many.

Auto Insurance with GEICO: A Trusted Choice

GEICO's auto insurance policies are designed to provide comprehensive protection for vehicle owners. With a wide range of coverage options, GEICO ensures that their customers can tailor their policies to meet their specific needs. Here's an overview of what GEICO's auto insurance has to offer:

Comprehensive Coverage

GEICO’s auto insurance policies include standard coverages such as liability, collision, and comprehensive protection. Liability coverage ensures that you’re protected if you’re found at fault in an accident, covering the costs of injuries and property damage to others. Collision coverage pays for repairs or replacements if your vehicle is damaged in an accident, while comprehensive coverage protects against non-collision incidents like theft, vandalism, or natural disasters.

Additional Coverage Options

- Medical Payments Coverage: This optional coverage pays for medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have enough insurance to cover the damages.

- Personal Injury Protection (PIP): Covers a wide range of medical and rehabilitation expenses, as well as lost wages and funeral costs.

- Rental Car Coverage: Provides reimbursement for rental car expenses while your vehicle is being repaired after an insured accident.

Discounts and Savings

GEICO offers a variety of discounts to help customers save on their auto insurance premiums. These include:

- Military Discount: Active duty military personnel, veterans, and their families are eligible for a discount on their auto insurance policies.

- Good Student Discount: Students under 25 with a grade point average of 3.0 or higher may qualify for a discount.

- Multi-Policy Discount: Combining your auto insurance with other policies, such as home or renters insurance, can lead to significant savings.

- Safe Driver Discount: Maintaining a clean driving record can result in lower premiums.

Digital Convenience

GEICO provides its customers with a range of digital tools and resources to make managing their insurance policies easier. This includes a mobile app for policy management, the ability to file claims online, and access to 24⁄7 customer support through their website and app.

Home Insurance: Protecting Your Greatest Asset

GEICO's home insurance policies are designed to provide comprehensive coverage for homeowners and renters. With a focus on customization, GEICO ensures that their customers can tailor their policies to meet the unique needs of their homes and lifestyles.

Homeowners Insurance Coverage

GEICO’s homeowners insurance policies offer a range of coverage options, including:

- Dwelling Coverage: Protects the physical structure of your home, including repairs or rebuilds in the event of a covered loss.

- Personal Property Coverage: Covers the cost of replacing your personal belongings if they are damaged or stolen.

- Liability Coverage: Provides protection if someone is injured on your property or if you’re found legally responsible for causing property damage or bodily injury to others.

- Additional Living Expenses: Covers temporary living expenses if your home becomes uninhabitable due to a covered loss.

Renters Insurance

For renters, GEICO offers affordable and comprehensive renters insurance policies. These policies typically include:

- Personal Property Coverage: Covers the cost of replacing your belongings if they are damaged or stolen.

- Liability Coverage: Protects you if someone is injured in your rented home or if you’re found legally responsible for causing property damage or bodily injury to others.

- Additional Living Expenses: Provides coverage for temporary living expenses if your rented home becomes uninhabitable due to a covered loss.

Additional Home Insurance Coverages

GEICO offers a range of additional coverages to enhance your home insurance policy, including:

- Identity Theft Coverage: Helps cover the costs associated with restoring your identity if you become a victim of identity theft.

- Water Backup Coverage: Provides protection against damage caused by water backup through sewers or drains.

- Personal Injury Coverage: Covers legal expenses if you’re sued for libel, slander, or other personal injury claims.

Discounts and Savings

GEICO provides several discounts on their home insurance policies, including:

- Multi-Policy Discount: Combining your home insurance with your auto insurance policy can lead to significant savings.

- New Homeowner Discount: If you’ve recently purchased a new home, you may be eligible for a discount on your homeowners insurance policy.

- Safety Features Discount: Installing certain safety features in your home, such as smoke detectors or burglar alarms, may qualify you for a discount.

Why Choose GEICO for Your Insurance Needs?

GEICO has established itself as a leading provider of insurance services, offering a range of benefits that make it a top choice for many:

Exceptional Customer Service

GEICO is renowned for its exceptional customer service. With a dedicated team of licensed agents, customers can expect prompt and knowledgeable assistance. GEICO’s 24⁄7 customer support ensures that policyholders can reach out for help or file claims at any time, day or night.

Competitive Pricing

GEICO is committed to providing competitive insurance rates. By offering a wide range of discounts and tailoring policies to individual needs, they ensure that customers receive the best value for their insurance dollar.

Convenience and Accessibility

GEICO’s digital tools and resources make managing insurance policies a breeze. From their user-friendly website to their mobile app, customers can easily access their policies, make payments, and file claims anytime, anywhere.

Financial Strength and Stability

With a long history of financial stability and strength, GEICO is a reliable choice for insurance coverage. Their strong financial position ensures that they can honor their policy commitments and provide long-term security for their customers.

Conclusion

GEICO's home and auto insurance policies offer comprehensive coverage, competitive pricing, and exceptional customer service. By tailoring their policies to individual needs and providing a range of discounts, GEICO ensures that their customers receive the best value for their insurance dollar. With a focus on digital convenience and financial stability, GEICO is a top choice for those seeking reliable and affordable insurance coverage.

How do I get a quote for GEICO’s auto insurance?

+You can get a quote for GEICO’s auto insurance by visiting their website and filling out a short form. Alternatively, you can call their customer service team or work with a licensed GEICO agent to obtain a personalized quote.

What is the process for filing a claim with GEICO?

+GEICO offers a simple and convenient process for filing claims. You can start the process online by visiting their website or by calling their 24⁄7 customer service hotline. You’ll be guided through the steps to provide the necessary information and documentation to initiate your claim.

Does GEICO offer insurance policies for classic cars or motorcycles?

+Yes, GEICO offers specialized insurance policies for classic cars and motorcycles. These policies are designed to provide comprehensive coverage for your vintage vehicles, taking into account their unique needs and values.