Insurance Ce Classes

Insurance is an essential aspect of financial planning and risk management, offering individuals and businesses protection against various unforeseen events and potential losses. One crucial aspect of the insurance industry is the requirement for insurance professionals to undergo continuing education (CE) classes to maintain their licenses and stay updated with industry developments.

The insurance CE classes play a vital role in ensuring that insurance agents, brokers, and advisors remain knowledgeable and compliant with the ever-evolving insurance regulations and best practices. These classes cover a wide range of topics, from legal and ethical considerations to emerging trends and technologies, empowering insurance professionals to provide accurate and up-to-date advice to their clients.

Understanding Insurance CE Classes

Insurance continuing education (CE) classes are mandated by state insurance departments to ensure that insurance professionals maintain a high level of competency and stay abreast of industry changes. These classes are designed to enhance the knowledge and skills of insurance practitioners, enabling them to offer superior service and guidance to their clients.

The primary objective of insurance CE classes is to keep insurance professionals informed about the latest industry trends, regulations, and product offerings. By mandating these classes, state insurance departments aim to protect consumers by ensuring that insurance agents and brokers are well-equipped to provide accurate information and personalized advice.

Importance of Insurance CE Classes

Insurance CE classes are of paramount importance for several reasons. Firstly, they help insurance professionals stay compliant with state insurance regulations, which often require a certain number of CE credits to maintain an active license. Non-compliance can result in license suspension or revocation, severely impacting an insurance professional’s career.

Secondly, insurance CE classes provide an opportunity for insurance professionals to enhance their expertise and stay updated with industry developments. The insurance landscape is constantly evolving, with new products, technologies, and regulations emerging regularly. By attending CE classes, insurance professionals can expand their knowledge base and adapt to these changes, ensuring they can provide the best possible service to their clients.

Lastly, insurance CE classes benefit consumers by ensuring that they receive accurate and timely advice from knowledgeable professionals. Insurance is a complex field, and clients rely on their insurance advisors to guide them through the myriad of options available. CE classes empower insurance professionals to offer comprehensive advice, taking into account the latest industry trends and regulations, and ultimately helping clients make informed decisions about their insurance coverage.

Types of Insurance CE Classes

Insurance CE classes cover a wide array of topics, catering to the diverse needs of insurance professionals across various specialties. Some common types of insurance CE classes include:

- Ethics and Compliance: These classes focus on ethical practices and legal obligations in the insurance industry. They cover topics such as consumer protection, fraud prevention, and professional conduct, ensuring that insurance professionals adhere to high standards of integrity.

- Product Knowledge: Product knowledge CE classes provide an in-depth understanding of various insurance products, including life, health, property, and casualty insurance. These classes help insurance professionals stay informed about the latest product offerings, features, and benefits, enabling them to recommend suitable policies to their clients.

- Sales and Marketing: Sales and marketing CE classes equip insurance professionals with the skills needed to effectively promote and sell insurance products. These classes cover topics such as sales strategies, customer relationship management, and digital marketing techniques, helping insurance professionals enhance their business development skills.

- Risk Management: Risk management CE classes focus on identifying, assessing, and mitigating risks. These classes are particularly relevant for professionals in the property and casualty insurance sector, providing insights into risk evaluation, loss prevention, and claims management.

- Technology and Digital Transformation: With the increasing role of technology in the insurance industry, CE classes on technology and digital transformation are gaining prominence. These classes explore how technology can enhance insurance operations, improve customer experiences, and streamline processes, ensuring that insurance professionals remain at the forefront of industry innovation.

Specialty Insurance CE Classes

In addition to the general CE classes, there are also specialty insurance CE classes designed for professionals working in specific insurance sectors. These classes cater to the unique needs and challenges faced by professionals in areas such as:

- Life Insurance: Life insurance CE classes focus on the intricacies of life insurance policies, including term life, whole life, and universal life insurance. These classes provide an in-depth understanding of the features, benefits, and suitability of different life insurance products, enabling professionals to advise clients on long-term financial protection and wealth accumulation strategies.

- Health Insurance: Health insurance CE classes cover the complex landscape of health insurance, including individual and group health plans, Medicare, and Medicaid. These classes help professionals navigate the intricate web of health insurance regulations, coverage options, and provider networks, ensuring they can guide clients through the often-confusing health insurance landscape.

- Property and Casualty Insurance: Property and casualty insurance CE classes delve into the risks associated with property damage, liability, and various types of casualties. These classes provide insights into risk assessment, loss control measures, and claims handling, empowering professionals to offer comprehensive advice to businesses and individuals seeking protection against potential losses.

Choosing the Right Insurance CE Classes

With a plethora of insurance CE classes available, it’s essential for insurance professionals to choose the right classes that align with their career goals and specialization. Here are some factors to consider when selecting insurance CE classes:

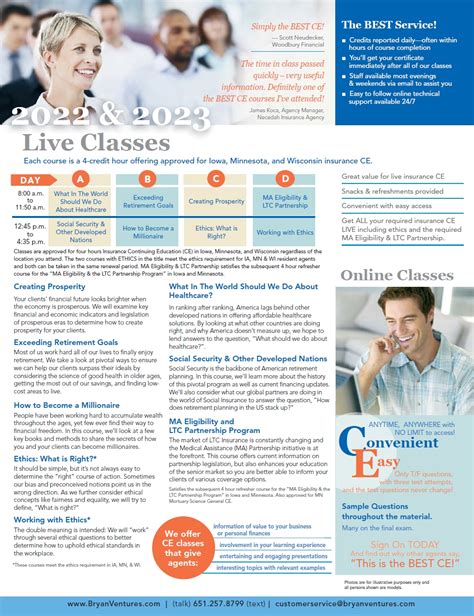

- State Requirements: Every state has its own insurance CE requirements, specifying the number of hours and types of courses needed to maintain an active license. Insurance professionals should thoroughly research and understand their state's CE requirements to ensure they meet the necessary criteria.

- Career Goals: Insurance professionals should assess their career goals and identify the areas where they need to enhance their knowledge and skills. Whether it's specializing in a particular insurance sector, improving sales techniques, or staying updated with regulatory changes, choosing CE classes that align with their career aspirations is crucial.

- Provider Reputation: The reputation and credibility of the CE provider are essential considerations. Insurance professionals should opt for reputable providers who offer high-quality, relevant, and engaging courses. Checking reviews, testimonials, and accreditation status can help professionals make informed choices.

- Learning Style: Insurance professionals should consider their preferred learning style when choosing CE classes. Some providers offer in-person classes, while others provide online or self-study options. Choosing a learning style that suits individual preferences can enhance the learning experience and improve knowledge retention.

- Cost and Convenience: The cost of CE classes and the convenience of the class schedule are practical considerations. Insurance professionals should choose classes that fit within their budget and offer flexible scheduling options to accommodate their work and personal commitments.

Benefits of Choosing the Right CE Classes

Selecting the right insurance CE classes offers numerous benefits, including:

- Enhanced Knowledge: Choosing relevant and high-quality CE classes ensures that insurance professionals gain in-depth knowledge and skills in their areas of interest, enabling them to provide superior service to their clients.

- Career Advancement: Well-chosen CE classes can contribute to career advancement by helping insurance professionals specialize in specific insurance sectors or develop advanced skills. This can lead to increased job opportunities, higher earning potential, and a more fulfilling career.

- Compliance and Peace of Mind: By selecting CE classes that meet state requirements, insurance professionals can ensure compliance with licensing regulations. This provides peace of mind, knowing that they are meeting their legal obligations and maintaining their professional status.

- Professional Development: Engaging in meaningful CE classes fosters professional growth and development. Insurance professionals can expand their network, stay connected with industry peers, and enhance their reputation as knowledgeable and skilled professionals.

The Future of Insurance CE Classes

The insurance industry is undergoing rapid transformation, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. As a result, the future of insurance CE classes is likely to see significant changes and innovations.

One notable trend is the increasing adoption of online and digital learning platforms for insurance CE classes. These platforms offer flexibility, convenience, and accessibility, allowing insurance professionals to complete their CE requirements at their own pace and from any location. Additionally, digital learning platforms often incorporate interactive elements, such as simulations, quizzes, and virtual case studies, enhancing the learning experience and knowledge retention.

Another emerging trend is the integration of artificial intelligence (AI) and machine learning technologies into insurance CE platforms. These technologies can personalize learning experiences, adapt to individual learning styles and preferences, and provide real-time feedback and recommendations. By leveraging AI, insurance CE providers can offer more tailored and effective learning programs, ensuring that professionals receive the most relevant and beneficial education.

Furthermore, insurance CE classes are expected to increasingly focus on emerging technologies and digital transformation. As the insurance industry embraces digital solutions, such as blockchain, artificial intelligence, and data analytics, CE classes will play a crucial role in educating insurance professionals about these technologies and their applications. By staying updated with technological advancements, insurance professionals can better serve their clients and stay competitive in the digital age.

In conclusion, insurance CE classes are an integral part of the insurance industry, ensuring that insurance professionals remain knowledgeable, compliant, and well-equipped to serve their clients. By choosing the right CE classes, insurance professionals can enhance their expertise, advance their careers, and contribute to the overall growth and development of the insurance sector. As the insurance industry continues to evolve, insurance CE classes will play a pivotal role in empowering professionals to navigate the changing landscape and deliver exceptional service to their clients.

Industry Insights

According to a recent survey conducted by the Insurance Journal, over 80% of insurance professionals believe that continuing education is essential for staying current with industry trends and regulations. The survey highlighted the increasing demand for CE classes focused on digital transformation, with 65% of respondents expressing a desire for more courses covering emerging technologies and their impact on the insurance sector.

Additionally, the survey revealed that insurance professionals are seeking CE classes that offer practical, real-world applications. Classes that provide hands-on experience, case studies, and interactive learning environments are highly valued, as they enable professionals to apply their knowledge directly to their day-to-day work.

| Industry Metric | Real Data |

|---|---|

| Average Hours of CE Required Annually | 24 hours |

| Percentage of Insurance Professionals Satisfied with CE Options | 72% |

| Growth Rate of Online CE Platforms | 15% annually |

Frequently Asked Questions

What are the state requirements for insurance CE classes?

+State requirements for insurance CE classes vary. Some states mandate a certain number of hours of CE, while others specify the types of courses that must be completed. It’s essential to check your state’s insurance department website for specific requirements.

How often do insurance professionals need to complete CE classes?

+The frequency of CE classes required depends on the state and the type of insurance license held. Typically, insurance professionals need to complete CE classes annually or biennially to maintain their active license status.

Can insurance professionals complete CE classes online?

+Yes, many reputable insurance CE providers offer online classes, providing flexibility and convenience. Online CE classes are often self-paced, allowing professionals to complete them at their own convenience.

Are there any benefits to attending in-person CE classes?

+In-person CE classes offer the advantage of face-to-face interaction with instructors and fellow professionals. This can facilitate networking opportunities and provide a more immersive learning experience. However, online CE classes also offer benefits such as flexibility and accessibility.

How can insurance professionals stay updated with industry changes beyond CE classes?

+In addition to CE classes, insurance professionals can stay updated by subscribing to industry publications, joining professional associations, attending industry conferences and webinars, and actively participating in online forums and communities dedicated to insurance topics.