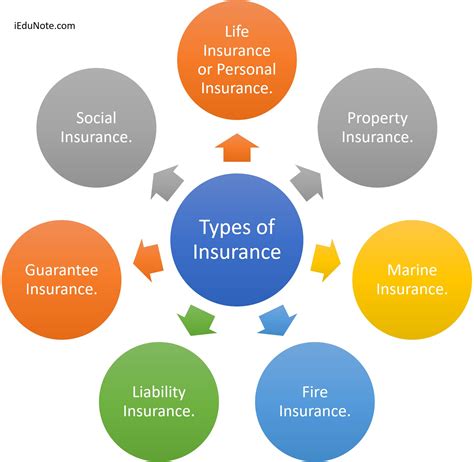

Different Kinds Of Insurance

Insurance, an indispensable tool in modern society, offers individuals and businesses protection against various risks and uncertainties. With an ever-evolving range of insurance types, it's crucial to understand the specific policies that cater to diverse needs and situations. From safeguarding your health to protecting your assets, insurance plays a pivotal role in financial planning and risk management.

Health Insurance: The Key to Peace of Mind

In the realm of personal insurance, health insurance stands out as a fundamental necessity. With the rising costs of medical care, this type of insurance provides individuals and families with the financial support needed to access quality healthcare. Health insurance policies vary widely, covering everything from routine check-ups and prescriptions to major surgeries and chronic illness management.

A comprehensive health insurance plan typically includes:

- Hospitalization coverage: This covers the cost of staying in a hospital, including room and board, medical procedures, and nursing care.

- Outpatient care: Coverage for visits to doctors, specialists, and diagnostic centers for non-hospitalized treatments.

- Prescription drugs: Reimbursement or discounted rates for essential medications.

- Preventive care: Regular check-ups, vaccinations, and screenings to detect and prevent health issues early on.

- Maternity and newborn care: Support for prenatal care, delivery, and postnatal care for both mother and child.

Additionally, many health insurance plans offer optional riders or add-ons to enhance coverage. These can include critical illness coverage, accidental death and dismemberment benefits, and even dental and vision care.

Choosing the Right Health Insurance Plan

When selecting a health insurance plan, consider your unique needs and circumstances. Factors such as age, family size, pre-existing conditions, and lifestyle can influence your choice. It’s essential to understand the policy’s coverage limits, deductibles, co-pays, and out-of-pocket maximums. Moreover, check for the network of healthcare providers and facilities covered by the plan to ensure access to your preferred doctors and hospitals.

| Health Insurance Type | Description |

|---|---|

| Individual Health Insurance | Covers one person and is ideal for those without employer-provided insurance. |

| Family Health Insurance | Provides coverage for the entire family, including spouses and dependent children. |

| Group Health Insurance | Offered by employers, this type of insurance covers employees and their dependents. |

| Short-Term Health Insurance | A temporary solution for those between jobs or awaiting long-term coverage. |

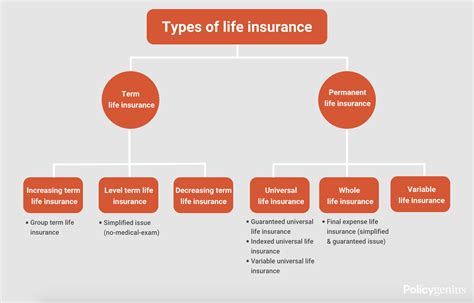

Life Insurance: Securing Your Legacy

Another critical type of personal insurance is life insurance. This policy provides financial protection to your loved ones in the event of your untimely demise. Life insurance serves as a safety net, ensuring your family’s financial stability and helping them maintain their standard of living after your passing.

The two main types of life insurance are:

- Term Life Insurance: Offers coverage for a specified period, typically 10-30 years. It's affordable and provides a fixed death benefit during the term.

- Permanent Life Insurance: Provides lifelong coverage and accumulates cash value over time. It offers flexibility with options like whole life, universal life, and variable life insurance.

The Benefits of Life Insurance

Life insurance serves multiple purposes. It can:

- Replace lost income and cover living expenses for your family.

- Pay off debts, including mortgages, loans, and credit card balances.

- Provide funds for your children's education.

- Cover estate taxes and settlement costs.

- Offer peace of mind, knowing your loved ones are financially secure.

| Life Insurance Type | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specified term, offering a death benefit if the insured passes away during the term. |

| Whole Life Insurance | A permanent insurance plan with guaranteed level premiums and a fixed death benefit. |

| Universal Life Insurance | A flexible permanent insurance plan with adjustable premiums and death benefits. |

| Variable Life Insurance | A permanent insurance plan that allows investment in a range of sub-accounts, offering the potential for higher returns but also carries more risk. |

Property Insurance: Protecting Your Assets

For homeowners and renters alike, property insurance is essential. This type of insurance safeguards your home, its contents, and your personal liability in case of accidents or disasters.

Key components of property insurance include:

- Dwelling coverage: Protects the structure of your home against damage from perils like fire, wind, and theft.

- Personal property coverage: Covers the cost of replacing your belongings if they're damaged or stolen.

- Liability coverage: Provides protection if someone is injured on your property or if you're found legally responsible for causing injury or property damage elsewhere.

- Additional living expenses: Covers the cost of temporary housing and other expenses if your home becomes uninhabitable due to a covered loss.

Understanding Different Types of Property Insurance

There are several types of property insurance, each offering different levels of coverage and benefits. The two primary types are:

- Homeowners Insurance: Designed for homeowners, this policy provides broad coverage for the structure and its contents, as well as personal liability.

- Renters Insurance: Suitable for renters, this policy covers personal property and provides liability coverage, but does not insure the structure of the building.

Additionally, there are specialized property insurance policies for unique situations, such as:

- Condo Insurance: Offers similar coverage to renters insurance but also includes protection for the condo unit's interior and personal liability.

- Mobile Home Insurance: Customized for mobile and manufactured homes, this policy covers the structure, personal property, and liability.

- Landlord Insurance: Provides coverage for rental properties, including building structures, liability, and loss of rental income.

| Property Insurance Type | Description |

|---|---|

| Homeowners Insurance | Covers the structure of the home, personal property, and personal liability. |

| Renters Insurance | Covers personal property and provides liability coverage for renters. |

| Condo Insurance | Offers coverage for condo owners, including the interior of the unit, personal property, and liability. |

| Mobile Home Insurance | Covers mobile and manufactured homes, providing protection for the structure, personal property, and liability. |

Auto Insurance: Safeguarding Your Wheels

For vehicle owners, auto insurance is a legal requirement and a smart financial decision. This type of insurance provides coverage for your vehicle and liability in the event of an accident.

Key components of auto insurance include:

- Liability coverage: Pays for injuries or damages you cause to others in an accident.

- Collision coverage: Covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive coverage: Provides protection for your vehicle against non-collision incidents like theft, vandalism, and natural disasters.

- Personal injury protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/underinsured motorist coverage: Protects you if you're involved in an accident with a driver who has no insurance or insufficient coverage.

Different Types of Auto Insurance

Auto insurance policies can vary based on the level of coverage and the types of vehicles insured. The main types include:

- Standard Auto Insurance: Provides basic liability and physical damage coverage for most vehicles.

- High-Risk Auto Insurance: Designed for drivers with a history of accidents, violations, or claims, this policy offers specialized coverage at a higher premium.

- Classic Car Insurance: Tailored for antique and classic vehicles, this policy provides specialized coverage for the unique needs of these cars.

- Motorcycle Insurance: Offers coverage for motorcycles, scooters, and other two-wheeled vehicles.

- Rideshare Insurance: Provides coverage for drivers who use their personal vehicles for ridesharing services like Uber or Lyft.

| Auto Insurance Type | Description |

|---|---|

| Standard Auto Insurance | Provides basic liability and physical damage coverage for most vehicles. |

| High-Risk Auto Insurance | Designed for drivers with a history of accidents, violations, or claims, offering specialized coverage at a higher premium. |

| Classic Car Insurance | Tailored for antique and classic vehicles, providing specialized coverage for their unique needs. |

| Motorcycle Insurance | Offers coverage for motorcycles, scooters, and other two-wheeled vehicles. |

Business Insurance: Protecting Your Enterprise

For business owners, business insurance is crucial to protect against a range of risks and liabilities. From small startups to large corporations, every business can benefit from tailored insurance coverage.

Key types of business insurance include:

- General Liability Insurance: Protects your business from claims of bodily injury, property damage, and personal and advertising injury that occur due to your products, premises, or operations.

- Professional Liability Insurance (or Errors and Omissions Insurance): Covers legal costs and damages if your business is sued for alleged negligent acts, errors, or omissions in the provision of professional services.

- Product Liability Insurance: Provides protection if your product causes bodily injury or property damage to a third party.

- Business Owner's Policy (BOP): A package policy that combines general liability insurance with commercial property insurance, offering comprehensive coverage for small to medium-sized businesses.

- Workers' Compensation Insurance: Covers medical expenses and a portion of lost wages for employees who are injured or become ill due to their work.

Specialized Business Insurance

In addition to the basic business insurance policies, there are specialized coverages tailored to specific industries and risks.

- Cyber Liability Insurance: Protects businesses from risks associated with conducting business online, including data breaches, hacking, and cyber extortion.

- Business Interruption Insurance: Provides financial protection if your business is forced to close temporarily due to a covered peril, such as a fire or natural disaster.

- Commercial Auto Insurance: Covers vehicles used for business purposes, including trucks, vans, and cars.

- Employment Practices Liability Insurance (EPLI): Protects your business against claims made by employees alleging wrongful employment practices, such as discrimination, harassment, or wrongful termination.

| Business Insurance Type | Description |

|---|---|

| General Liability Insurance | Protects businesses from various liability claims, including bodily injury, property damage, and personal injury. |

| Professional Liability Insurance | Covers legal costs and damages for businesses in the event of negligent acts, errors, or omissions in professional services. |

| Product Liability Insurance | Provides protection for businesses if their products cause bodily injury or property damage to third parties. |

| Business Owner's Policy (BOP) | A comprehensive package policy combining general liability and commercial property insurance for small to medium-sized businesses. |

The Importance of Insurance in Modern Life

Insurance plays a vital role in modern society, providing financial security and peace of mind. From safeguarding our health and assets to protecting our businesses and loved ones, insurance policies offer a safety net against life's uncertainties. By understanding the different types of insurance and their specific benefits, we can make informed decisions to secure our future and mitigate potential risks.

The Future of Insurance

As technology advances and societal needs evolve, the insurance industry is also transforming. Insurtech, the fusion of insurance and technology, is driving innovation and improving customer experiences. From digital claims processing to personalized insurance products, the industry is adapting to meet the changing demands of policyholders.

Moreover, with the rise of the gig economy and remote work, traditional insurance models are being challenged. New insurance products are emerging to cater to the unique needs of gig workers and digital nomads. These innovations ensure that no matter the work arrangement, individuals can access the insurance coverage they need.

In conclusion, insurance is a critical component of financial planning and risk management. By understanding the different types of insurance and their specific benefits, we can make informed choices to protect ourselves, our loved ones, and our assets. As the insurance landscape continues to evolve, staying informed and adapting to new offerings can help us navigate life's uncertainties with greater resilience and peace of mind.

How do I choose the right insurance policy for my needs?

+Selecting the right insurance policy involves assessing your unique circumstances and priorities. Consider factors like your age, family size, financial goals, and potential risks. For instance, if you have a family, life insurance and health insurance are essential. If you own a home, property insurance is a must. For your vehicles, auto insurance is not just a legal requirement but also a financial safeguard. Evaluate your needs, research different policy options, and consult with insurance professionals to find the best fit.

What are some common misconceptions about insurance?

+One common misconception is that insurance is only necessary for those with significant assets or high-risk occupations