What Is The Main Purpose Of Having Auto Insurance

Auto insurance, often referred to as car insurance or motor insurance, is a vital component of responsible vehicle ownership. It serves multiple purposes, each of which contributes to the overall safety and security of drivers, passengers, and other road users. This article delves into the primary objectives of auto insurance, exploring how it provides financial protection, legal compliance, and peace of mind to those navigating the complex world of motor vehicles.

Financial Protection in the Event of Accidents

One of the most critical aspects of auto insurance is its role in offering financial security. When an accident occurs, the costs associated with repairs, medical treatment, and potential legal fees can be substantial. Auto insurance acts as a safeguard, ensuring that policyholders are not left financially burdened by these unforeseen expenses.

Coverage for Vehicle Repairs

After an accident, the first concern for many is the state of their vehicle. Auto insurance policies typically include collision coverage, which provides for the repair or replacement of the insured vehicle, depending on the extent of the damage. This coverage is essential for getting your car back on the road as quickly and safely as possible.

| Coverage Type | Description |

|---|---|

| Comprehensive Coverage | Protects against damage from non-collision incidents like theft, vandalism, or natural disasters. |

| Collision Coverage | Covers repairs or replacement after a collision with another vehicle or object. |

Medical Expense Coverage

In the unfortunate event of an accident, injuries to the driver and passengers can occur. Auto insurance policies often include personal injury protection (PIP) or medical payments coverage, which helps cover the cost of medical treatment, rehabilitation, and even lost wages resulting from the accident.

Compliance with Legal Requirements

Every state in the US has its own set of laws regarding auto insurance. These laws dictate the minimum level of coverage required to legally operate a vehicle on public roads. By carrying auto insurance, drivers ensure they are complying with these regulations, avoiding potential legal penalties, and providing a measure of financial responsibility.

Liability Coverage

One of the key components of auto insurance is liability coverage. This type of insurance protects the policyholder in the event they are found legally responsible for an accident. It covers the cost of damages to other vehicles, property, and any bodily injuries sustained by third parties involved in the accident.

Uninsured/Underinsured Motorist Coverage

Despite legal requirements, not all drivers carry adequate insurance. Uninsured/underinsured motorist coverage steps in to protect policyholders in cases where the at-fault driver lacks sufficient insurance to cover the costs of the accident. This coverage ensures that the insured party is not left to bear the financial burden alone.

Peace of Mind and Risk Mitigation

Beyond the financial and legal aspects, auto insurance provides a sense of security and peace of mind. Knowing that you are protected in the event of an accident can reduce stress and anxiety, allowing drivers to focus on the road and their surroundings. It also mitigates the risks associated with driving, which can be a significant source of concern for many individuals.

Roadside Assistance and Additional Benefits

Many auto insurance policies offer additional benefits, such as roadside assistance, which can provide valuable support in emergency situations. This might include services like towing, flat tire changes, or even fuel delivery. These extra perks further enhance the peace of mind associated with auto insurance.

Conclusion

Auto insurance is an essential tool for navigating the complex world of motor vehicle ownership. It provides a safety net against financial ruin, ensures legal compliance, and offers peace of mind to drivers and their families. By understanding the main purposes and benefits of auto insurance, individuals can make informed decisions about their coverage, ensuring they are adequately protected on the road.

What is the main benefit of auto insurance?

+The primary benefit of auto insurance is the financial protection it provides in the event of an accident. It covers the cost of vehicle repairs, medical expenses, and legal liabilities, ensuring policyholders are not left with overwhelming financial burdens.

Is auto insurance mandatory in the US?

+Yes, auto insurance is mandatory in every state in the US. Each state has its own set of laws regarding the minimum required coverage to legally operate a vehicle on public roads.

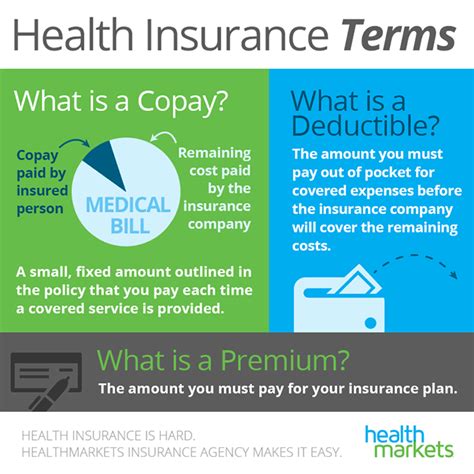

What types of coverage are typically included in an auto insurance policy?

+Common coverages include collision, comprehensive, liability, personal injury protection (PIP), medical payments, and uninsured/underinsured motorist coverage. Policyholders can also opt for additional coverages like roadside assistance or rental car reimbursement.