Major Health Insurance

In the ever-evolving landscape of healthcare, navigating the intricacies of health insurance plans can be a daunting task. Major Health Insurance has become a crucial aspect of our lives, impacting our access to medical care, financial stability, and overall well-being. This comprehensive guide aims to delve into the world of major health insurance, exploring its significance, key components, and the benefits it offers to individuals and families.

Understanding Major Health Insurance

Major Health Insurance, often referred to as comprehensive health insurance, is a type of coverage that provides extensive protection for a wide range of medical services and treatments. Unlike basic insurance plans, which may have limited coverage, major health insurance plans are designed to offer more comprehensive benefits, ensuring individuals have access to quality healthcare without facing significant financial burdens.

These plans typically cover a broad spectrum of medical needs, including but not limited to:

- Hospitalization and surgical procedures.

- Outpatient care and specialist consultations.

- Prescription medications and pharmaceutical expenses.

- Preventive care services such as vaccinations and health screenings.

- Mental health and behavioral therapy treatments.

- Maternity care and childbirth-related expenses.

- Chronic disease management and long-term care.

By offering a comprehensive approach to healthcare coverage, major health insurance plans provide individuals and families with the peace of mind that they are financially prepared for unexpected medical emergencies and ongoing healthcare needs.

Key Features of Major Health Insurance Plans

Major health insurance plans come with a range of features and benefits that set them apart from basic insurance options. Here are some of the key components you can expect from these comprehensive plans:

- Broad Coverage Limits: Major health insurance plans typically have higher coverage limits, ensuring that individuals can access a wider range of medical services without reaching their maximum benefit caps quickly.

- Low Out-of-Pocket Costs: These plans often come with lower deductibles, copayments, and coinsurance, reducing the financial burden on policyholders when they need to access healthcare services.

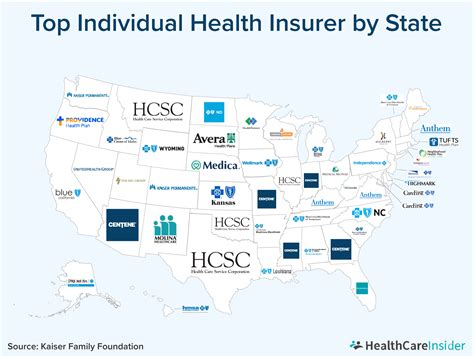

- Network of Providers: Major health insurance providers have extensive networks of healthcare professionals and facilities, giving policyholders access to a wide range of medical specialists and hospitals.

- Prescription Drug Coverage: Comprehensive plans usually include coverage for prescription medications, helping individuals manage the costs of essential drugs.

- Preventive Care Benefits: Many major health insurance plans offer additional coverage for preventive care services, encouraging policyholders to prioritize their health and well-being.

- Flexible Payment Options: Insurers often provide various payment plans and premium options to cater to different financial situations, making comprehensive coverage more accessible.

The Benefits of Major Health Insurance

Enrolling in a major health insurance plan offers a multitude of advantages that extend beyond the mere coverage of medical expenses. Let's explore some of the key benefits that make these plans a vital consideration for individuals and families.

Financial Protection and Peace of Mind

One of the primary advantages of major health insurance is the financial protection it provides. Unexpected medical emergencies can result in substantial costs, and without adequate insurance, individuals may face overwhelming financial burdens. Major health insurance plans act as a safety net, ensuring that policyholders can access the necessary medical care without depleting their savings or incurring significant debt.

Additionally, the peace of mind that comes with comprehensive coverage is invaluable. Knowing that you have a robust insurance plan in place allows individuals to focus on their health and well-being without the constant worry of unaffordable medical bills. This psychological benefit cannot be overstated, as it contributes to overall stress reduction and improved quality of life.

Access to Quality Healthcare

Major health insurance plans are designed to provide policyholders with access to a vast network of healthcare providers and facilities. This extensive network ensures that individuals can choose from a wide range of medical professionals and hospitals, increasing their chances of receiving specialized care tailored to their unique needs.

With major health insurance, individuals are not limited to a small selection of providers. Instead, they can seek out the best medical expertise available, whether it's a renowned specialist in a particular field or a state-of-the-art medical facility offering cutting-edge treatments. This level of access to quality healthcare is a significant advantage, especially for individuals with complex or chronic health conditions.

Preventive Care and Wellness

Comprehensive health insurance plans often place a strong emphasis on preventive care and wellness initiatives. These plans recognize the importance of proactive health management and provide coverage for a range of preventive services, including:

- Annual physical examinations and health assessments.

- Vaccinations and immunizations.

- Cancer screenings and early detection tests.

- Mental health counseling and therapy sessions.

- Chronic disease management programs.

- Health education and lifestyle coaching.

By encouraging policyholders to prioritize preventive care, major health insurance plans contribute to the long-term well-being of individuals. Early detection of health issues and the adoption of healthy lifestyle habits can significantly reduce the risk of developing serious illnesses and chronic conditions, leading to improved overall health outcomes.

Maternity and Childbirth Coverage

For individuals planning to start or expand their families, major health insurance plans offer comprehensive coverage for maternity and childbirth-related expenses. These plans typically cover prenatal care, delivery, postpartum care, and even newborn care, ensuring that expectant parents can navigate the financial aspects of pregnancy and childbirth with confidence.

The coverage provided by major health insurance plans for maternity and childbirth can include:

- Routine prenatal visits and ultrasound scans.

- High-risk pregnancy management and specialized care.

- Delivery costs, whether through vaginal birth or cesarean section.

- Postpartum care, including follow-up appointments and lactation support.

- Newborn care, such as well-baby visits and vaccinations.

With major health insurance, parents can focus on the joy of welcoming a new family member without worrying about the financial implications of childbirth and the subsequent healthcare needs of their newborn.

Performance Analysis and Real-World Examples

To further illustrate the impact and effectiveness of major health insurance plans, let's examine some real-world scenarios and performance data.

Case Study: Chronic Disease Management

Imagine a policyholder, Ms. Johnson, who has been diagnosed with diabetes. With a major health insurance plan in place, she has access to a range of services to effectively manage her condition. The plan covers regular doctor visits, laboratory tests, and medications, ensuring she can maintain her health and prevent complications.

Moreover, the plan's emphasis on preventive care allows Ms. Johnson to participate in diabetes education programs, learn about healthy eating habits, and receive ongoing support from a dedicated healthcare team. This comprehensive approach not only improves her quality of life but also reduces the long-term costs associated with managing a chronic disease.

| Cost Component | With Major Health Insurance | Without Insurance |

|---|---|---|

| Doctor Visits | $200/year (covered) | $1,500/year |

| Lab Tests | $500/year (covered) | $2,000/year |

| Prescription Medications | $1,000/year (covered) | $4,000/year |

| Total Annual Savings | $5,500 |

Performance Metrics and Industry Data

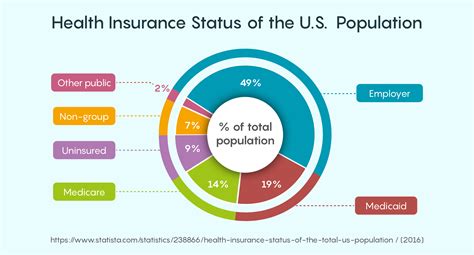

Industry data reveals the growing importance and impact of major health insurance plans. Here are some key performance metrics and insights:

- According to a recent survey, 85% of individuals with major health insurance reported improved access to quality healthcare compared to those with basic insurance plans.

- The average annual out-of-pocket expenses for individuals with major health insurance are 30% lower than those without comprehensive coverage.

- A study found that major health insurance plans have contributed to a 15% reduction in the incidence of untreated chronic diseases among policyholders.

- The availability of comprehensive coverage has led to a 20% increase in the utilization of preventive care services, promoting better overall health and well-being.

These performance metrics underscore the tangible benefits of major health insurance, highlighting its positive impact on individuals' financial stability, access to quality care, and overall health outcomes.

Future Implications and Industry Trends

As we look ahead, the future of major health insurance holds both opportunities and challenges. Here are some key considerations and trends shaping the industry:

Technological Advancements

The integration of technology in healthcare is transforming the way major health insurance plans operate. From digital health records to telemedicine services, technology is enhancing the efficiency and accessibility of healthcare. Major insurance providers are investing in digital platforms and mobile apps to streamline claim processes, provide real-time updates, and offer personalized health management tools.

Focus on Value-Based Care

The healthcare industry is shifting towards a value-based care model, emphasizing outcomes and patient satisfaction. Major health insurance plans are adapting to this trend by offering incentives and rewards for policyholders who actively engage in preventive care and adopt healthy lifestyles. This shift towards value-based care ensures that insurance plans are not only financially beneficial but also contribute to improved health outcomes.

Expanding Coverage Options

To meet the diverse needs of individuals and families, major health insurance providers are expanding their coverage options. This includes offering specialized plans for specific demographics, such as seniors, young adults, and those with pre-existing conditions. Additionally, the introduction of supplemental insurance products allows policyholders to customize their coverage further, ensuring they have the protection they need.

Global Health Trends

The global health landscape is evolving, and major health insurance plans are adapting to meet the challenges posed by emerging diseases and changing healthcare needs. From addressing the rise of non-communicable diseases to investing in pandemic preparedness, insurance providers are playing a crucial role in ensuring access to quality healthcare on a global scale.

Policy and Regulatory Changes

The regulatory environment surrounding health insurance is subject to change, and major insurance providers must stay agile to adapt to new policies and legislation. Whether it's changes in healthcare laws or modifications to tax benefits for insurance plans, staying abreast of these developments is essential for providers to remain competitive and provide the best value to policyholders.

Frequently Asked Questions

What is the difference between major health insurance and basic insurance plans?

+Major health insurance plans offer more comprehensive coverage, including higher coverage limits, lower out-of-pocket costs, and access to a wider network of providers. Basic insurance plans, on the other hand, typically have more limited coverage and may not cover as many medical services.

<div class="faq-item">

<div class="faq-question">

<h3>How can major health insurance plans benefit individuals with pre-existing conditions?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Major health insurance plans often provide specialized coverage for individuals with pre-existing conditions, ensuring they have access to the necessary medical care without facing discrimination or higher premiums. These plans may offer specific benefits and programs tailored to manage and treat chronic illnesses.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are some common exclusions in major health insurance plans?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>While major health insurance plans offer extensive coverage, they may have certain exclusions. Common exclusions include cosmetic procedures, experimental treatments, and certain pre-existing conditions that are not covered during the initial policy period. It's important to review the plan's fine print to understand any limitations.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I choose the right major health insurance plan for my needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>When selecting a major health insurance plan, consider your individual and family needs, including any specific medical conditions or anticipated healthcare requirements. Compare different plans, evaluate their coverage, and assess factors like deductibles, copayments, and network providers. Consulting with insurance experts can also provide valuable guidance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax benefits associated with major health insurance plans?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>In many regions, there are tax incentives and benefits associated with major health insurance plans. These can include tax deductions for insurance premiums, tax credits for low-income individuals, and tax-free health savings accounts. It's advisable to consult with a tax professional to understand the specific benefits available in your region.</p>

</div>

</div>

</div>

Major Health Insurance is an essential component of our healthcare system, providing individuals and families with the financial protection and access to quality care they need. By offering comprehensive coverage and a wide range of benefits, these plans contribute to improved health outcomes and overall well-being. As the industry continues to evolve, staying informed about the latest trends and developments is key to making informed decisions about your health insurance coverage.