What Is Pip Insurance

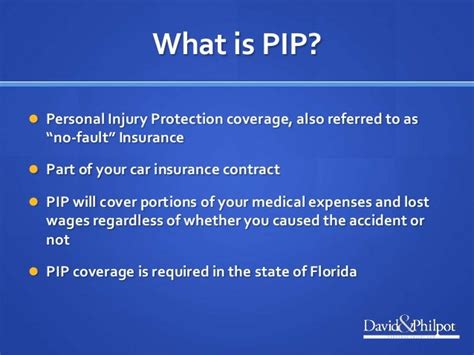

Welcome to a comprehensive guide on PIP insurance, a crucial aspect of automotive coverage. Personal Injury Protection, or PIP, is a type of insurance that provides financial protection to policyholders in the event of an accident, regardless of who is at fault. This form of insurance is designed to cover medical expenses, lost wages, and other related costs, ensuring individuals receive the necessary care and support during their recovery.

Understanding PIP Insurance

PIP insurance, often referred to as no-fault insurance, plays a vital role in the automotive insurance landscape. It serves as a safety net, ensuring that victims of road accidents can access immediate medical attention and financial support without the added stress of legal battles or insurance claim processes. This type of insurance is mandatory in many states and is an essential component of a comprehensive automotive insurance plan.

The primary objective of PIP is to streamline the process of obtaining medical care and compensation for accident victims. By offering prompt coverage, PIP insurance reduces the burden on individuals and encourages a quicker recovery process. This insurance coverage is especially beneficial in states with a high volume of traffic and a greater risk of accidents.

Coverage Details

PIP insurance typically covers a wide range of expenses associated with an accident. These include:

- Medical Expenses: This covers the cost of treatment for injuries sustained in the accident, including doctor visits, hospital stays, surgical procedures, and prescription medications.

- Lost Wages: If an accident victim is unable to work due to their injuries, PIP insurance provides compensation for lost income, ensuring financial stability during recovery.

- Rehabilitation Costs: Coverage extends to rehabilitation services such as physical therapy, occupational therapy, and speech therapy, which are crucial for a full recovery.

- Funeral Expenses: In unfortunate cases where an accident results in a fatality, PIP insurance can help cover the costs of funeral arrangements.

- Child Care and Housekeeping: If an insured individual requires temporary child care or housekeeping services due to their injuries, PIP may provide coverage for these expenses.

The specific coverage limits and benefits vary depending on the insurance provider and the policy chosen. It's essential to review the policy details thoroughly to understand the exact coverage and any potential exclusions.

How PIP Insurance Works

When an accident occurs, PIP insurance steps in to provide coverage. The process typically involves the following steps:

- Accident Occurrence: In the event of an accident, the insured individual or their authorized representative should notify their insurance provider as soon as possible.

- Claim Submission: The insured party submits a claim to their PIP insurance provider, providing details of the accident, injuries sustained, and any related expenses.

- Claim Review: The insurance provider reviews the claim, verifying the accuracy of the information provided and assessing the extent of coverage.

- Benefit Disbursement: Once the claim is approved, the insurance provider disburses the benefits to cover the insured’s medical expenses, lost wages, and other applicable costs.

It's important to note that PIP insurance claims are typically processed promptly, ensuring that accident victims receive the necessary financial support without delay. However, it's advisable to consult with an insurance expert or legal professional to navigate the claim process effectively.

The Benefits of PIP Insurance

PIP insurance offers numerous advantages, making it an essential component of automotive insurance:

- Swift Medical Care: PIP insurance ensures that accident victims can access immediate medical treatment without worrying about upfront costs or insurance claims.

- Financial Stability: By covering lost wages and other expenses, PIP insurance provides financial support during recovery, ensuring individuals can focus on their health without added financial stress.

- No-Fault Coverage: As a no-fault insurance, PIP provides coverage regardless of who is at fault in the accident, simplifying the claims process and reducing legal complexities.

- Comprehensive Coverage: PIP insurance covers a wide range of expenses, including medical, rehabilitation, and even funeral costs, offering a comprehensive safety net for accident victims.

With its prompt coverage and comprehensive benefits, PIP insurance is a vital safeguard for individuals and their families, ensuring they can navigate the challenges of an accident with financial security and peace of mind.

PIP Insurance in Different States

The implementation and requirements of PIP insurance vary across different states in the United States. While some states mandate PIP coverage as a compulsory part of automotive insurance, others have different regulations and requirements.

Mandatory PIP States

In states like New York, Michigan, and Florida, PIP insurance is mandatory for all vehicle owners. These states recognize the importance of providing immediate medical coverage and financial support to accident victims, regardless of fault. As a result, vehicle owners in these states are required to include PIP coverage in their insurance policies.

| State | PIP Insurance Requirements |

|---|---|

| New York | All vehicle owners must carry PIP insurance with a minimum coverage of $50,000. |

| Michigan | PIP insurance is mandatory, with a minimum coverage of $250,000 for personal protection insurance. |

| Florida | Vehicle owners are required to have PIP insurance with a minimum coverage of $10,000. |

In these states, PIP insurance is a crucial component of the automotive insurance landscape, ensuring that accident victims receive the necessary care and support promptly.

Optional PIP States

In contrast, there are states where PIP insurance is optional. Vehicle owners in these states have the choice to include PIP coverage in their insurance policies or opt for other types of coverage. While optional, PIP insurance still provides valuable benefits, especially in cases of severe accidents or injuries.

Some states with optional PIP insurance include California, Texas, and Washington. In these states, vehicle owners can decide whether to include PIP coverage based on their individual needs and preferences.

Comparing PIP Insurance to Other Coverage Types

While PIP insurance is a vital component of automotive insurance, it’s essential to understand how it differs from other types of coverage. Here’s a comparison of PIP insurance with other common insurance coverages:

PIP vs. Liability Insurance

Liability insurance is a fundamental component of automotive insurance, covering the costs associated with injuries or damages caused to others in an accident for which the insured is at fault. Unlike PIP insurance, liability insurance does not provide coverage for the insured’s own injuries or damages. It primarily focuses on compensating third parties.

In contrast, PIP insurance is a no-fault coverage that provides immediate medical and financial support to the insured, regardless of fault. This makes PIP insurance a crucial safeguard for accident victims, ensuring they receive the necessary care and compensation without the need for lengthy legal processes.

PIP vs. Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, is an optional insurance coverage that provides medical expense coverage for the insured and their passengers in the event of an accident. While similar to PIP insurance, MedPay has some key differences.

MedPay typically has lower coverage limits compared to PIP insurance. It also does not cover expenses such as lost wages or rehabilitation costs, which are covered by PIP. Additionally, MedPay may have restrictions on the types of medical treatments covered, whereas PIP insurance offers more comprehensive coverage.

PIP vs. Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage provides protection for the insured in cases where the at-fault driver does not have sufficient insurance coverage to compensate for the insured’s losses. This coverage is crucial in ensuring that the insured receives adequate compensation for their injuries and damages.

While PIP insurance provides immediate coverage for medical expenses and other related costs, UM/UIM coverage comes into play when the at-fault driver's insurance is insufficient. In such cases, UM/UIM coverage steps in to bridge the gap and provide additional financial support to the insured.

Choosing the Right PIP Insurance Coverage

When selecting PIP insurance coverage, it’s essential to consider various factors to ensure you have adequate protection. Here are some key considerations:

Coverage Limits

PIP insurance policies typically offer different coverage limits. It’s crucial to choose a limit that aligns with your needs and provides sufficient coverage for potential expenses. Consider factors such as your state’s minimum requirements, the cost of medical care in your area, and your personal financial situation when determining the appropriate coverage limit.

Policy Exclusions

Like any insurance policy, PIP insurance may have certain exclusions. Review the policy carefully to understand what is and isn’t covered. Some common exclusions may include pre-existing conditions, intentional self-injury, or certain types of medical treatments. Understanding these exclusions can help you make informed decisions about additional coverage or alternative options.

Network of Providers

Some PIP insurance policies may have a network of preferred providers, while others offer more flexibility in choosing healthcare professionals. Consider your personal preferences and the availability of healthcare providers in your area when selecting a PIP policy. Ensure that the policy allows access to the medical care and specialists you may require.

The Future of PIP Insurance

As the automotive insurance landscape continues to evolve, so does the role of PIP insurance. With advancements in technology and changes in the way we use and interact with vehicles, the future of PIP insurance holds several key developments and considerations:

Autonomous Vehicles

The rise of autonomous vehicles presents a unique challenge and opportunity for PIP insurance. As self-driving cars become more prevalent, the traditional concept of fault in accidents may evolve. PIP insurance will need to adapt to cover potential injuries and damages caused by autonomous vehicles, ensuring that accident victims still receive the necessary medical and financial support.

Telematics and Usage-Based Insurance

Telematics and usage-based insurance are gaining traction, offering personalized insurance rates based on an individual’s driving behavior and habits. This data-driven approach could influence the future of PIP insurance, with premiums potentially being adjusted based on factors such as driving distance, time of day, and even the driver’s health status.

Enhanced Medical Coverage

As medical technology advances and treatment options become more sophisticated, PIP insurance may need to expand its coverage to include emerging therapies and treatments. This could involve covering costs for innovative medical procedures, specialized medications, or even experimental treatments, ensuring that accident victims have access to the best possible care.

Integration with Healthcare Systems

The future of PIP insurance may also involve greater integration with healthcare systems. This could include streamlined processes for medical claim submissions, real-time data sharing between insurance providers and healthcare facilities, and even the development of digital health platforms that facilitate communication and coordination between patients, providers, and insurance companies.

How much does PIP insurance typically cost?

+The cost of PIP insurance can vary depending on factors such as the state, coverage limits, and the individual’s driving history. On average, PIP insurance can range from 50 to 300 per year. It’s recommended to obtain quotes from multiple insurance providers to find the best rate.

Can I choose my own healthcare provider with PIP insurance?

+In most cases, PIP insurance policies allow policyholders to choose their own healthcare providers. However, some policies may have a network of preferred providers, and utilizing these providers may offer additional benefits or cost savings. It’s important to review the policy details to understand the options available.

What happens if I don’t have PIP insurance and get into an accident?

+If you are involved in an accident and do not have PIP insurance, you may face challenges in accessing immediate medical care and financial support. In such cases, it’s crucial to have other forms of insurance coverage, such as health insurance or liability insurance, to cover your expenses. Additionally, seeking legal advice can help navigate the situation and explore potential options.