Health Insurance In Massachusetts

Massachusetts has a unique and progressive approach to healthcare and health insurance, setting it apart from many other states in the United States. The state's commitment to ensuring access to quality healthcare for its residents has resulted in a comprehensive and innovative health insurance system. This article delves into the intricacies of health insurance in Massachusetts, exploring its history, key features, and the impact it has on individuals and families across the state.

The Evolution of Health Insurance in Massachusetts

The journey towards a robust health insurance system in Massachusetts began with the Massachusetts Health Reform Act of 2006, commonly known as Chapter 58. This landmark legislation aimed to provide health insurance coverage to all Massachusetts residents and establish a framework for affordable and accessible healthcare.

One of the key outcomes of Chapter 58 was the creation of the Massachusetts Health Connector, an online marketplace that offers a range of health insurance plans from various carriers. The Connector serves as a one-stop shop for individuals, families, and small businesses to compare and enroll in health insurance coverage.

The implementation of the Massachusetts Health Reform Act led to significant improvements in healthcare access. The state successfully reduced the number of uninsured residents, with nearly 97% of its population now covered by health insurance. This achievement sets Massachusetts apart as a leader in healthcare reform.

Understanding the Massachusetts Health Insurance Market

The health insurance market in Massachusetts is diverse and caters to the unique needs of its residents. It comprises a mix of private insurers, non-profit organizations, and government-sponsored programs. Here's a closer look at the key players:

Private Health Insurance Carriers

Massachusetts is home to several prominent private health insurance carriers, including Blue Cross Blue Shield of Massachusetts, Harvard Pilgrim Health Care, and Tufts Health Plan. These companies offer a wide range of plans, from comprehensive coverage for individuals and families to specialized plans for seniors and those with specific healthcare needs.

Private insurers in Massachusetts are known for their innovation and commitment to quality care. They often provide additional benefits and services beyond basic coverage, such as wellness programs, telemedicine options, and access to a broad network of healthcare providers.

Non-Profit Health Insurance Organizations

Non-profit health insurance organizations play a vital role in ensuring access to healthcare for underserved populations in Massachusetts. These organizations, such as Neighborhood Health Plan and BMC HealthNet Plan, often receive funding and support from the state to provide coverage to low-income individuals and families who may not qualify for other programs.

Non-profits focus on community-based care and often have a strong presence in urban areas, where they provide culturally sensitive and language-appropriate services. They collaborate with local healthcare providers and community organizations to deliver comprehensive healthcare solutions.

Government-Sponsored Health Insurance Programs

Massachusetts offers several government-sponsored health insurance programs to ensure coverage for specific populations. These programs include:

- MassHealth: This is the state's Medicaid program, providing healthcare coverage to low-income residents, pregnant women, children, and individuals with disabilities. MassHealth covers a wide range of medical services, including doctor visits, hospital stays, and prescription medications.

- Commonwealth Care Health Insurance Program: Designed for individuals and families who do not qualify for MassHealth but cannot afford private insurance, this program offers subsidized health insurance coverage. It aims to bridge the gap for those who fall into the "coverage gap."

- Health Safety Net: Funded by the state, this program provides healthcare services to uninsured residents who are not eligible for other coverage options. It primarily serves undocumented immigrants and those who do not meet the income requirements for MassHealth.

Key Features of Massachusetts Health Insurance

Massachusetts health insurance plans offer a range of benefits and protections that align with the state's commitment to high-quality healthcare. Here are some key features to consider:

Mandatory Coverage Requirements

Massachusetts requires all residents to have health insurance coverage. This individual mandate ensures that everyone contributes to the healthcare system, helping to keep costs down for all residents. Those who do not have coverage may face penalties.

Comprehensive Benefits

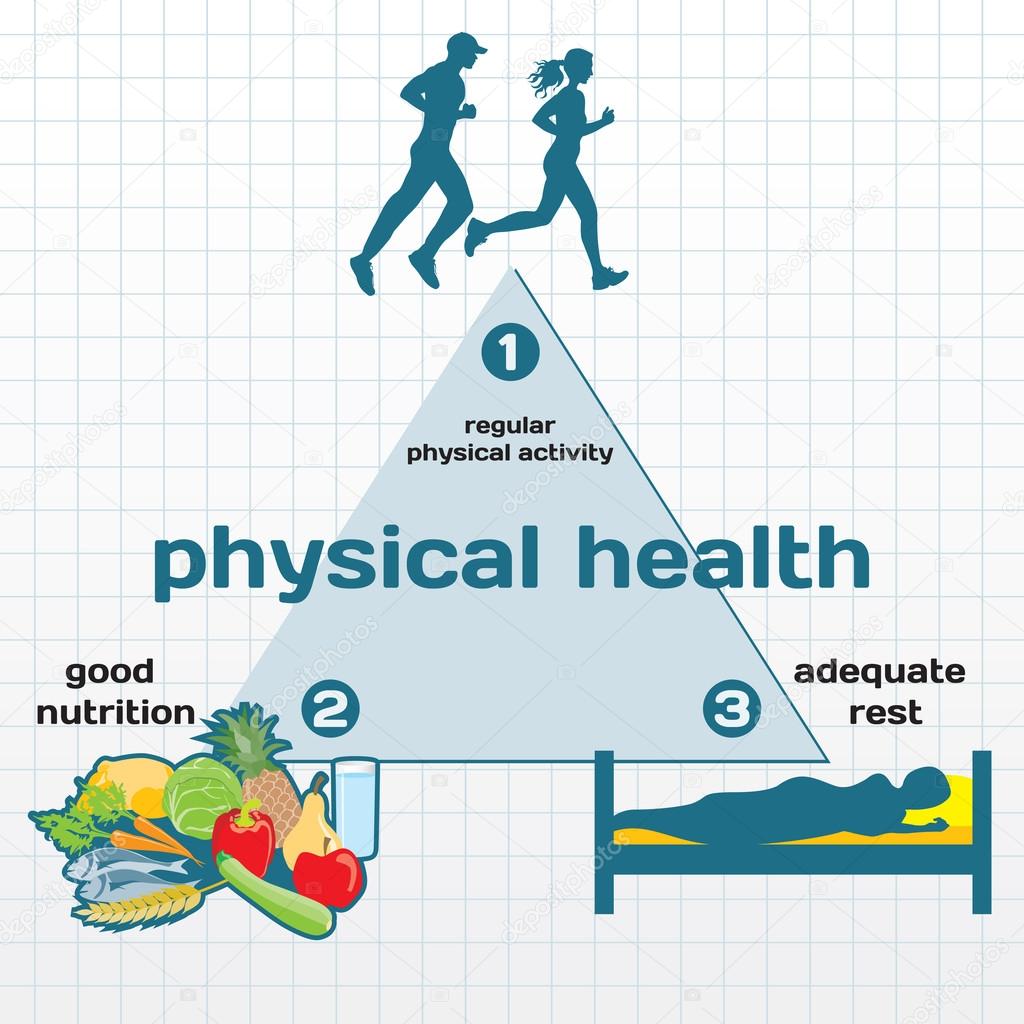

Health insurance plans in Massachusetts must meet certain minimum standards for coverage. These standards include essential health benefits such as ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative services, and more. This ensures that residents receive a robust level of coverage.

Consumer Protections

Massachusetts has implemented strong consumer protections to safeguard the rights of policyholders. These protections include guaranteed issue, which means that insurers cannot deny coverage based on pre-existing conditions, and community rating, which limits the extent to which insurers can vary premiums based on age or health status.

Cost-Sharing and Subsidies

To make health insurance more affordable, Massachusetts offers premium tax credits and cost-sharing reductions for eligible individuals and families. These subsidies help reduce the financial burden of insurance premiums and out-of-pocket costs for those with lower incomes.

Telehealth and Virtual Care

Massachusetts has embraced telehealth and virtual care services, particularly during the COVID-19 pandemic. Many health insurance plans now cover telemedicine visits, allowing residents to access healthcare services remotely, improving convenience and access to care.

The Impact on Residents

The comprehensive health insurance system in Massachusetts has had a significant impact on the well-being of its residents. Here are some key outcomes:

Improved Access to Healthcare

With nearly universal health insurance coverage, Massachusetts residents have better access to healthcare services. This has led to improved health outcomes, as individuals are more likely to seek preventive care, manage chronic conditions, and receive timely treatment.

Reduced Financial Burden

The availability of subsidized health insurance plans and cost-sharing reductions has made healthcare more affordable for many residents. This has alleviated the financial strain associated with medical expenses, especially for those with low incomes or pre-existing conditions.

Enhanced Quality of Care

Massachusetts' focus on healthcare reform has driven improvements in the quality of care. Insurers and healthcare providers are incentivized to deliver high-quality, efficient care, leading to better patient experiences and outcomes. The state's emphasis on preventive care and early intervention further contributes to overall health improvement.

Navigating the Health Insurance Process

For individuals and families in Massachusetts, navigating the health insurance landscape can be complex. Here are some steps to help guide the process:

Assess Your Needs

Start by evaluating your healthcare needs and those of your family. Consider factors such as age, health status, prescription medication requirements, and any specific healthcare services you may need. This assessment will help you determine the type of coverage that best suits your circumstances.

Explore Plan Options

Visit the Massachusetts Health Connector website to explore the range of health insurance plans available. Compare premiums, deductibles, copayments, and the scope of coverage offered by each plan. Consider the network of healthcare providers and specialists included in the plan to ensure access to your preferred doctors and hospitals.

Check Eligibility for Subsidies

Determine if you qualify for premium tax credits or cost-sharing reductions. These subsidies can significantly reduce your out-of-pocket expenses, making health insurance more affordable. Use the Health Connector's online tools to estimate your potential savings.

Enroll During Open Enrollment

The annual Open Enrollment Period typically runs from November 1st to January 15th. During this time, you can enroll in a new health insurance plan or make changes to your existing coverage. If you miss the Open Enrollment Period, you may still be able to enroll if you experience a qualifying life event, such as losing your job, getting married, or having a baby.

Frequently Asked Questions (FAQ)

What happens if I don't have health insurance in Massachusetts?

+Massachusetts requires all residents to have health insurance coverage. If you do not have coverage, you may face a penalty known as the Individual Mandate Assessment. This penalty is calculated based on your household income and is due when you file your state income tax return. However, there are exemptions for certain individuals, such as those experiencing financial hardship or religious objections.

Are there any low-cost health insurance options in Massachusetts?

+Yes, Massachusetts offers several low-cost health insurance options through the Health Safety Net program. This program provides healthcare services to uninsured residents who are not eligible for MassHealth. Additionally, the Commonwealth Care Health Insurance Program offers subsidized coverage for individuals and families who do not qualify for other programs but cannot afford private insurance.

How can I find a healthcare provider within my insurance network?

+When selecting a health insurance plan, it's important to consider the network of healthcare providers included. Most insurance carriers provide online directories or tools to search for in-network doctors and hospitals. You can also contact your insurance company's customer service to verify if a specific provider is within your network.

What should I do if I have a complaint or issue with my health insurance plan?

+Massachusetts has a robust consumer protection system for health insurance. If you have a complaint or issue with your plan, you can file a complaint with the Division of Insurance. They will investigate your case and work towards a resolution. Additionally, you can seek assistance from patient advocacy groups or legal aid organizations.

Can I keep my current doctor if I switch health insurance plans?

+Whether you can keep your current doctor when switching health insurance plans depends on whether they are in-network with your new plan. It's essential to check the provider network of your new plan before making the switch. If your doctor is not in-network, you may need to find a new provider or explore options for out-of-network care, which may come with higher out-of-pocket costs.

Massachusetts’ journey towards a comprehensive health insurance system has been a success story, with nearly universal coverage and improved healthcare access for its residents. The state’s innovative approaches, strong consumer protections, and commitment to quality care have set a standard for healthcare reform. As the healthcare landscape continues to evolve, Massachusetts remains at the forefront, ensuring that its residents have access to the healthcare services they need.