Lower Car Insurance Rates

The cost of car insurance is a significant expense for many vehicle owners, and finding ways to reduce these rates is a common goal. Fortunately, there are various strategies and factors that can influence insurance premiums, offering opportunities to lower costs while maintaining adequate coverage. This comprehensive guide delves into the intricacies of car insurance, providing an expert analysis of the key aspects that impact rates and offering practical advice to help drivers navigate the insurance landscape more affordably.

Understanding the Fundamentals of Car Insurance

Car insurance is a financial safety net that provides coverage for a range of potential risks and expenses associated with vehicle ownership. It is designed to protect drivers from financial losses resulting from accidents, theft, natural disasters, and other unforeseen events. The complexity of insurance policies stems from the multitude of variables that can influence the likelihood and cost of these events.

The cost of car insurance is determined by a combination of factors, including the type of coverage chosen, the driver's personal profile, and the specific vehicle being insured. Coverage types encompass liability insurance, which protects against claims arising from accidents caused by the policyholder, and comprehensive and collision insurance, which cover damage to the insured vehicle from incidents like theft, fire, or collisions with animals.

Key Factors Influencing Insurance Rates

- Driver Profile: Insurance companies assess a driver’s profile to gauge the level of risk they pose. Factors such as age, gender, driving record, and years of driving experience significantly impact rates. Younger drivers, especially males, often face higher premiums due to their perceived higher risk of involvement in accidents.

- Vehicle Characteristics: The make, model, and year of a vehicle play a crucial role in determining insurance costs. Factors such as the vehicle’s safety rating, theft rate, and repair costs all influence insurance rates. For instance, sports cars or luxury vehicles generally attract higher premiums due to their higher replacement costs and potential for more severe accidents.

- Coverage Options: The type and extent of coverage chosen also affect insurance rates. Comprehensive and collision coverage, while providing broader protection, typically result in higher premiums. On the other hand, liability-only coverage, which is legally required in most states, offers more limited protection but at a lower cost.

- Location and Usage: Where a vehicle is garaged and how it is used can significantly impact insurance rates. Drivers residing in urban areas or high-crime neighborhoods often face higher premiums due to the increased risk of accidents and theft. Additionally, those who drive frequently or for work purposes may also see higher rates due to the increased exposure to potential risks.

| Factor | Impact on Rates |

|---|---|

| Driver Age | Younger drivers often pay more due to higher accident risks. |

| Vehicle Type | Sports cars and luxury vehicles typically have higher premiums. |

| Coverage Level | Comprehensive coverage results in higher rates compared to liability-only. |

| Location | Urban areas and high-crime zones may result in increased premiums. |

Strategies to Lower Car Insurance Rates

While certain factors like age and vehicle type are beyond an individual’s control, there are several strategies that drivers can employ to potentially reduce their insurance rates. These strategies involve a combination of improving driving habits, utilizing available discounts, and shopping around for the best rates.

Improving Driving Behavior

Insurance companies reward safe driving practices, and maintaining a clean driving record is one of the most effective ways to lower insurance rates. This involves avoiding traffic violations, such as speeding tickets or moving violations, and ensuring a safe and accident-free driving history. A clean record not only leads to lower premiums but can also result in discounts or rewards from insurance providers.

Additionally, defensive driving courses can be beneficial. These courses teach drivers how to anticipate and respond to hazardous situations on the road, ultimately reducing the likelihood of accidents. Many insurance companies offer discounts to policyholders who complete such courses, recognizing the value of these skills in preventing accidents.

Utilizing Discounts and Bundling Policies

Insurance companies often offer a variety of discounts to policyholders, and being aware of these opportunities can lead to significant savings. Common discounts include those for safe driving, good academic performance (often for younger drivers), and vehicle safety features such as anti-theft systems or advanced driver-assistance systems.

Bundling policies, such as combining auto and home insurance, is another effective strategy to reduce insurance costs. Many insurers offer multi-policy discounts, recognizing the value of insuring multiple assets with the same provider. By bundling policies, policyholders can often negotiate better rates and save on overall insurance costs.

Comparing Quotes and Shopping Around

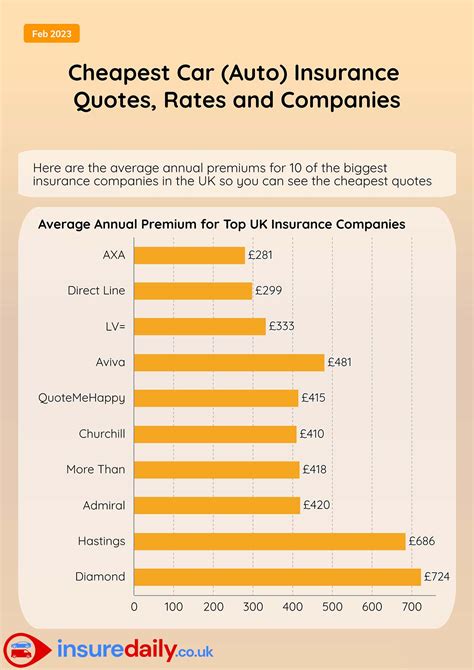

The insurance market is highly competitive, and rates can vary significantly between providers. Shopping around and comparing quotes from different insurers is a crucial step in finding the best rates. Online comparison tools and insurance brokers can be invaluable resources in this process, allowing policyholders to quickly assess and compare rates from multiple providers.

When comparing quotes, it's important to ensure that the policies being compared offer similar levels of coverage. While the cheapest quote may be tempting, it's essential to ensure that the coverage provided is adequate and aligns with individual needs. Additionally, reading reviews and understanding the reputation of the insurer can provide valuable insights into the quality of service and potential hidden costs or exclusions.

The Role of Technology in Reducing Insurance Rates

Advancements in technology have introduced new opportunities for drivers to demonstrate their safe driving habits and potentially reduce insurance rates. Telematics and usage-based insurance (UBI) programs are prime examples of this trend.

Telematics and Usage-Based Insurance

Telematics devices, often referred to as ‘black boxes’, are installed in vehicles and track driving behavior. These devices monitor factors such as acceleration, braking, cornering, and overall mileage. Insurance companies use this data to assess a driver’s risk profile and offer personalized insurance rates. Drivers who exhibit safe driving habits may be rewarded with lower premiums.

Usage-based insurance programs take this concept further, often offering real-time feedback to drivers. These programs may provide discounts based on the number of miles driven, time of day, or even specific driving behaviors. By encouraging safer driving habits and reducing overall mileage, policyholders can potentially lower their insurance rates.

The Future of Insurance: Data-Driven Personalization

As technology continues to evolve, the insurance industry is moving towards more personalized and data-driven models. Advanced analytics and machine learning algorithms are being utilized to process vast amounts of data, allowing insurers to more accurately assess risk and offer tailored insurance products.

This shift towards data-driven personalization is expected to benefit policyholders by offering more precise pricing based on individual risk profiles. However, it also underscores the importance of maintaining a clean driving record and practicing safe driving habits, as these will become increasingly critical factors in determining insurance rates.

Conclusion: Navigating the Insurance Landscape

Lowering car insurance rates is a complex process that involves understanding the various factors that influence premiums and implementing strategic approaches to reduce costs. From improving driving behavior to utilizing discounts and shopping around for the best rates, there are numerous avenues through which policyholders can navigate the insurance landscape more affordably.

As the insurance industry continues to evolve, driven by technological advancements and a shift towards data-driven personalization, the strategies for reducing insurance rates will also need to adapt. By staying informed about the latest trends and opportunities in the insurance market, drivers can make more informed decisions and potentially secure more favorable insurance rates.

What is the average cost of car insurance in the US?

+The average cost of car insurance in the US varies depending on several factors, including the state, the driver’s profile, and the type of coverage. As of 2021, the national average cost of car insurance was approximately 1,674 per year, or 139.50 per month.

How can I get cheap car insurance for young drivers?

+Getting cheap car insurance for young drivers can be challenging due to their higher perceived risk. However, strategies include maintaining a clean driving record, taking defensive driving courses, and utilizing discounts for good academic performance. Additionally, comparing quotes from multiple insurers can help identify the most affordable options.

Are there any ways to reduce insurance rates for high-risk drivers?

+High-risk drivers, such as those with multiple accidents or violations, often face higher insurance rates. To reduce these rates, it’s crucial to maintain a clean driving record going forward. Additionally, some insurers offer high-risk driver programs or specialized insurance policies that can help manage costs.