Nys Marketplace Insurance

Introduction: Understanding the Importance of Health Insurance

In today’s world, access to affordable and comprehensive health insurance is a fundamental aspect of financial security and overall well-being. The New York State Marketplace, also known as the NY State of Health, plays a crucial role in providing individuals and families with the tools they need to secure adequate healthcare coverage. This guide aims to delve into the intricacies of the NYS Marketplace, offering an in-depth analysis of its features, benefits, and the steps involved in selecting the right insurance plan.

The NY State of Health is an essential resource for New Yorkers, ensuring that residents have access to a range of health insurance options tailored to their specific needs and financial circumstances. By offering a user-friendly platform and a comprehensive selection of insurance plans, the marketplace empowers individuals to make informed decisions about their healthcare.

Exploring the NYS Marketplace: A User-Friendly Platform

The New York State Marketplace is designed with user convenience and transparency in mind. Upon accessing the platform, users are greeted with a straightforward interface that guides them through the process of comparing and selecting insurance plans. The website provides a wealth of information, including detailed plan descriptions, coverage summaries, and an easy-to-use search function to narrow down options based on individual preferences.

Key Features of the NYS Marketplace:

Plan Comparison Tool: This feature allows users to compare different insurance plans side by side, making it easier to evaluate factors such as premium costs, deductibles, copayments, and covered services.

Personalized Recommendations: By inputting relevant information about their healthcare needs and financial situation, users can receive tailored plan suggestions, ensuring they find the most suitable coverage.

Online Application Process: The marketplace offers a seamless online application system, eliminating the need for extensive paperwork. Users can complete the application at their own pace and track its progress through the website.

Customer Support: Recognizing that navigating insurance options can be complex, the NYS Marketplace provides dedicated customer support services. Trained professionals are available to assist with any queries or concerns, ensuring a smooth and stress-free experience.

Understanding Insurance Plans: Coverage and Costs

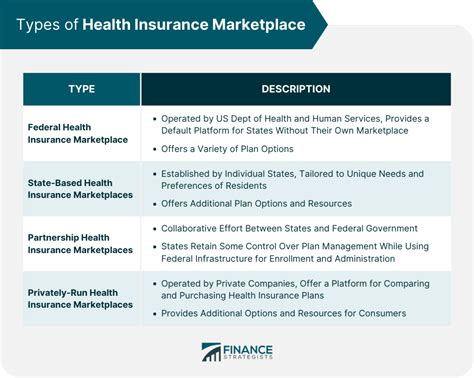

The NYS Marketplace offers a diverse range of insurance plans, each with its own unique features and benefits. Understanding the different types of plans available is essential to making an informed choice. Here’s an overview of the primary insurance plan categories:

Major Insurance Plan Types:

1. Health Maintenance Organizations (HMOs): - Coverage: HMOs typically provide comprehensive coverage for a wide range of medical services, including doctor visits, hospitalizations, and prescription medications. - Network Restrictions: Members must choose a primary care physician (PCP) and receive referrals from their PCP to see specialists. Out-of-network care is generally not covered. - Cost: HMOs often have lower monthly premiums but may have higher out-of-pocket costs for specialized care.

2. Preferred Provider Organizations (PPOs): - Coverage: PPOs offer a flexible approach, allowing members to choose from a network of preferred providers without requiring referrals. - Network Flexibility: Members have the option to receive care from both in-network and out-of-network providers, although costs may vary. - Cost: PPOs tend to have higher monthly premiums but may offer more flexibility and lower out-of-pocket expenses for specialized care.

3. Exclusive Provider Organizations (EPOs): - Coverage: EPOs provide coverage for services received from a network of preferred providers without the need for referrals. - Network Coverage: Members are only covered for services received within the network, and out-of-network care is not covered. - Cost: EPOs strike a balance between HMOs and PPOs, offering slightly higher premiums than HMOs but lower out-of-pocket costs compared to PPOs.

4. Point-of-Service (POS) Plans: - Coverage: POS plans combine elements of both HMOs and PPOs, allowing members to choose between a primary care physician within a network or seek care from out-of-network providers. - Flexibility: Members can receive care from both in-network and out-of-network providers, with varying levels of coverage and costs. - Cost: POS plans offer a middle ground in terms of premiums and out-of-pocket expenses, providing a balance between cost and flexibility.

Choosing the Right Insurance Plan: A Step-by-Step Guide

Selecting the appropriate insurance plan involves careful consideration of individual needs and financial circumstances. Here’s a comprehensive guide to help you navigate the process:

Step 1: Assess Your Healthcare Needs

Evaluate your current and potential future healthcare requirements. Consider factors such as chronic conditions, regular prescriptions, and the need for specialized care.

Determine the level of coverage you require, including the frequency of doctor visits, hospitalizations, and other medical services.

Step 2: Understand Your Financial Situation

Assess your monthly budget and the amount you can afford to allocate towards insurance premiums.

Consider your ability to cover out-of-pocket expenses, including deductibles, copayments, and coinsurance.

Step 3: Research Plan Options

Utilize the NYS Marketplace’s plan comparison tool to explore different insurance plans.

Review the coverage details, including the network of providers, covered services, and any exclusions or limitations.

Compare premiums, deductibles, and out-of-pocket maximums to understand the financial implications of each plan.

Step 4: Evaluate Additional Plan Features

Consider the availability of wellness programs, preventive care services, and mental health support offered by each plan.

Assess the convenience of accessing care, including the proximity of in-network providers and the ease of obtaining referrals (if required).

Evaluate customer satisfaction ratings and reviews to gain insights into the overall experience of plan members.

Step 5: Make an Informed Decision

Based on your assessment of healthcare needs, financial considerations, and plan features, narrow down your options to a few suitable plans.

Seek advice from healthcare professionals or financial advisors if needed to ensure you make the right choice.

Complete the online application process through the NYS Marketplace, providing accurate and up-to-date information.

The Benefits of the NYS Marketplace

The New York State Marketplace offers a multitude of benefits to residents seeking affordable and comprehensive health insurance:

Key Benefits:

Affordable Coverage: The marketplace ensures that individuals and families have access to a range of insurance plans with varying premium costs, allowing them to find coverage that fits their budget.

Competitive Rates: By bringing together multiple insurance providers, the NYS Marketplace fosters competition, resulting in more competitive pricing and a wider selection of plans.

Subsidies and Tax Credits: Eligible individuals and families may qualify for financial assistance, including subsidies to lower monthly premiums and tax credits to offset the cost of coverage.

Ease of Comparison: The user-friendly platform simplifies the process of comparing insurance plans, making it easier to find the most suitable option based on individual needs and preferences.

Consumer Protection: The marketplace enforces strict regulations, ensuring that insurance providers offer transparent and fair coverage. This protects consumers from unfair practices and ensures they receive the benefits they are entitled to.

Navigating Special Enrollment Periods

In addition to the annual open enrollment period, the NYS Marketplace offers special enrollment periods (SEPs) for individuals experiencing specific life events. These SEPs allow individuals to enroll in or change their insurance plans outside of the regular enrollment window.

Common Reasons for SEPs:

Loss of Coverage: If you lose your job or experience a reduction in work hours, resulting in the loss of employer-sponsored insurance, you may qualify for an SEP.

Change in Family Status: Events such as marriage, divorce, birth, or adoption can trigger an SEP, allowing you to adjust your insurance coverage accordingly.

Move to a New Location: Changing your residence may impact your insurance options, and an SEP can be used to enroll in a new plan or make necessary changes.

Other Qualifying Events: Certain life events, such as gaining citizenship or experiencing a natural disaster, may also qualify you for an SEP.

Future Implications and Ongoing Support

The NYS Marketplace continues to evolve, adapting to the changing healthcare landscape and the needs of New Yorkers. The platform is committed to providing ongoing support and resources to ensure residents have access to the most up-to-date information and insurance options.

Conclusion: Empowering New Yorkers with Affordable Healthcare

The New York State Marketplace plays a vital role in ensuring that residents have access to affordable and comprehensive health insurance. By offering a user-friendly platform, a wide range of insurance plans, and valuable resources, the marketplace empowers individuals to take control of their healthcare and financial well-being. Whether you’re a young adult seeking your first insurance plan or a family navigating complex healthcare needs, the NYS Marketplace is a trusted resource to guide you toward the right coverage.

Key Takeaways:

User-Friendly Platform: The NYS Marketplace provides a straightforward and intuitive interface, making it easy for individuals to compare and select insurance plans.

Wide Range of Plans: With multiple insurance providers and plan types to choose from, individuals can find coverage that aligns with their specific needs and budget.

Financial Assistance: Eligible individuals may benefit from subsidies and tax credits, making insurance more affordable and accessible.

Consumer Protection: Strict regulations ensure that insurance providers offer fair and transparent coverage, protecting consumers from potential abuses.

Ongoing Support: The marketplace remains committed to providing ongoing support and resources, ensuring that individuals have access to the most current information and insurance options.

What is the New York State Marketplace, and how does it work?

+

The New York State Marketplace, also known as the NY State of Health, is an online platform that offers a wide range of health insurance plans to individuals and families. It allows users to compare different plans, assess their eligibility for financial assistance, and enroll in coverage. The marketplace is designed to provide a user-friendly experience, making it easier for residents to navigate the complex world of health insurance.

When is the annual open enrollment period for the NYS Marketplace?

+

The annual open enrollment period typically runs from November 1st to December 15th each year. During this time, individuals can enroll in or change their health insurance plans for the upcoming year. It’s important to note that missing the open enrollment period may result in limited options for obtaining coverage outside of special enrollment periods.

How can I determine if I’m eligible for financial assistance through the NYS Marketplace?

+

Eligibility for financial assistance, including subsidies and tax credits, is determined based on factors such as household income and family size. The NYS Marketplace provides a simple eligibility calculator on its website, allowing users to input their information and receive an estimate of their potential financial assistance. It’s recommended to review your eligibility annually, as income and family composition can impact your qualification.

What should I consider when choosing an insurance plan on the NYS Marketplace?

+

When selecting an insurance plan, it’s crucial to consider your specific healthcare needs, including any chronic conditions, regular prescriptions, and the frequency of doctor visits. Evaluate the plan’s coverage, including the network of providers, and assess your ability to afford the monthly premiums and out-of-pocket expenses. Additionally, consider the plan’s flexibility and any additional benefits or perks it may offer.

How can I contact the NYS Marketplace for assistance or support?

+

The NYS Marketplace provides multiple avenues for support and assistance. You can reach out to their customer service team via phone, email, or live chat. Additionally, the website offers a comprehensive help section with frequently asked questions and detailed explanations of various topics related to health insurance and the marketplace. For more personalized assistance, you can also schedule an appointment with a navigator or broker who can guide you through the enrollment process.