Cheapest Auto Insurance

Finding the cheapest auto insurance can be a daunting task, especially with the myriad of options and factors to consider. In today's market, understanding the nuances of car insurance and the various strategies to reduce costs is essential. This comprehensive guide will delve into the world of auto insurance, offering expert advice and insights to help you secure the most affordable coverage tailored to your needs.

Understanding Auto Insurance Costs: A Comprehensive Breakdown

The cost of auto insurance is influenced by a complex interplay of factors, ranging from personal circumstances to regional regulations. To truly grasp the landscape of insurance pricing, we must explore these elements in depth.

Individual Factors Affecting Insurance Rates

Insurance providers assess a range of personal details to calculate your insurance premium. These factors include your age, gender, driving history, and the type of vehicle you drive. For instance, younger drivers, particularly males under 25, often face higher premiums due to their perceived higher risk profile. Similarly, a clean driving record with no accidents or violations can significantly reduce your insurance costs.

The type of vehicle you own also plays a crucial role. Insurance rates for sports cars or high-performance vehicles tend to be higher due to their association with increased speeding and accident risks. Conversely, safer and more economical cars often attract lower insurance premiums.

Geographical Variations in Insurance Costs

The location where you live and drive significantly impacts your insurance rates. States with higher population densities and more traffic often have higher insurance premiums due to the increased likelihood of accidents. Additionally, regions with a history of severe weather conditions, such as hurricanes or tornadoes, may also see higher insurance costs.

Regional differences also extend to variations in state-mandated insurance requirements. Some states have no-fault insurance systems, where each driver's insurance covers their own damages, regardless of fault. In contrast, at-fault systems require the at-fault driver's insurance to cover the damages. These variations can significantly impact your insurance costs.

Understanding Insurance Coverage and Policy Options

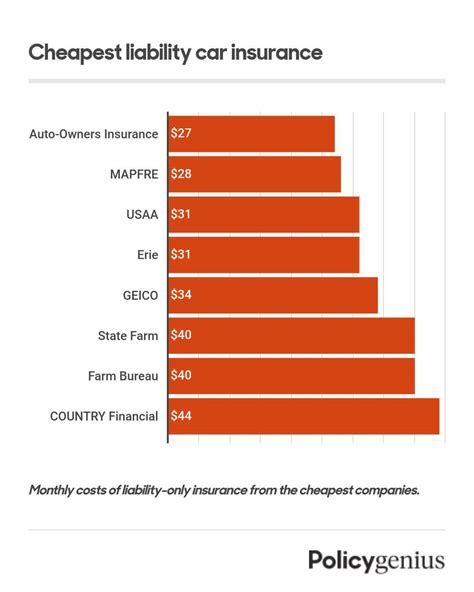

Auto insurance policies are comprised of various coverage types, each with its own cost implications. These include liability coverage, which covers damages you cause to others, and comprehensive and collision coverage, which protect your vehicle from damage or theft.

Optional add-ons like rental car coverage, roadside assistance, and gap insurance can further customize your policy but will also increase your premium. Understanding these coverage options and choosing the ones that best fit your needs and budget is essential to securing affordable insurance.

Strategies to Reduce Auto Insurance Costs

Navigating the complex world of auto insurance can be challenging, but with the right strategies, you can significantly reduce your insurance costs without compromising on coverage. Here are some expert tips to help you find the cheapest auto insurance tailored to your needs.

Shop Around and Compare Quotes

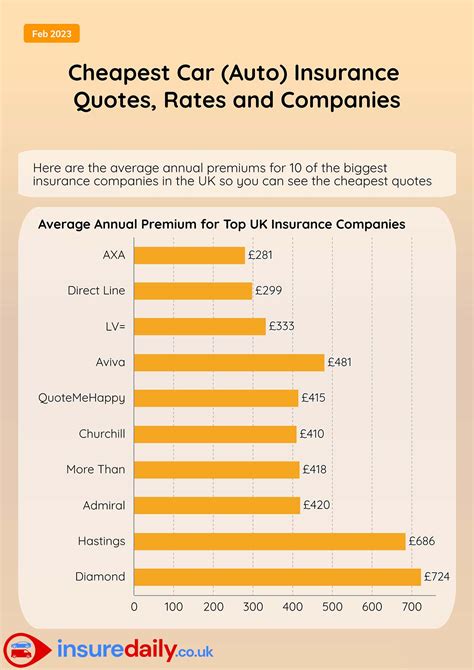

The insurance market is highly competitive, with numerous providers offering a wide range of policies and rates. Shopping around and comparing quotes is an essential step in finding the cheapest auto insurance. Online comparison tools can provide a quick and convenient way to assess various options, but it’s also beneficial to speak directly with insurance agents to understand the nuances of each policy.

Utilize Discounts and Special Offers

Insurance providers offer a variety of discounts and special offers that can significantly reduce your premium. These discounts can be based on your driving habits, such as low-mileage or safe-driver discounts, or your profession or affiliations, such as discounts for teachers, military personnel, or certain professional associations.

Additionally, bundling your auto insurance with other policies, such as homeowners or renters insurance, can often lead to substantial savings. It's worth exploring these options with your insurance provider to maximize your discounts.

Optimize Your Coverage

Reviewing your insurance coverage regularly is crucial to ensuring you’re not overpaying for unnecessary coverage. Assess your needs and adjust your policy accordingly. For instance, if you drive an older vehicle, you may consider reducing your collision and comprehensive coverage, as the cost of repairs may not justify the insurance premium.

Similarly, if you have a clean driving record, you may be eligible for higher liability limits, which can provide better protection at a potentially lower cost. Optimizing your coverage to fit your specific needs can lead to significant savings.

Improve Your Driving Record and Habits

Your driving record is a significant factor in determining your insurance premium. Maintaining a clean record, free of accidents and violations, can lead to substantial savings. Additionally, many insurance providers offer discounts for completing defensive driving courses, which can not only improve your driving skills but also reduce your insurance costs.

Improving your driving habits, such as avoiding aggressive driving and reducing your mileage, can also lead to safer driving and lower insurance costs. Some insurance providers even offer usage-based insurance programs, where your premium is based on your actual driving behavior, providing an incentive to drive safely and responsibly.

Consider Alternative Insurance Options

The traditional insurance market isn’t the only option for securing auto insurance. Alternative options like peer-to-peer insurance, where you’re insured by a group of individuals rather than a traditional insurer, or usage-based insurance, where your premium is based on your actual driving behavior, can provide more affordable coverage for certain individuals.

It's important to thoroughly research and understand these alternative options, as they may not be suitable for everyone. However, for those who fit the criteria, they can often provide significant cost savings.

The Future of Auto Insurance: What to Expect

The auto insurance landscape is continually evolving, driven by technological advancements and changing consumer preferences. Understanding these trends can provide valuable insights into the future of auto insurance and help you make informed decisions about your coverage.

The Rise of Telematics and Usage-Based Insurance

Telematics, the technology that allows insurance providers to track your driving behavior, is becoming increasingly prevalent in the insurance industry. Usage-based insurance, where your premium is based on your actual driving behavior, is a growing trend. This type of insurance offers a more personalized premium, rewarding safe drivers with lower rates.

As telematics technology advances, we can expect to see more insurance providers offering usage-based insurance plans. This shift towards a more personalized insurance model could significantly impact the auto insurance market, potentially reducing costs for safe drivers while providing more accurate risk assessments.

The Impact of Autonomous Vehicles

The advent of autonomous vehicles is expected to revolutionize the auto insurance industry. With self-driving cars, the risk of human error, a significant factor in accidents, is greatly reduced. This could lead to a substantial decrease in the number of accidents, potentially resulting in lower insurance premiums for all drivers.

However, the transition to autonomous vehicles is expected to be gradual, and the insurance industry will need to adapt to this new reality. It's likely that insurance providers will develop new coverage options tailored to autonomous vehicles, potentially offering lower rates for drivers who use self-driving features.

The Role of Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are already transforming the insurance industry. These technologies are being used to streamline insurance processes, from quote generation to claims handling. By analyzing vast amounts of data, AI and ML can provide more accurate risk assessments, leading to more precise insurance pricing.

In the future, we can expect to see even more sophisticated use of AI and ML in the insurance industry. These technologies could potentially personalize insurance policies even further, offering customized coverage and pricing based on individual driving behavior and preferences.

Conclusion: Navigating the Cheapest Auto Insurance Options

Finding the cheapest auto insurance requires a comprehensive understanding of the factors that influence insurance costs and a strategic approach to shopping for coverage. By understanding the individual, geographical, and coverage-related factors that impact insurance rates, you can make informed decisions about your policy.

Utilizing discounts, optimizing your coverage, improving your driving habits, and considering alternative insurance options are all strategies that can help reduce your insurance costs. Additionally, staying abreast of the latest trends and technologies in the insurance industry can provide valuable insights into future cost-saving opportunities.

Remember, the cheapest auto insurance isn't always the best option. It's crucial to balance cost with the level of coverage you need. By combining a thorough understanding of the insurance market with strategic planning, you can find the most affordable auto insurance that provides the protection you require.

How can I get the best auto insurance rate for my needs?

+To get the best auto insurance rate, compare quotes from multiple providers, utilize discounts, optimize your coverage, improve your driving record and habits, and consider alternative insurance options like usage-based insurance.

What factors influence auto insurance rates?

+Auto insurance rates are influenced by a variety of factors, including individual characteristics (age, gender, driving record), vehicle type, geographical location, and coverage options chosen.

Are there any strategies to reduce my auto insurance costs significantly?

+Yes, strategies to reduce auto insurance costs include shopping around for quotes, utilizing discounts, optimizing your coverage to fit your needs, improving your driving habits, and considering alternative insurance options like peer-to-peer insurance or usage-based insurance.

How will the rise of autonomous vehicles impact auto insurance rates?

+The advent of autonomous vehicles is expected to lead to a decrease in accidents, potentially resulting in lower insurance premiums for all drivers. However, the transition to autonomous vehicles will be gradual, and insurance providers will need to adapt by developing new coverage options tailored to self-driving features.