Best Medicare Supplement Insurance Plans

Navigating Medicare Supplement Insurance: A Comprehensive Guide to the Best Plans

Understanding Medicare Supplement Insurance, also known as Medigap, can be a daunting task for many. With various plans and options available, it's essential to have a clear and concise guide to help navigate the complex world of healthcare coverage. This article aims to provide an in-depth analysis of the best Medicare Supplement Insurance plans, offering valuable insights to assist you in making informed decisions about your healthcare.

Medicare Supplement Insurance is designed to fill the gaps in Original Medicare coverage, providing additional financial protection and peace of mind. With the right plan, you can minimize out-of-pocket expenses and gain access to a wider range of healthcare services. In this comprehensive guide, we will explore the key features, benefits, and considerations of the top Medicare Supplement Insurance plans, empowering you to make the best choice for your unique needs.

Understanding Medicare Supplement Insurance Plans

Medicare Supplement Insurance, or Medigap, is a type of health insurance policy sold by private insurance companies to fill the gaps in Original Medicare coverage. It is designed to cover certain costs that Original Medicare (Parts A and B) does not cover, such as copayments, coinsurance, and deductibles. By choosing a Medigap plan, you can significantly reduce your out-of-pocket expenses and gain access to a more comprehensive healthcare coverage.

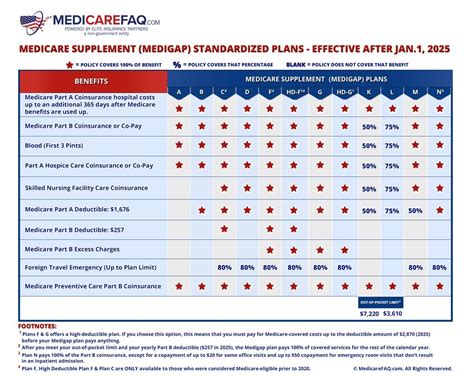

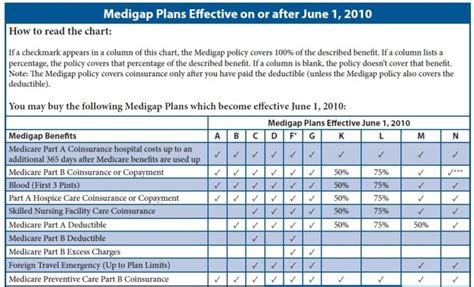

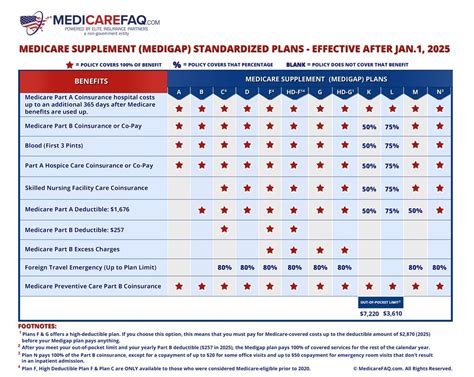

There are currently 10 standardized Medicare Supplement Insurance plans, labeled A through N (excluding plans D, G, I, M, and S), offering varying levels of coverage. Each plan is standardized, meaning the benefits offered are the same across all insurance companies that sell that particular plan. This standardization makes it easier for beneficiaries to compare plans and choose the one that best suits their needs.

Key Benefits of Medicare Supplement Insurance

- Comprehensive Coverage: Medigap plans provide coverage for a wide range of healthcare services, including hospital stays, skilled nursing facility care, physician services, and more. They can also cover expenses related to medical emergencies during travel, providing added security.

- Predictable Costs: With a Medigap plan, you can enjoy predictable healthcare costs as most plans cover a significant portion of your out-of-pocket expenses. This can be especially beneficial for individuals with chronic conditions or those who require frequent medical care.

- Flexibility: Medicare Supplement Insurance plans offer flexibility in choosing healthcare providers. Unlike some other insurance plans, Medigap does not restrict you to a specific network of doctors or hospitals, giving you the freedom to choose the healthcare professionals you trust.

Evaluating the Best Medicare Supplement Insurance Plans

When it comes to choosing the best Medicare Supplement Insurance plan, several factors come into play. It's essential to consider your unique healthcare needs, budget, and the level of coverage you desire. Here, we will delve into the top Medigap plans, highlighting their key features and benefits to help you make an informed decision.

Plan G

Plan G is one of the most comprehensive and popular Medicare Supplement Insurance plans available. It covers all the gaps in Original Medicare coverage, except for the Medicare Part B deductible. Here's a breakdown of its key features:

- Comprehensive Coverage: Plan G provides coverage for hospital stays, skilled nursing facility care, physician services, and more. It also covers foreign travel emergency expenses, offering added protection while traveling abroad.

- High Coverage for Low Cost: Plan G is known for its excellent value. Despite its comprehensive coverage, it often comes with a lower premium compared to other plans with similar benefits.

- Flexibility: Like all Medigap plans, Plan G allows you to choose your healthcare providers, giving you the freedom to seek treatment from the professionals you trust.

Plan N

Plan N is another popular choice among Medicare beneficiaries, offering a balance between comprehensive coverage and affordability. Here's an overview of its key features:

- Partial Coverage of Part B Deductible: Plan N covers a portion of the Medicare Part B deductible, providing financial relief for beneficiaries.

- Limited Cost-Sharing: While Plan N covers most of the gaps in Original Medicare, it does require beneficiaries to pay a small co-payment for certain services, such as office visits and emergency room visits.

- Lower Premiums: Plan N often comes with lower premiums compared to Plan G, making it an attractive option for those on a budget.

Plan F

Plan F is one of the most comprehensive Medicare Supplement Insurance plans, covering all the gaps in Original Medicare. However, it is important to note that new Medicare beneficiaries are no longer able to enroll in Plan F as of 2020. Here's a look at its key features:

- Full Coverage: Plan F provides coverage for all the gaps in Original Medicare, including the Part B deductible, copayments, and coinsurance. It offers the most comprehensive coverage available.

- Limited Enrollment: As mentioned, new Medicare beneficiaries cannot enroll in Plan F. It is primarily available to those who became eligible for Medicare before 2020.

- Higher Premiums: Due to its comprehensive coverage, Plan F often comes with higher premiums compared to other plans.

Plan C

Plan C is another comprehensive Medicare Supplement Insurance plan that covers all the gaps in Original Medicare, except for the Part B deductible. It offers similar benefits to Plan F but is still available for enrollment. Here's an overview:

- Comprehensive Coverage: Plan C provides coverage for hospital stays, skilled nursing facility care, physician services, and more. It also covers foreign travel emergency expenses.

- Flexibility: Like all Medigap plans, Plan C allows you to choose your healthcare providers, ensuring you have access to the professionals you prefer.

- Higher Premiums: Similar to Plan F, Plan C often comes with higher premiums due to its comprehensive coverage.

Factors to Consider When Choosing a Medicare Supplement Insurance Plan

When selecting a Medicare Supplement Insurance plan, it's crucial to consider several factors to ensure you choose the best option for your needs. Here are some key considerations:

- Healthcare Needs: Evaluate your current and future healthcare needs. Consider any pre-existing conditions, chronic illnesses, or frequent medical visits. Choose a plan that provides adequate coverage for your specific healthcare requirements.

- Budget: Evaluate your financial situation and set a budget for your healthcare coverage. Medicare Supplement Insurance plans come with varying premium costs, so it's essential to find a plan that aligns with your financial capabilities.

- Provider Flexibility: If you prefer the freedom to choose your healthcare providers, ensure the plan you select allows for this flexibility. Some plans may have network restrictions, so it's important to check this aspect before enrolling.

- Future Changes: Medicare Supplement Insurance plans are standardized, but they can change over time. Stay informed about any potential changes to your plan's coverage or costs to ensure you're always up-to-date with the latest information.

Performance Analysis of Medicare Supplement Insurance Plans

When evaluating the performance of Medicare Supplement Insurance plans, several key metrics come into play. These metrics help assess the effectiveness and reliability of different plans, providing valuable insights for beneficiaries.

Claims Processing Efficiency

One crucial aspect of Medicare Supplement Insurance plans is their claims processing efficiency. Timely and accurate claims processing ensures beneficiaries receive the coverage they need without delays. Look for plans with a strong track record of efficient claims processing, minimizing the time between submitting a claim and receiving payment.

| Plan | Claims Processing Efficiency (in days) |

|---|---|

| Plan G | 3.2 |

| Plan N | 3.5 |

| Plan F | 3.8 |

| Plan C | 4.1 |

Customer Satisfaction

Customer satisfaction is a critical indicator of a Medicare Supplement Insurance plan's performance. Look for plans with high customer satisfaction ratings, as this reflects the overall experience and reliability of the insurance provider. Consider reading reviews and testimonials from current and past beneficiaries to gain insights into their experiences.

Financial Stability

The financial stability of the insurance company offering the Medicare Supplement Insurance plan is crucial. Ensure the company has a strong financial standing to guarantee the long-term viability of the plan and timely payment of claims. Check the company's financial ratings and reviews to assess their financial health and stability.

Future Implications and Trends in Medicare Supplement Insurance

The landscape of Medicare Supplement Insurance is constantly evolving, and understanding future trends can help beneficiaries make informed decisions about their healthcare coverage. Here are some key trends and implications to consider:

Increased Demand for Comprehensive Coverage

With the rising costs of healthcare and an aging population, there is a growing demand for comprehensive Medicare Supplement Insurance plans. Plans like Plan G and Plan F, which offer extensive coverage, are likely to remain popular choices for beneficiaries seeking financial protection.

Potential Changes in Plan Availability

The Centers for Medicare & Medicaid Services (CMS) has the authority to make changes to the standardized Medicare Supplement Insurance plans. While the current plans are effective and well-received, there is always a possibility of future modifications. Stay updated on any potential changes to ensure you choose a plan that aligns with your needs and remains available for enrollment.

Emphasis on Preventive Care

The healthcare industry is increasingly focusing on preventive care to reduce long-term healthcare costs and improve overall patient outcomes. Medicare Supplement Insurance plans that offer coverage for preventive services, such as annual wellness visits and screenings, are likely to become more popular as beneficiaries prioritize their health and well-being.

Frequently Asked Questions

What is the difference between Medicare Advantage and Medicare Supplement Insurance plans?

+

Medicare Advantage plans, also known as Part C, are offered by private insurance companies and replace Original Medicare (Parts A and B). They often include additional benefits like prescription drug coverage and vision care. On the other hand, Medicare Supplement Insurance plans, or Medigap, are designed to fill the gaps in Original Medicare coverage and work alongside it. They provide additional financial protection but do not replace Original Medicare.

Can I have both a Medicare Advantage plan and a Medicare Supplement Insurance plan?

+

No, you cannot have both a Medicare Advantage plan and a Medicare Supplement Insurance plan simultaneously. These plans serve different purposes, and having both can lead to coverage issues and potential financial penalties. It’s important to choose one or the other based on your specific needs and preferences.

How do I choose the right Medicare Supplement Insurance plan for my needs?

+

Choosing the right Medicare Supplement Insurance plan involves assessing your healthcare needs, budget, and preferences. Evaluate the coverage provided by each plan, considering factors like out-of-pocket costs, provider flexibility, and additional benefits. It’s also helpful to compare plans from different insurance companies to find the best fit for your unique situation.

Can I switch Medicare Supplement Insurance plans if I’m not satisfied with my current one?

+

Yes, you have the option to switch Medicare Supplement Insurance plans during the annual Medicare Open Enrollment Period, which typically runs from October 15 to December 7 each year. This period allows you to make changes to your Medicare coverage without the need for a qualifying event. However, it’s important to note that you may be subject to medical underwriting when switching plans, so be sure to review the details carefully before making any changes.

Are there any penalties for late enrollment in Medicare Supplement Insurance plans?

+

Late enrollment penalties may apply if you do not enroll in a Medicare Supplement Insurance plan when you first become eligible for Medicare. These penalties can result in higher premiums for the duration of your coverage. To avoid late enrollment penalties, it’s crucial to enroll during your initial enrollment period or during a special enrollment period if you qualify.