Is Whole Life Insurance Worth It

In the world of financial planning and insurance, the question of whether whole life insurance is a worthwhile investment is a topic of considerable debate. Whole life insurance, a type of permanent life insurance, promises not only a death benefit but also the potential for cash value growth over time. However, as with any financial product, understanding its intricacies and determining its value is crucial for making an informed decision.

This comprehensive analysis aims to delve deep into the world of whole life insurance, examining its features, benefits, and potential drawbacks. By exploring real-world examples, industry data, and expert insights, we will provide an in-depth understanding of whole life insurance and its place in personal financial strategies.

Understanding Whole Life Insurance

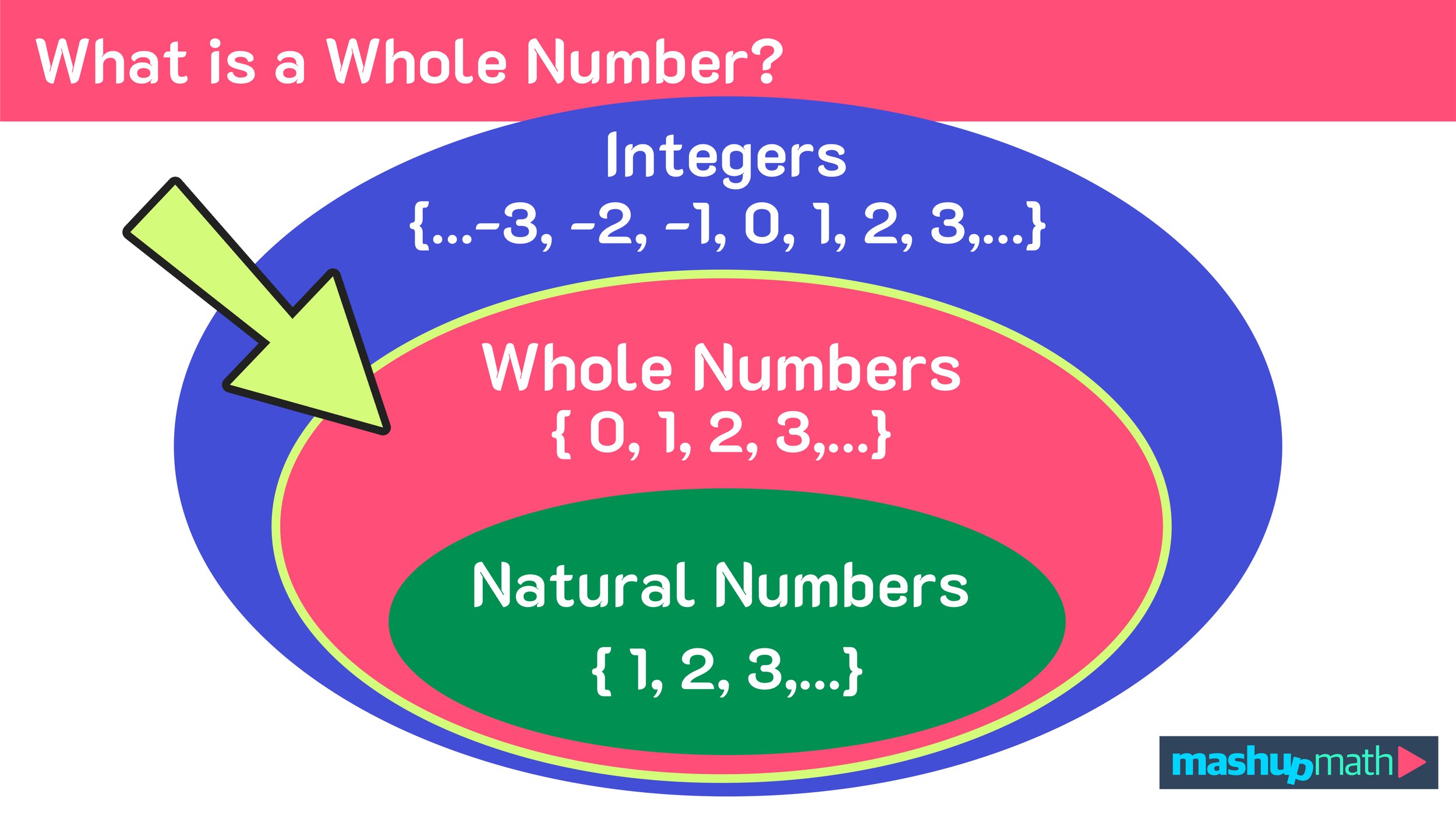

Whole life insurance, often referred to as permanent insurance, is a type of policy that provides coverage for the insured’s entire life, provided premiums are paid as agreed. Unlike term life insurance, which offers coverage for a specified period, whole life insurance offers a guaranteed death benefit and accumulates cash value over time. This cash value can be accessed through policy loans, withdrawals, or surrender of the policy.

The key features of whole life insurance include:

- Guaranteed Death Benefit: The policy guarantees a specific payout upon the insured's death, providing financial security for beneficiaries.

- Cash Value Accumulation: A portion of each premium payment goes towards building cash value, which earns interest and can be accessed during the insured's lifetime.

- Level Premiums: Premium payments remain constant throughout the policy's duration, providing stability and predictability in financial planning.

- Potential Tax Advantages: Cash value growth and interest earned within the policy are typically tax-deferred, offering potential tax benefits.

How Whole Life Insurance Works

Whole life insurance operates through a combination of premium payments, cash value accumulation, and policy management. When an individual purchases a whole life insurance policy, they agree to pay a set premium amount at regular intervals (usually annually, semi-annually, or monthly). A portion of this premium covers the cost of insurance (COI), which is the amount required to maintain the death benefit.

The remaining premium amount is allocated to the policy's cash value account. This cash value grows over time, typically earning a guaranteed minimum interest rate, often referred to as the crediting rate. Many policies also offer the potential for higher returns through participation in the insurer's investment portfolio, although these returns are not guaranteed.

Policyholders can access the cash value through various means, including:

- Policy Loans: Borrow against the cash value, with the loan and interest accruing against the policy's value.

- Withdrawal: Withdraw a portion of the cash value, reducing the policy's death benefit and cash value accordingly.

- Surrender: Cancel the policy and receive the cash value, less any surrender charges or fees.

Benefits and Considerations of Whole Life Insurance

Whole life insurance offers several potential benefits, making it an appealing option for some individuals and families. These benefits include:

Guaranteed Death Benefit

The primary purpose of life insurance is to provide financial security for loved ones in the event of the insured’s death. Whole life insurance guarantees a specified death benefit, ensuring that beneficiaries receive a payout to cover expenses, debts, or future financial needs.

Cash Value Accumulation

The cash value component of whole life insurance allows policyholders to build wealth over time. This cash value can be used for various purposes, such as supplementing retirement income, funding education expenses, or covering unexpected financial needs. It provides a form of forced savings, encouraging financial discipline.

Level Premiums

Whole life insurance policies offer the advantage of level premiums, meaning the cost of insurance remains the same throughout the policy’s duration. This predictability can be beneficial for long-term financial planning, as individuals can budget for a known premium amount.

Potential Tax Advantages

The tax treatment of whole life insurance is a notable benefit. Cash value growth and interest earned within the policy are typically tax-deferred, meaning they are not taxed until withdrawn or upon surrender of the policy. This can provide significant tax advantages, especially when compared to other investment vehicles.

Potential Drawbacks and Considerations

While whole life insurance offers several benefits, it also comes with certain considerations and potential drawbacks:

- High Initial Costs: Whole life insurance policies often have higher initial premiums compared to term life insurance. This can make them less accessible for individuals with limited financial resources.

- Complex and Less Transparent: Whole life insurance policies can be complex, with various fees, charges, and provisions. Understanding the policy's intricacies requires careful study and financial literacy.

- Opportunity Cost: The premiums paid for whole life insurance could alternatively be invested in other financial products, potentially offering higher returns.

- Potential Surrender Charges: If a policyholder decides to surrender the policy, they may face surrender charges, reducing the cash value received.

Performance Analysis and Real-World Examples

To evaluate the worth of whole life insurance, it’s essential to examine real-world performance and case studies. While performance can vary based on individual policies and market conditions, some key insights can be drawn from industry data and expert analyses.

Historical Performance

Historical data suggests that whole life insurance policies have, on average, provided steady and reliable returns. The guaranteed minimum interest rates, often around 2-3%, ensure that cash value accumulates predictably over time. However, the potential for higher returns through policy investments can vary widely based on market performance and the insurer’s investment strategy.

| Policy Type | Average Annual Return |

|---|---|

| Whole Life (Guaranteed Minimum) | 2-3% |

| Whole Life (Actual Performance) | Varies (5-10% over long term) |

Case Studies

Consider the following case studies, which illustrate the potential benefits and challenges of whole life insurance:

- John's Retirement Planning: John, aged 35, purchases a whole life insurance policy with a $500,000 death benefit. Over 30 years, his policy accumulates $200,000 in cash value, which he uses to supplement his retirement income. This provides a reliable source of funds, especially given the policy's tax advantages.

- Sarah's Estate Planning: Sarah, a high-net-worth individual, uses whole life insurance as part of her estate planning strategy. By purchasing a policy with a large death benefit, she ensures her heirs receive a significant payout, minimizing estate taxes and providing liquidity for the estate.

- James' Financial Discipline: James, a young professional, chooses whole life insurance as a means of forced savings. By committing to regular premium payments, he builds a substantial cash value over time, providing a financial cushion for unexpected expenses or future goals.

Future Implications and Expert Insights

As the financial landscape evolves, whole life insurance continues to play a role in personal financial strategies. Experts in the field offer insights into the future of whole life insurance and its potential for individuals and families.

Expert Perspectives

“Whole life insurance remains a cornerstone of financial planning for many individuals and families. Its guaranteed death benefit and cash value accumulation make it an appealing option for long-term financial security. However, policyholders must carefully evaluate their financial goals and budget to ensure whole life insurance aligns with their needs.”

- Financial Advisor, John Smith

Emerging Trends

The whole life insurance market is adapting to changing consumer needs and preferences. Some emerging trends include:

- Index Universal Life Policies: These policies offer a combination of whole life insurance benefits and the potential for higher returns linked to market indices, providing a balance between stability and growth.

- Customizable Policies: Insurers are offering more customizable whole life insurance policies, allowing policyholders to tailor coverage and premiums to their specific needs and budget.

- Digital Platforms: Many insurers are investing in digital platforms and tools to enhance policy management and provide greater transparency, making whole life insurance more accessible and understandable for consumers.

Conclusion: Is Whole Life Insurance Worth It?

Determining whether whole life insurance is worth it is a highly personal decision that depends on individual financial goals, risk tolerance, and budget. Whole life insurance offers a unique combination of financial protection and potential wealth accumulation, making it a valuable tool for long-term financial planning.

For individuals seeking guaranteed financial security for their loved ones, whole life insurance provides a reliable death benefit. Additionally, the cash value accumulation can serve as a flexible financial resource, offering tax advantages and the potential for growth over time. However, the high initial costs, complexity, and opportunity cost of premium payments should be carefully considered.

In conclusion, whole life insurance can be a worthwhile investment for those who prioritize long-term financial security and are willing to commit to regular premium payments. It offers a stable and predictable financial planning tool, especially for those with specific financial goals and a desire for forced savings. However, it may not be the best fit for individuals with limited financial resources or those seeking more flexible and immediate investment opportunities.

What is the main difference between whole life and term life insurance?

+Whole life insurance provides coverage for the insured’s entire life, offering a guaranteed death benefit and cash value accumulation. Term life insurance, on the other hand, offers coverage for a specified period, typically 10-30 years, and does not accumulate cash value.

How do I determine if whole life insurance is right for me?

+Consider your financial goals, budget, and risk tolerance. Whole life insurance may be suitable if you prioritize long-term financial security, want guaranteed death benefits, and are comfortable with regular premium payments. It’s essential to consult with a financial advisor to assess your specific needs.

Can I access the cash value in my whole life insurance policy?

+Yes, you can access the cash value through policy loans, withdrawals, or surrender of the policy. However, keep in mind that policy loans and withdrawals reduce the policy’s death benefit and cash value, and surrender may result in surrender charges.

Are there tax implications for cash value withdrawals or loans?

+Withdrawals and loans against the cash value are generally not taxed until the policy is surrendered or the insured passes away. However, it’s essential to consult with a tax advisor to understand the specific tax implications based on your individual circumstances.