Chubb Insurance Claims Phone Number

In today's fast-paced world, unforeseen circumstances can arise, leading to the need for insurance claims. When it comes to Chubb Insurance, a renowned provider in the industry, understanding the process and having access to the right contact information is crucial. This article aims to provide an in-depth guide on how to navigate the Chubb Insurance claims process, focusing on the phone number as the primary contact method.

The Chubb Insurance Claims Experience

Chubb Insurance, known for its comprehensive coverage and exceptional customer service, offers a seamless claims experience. The company understands that dealing with insurance claims can be stressful, which is why they prioritize efficiency and support throughout the process. By providing multiple contact options, including a dedicated claims phone number, Chubb ensures that policyholders can reach out whenever and wherever they need assistance.

The claims phone number serves as a direct line of communication between policyholders and Chubb's knowledgeable claims specialists. These professionals are trained to handle a wide range of claims, from home and auto accidents to more complex commercial and specialty claims. With their expertise, they guide policyholders through the entire claims process, offering personalized support and ensuring a swift resolution.

Navigating the Claims Process with Chubb’s Phone Support

When it comes to initiating a claim with Chubb Insurance, the phone number is often the first point of contact. Here’s a step-by-step guide on how to navigate the claims process effectively:

Step 1: Contact Chubb’s Claims Department

To begin the claims process, policyholders can reach out to Chubb’s claims department by calling the dedicated phone number. This number is typically toll-free and accessible 24⁄7, ensuring that help is always within reach. Upon calling, policyholders will be connected to a claims representative who will guide them through the initial steps.

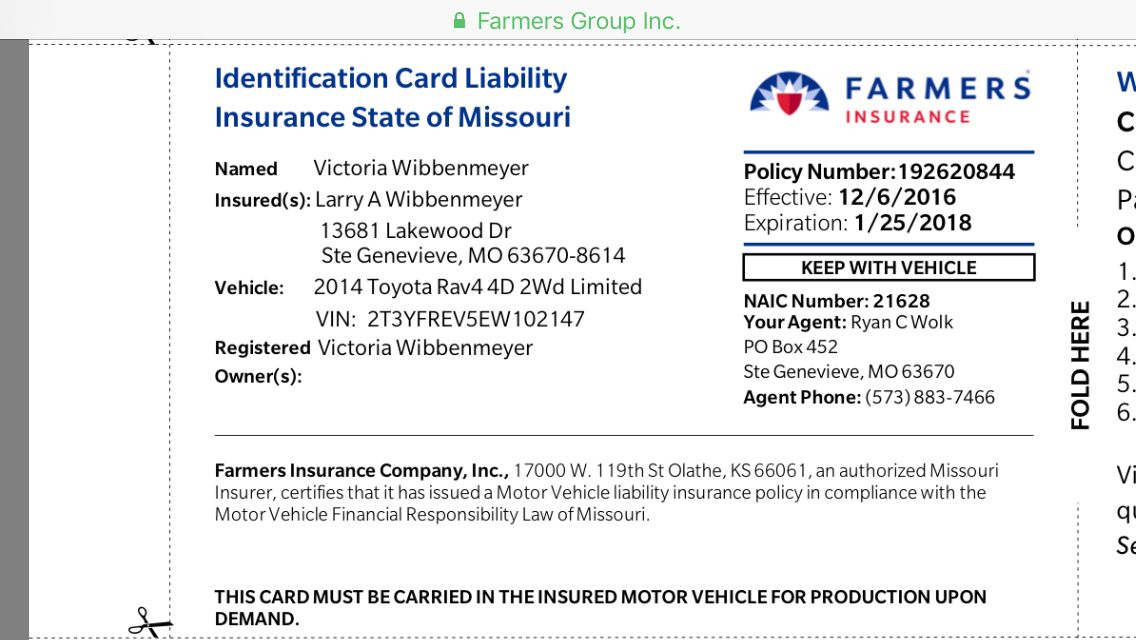

Step 2: Provide Essential Information

During the call, the claims representative will gather crucial information to understand the nature of the claim. This may include details such as the policy number, the date and time of the incident, a description of the loss or damage, and any relevant documentation or evidence. It’s important to provide accurate and detailed information to expedite the claims process.

Step 3: Discuss the Claims Process

Once the initial information is gathered, the claims representative will discuss the specific steps involved in processing the claim. They will explain the expected timeline, any additional documentation required, and the potential outcomes. This transparent communication ensures that policyholders are well-informed and can plan accordingly.

Step 4: Submit Additional Documentation

Depending on the type of claim, the claims representative may request additional documentation to support the claim. This could include photographs, police reports, repair estimates, or other relevant records. Policyholders should gather and submit these documents promptly to avoid delays in the claims process.

Step 5: Receive Updates and Support

Throughout the claims process, Chubb’s claims team remains dedicated to providing regular updates and support. Policyholders can expect timely communication regarding the status of their claim, any additional steps required, and the estimated resolution time. This proactive approach ensures that policyholders are kept in the loop and can address any concerns promptly.

Step 6: Resolve the Claim

As the claims process progresses, Chubb’s claims specialists work diligently to resolve the claim efficiently. They may conduct further investigations, assess the damage, and determine the appropriate course of action. Once a decision is made, policyholders will be informed of the outcome and any necessary next steps.

Chubb Insurance Claims Phone Number: A Convenient and Reliable Option

Chubb Insurance understands the importance of accessibility and convenience when it comes to insurance claims. The dedicated claims phone number offers a reliable and efficient channel for policyholders to seek assistance. Here are some key advantages of using the phone number to initiate and manage claims:

Immediate Assistance

By calling the claims phone number, policyholders can receive immediate assistance from trained claims specialists. This real-time support ensures that inquiries and concerns are addressed promptly, providing peace of mind during stressful situations.

Personalized Guidance

Chubb’s claims representatives are highly knowledgeable and experienced in handling a variety of claims. They provide personalized guidance tailored to each policyholder’s unique situation, ensuring a comprehensive and accurate claims process.

24⁄7 Accessibility

The claims phone number is typically accessible 24 hours a day, 7 days a week. This round-the-clock availability ensures that policyholders can reach out whenever they need assistance, regardless of their time zone or schedule.

Quick Resolution

Chubb’s commitment to efficiency and customer satisfaction means that claims are processed promptly. By utilizing the phone number, policyholders can expedite the claims process, allowing for a quicker resolution and a more seamless experience.

Expert Support

Chubb’s claims specialists are experts in their field, possessing extensive knowledge of insurance regulations and industry best practices. Their expertise ensures that policyholders receive accurate and reliable guidance throughout the claims journey.

Chubb’s Commitment to Customer Satisfaction

At Chubb Insurance, customer satisfaction is a top priority. The company’s dedication to providing exceptional service extends beyond the claims process. Here’s how Chubb goes the extra mile to ensure a positive customer experience:

Proactive Communication

Chubb believes in keeping policyholders informed at every stage of the claims process. They maintain open lines of communication, providing regular updates and ensuring that policyholders are aware of the progress and any potential delays.

Personalized Claims Handling

Recognizing that each claim is unique, Chubb’s claims specialists take a personalized approach. They tailor their support to the specific needs and circumstances of each policyholder, ensuring a tailored and empathetic experience.

Continuous Improvement

Chubb Insurance is committed to continuous improvement. The company actively seeks feedback from policyholders to enhance its claims processes and services. By listening to customer insights, Chubb strives to deliver an even better experience with each interaction.

The Future of Insurance Claims: Digital Innovations

While the phone number remains a vital channel for insurance claims, the industry is witnessing exciting digital innovations. Chubb Insurance embraces these advancements to enhance the claims experience further. Here’s a glimpse into the future of insurance claims with Chubb:

Online Claims Portals

Chubb has developed user-friendly online portals where policyholders can initiate, track, and manage their claims. These portals offer a convenient and secure way to submit documentation, receive updates, and communicate with claims representatives, providing a seamless digital experience.

Mobile Apps

Chubb understands the importance of mobility in today’s world. The company has introduced mobile apps that allow policyholders to access their insurance information, report claims, and receive real-time updates on the go. These apps streamline the claims process and provide a modern, accessible solution.

AI-Powered Assistance

Artificial Intelligence (AI) is revolutionizing the insurance industry. Chubb utilizes AI technologies to enhance its claims processes. AI-powered chatbots and virtual assistants offer instant support, answering common inquiries and guiding policyholders through the initial steps of the claims process.

Digital Documentation

Chubb encourages the use of digital documentation, such as electronic signatures and online forms, to streamline the claims submission process. This not only reduces paperwork but also ensures a faster and more efficient claims journey.

Telematics and Sensor Technologies

In the realm of auto insurance, Chubb explores innovative telematics and sensor technologies. These technologies can provide real-time data on vehicle usage and driving behavior, offering valuable insights for claims assessment and fraud prevention.

A Comprehensive Approach to Insurance Claims

Chubb Insurance’s dedication to providing a comprehensive claims experience is evident in its approach. By offering multiple contact options, including the dedicated claims phone number, Chubb ensures that policyholders have the support they need whenever and wherever they require it. The company’s commitment to customer satisfaction, coupled with its embrace of digital innovations, positions Chubb as a leader in the insurance industry.

As the insurance landscape continues to evolve, Chubb remains at the forefront, delivering exceptional service and innovative solutions. Whether through traditional phone support or cutting-edge digital channels, Chubb Insurance is dedicated to making the claims process as smooth and efficient as possible.

How can I find the Chubb Insurance claims phone number?

+The Chubb Insurance claims phone number can be found on their official website, typically under the “Contact Us” or “Claims” section. Alternatively, policyholders can refer to their insurance policy documents, where the phone number is often listed.

Are there any specific hours of operation for the claims phone number?

+Chubb’s claims phone number is often accessible 24 hours a day, 7 days a week. However, it’s recommended to check their website or policy documents for any specific hours of operation or any temporary adjustments due to holidays or other circumstances.

Can I start a claim online instead of calling the phone number?

+Yes, Chubb Insurance offers online claims submission through their website. Policyholders can initiate a claim online by providing the necessary details and uploading any relevant documentation. However, the phone number remains a convenient option for immediate assistance and personalized guidance.

What documentation do I need to have ready when calling the claims phone number?

+When calling the Chubb Insurance claims phone number, it’s helpful to have your policy number and details about the incident or loss readily available. Additionally, any relevant documentation, such as photographs or repair estimates, can be beneficial to provide during the call.

How long does it typically take for a claim to be processed and resolved by Chubb Insurance?

+The time it takes to process and resolve a claim can vary depending on the complexity and nature of the claim. Chubb Insurance aims to provide timely resolutions, and their claims specialists work diligently to expedite the process. Policyholders can expect regular updates on the progress of their claim.