Types Of Health Insurance

Understanding the Diverse Landscape of Health Insurance

Health insurance is an essential component of modern healthcare systems, providing individuals and families with financial protection against the often-substantial costs of medical treatment. With a wide array of plans and policies available, understanding the different types of health insurance is crucial for making informed decisions about your healthcare coverage.

In this comprehensive guide, we delve into the various categories of health insurance, exploring their unique features, benefits, and considerations. Whether you're an individual seeking personal coverage or an employer looking to provide health benefits to your workforce, this article will equip you with the knowledge to navigate the complex world of health insurance with confidence.

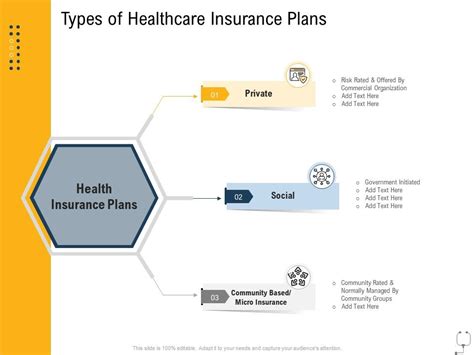

The Spectrum of Health Insurance Options

Health insurance can be broadly categorized into several types, each designed to meet different needs and preferences. Let's explore some of the most common varieties of health insurance plans:

1. Private Health Insurance

Private health insurance is a popular choice for individuals and families who wish to have more control over their healthcare decisions. These plans are typically purchased directly from insurance companies and offer a wide range of coverage options. Here's a closer look at some of the key types of private health insurance:

- Indemnity Plans: Also known as fee-for-service plans, indemnity insurance allows policyholders to choose their healthcare providers without restrictions. You pay a premium, and the insurance company reimburses you for a portion of your medical expenses. These plans often provide more flexibility but can be more expensive.

- Preferred Provider Organizations (PPOs): PPO plans offer a balance between choice and cost. Policyholders have access to a network of preferred providers, and they can visit any in-network doctor or hospital without a referral. Out-of-network care is also an option, but it may come with higher out-of-pocket costs.

- Health Maintenance Organizations (HMOs): HMOs are known for their comprehensive coverage and lower premiums. Members must choose a primary care physician (PCP) within the HMO network, who coordinates their healthcare. Referrals are required to see specialists, and out-of-network care is generally not covered.

- Point-of-Service (POS) Plans: POS plans combine elements of PPOs and HMOs. Members can choose between in-network and out-of-network care, with different cost-sharing structures for each. This flexibility allows for more personalized healthcare decisions.

- Exclusive Provider Organizations (EPOs): EPO plans are similar to PPOs but with a more restricted network. Members have access to a larger network of providers than HMOs, but they typically need referrals to see specialists. EPOs offer a balance between choice and cost.

2. Group Health Insurance

Group health insurance is often offered by employers as a benefit to their employees. This type of insurance provides coverage to a group of individuals, typically at a lower cost than individual plans. Here's an overview of the primary types of group health insurance:

- Employer-Sponsored Plans: Many employers offer health insurance as part of their employee benefits package. These plans are typically more affordable for employees, as the employer contributes to the premium. Coverage options can vary depending on the employer's choice of plan.

- Association Health Plans (AHPs): AHPs are group plans available to members of associations, such as professional organizations or trade groups. These plans offer the benefits of group insurance to individuals who may not have access to employer-sponsored coverage.

- Government Employee Health Plans: Government employees, including those working for federal, state, and local agencies, often have access to comprehensive health insurance plans. These plans are typically well-funded and offer a wide range of coverage options.

3. Government-Sponsored Health Insurance

Government-sponsored health insurance programs are designed to provide coverage to specific groups of individuals who may not have access to private or employer-sponsored plans. These programs are often funded and managed by federal, state, or local governments. Some key examples include:

- Medicare: Medicare is a federal health insurance program primarily for individuals aged 65 and older, as well as those with certain disabilities. It offers four parts (A, B, C, and D) that cover hospital stays, medical services, prescription drugs, and supplemental coverage.

- Medicaid: Medicaid is a joint federal-state program that provides health coverage to low-income individuals and families. Each state has its own eligibility criteria and coverage options, but all states must cover certain mandatory benefits.

- The Children's Health Insurance Program (CHIP): CHIP is a federal-state partnership that provides health coverage to children in families who earn too much to qualify for Medicaid but cannot afford private insurance. CHIP offers comprehensive benefits, including dental and vision care.

4. Short-Term Health Insurance

Short-term health insurance plans are designed to provide temporary coverage for individuals who are between jobs, awaiting approval for long-term coverage, or facing other transitional situations. These plans typically have shorter durations (usually 3–12 months) and more limited benefits compared to traditional health insurance plans.

5. High-Deductible Health Plans (HDHPs)

HDHPs are a type of health insurance plan with higher deductibles than traditional plans. These plans are often paired with health savings accounts (HSAs), allowing individuals to save money tax-free for medical expenses. HDHPs can be a cost-effective option for those who anticipate few medical expenses in a given year.

Navigating the Complexities of Health Insurance

Choosing the right health insurance plan involves careful consideration of your personal needs, budget, and healthcare preferences. Here are some key factors to keep in mind when evaluating different options:

- Coverage and Benefits: Review the scope of coverage provided by each plan, including what services, treatments, and prescriptions are covered. Look for plans that align with your healthcare needs and offer comprehensive benefits.

- Cost and Out-of-Pocket Expenses: Consider the premium, deductible, copayments, and coinsurance associated with each plan. Assess how these costs fit within your budget and how much you're comfortable paying out of pocket for medical expenses.

- Provider Networks: If you have a preferred doctor or hospital, ensure that they are in-network for the plan you're considering. Out-of-network care can be significantly more expensive.

- Flexibility and Choice: Some plans offer more flexibility in choosing providers and treatments, while others have more restrictions. Evaluate whether you prioritize freedom of choice or prefer a more structured approach.

- Prescription Drug Coverage: If you take prescription medications regularly, confirm that your plan covers these drugs and that the cost is reasonable.

- Specialized Services: If you have specific healthcare needs, such as mental health treatment or maternity care, ensure that the plan covers these services adequately.

Conclusion: Empowering Your Health Insurance Decisions

Understanding the diverse landscape of health insurance is the first step toward making informed choices about your healthcare coverage. By exploring the various types of plans available, from private and group insurance to government-sponsored programs, you can select an option that best aligns with your needs and budget.

Remember, health insurance is a crucial investment in your well-being and financial security. Take the time to research and compare different plans, and don't hesitate to seek guidance from insurance professionals or healthcare experts. With the right coverage, you can navigate the complexities of healthcare with confidence and peace of mind.

How do I choose the right health insurance plan for me?

+Selecting the right health insurance plan involves evaluating your healthcare needs, budget, and preferences. Consider factors like coverage, cost, provider networks, flexibility, and specialized services. Assess your typical healthcare expenses and choose a plan that aligns with your financial situation and provides adequate coverage for your anticipated needs.

What’s the difference between an HMO and a PPO plan?

+HMO plans typically have a narrower network of providers and require referrals to see specialists, while PPO plans offer more flexibility with a larger network and the option to see out-of-network providers at a higher cost. HMOs often have lower premiums, while PPOs may provide more choice but at a potentially higher price point.

Are government-sponsored health insurance plans available to everyone?

+Government-sponsored health insurance programs like Medicare, Medicaid, and CHIP have specific eligibility criteria. Medicare is primarily for individuals aged 65 and older, Medicaid is for low-income individuals and families, and CHIP covers children in families who earn too much for Medicaid but not enough for private insurance.