Motor Insurance Rates

Welcome to an in-depth exploration of the world of motor insurance rates. In today's fast-paced and dynamic environment, understanding the factors that influence these rates is crucial for both insurers and policyholders alike. This article aims to shed light on the intricate mechanisms that govern motor insurance premiums, offering a comprehensive analysis backed by real-world data and industry insights.

Unraveling the Complexity of Motor Insurance Rates

Motor insurance rates, also known as premiums, are the financial amounts that individuals or businesses pay to secure coverage for their vehicles. These rates are calculated based on a myriad of factors, each playing a significant role in determining the overall cost of insurance.

The complexity arises from the need to balance the risk associated with insuring vehicles against the financial stability of the insurance provider. Insurers must carefully assess and quantify these risks to ensure they can provide coverage while remaining profitable. This delicate balance often leads to intricate calculations and considerations, making motor insurance rates a fascinating subject of study.

Factors Influencing Motor Insurance Rates

When it comes to setting motor insurance rates, insurers take into account a wide range of variables. These factors can be broadly categorized into personal, vehicle, and environmental considerations. Let’s delve into each category to understand their impact on insurance premiums.

Personal Factors

Personal factors refer to the characteristics and behaviors of the policyholder that can influence the risk profile. Here are some key aspects that insurers evaluate:

- Age and Gender: Younger drivers, especially males, are often considered higher-risk due to their propensity for more aggressive driving and higher accident rates. As individuals age, their insurance rates typically decrease.

- Driving Record: A clean driving record with no accidents or traffic violations is favorable and can lead to lower insurance rates. Conversely, a history of accidents or traffic citations may result in higher premiums.

- Credit Score: Surprisingly, insurers often use credit scores as an indicator of financial responsibility. Individuals with higher credit scores may enjoy more favorable insurance rates.

- Claims History: Previous insurance claims can impact future rates. Frequent claims may signal higher risk, leading to increased premiums.

Vehicle Factors

The type of vehicle and its specific characteristics play a crucial role in determining insurance rates. Here’s a breakdown of the key considerations:

- Vehicle Type: Sports cars and high-performance vehicles are generally more expensive to insure due to their higher accident risk and potential for costly repairs.

- Vehicle Age: Older vehicles may have lower insurance rates as they are less valuable and may not require as extensive coverage.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and collision avoidance systems often qualify for discounts, as they reduce the risk of accidents.

- Vehicle Usage: The purpose for which a vehicle is used can impact insurance rates. Personal use vehicles may have different rates compared to those used for business or commercial purposes.

Environmental Factors

The environment in which a vehicle is driven and insured can also influence insurance rates. Here are some key environmental considerations:

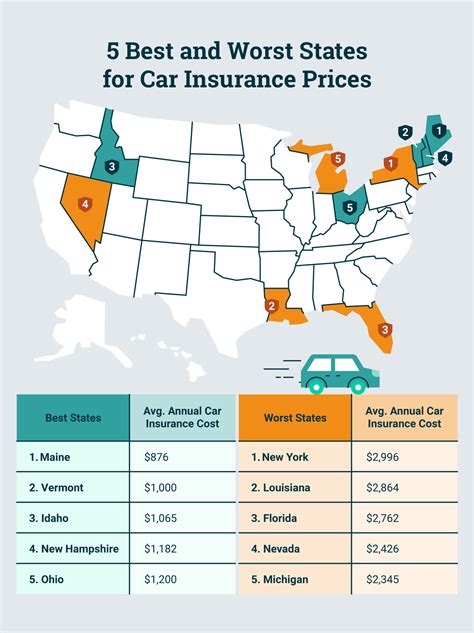

- Location: Insurance rates can vary significantly based on the geographic location. Areas with higher population densities, more traffic, or a higher incidence of accidents and theft may have higher insurance rates.

- Weather Conditions: Regions prone to extreme weather events like hurricanes, floods, or heavy snowfall may experience higher insurance rates due to the increased risk of vehicle damage.

- Traffic Volume: Areas with high traffic congestion or a higher number of vehicles on the road may have higher insurance rates due to the increased likelihood of accidents.

Real-World Examples and Case Studies

To illustrate the impact of these factors on motor insurance rates, let’s explore some real-world scenarios and case studies.

Case Study: Young Driver Insurance

Consider a 19-year-old male driver with a clean driving record residing in a suburban area. Despite his clean record, his young age and gender may result in higher insurance rates due to the statistically higher risk associated with this demographic. Insurers may offer him a comprehensive insurance policy with a premium of approximately $1,800 per year.

| Policy Type | Premium |

|---|---|

| Comprehensive | $1,800 |

| Collision Only | $1,400 |

| Liability Only | $800 |

In contrast, a 35-year-old female driver with a similar clean driving record and residing in the same area may enjoy more favorable insurance rates due to her lower-risk profile. Her comprehensive insurance policy may cost around $1,200 per year, reflecting the reduced risk associated with her demographic.

Case Study: Vehicle Usage and Insurance Rates

Imagine a small business owner who uses their personal vehicle for business purposes, such as deliveries and client meetings. This increased usage and exposure to potential risks may result in higher insurance rates. The business owner may opt for a commercial auto insurance policy, which provides coverage specifically for business-related incidents. The premium for such a policy could be approximately $1,500 per year, reflecting the higher risk associated with business usage.

Industry Insights and Expert Perspectives

To gain deeper insights into the world of motor insurance rates, we interviewed industry experts and analysts. Their perspectives offer valuable insights into the current trends and future directions of motor insurance.

According to industry experts, the future of motor insurance rates lies in the integration of technology and data-driven decision-making. With the advent of telematics and connected vehicles, insurers can now gather real-time driving data, allowing for more precise risk assessment and personalized insurance offerings.

Future Implications and Trends

As we look ahead, several key trends and developments are poised to shape the future of motor insurance rates.

Telematics and Usage-Based Insurance

Telematics technology, which includes devices and apps that track driving behavior, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, allows insurers to offer premiums based on an individual’s actual driving behavior rather than general demographic profiles. This shift towards personalized insurance is expected to revolutionize the industry, providing fairer rates for safe drivers while incentivizing better driving habits.

Autonomous Vehicles and Insurance

The advent of autonomous vehicles (AVs) is set to have a significant impact on motor insurance rates. As AV technology matures and becomes more widespread, insurers will need to adapt their risk assessment models to account for the reduced risk of human error. This could lead to lower insurance rates for AV owners, as the risk of accidents and claims decreases.

Regulatory Changes and Industry Dynamics

The insurance industry is subject to constant regulatory changes and market dynamics. Insurers must navigate these shifts while ensuring they remain competitive and financially stable. Regulatory changes, such as revised compensation guidelines or mandatory coverage requirements, can directly impact insurance rates and the overall market landscape.

Conclusion: Navigating the Complex World of Motor Insurance Rates

Motor insurance rates are a multifaceted and dynamic aspect of the insurance industry. From personal and vehicle factors to environmental considerations, a multitude of variables influence the premiums policyholders pay. As we’ve explored, the insurance industry is embracing technological advancements and data-driven decision-making to offer more personalized and fair insurance rates.

For policyholders, understanding the factors that influence their insurance rates can empower them to make informed decisions and potentially negotiate better rates. By staying informed about industry trends and advancements, individuals can navigate the complex world of motor insurance with confidence and ensure they receive the coverage they need at a fair price.

How do insurance companies determine my insurance rate?

+Insurance companies use a combination of personal, vehicle, and environmental factors to assess risk and determine insurance rates. Personal factors include age, gender, driving record, and credit score. Vehicle factors encompass the type, age, and safety features of the vehicle. Environmental factors consider the location, weather conditions, and traffic volume. By analyzing these variables, insurers can assign a risk profile and set appropriate insurance rates.

Are insurance rates the same for everyone in a particular area?

+No, insurance rates are not uniform for everyone in a specific area. Insurance companies tailor rates based on individual risk profiles. Even within the same geographic location, rates can vary significantly depending on personal factors such as driving history, credit score, and the type of vehicle insured. This individualized approach ensures that insurance rates reflect the unique circumstances and risks associated with each policyholder.

Can I negotiate my insurance rates with my insurance company?

+While insurance rates are primarily based on risk assessment and industry standards, there may be opportunities to negotiate or explore alternative options. Some insurance companies offer discounts for safe driving, loyalty, or bundling multiple policies. Additionally, shopping around and comparing quotes from different insurers can help you find more competitive rates. It’s always beneficial to discuss your options with your insurance provider to understand potential avenues for savings.