Senior Life Insurance Rates

As we navigate the complexities of life, it becomes increasingly important to secure our financial well-being and that of our loved ones. Senior life insurance rates represent a crucial aspect of financial planning, offering peace of mind and a safety net for seniors and their families. This article delves into the intricacies of senior life insurance, exploring the factors that influence rates, the various policy options available, and the steps one can take to find the most suitable coverage.

Understanding Senior Life Insurance Rates

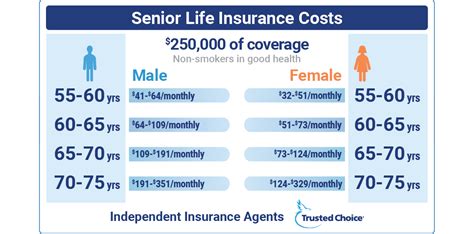

Senior life insurance rates are determined by a variety of factors, each playing a significant role in the overall cost of coverage. These factors include:

- Age: One of the primary determinants, as older individuals typically face higher rates due to increased health risks.

- Health Status: The overall health of the insured person is crucial. Pre-existing conditions or a history of chronic illnesses can lead to higher premiums.

- Lifestyle Factors: Habits such as smoking or engaging in high-risk activities can impact rates. Leading a healthy lifestyle often results in more favorable terms.

- Policy Type: Different types of life insurance policies come with varying costs. Term life insurance, for instance, is generally more affordable than permanent policies like whole life insurance.

- Face Value: The coverage amount, also known as the death benefit, directly influences rates. Higher face values require higher premiums.

- Rider Options: Additional features like accelerated death benefits or waiver of premium can increase the overall cost of the policy.

- Gender: In some cases, gender can play a role, with insurers considering statistical differences in life expectancy between men and women.

- Medical Exam Requirements: Policies that require medical exams may offer more precise rates based on individual health assessments.

Understanding these factors is crucial when shopping for senior life insurance. It empowers individuals to make informed decisions about their coverage and ensures they obtain the best value for their specific needs.

Policy Options for Seniors

The life insurance market offers a range of policy options tailored to the unique needs of seniors. These policies can be broadly categorized into two main types:

Term Life Insurance

Term life insurance is a popular choice for seniors seeking coverage for a specific period, typically 10 to 30 years. This type of policy provides a death benefit to the beneficiaries only if the insured person passes away during the term. It is often the most cost-effective option for seniors, especially those on a budget. The key features include:

- Affordable Premiums: Term life insurance is known for its low initial costs, making it accessible to a wide range of seniors.

- Renewable Options: Many policies offer the ability to renew, allowing seniors to extend their coverage beyond the initial term.

- Flexibility: Seniors can choose the term length that best suits their needs, providing a customizable coverage period.

- No Cash Value: Unlike permanent policies, term life insurance does not build cash value over time.

Permanent Life Insurance

Permanent life insurance, on the other hand, provides coverage for the insured person's entire life, offering more comprehensive benefits. While it may be more expensive upfront, permanent policies offer a range of advantages, including:

- Lifetime Coverage: As the name suggests, permanent life insurance remains in force as long as premiums are paid, providing lifelong protection.

- Cash Value Accumulation: These policies build cash value over time, which can be borrowed against or withdrawn, offering financial flexibility.

- Guaranteed Death Benefit: Permanent life insurance ensures that the beneficiaries receive the full death benefit, regardless of when the insured person passes away.

- Rider Options: Permanent policies often come with a variety of rider options, allowing seniors to customize their coverage further.

When deciding between term and permanent life insurance, seniors should consider their financial goals, the need for coverage, and their overall financial situation. Consulting with a financial advisor or insurance professional can provide valuable guidance in making this important decision.

Factors Influencing Senior Life Insurance Rates: A Comparative Analysis

To better understand the impact of various factors on senior life insurance rates, let's consider a hypothetical scenario involving two individuals, Mr. Smith and Mrs. Jones. Both are 65 years old and in relatively good health, but their life insurance journeys differ due to certain unique circumstances.

| Factor | Mr. Smith | Mrs. Jones |

|---|---|---|

| Age | 65 | 65 |

| Health Status | Good (No Pre-existing Conditions) | Good, but with a History of High Blood Pressure |

| Lifestyle | Non-Smoker, Regular Exercise | Non-Smoker, Sedentary Lifestyle |

| Policy Type | Term Life (10-year term) | Whole Life |

| Face Value | $100,000 | $200,000 |

| Rider Options | None | Waiver of Premium |

| Gender | Male | Female |

| Medical Exam | Required | Required |

In this scenario, Mr. Smith's healthier lifestyle and simpler policy choices result in more favorable rates for his term life insurance policy. On the other hand, Mrs. Jones, despite her good health, faces higher rates due to her history of high blood pressure, the higher face value of her policy, and the inclusion of the waiver of premium rider. This example highlights how individual circumstances can significantly impact senior life insurance rates.

Maximizing Savings on Senior Life Insurance

While senior life insurance rates are influenced by various factors, there are strategies seniors can employ to potentially reduce their premiums and maximize savings. Here are some effective approaches:

Shop Around and Compare Quotes

Obtaining multiple quotes from different insurance providers is essential. Rates can vary significantly between companies, so comparing options can lead to substantial savings. Online comparison tools and insurance brokers can simplify this process, ensuring you find the most competitive rates.

Consider Term Length

For term life insurance, the length of the term can impact premiums. Longer terms often result in higher costs. Seniors should carefully consider their needs and the length of coverage required to find the most cost-effective option.

Evaluate Policy Riders

Rider options, while providing additional benefits, can increase the overall cost of the policy. Seniors should carefully assess their needs and choose riders wisely. Opting for only the necessary riders can help keep premiums manageable.

Maintain a Healthy Lifestyle

Leading a healthy lifestyle can have a positive impact on life insurance rates. Regular exercise, a balanced diet, and avoiding harmful habits like smoking can improve health status, leading to more favorable rates. Additionally, maintaining a healthy weight and managing chronic conditions can further enhance the chances of obtaining lower premiums.

Bundle Policies

Some insurance companies offer discounts when seniors bundle multiple policies together. For instance, combining life insurance with other types of coverage, such as auto or home insurance, can result in savings on all policies involved.

Explore Group Life Insurance

Group life insurance policies, often offered through employers or associations, can provide coverage at a discounted rate. These policies typically offer more affordable premiums, making them a worthwhile option for seniors with access to such plans.

Seek Professional Guidance

Consulting with insurance professionals or financial advisors can be invaluable. They can provide expert advice tailored to your specific needs and circumstances, helping you navigate the complexities of senior life insurance and make informed decisions.

The Impact of Senior Life Insurance on Financial Planning

Senior life insurance plays a pivotal role in overall financial planning, offering a range of benefits that extend beyond mere coverage. Here's how senior life insurance can positively impact financial stability and security:

Peace of Mind

One of the primary advantages of senior life insurance is the peace of mind it provides. Knowing that your loved ones are financially protected in the event of your passing can alleviate significant stress and worry. This security allows seniors to focus on their present and future goals without the burden of financial uncertainty.

Debt Repayment and Estate Planning

Senior life insurance can be a vital tool for debt repayment and estate planning. The death benefit can be used to pay off outstanding debts, such as mortgages or loans, ensuring that beneficiaries are not burdened with these financial obligations. Additionally, life insurance proceeds can be utilized to fund estate planning strategies, providing liquidity for tax payments and ensuring a smooth transition of assets.

Legacy Building

For seniors who wish to leave a lasting legacy, life insurance can be a powerful tool. The death benefit can be used to support charitable causes, fund educational expenses for grandchildren, or establish trust funds for future generations. Life insurance allows seniors to make a meaningful impact and leave a positive mark on the world.

Business Continuity

Seniors who are business owners can utilize life insurance to ensure the continuity of their businesses. Key person life insurance can provide financial protection in the event of the unexpected passing of a critical business figure, ensuring that operations can continue smoothly. This safeguards the business's future and protects the interests of employees and stakeholders.

Income Replacement

Senior life insurance can serve as a vital source of income replacement for beneficiaries. In the absence of a regular income stream, the death benefit can provide much-needed financial support, covering living expenses, medical costs, or other financial obligations. This ensures that beneficiaries can maintain their standard of living and avoid financial hardship.

Tax Advantages

Certain types of life insurance policies, such as permanent life insurance, offer tax advantages. The cash value accumulation within these policies grows tax-deferred, and the death benefit is typically paid out tax-free. This can provide significant financial benefits, especially for seniors with specific tax planning goals.

The Future of Senior Life Insurance

The landscape of senior life insurance is evolving, driven by advancements in technology, changing demographics, and evolving consumer preferences. Here's a glimpse into the future of senior life insurance:

Digital Transformation

The insurance industry is increasingly embracing digital technologies, and senior life insurance is no exception. Online platforms and mobile apps are making it easier for seniors to research, compare, and purchase policies. This digital transformation enhances convenience and accessibility, allowing seniors to manage their insurance needs from the comfort of their homes.

Personalized Underwriting

Advancements in data analytics and artificial intelligence are revolutionizing the underwriting process. Insurers are now able to personalize rates and coverage based on an individual's unique health and lifestyle factors. This shift towards personalized underwriting ensures that seniors receive fair and accurate rates, reflecting their actual risk profile.

Simplified Application Processes

Traditional life insurance applications often involve extensive paperwork and medical exams. However, the future of senior life insurance is moving towards simplified and streamlined processes. Telemedicine and remote medical exams are becoming more common, making it easier and more convenient for seniors to apply for coverage.

Expanded Coverage Options

As the needs and expectations of seniors evolve, so too do the coverage options available. Insurers are introducing innovative policies that address specific concerns, such as long-term care needs or coverage for critical illnesses. These expanded options provide seniors with greater flexibility and peace of mind, ensuring they can tailor their coverage to their unique circumstances.

Increased Focus on Wellness

There is a growing recognition of the link between health and longevity. Insurers are incentivizing seniors to maintain healthy lifestyles by offering discounts or rewards for engaging in wellness programs or achieving certain health milestones. This shift towards wellness-focused insurance promotes healthier behaviors and can lead to more favorable rates for seniors who prioritize their well-being.

Improved Customer Experience

The future of senior life insurance places a strong emphasis on enhancing the overall customer experience. Insurers are investing in technology and customer service to provide seniors with personalized support and seamless interactions. This includes offering 24/7 customer service, providing educational resources, and ensuring a smooth claims process.

Frequently Asked Questions

How do I know if I need senior life insurance?

+Senior life insurance is often beneficial if you have financial obligations or loved ones who depend on your income. It provides a safety net and ensures financial stability for your beneficiaries.

Can I get senior life insurance if I have health issues?

+Yes, many insurers offer policies tailored to individuals with health conditions. However, premiums may be higher, and certain conditions may require specialized coverage.

What happens if I outlive my term life insurance policy?

+If you outlive your term policy, you may have the option to renew or convert it into a permanent policy. Alternatively, you can explore new term policies or consider other coverage options.

How much senior life insurance coverage do I need?

+The amount of coverage you need depends on your financial goals and obligations. It's recommended to consult with a financial advisor to determine the appropriate coverage amount.

Senior life insurance rates are a complex but crucial aspect of financial planning. By understanding the factors that influence rates, exploring the available policy options, and implementing strategic savings approaches, seniors can secure the coverage they need at a manageable cost. Additionally, the future of senior life insurance promises increased accessibility, personalization, and a focus on wellness, ensuring that seniors can navigate their financial journeys with confidence and peace of mind.