General Liability Insurance Small Business Cost

Introduction

General Liability Insurance is an essential component of any small business’s risk management strategy, providing coverage for a range of potential liabilities that a business may face. The cost of this insurance is a critical factor for small business owners, as it directly impacts their operational expenses and financial planning. In this comprehensive guide, we will delve into the various factors that influence the cost of General Liability Insurance for small businesses, providing real-world examples and industry insights to help you make informed decisions.

Understanding General Liability Insurance

General Liability Insurance, often referred to as GL Insurance, is a form of business insurance that protects against third-party claims, including bodily injury, property damage, and personal and advertising injury. It is designed to safeguard a business’s assets and reputation in the event of lawsuits or legal actions stemming from accidents or errors.

For instance, consider a small bakery. If a customer slips and falls on their premises, the bakery could be held liable for the customer’s injuries. General Liability Insurance would provide coverage for the medical expenses and any legal fees associated with the claim, helping the bakery manage the financial fallout.

Factors Influencing Cost

The cost of General Liability Insurance can vary significantly based on several key factors:

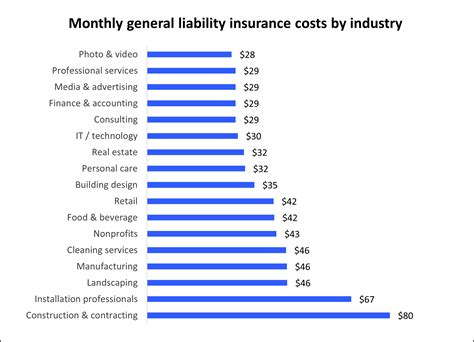

1. Industry and Business Type

The industry in which a small business operates plays a pivotal role in determining the cost of GL Insurance. High-risk industries, such as construction or manufacturing, often face higher insurance premiums due to the increased likelihood of accidents and claims.

For example, a construction company specializing in high-rise buildings will likely pay more for General Liability Insurance compared to a boutique clothing store, given the inherent risks associated with construction work.

2. Policy Limits and Deductibles

The policy limits and deductibles chosen by a business also influence the cost of GL Insurance. Higher policy limits, which represent the maximum amount the insurer will pay for a covered claim, typically result in higher premiums. Similarly, lower deductibles, which are the amount a business must pay out-of-pocket before the insurer covers the rest of a claim, can also increase premiums.

Let’s consider a small software development firm. If they opt for a policy with a high limit of 2 million and a low deductible of 1,000, they can expect to pay a higher premium compared to a policy with a lower limit and higher deductible.

3. Claims History

Insurance companies carefully evaluate a business’s claims history when determining premiums. A history of frequent or large claims can signal a higher risk to the insurer, leading to increased premiums.

For instance, a small restaurant that has had multiple slip-and-fall incidents in the past may face higher General Liability Insurance costs due to their claims history.

4. Location

The location of a small business can impact the cost of GL Insurance. Areas with higher population densities or higher crime rates may see increased premiums due to the higher likelihood of accidents or theft.

A small retail store located in a busy urban area may pay more for General Liability Insurance compared to a similar store in a rural setting.

5. Coverage Add-ons

Small businesses can customize their General Liability Insurance policies with additional coverage options to suit their specific needs. However, these add-ons often come at an additional cost.

For example, a small event planning business might opt for an add-on to cover cancellation or postponement due to weather or other unforeseen circumstances.

Cost Analysis: Real-World Examples

To provide a clearer picture of General Liability Insurance costs, let’s examine some real-world examples:

Example 1: Small Consulting Firm

A small consulting firm specializing in environmental sustainability with an annual revenue of 500,000 and a 5-year claims-free history can expect to pay an average premium of 750-1,200 per year for a standard GL policy with a 1 million/2 million limit and a 1,000 deductible.

Example 2: Retail Store

A retail store selling electronics with an annual revenue of 2 million and a location in a high-traffic urban area might pay an average premium of 2,500-$3,500 per year for a standard GL policy with the same limits and deductible as the consulting firm.

Example 3: Construction Company

A small construction company specializing in residential renovations with an annual revenue of 1 million and a location in a suburban area could pay an average premium of 3,000-5,000 per year for a standard GL policy with a 2 million limit and a $2,000 deductible.

Expert Insights

- Risk Mitigation: While the cost of General Liability Insurance is a necessary expense, small business owners can take steps to mitigate their risks and potentially reduce their premiums. This includes implementing safety measures, regular training for employees, and maintaining a detailed record of all incidents and near-misses.

- Shop Around: It’s essential to compare quotes from multiple insurers to ensure you’re getting the best rate for your specific business needs.

- Policy Review: Regularly review your General Liability Insurance policy to ensure it aligns with your business’s current operations and risk profile.

Future Implications

As small businesses continue to navigate an increasingly complex and dynamic risk landscape, the role of General Liability Insurance will only grow in importance. The cost of this insurance, while a significant consideration, should not deter small business owners from securing adequate coverage. By understanding the factors that influence these costs and taking proactive steps to manage their risks, small businesses can protect their assets and ensure their long-term viability.

FAQ

How often should I review my General Liability Insurance policy?

+It’s recommended to review your policy annually or whenever there are significant changes to your business operations, such as expansion, new services, or changes in ownership.

Can I get discounts on my General Liability Insurance premiums?

+Yes, some insurers offer discounts for businesses with good safety records, those that bundle multiple insurance policies, or for those that have been with the insurer for a certain period of time.

What happens if I don’t have enough General Liability Insurance coverage?

+If you don’t have sufficient coverage and a claim exceeds your policy limits, you may be personally liable for the remaining amount, which could have severe financial implications.