How Much Is Personal Health Insurance

In today's dynamic healthcare landscape, understanding the costs and benefits of personal health insurance is crucial for individuals and families alike. This comprehensive guide aims to delve into the intricate world of personal health insurance, offering a detailed breakdown of costs, coverage options, and the various factors influencing insurance premiums.

Understanding Personal Health Insurance Costs

The cost of personal health insurance is a multifaceted topic, influenced by a range of variables that can significantly impact the overall premium. These variables include age, gender, location, pre-existing medical conditions, and the chosen level of coverage. While personal health insurance is a necessity for many, the expenses associated with it can vary widely, making it essential to grasp the factors contributing to these variations.

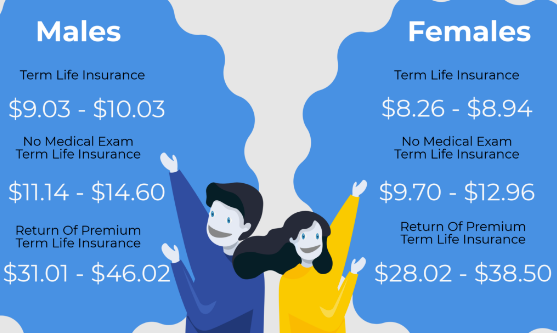

Age and Gender Considerations

Age and gender play a pivotal role in determining insurance premiums. Typically, younger individuals enjoy lower premiums due to their generally better health and reduced risk of developing chronic illnesses. Conversely, as individuals age, their health tends to decline, leading to higher premiums. Gender-based differences in healthcare needs and utilization can also affect insurance costs, with women often facing higher premiums due to factors like pregnancy and maternity care.

Consider the following example: a 25-year-old male with no pre-existing conditions may pay significantly less for health insurance compared to a 55-year-old female with a history of heart disease. This disparity highlights the impact of age and gender on insurance costs.

Geographic Location and its Impact

The region where an individual resides can also heavily influence insurance premiums. Healthcare costs can vary widely across different states and cities due to factors such as the cost of living, the availability of healthcare services, and local regulations. In areas with a higher cost of living and advanced healthcare facilities, insurance premiums tend to be higher.

For instance, the average health insurance premium in a metropolitan area like New York City could be substantially higher than in a rural area like Montana, primarily due to differences in the cost of healthcare services and the availability of specialized medical facilities.

The Role of Pre-existing Conditions

Pre-existing medical conditions are a critical factor in determining insurance costs. Insurers carefully assess an individual’s medical history to gauge the potential risk of future health issues. Conditions such as diabetes, heart disease, or cancer can significantly increase insurance premiums, as they often require ongoing medical care and treatments.

An individual with a history of diabetes, for example, might face higher premiums due to the ongoing management and potential complications associated with the condition. This underscores the importance of considering pre-existing conditions when evaluating personal health insurance options.

Factors Influencing Personal Health Insurance Costs

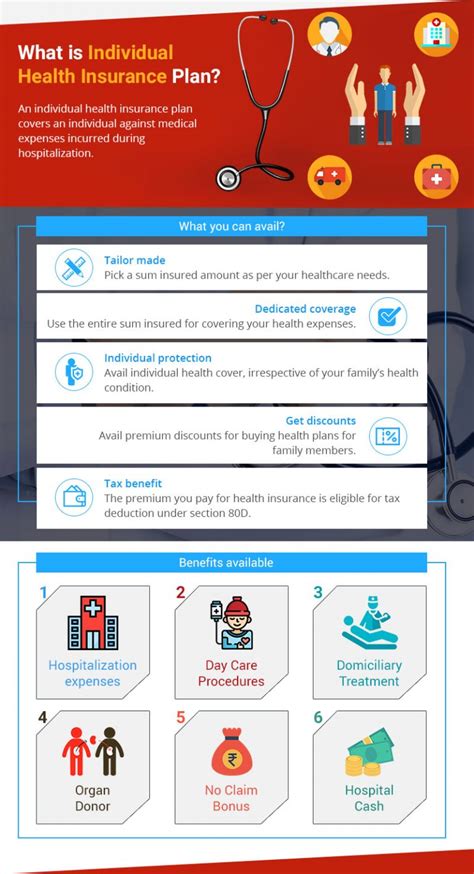

Beyond the fundamental factors of age, gender, location, and pre-existing conditions, several other elements contribute to the overall cost of personal health insurance. These factors include the chosen level of coverage, deductible amounts, co-pays, and additional benefits like dental and vision coverage.

Coverage Options and Deductibles

The level of coverage chosen by an individual is a significant determinant of insurance costs. Higher coverage levels, often referred to as “platinum” or “gold” plans, offer more comprehensive benefits and typically result in higher premiums. Conversely, “bronze” or “silver” plans with lower coverage levels generally come with lower premiums.

Additionally, the deductible, which is the amount an insured individual must pay out-of-pocket before the insurance coverage kicks in, can greatly impact the overall cost. Higher deductibles often lead to lower premiums, as individuals are taking on more financial responsibility for their healthcare costs.

Co-pays and Additional Benefits

Co-pays, or the fixed amounts paid by an insured individual for specific healthcare services, can also affect the overall insurance cost. Plans with lower co-pays for doctor visits or prescription medications may have higher premiums to offset the increased cost of these services.

Furthermore, the inclusion of additional benefits like dental, vision, or mental health coverage can influence insurance premiums. These benefits, while valuable, add to the overall cost of the insurance plan.

Employer-Sponsored vs. Individual Plans

The decision to opt for an employer-sponsored health insurance plan or an individual plan can also impact insurance costs. Employer-sponsored plans often provide a level of cost-sharing, where the employer contributes to the premium, making these plans more affordable for employees. Individual plans, on the other hand, are solely the responsibility of the insured individual and can be more costly.

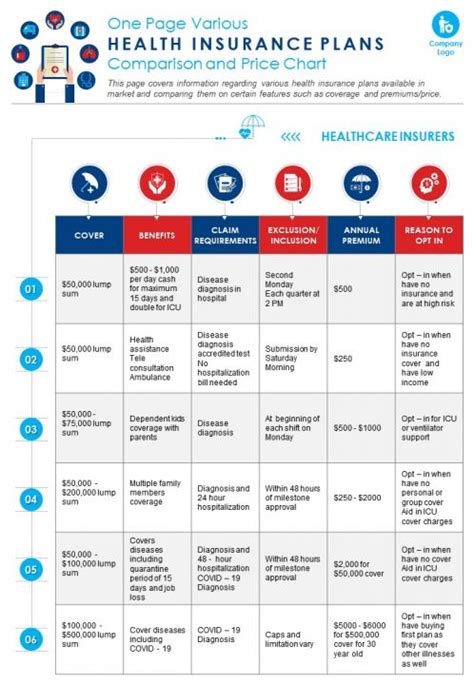

Analyzing Insurance Premiums and Coverage

When evaluating personal health insurance options, it’s crucial to strike a balance between affordable premiums and comprehensive coverage. While lower premiums might be tempting, they often come with higher deductibles, co-pays, or limited coverage, which can lead to unexpected out-of-pocket expenses.

Consider the following table, which provides a comparative analysis of different health insurance plans based on premiums, deductibles, and coverage levels:

| Plan | Premium | Deductible | Coverage Level |

|---|---|---|---|

| Plan A | $350/month | $5,000 | 80% |

| Plan B | $400/month | $2,000 | 90% |

| Plan C | $500/month | $1,000 | 100% |

In this example, Plan A offers the lowest premium but has a high deductible and limited coverage. Plan B provides a balance between premium and coverage, while Plan C offers the most comprehensive coverage but comes with the highest premium.

Personalized Insurance Solutions

Finding the right personal health insurance plan often requires a personalized approach. Factors such as individual health needs, financial situation, and lifestyle choices play a significant role in determining the most suitable plan. Consulting with insurance brokers or healthcare advisors can provide valuable insights and help individuals make informed decisions.

Future Implications and Market Trends

The landscape of personal health insurance is dynamic, influenced by evolving healthcare needs, technological advancements, and regulatory changes. As healthcare costs continue to rise, the focus on preventative care and wellness programs is expected to grow, potentially impacting insurance premiums and coverage options.

Furthermore, the increasing adoption of digital health technologies and telemedicine services could lead to more efficient healthcare delivery and potentially reduce insurance costs over time. Regulatory changes, such as those related to pre-existing condition coverage, can also have a significant impact on the affordability and accessibility of personal health insurance.

Navigating Health Insurance Challenges

Despite the challenges and complexities, personal health insurance remains a vital component of financial planning and healthcare management. By staying informed about insurance options, understanding the factors influencing premiums, and seeking professional guidance when needed, individuals can make more informed decisions about their healthcare coverage.

In an ever-changing healthcare environment, staying proactive and engaged in one's healthcare journey is essential. This includes regularly reviewing insurance plans, staying abreast of market trends, and seeking opportunities to optimize coverage and reduce costs.

Conclusion

Understanding the costs and intricacies of personal health insurance is a critical step towards securing comprehensive healthcare coverage. By considering the various factors that influence insurance premiums and exploring a range of coverage options, individuals can make informed decisions that balance affordability and comprehensive healthcare protection.

As the healthcare landscape continues to evolve, staying informed and proactive in managing personal health insurance is more important than ever. With a strategic approach to healthcare coverage, individuals can navigate the complexities of the insurance market and ensure they have the protection they need to maintain their health and well-being.

How do I choose the right health insurance plan for my needs?

+Choosing the right health insurance plan involves considering your specific healthcare needs, financial situation, and the coverage options available. Assess your medical history, including any pre-existing conditions, and determine the level of coverage you require. Compare plans based on premiums, deductibles, co-pays, and additional benefits to find the best fit for your needs and budget.

What are the benefits of employer-sponsored health insurance plans?

+Employer-sponsored health insurance plans often provide cost-sharing, where the employer contributes to the premium, making healthcare coverage more affordable for employees. These plans can offer a range of coverage options, including comprehensive benefits, and are typically easier to manage compared to individual plans.

Can I negotiate health insurance premiums with providers?

+Negotiating health insurance premiums directly with providers is generally not possible, as insurance premiums are based on a combination of factors, including age, location, and coverage level. However, you can shop around for different plans and providers to find the most affordable option that suits your needs.