Life Insurance Cheap

Life insurance is a crucial financial tool that provides security and peace of mind for individuals and their loved ones. However, the cost of life insurance policies can vary significantly, and many people are often deterred by the perception that it is an expensive endeavor. In this comprehensive guide, we will delve into the world of affordable life insurance, exploring the factors that influence costs, uncovering strategies to find cheap policies, and shedding light on the potential benefits of securing coverage at an economical rate.

Understanding the Cost of Life Insurance

The price of life insurance is determined by a multitude of factors, each playing a unique role in shaping the overall expense. Let’s take a closer look at some of the key determinants:

Risk Assessment

Insurance companies assess the risk associated with insuring an individual based on their health, lifestyle, and other personal factors. Underwriting is the process by which these risks are evaluated, and it significantly impacts the cost of a policy. For instance, individuals with pre-existing medical conditions or high-risk occupations may face higher premiums due to the increased likelihood of potential claims.

| Risk Factor | Impact on Premium |

|---|---|

| Health Status | Significant |

| Age | Moderate to High |

| Lifestyle Choices | Moderate |

| Occupation | Variable |

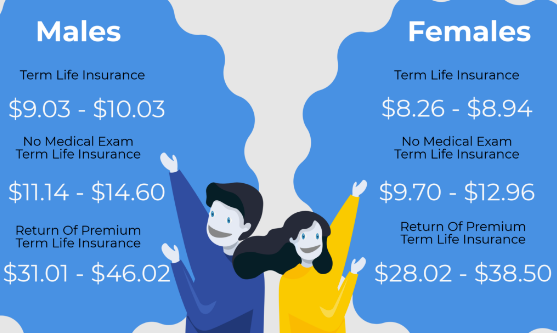

Policy Type and Coverage

The type of life insurance policy and the amount of coverage desired are fundamental considerations. Term life insurance, which provides coverage for a specific period, is generally more affordable than permanent life insurance, which offers lifelong coverage and additional benefits such as cash value accumulation. The level of coverage chosen, whether it’s a basic policy or a more comprehensive plan, will also affect the cost.

Rider Options

Riders, or policy add-ons, can enhance the coverage of a life insurance policy but often come at an additional cost. Common riders include accelerated death benefits, waiver of premium, and spousal coverage. While these riders can be beneficial, they should be carefully considered as they may increase the overall premium.

Insurance Company and Competition

The insurance market is highly competitive, and rates can vary significantly between providers. Some companies specialize in offering affordable coverage for specific risk profiles, while others may focus on providing comprehensive benefits. Shopping around and comparing quotes from multiple insurers is essential to finding the best deal.

Strategies for Securing Cheap Life Insurance

While the cost of life insurance is influenced by various factors, there are several strategies individuals can employ to secure cheap coverage. Here are some effective approaches:

Opt for Term Life Insurance

Term life insurance is often the most cost-effective option for individuals seeking affordable coverage. It provides protection for a specific period, typically ranging from 10 to 30 years, and is ideal for those who require coverage during their working years or while their children are dependent. Once the term expires, individuals can reassess their needs and either renew the policy or switch to a more permanent option.

Choose the Right Coverage Amount

Determining the appropriate level of coverage is crucial to keeping costs down. While it’s essential to have enough coverage to protect your loved ones financially, overinsuring can lead to unnecessary expenses. Assess your financial obligations, such as mortgage payments, outstanding debts, and future education expenses, to determine the appropriate coverage amount.

Improve Your Health Profile

Your health is a significant factor in determining life insurance premiums. Maintaining a healthy lifestyle, managing any existing medical conditions, and regularly visiting your healthcare provider can positively impact your risk assessment. Insurance companies often offer discounts or preferred rates to individuals who demonstrate a commitment to their well-being.

Bundle Policies

Many insurance companies offer discounts when you bundle multiple policies together. If you already have other types of insurance, such as auto or homeowners insurance, inquire about potential discounts for adding life insurance to your existing coverage. Bundling policies can result in significant savings over time.

Consider Group Policies

Group life insurance policies, often offered through employers or membership organizations, can provide cost-effective coverage. These policies typically offer simplified underwriting processes and may have lower premiums due to the reduced risk associated with insuring a larger group of individuals.

Compare Quotes and Shop Around

The insurance market is highly competitive, and quotes can vary significantly between providers. Take the time to compare quotes from multiple insurers to find the best rate for your specific needs. Online comparison tools and independent insurance agents can be valuable resources for this process.

Benefits of Affordable Life Insurance

Securing affordable life insurance offers a range of benefits that extend beyond the financial savings. Here’s a closer look at some of the advantages:

Peace of Mind

One of the primary benefits of affordable life insurance is the peace of mind it provides. Knowing that your loved ones are financially protected in the event of your untimely demise can alleviate a significant burden. With affordable coverage, you can rest assured that your family’s future is secure, allowing you to focus on living life to the fullest.

Financial Security for Dependents

Life insurance ensures that your dependents, whether they are children, a spouse, or other family members, will have the financial resources they need to maintain their standard of living. The death benefit from an affordable life insurance policy can cover expenses such as funeral costs, outstanding debts, and ongoing living expenses, providing a safety net during a difficult time.

Flexibility and Customization

Affordable life insurance policies often offer a high degree of flexibility and customization. You can choose the level of coverage that aligns with your specific needs and budget, ensuring that you are not overpaying for unnecessary benefits. This flexibility allows you to tailor your policy to your unique circumstances, whether you require coverage for a short term or wish to secure long-term protection.

Long-Term Savings

While affordable life insurance policies may have lower premiums, they can also lead to significant long-term savings. By securing coverage early in life, you can lock in a lower rate for an extended period. As you age, the cost of life insurance tends to increase, so starting with an affordable policy can result in substantial savings over time.

Conclusion: Navigating the Path to Affordable Protection

Finding cheap life insurance is not an impossible task. By understanding the factors that influence cost, employing effective strategies, and exploring the benefits of affordable coverage, individuals can secure the protection they need without breaking the bank. Remember, life insurance is an investment in your loved ones’ future, and with the right approach, it can be an achievable and rewarding endeavor.

How much does life insurance typically cost?

+

The cost of life insurance varies based on factors such as age, health, lifestyle, and the type of policy. On average, a 500,000 term life insurance policy for a healthy 30-year-old can range from 20 to $40 per month. However, rates can be significantly higher or lower depending on individual circumstances.

Are there any alternatives to traditional life insurance policies?

+

Yes, there are alternative forms of life insurance, such as simplified issue or guaranteed issue policies, which have relaxed underwriting requirements but may have higher premiums. Additionally, some companies offer final expense policies, which are smaller in coverage amount and typically have a simplified application process.

Can I qualify for affordable life insurance if I have a pre-existing medical condition?

+

While pre-existing conditions can impact the cost of life insurance, there are still options available. Some insurers specialize in providing coverage for individuals with health issues, and you may be eligible for a policy with a higher premium or a simplified underwriting process. It’s important to shop around and compare quotes.