Best Health Insurance Family

When it comes to securing the health and well-being of your loved ones, finding the best health insurance for your family is paramount. With numerous options available in the market, it can be a daunting task to navigate through the intricacies of healthcare plans. However, with the right knowledge and understanding of your family's unique needs, you can make an informed decision that provides comprehensive coverage and peace of mind.

Understanding the Importance of Family Health Insurance

In today’s fast-paced world, unforeseen medical emergencies and health challenges are an inevitable part of life. The rising costs of healthcare further emphasize the need for a robust family health insurance plan. By investing in the right coverage, you ensure that your family receives the necessary medical attention without incurring significant financial burdens.

Family health insurance plans offer a range of benefits tailored to meet the diverse needs of families. From routine check-ups and preventive care to specialized treatments and hospital stays, these plans provide a safety net that covers a wide spectrum of healthcare services. Moreover, with the increasing prevalence of chronic conditions and the need for long-term care, having comprehensive health insurance becomes even more crucial.

Key Factors to Consider When Choosing a Family Health Insurance Plan

Selecting the best health insurance plan for your family involves evaluating several critical factors. Firstly, assess your family’s current and future healthcare needs. Consider factors such as the age and health status of each family member, existing medical conditions, and any specific requirements for specialized care.

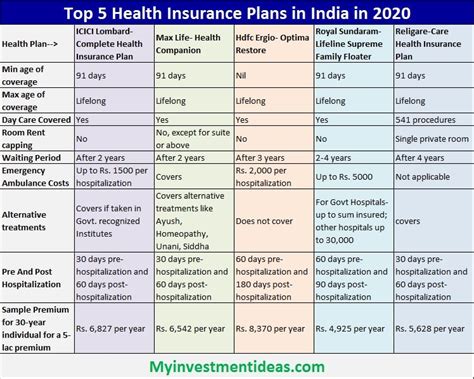

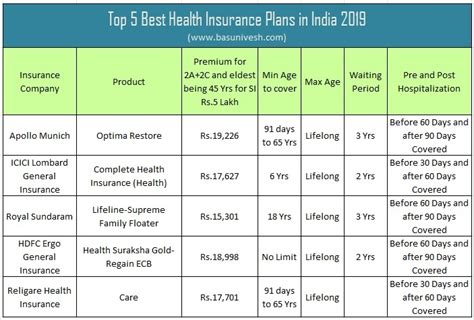

Next, compare the coverage and benefits offered by different insurance providers. Look for plans that offer a wide network of hospitals and healthcare providers, ensuring easy access to quality medical facilities. Evaluate the scope of coverage, including the inclusion of pre-existing conditions, maternity benefits, and coverage for critical illnesses.

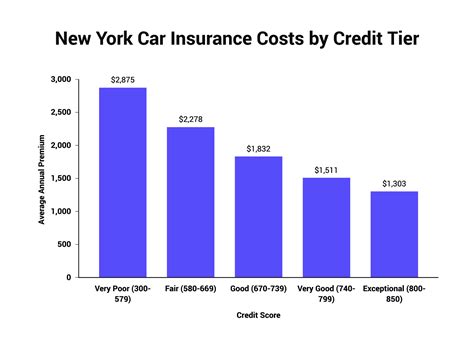

The financial aspects of the plan are equally important. Compare the premiums, deductibles, and co-payment structures to find a plan that aligns with your family's budget. Additionally, understand the renewal and portability options to ensure a seamless transition as your family's needs evolve over time.

Analyzing Top-Rated Family Health Insurance Plans

Several insurance providers offer highly-rated family health insurance plans with comprehensive coverage and competitive pricing. One such plan is the Family Health Secure Plan offered by [Insurance Provider A]. This plan boasts an extensive network of over 5,000 hospitals across the country, ensuring easy access to quality healthcare. It provides coverage for a wide range of medical expenses, including hospitalization, outpatient treatments, and even ayurvedic and homeopathic treatments.

Another notable plan is the Family Care Advantage Plan from [Insurance Provider B]. This plan stands out for its unique features, such as coverage for alternative therapies like naturopathy and yoga, and access to a dedicated health management program. With a focus on preventive care and holistic well-being, it offers a comprehensive approach to family healthcare.

For families seeking extensive coverage, the Platinum Family Health Plan by [Insurance Provider C] is an excellent choice. This plan provides unlimited pre and post-hospitalization benefits, coverage for ambulance services, and even offers international travel coverage for medical emergencies. Additionally, it includes a wellness program with access to online health consultations and fitness tracking tools.

Comparison Table: Top Family Health Insurance Plans

| Plan Name | Insurance Provider | Network Hospitals | Coverage Highlights |

|---|---|---|---|

| Family Health Secure Plan | [Insurance Provider A] | 5,000+ hospitals | Wide range of medical treatments, ayurvedic/homeopathic coverage |

| Family Care Advantage Plan | [Insurance Provider B] | 4,000+ hospitals | Alternative therapies, health management program |

| Platinum Family Health Plan | [Insurance Provider C] | 6,000+ hospitals | Unlimited pre/post-hospitalization, international travel coverage |

Expert Insights: Maximizing Your Family Health Insurance Benefits

As a healthcare expert, I recommend going beyond the basic coverage and exploring additional benefits offered by these plans. For instance, many family health insurance plans now include wellness programs that encourage preventive care and healthy lifestyles. These programs often provide access to online health consultations, fitness trackers, and even discounts on health-related products and services.

Pro Tip: When selecting a plan, pay close attention to the coverage for pre-existing conditions. Some plans offer limited coverage or impose waiting periods for certain conditions. Understanding these limitations will help you make an informed decision and ensure that your family receives the necessary care without unexpected hurdles.

Furthermore, consider the convenience and ease of claim settlement offered by different insurance providers. Look for plans that provide hassle-free claim processes, including cashless treatments at network hospitals and efficient reimbursement procedures. A seamless claim settlement process can greatly reduce the stress and worry associated with medical emergencies.

Future Trends and Implications for Family Health Insurance

The landscape of family health insurance is constantly evolving, driven by advancements in technology and changing healthcare needs. One emerging trend is the integration of telemedicine and digital health solutions into insurance plans. This allows for convenient access to medical advice and consultations, especially beneficial for families in remote areas or during times of restricted mobility.

Additionally, the focus on preventive care and holistic well-being is likely to continue gaining prominence. Insurance providers are increasingly recognizing the importance of promoting healthy lifestyles and offering incentives for families to adopt healthier habits. This shift towards prevention can lead to significant long-term benefits for both families and the healthcare system as a whole.

As we navigate the complexities of the healthcare industry, staying informed and proactive is key. By staying up-to-date with the latest trends and understanding the evolving needs of your family, you can make informed decisions to secure the best health insurance coverage for your loved ones.

How do I determine the right coverage limits for my family’s health insurance plan?

+Assessing your family’s unique healthcare needs is crucial. Consider factors such as age, existing medical conditions, and the frequency of healthcare visits. A good starting point is to evaluate the past year’s medical expenses and plan accordingly. Additionally, consult with insurance experts who can guide you in selecting appropriate coverage limits based on your family’s profile.

Are there any tax benefits associated with family health insurance plans?

+Yes, in many countries, there are tax benefits available for individuals who purchase health insurance for their families. These benefits can include tax deductions on the premiums paid or exemptions from certain taxes. It’s advisable to consult a tax professional or refer to your country’s tax guidelines to understand the specific benefits applicable to you.

What should I do if I’m not satisfied with my current family health insurance plan?

+If you find that your current plan is not meeting your family’s needs, it’s essential to explore your options. Research and compare different insurance providers and plans to identify one that better aligns with your requirements. Remember to consider factors like coverage, network of healthcare providers, and premium costs when making the switch.