New York Insurance Car

The state of New York has a robust and comprehensive system for automotive insurance, ensuring that drivers are protected and adhere to the necessary legal requirements. Understanding the intricacies of New York car insurance is crucial for anyone residing in or driving through the state. This article aims to provide an in-depth analysis of the unique features, requirements, and options available within the New York automotive insurance landscape.

Understanding New York’s Insurance Landscape

New York’s insurance market is highly regulated, aiming to strike a balance between providing adequate coverage for drivers and maintaining affordability. The state’s Department of Financial Services plays a pivotal role in overseeing insurance companies, ensuring compliance with state laws, and protecting consumer rights.

One of the key aspects of New York's insurance landscape is the No-Fault Insurance system. This system, unique to the state, mandates that drivers' insurance policies cover the costs of injuries and lost wages resulting from an accident, regardless of who is at fault. This approach aims to streamline the claims process and reduce litigation.

Minimum Coverage Requirements

To legally operate a vehicle in New York, drivers must carry insurance that meets the state’s minimum coverage requirements. These include:

- Bodily Injury Liability: Covers the costs of injuries or deaths caused to others in an accident for which the insured driver is at fault. The minimum requirement is $25,000 per person and $50,000 per accident.

- Property Damage Liability: Provides coverage for damage to other people's property, such as vehicles or structures, in an accident caused by the insured driver. The minimum requirement is $10,000.

- No-Fault Coverage: As mentioned earlier, New York's No-Fault system requires drivers to carry Personal Injury Protection (PIP) coverage. This coverage provides up to $50,000 for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault.

While these are the minimum requirements, it is often recommended to carry higher limits, especially for liability coverage, to ensure adequate protection in the event of a serious accident.

Optional Coverages

Beyond the mandatory coverages, New York drivers have the option to purchase additional insurance to enhance their protection. These include:

- Collision Coverage: Pays for damages to the insured vehicle in an accident, regardless of fault. This coverage is particularly beneficial for newer or financed vehicles.

- Comprehensive Coverage: Provides protection against damage to the insured vehicle due to non-accident events, such as theft, vandalism, natural disasters, or collisions with animals. It is often required by lenders if the vehicle is leased or financed.

- Uninsured/Underinsured Motorist Coverage: Protects the insured driver in the event of an accident with a driver who does not have insurance or does not have sufficient insurance to cover the damages.

- Medical Payments Coverage: Similar to No-Fault coverage, this option provides additional medical expense coverage for the insured driver and passengers, regardless of fault.

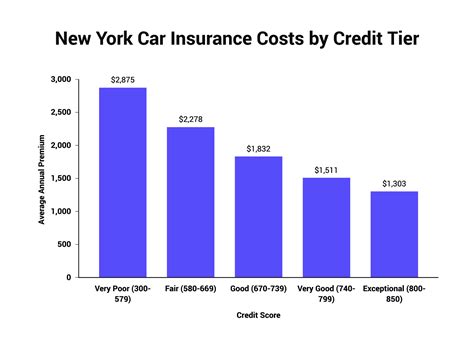

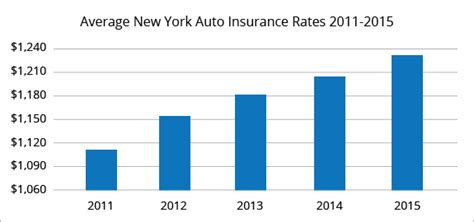

Factors Affecting Insurance Premiums

Insurance premiums in New York, as in any other state, are influenced by a multitude of factors. These factors can vary significantly from one driver to another, making it challenging to provide a universal estimate for insurance costs.

Demographic Factors

Demographic factors such as age, gender, and marital status can impact insurance rates. Generally, younger drivers, particularly those under 25, are considered high-risk and may face higher premiums. Gender-based pricing is prohibited in New York, ensuring that insurance rates are not influenced by this factor.

Driving History

One of the most significant factors in determining insurance premiums is an individual’s driving history. A clean driving record with no at-fault accidents or serious violations can lead to lower premiums. Conversely, multiple accidents, traffic violations, or a DUI conviction can significantly increase insurance costs.

Vehicle Factors

The type of vehicle an individual drives can also impact insurance rates. Newer, more expensive vehicles, or those with high repair costs, may command higher premiums. Additionally, vehicles with advanced safety features or anti-theft devices may qualify for discounts.

Coverage and Deductibles

The level of coverage an individual chooses, along with the associated deductibles, plays a crucial role in determining insurance premiums. Higher coverage limits and lower deductibles generally result in higher premiums, while lower coverage limits and higher deductibles can lead to reduced premiums.

Location

The geographical location where an individual resides or primarily drives can significantly influence insurance rates. Urban areas with higher population densities and increased traffic often carry higher insurance costs due to the higher risk of accidents and claims.

| Location Type | Insurance Premium Impact |

|---|---|

| Urban Areas | Higher premiums due to increased risk of accidents and claims. |

| Suburban/Rural Areas | Generally lower premiums due to reduced traffic and accident risks. |

Shopping for Car Insurance in New York

With the vast array of insurance providers and coverage options available, shopping for car insurance in New York can be a daunting task. However, by following a systematic approach, drivers can make informed decisions and find the best coverage at the most competitive rates.

Research and Compare

Start by researching the major insurance providers in New York. Online resources, consumer reviews, and industry ratings can provide valuable insights into the reputation and reliability of different companies. Compare the coverage options, premiums, and any additional benefits or discounts offered.

Consider Bundling

Many insurance companies offer discounts when multiple policies are bundled together. For instance, if you have a home or renters insurance policy with a particular company, you may be eligible for a discount on your automotive insurance if you switch to the same provider. This strategy can lead to significant savings over time.

Understand Discounts

Insurance companies often provide a variety of discounts to attract customers. These may include safe driver discounts, loyalty discounts, student discounts, or discounts for completing defensive driving courses. Understanding the eligibility criteria and requirements for these discounts can help you make more informed decisions.

Review Your Coverage Regularly

Insurance needs can change over time, and it’s essential to periodically review your coverage to ensure it aligns with your current situation. Life events such as marriage, purchasing a new home, or adding a teenage driver to your policy can impact your insurance needs. Regularly reviewing your coverage can help you stay protected and save money.

Work with an Agent

While online research and comparison tools are valuable, working with a licensed insurance agent can provide personalized guidance. Agents can help you navigate the complexities of insurance, understand the unique aspects of New York’s insurance landscape, and find the best coverage options tailored to your needs.

Claim Process and Dispute Resolution

In the event of an accident or incident, understanding the claim process is crucial. New York’s insurance regulations provide a structured process for filing claims and resolving disputes.

Filing a Claim

When an accident occurs, it’s essential to promptly notify your insurance company. Most companies provide 24⁄7 claims reporting services, allowing you to initiate the process quickly. Provide as much detail as possible about the incident, including any relevant photos or videos.

Dispute Resolution

In cases where there is a disagreement over fault, liability, or the value of damages, New York’s insurance regulations provide avenues for dispute resolution. This may involve mediation, arbitration, or, in more complex cases, litigation. The state’s Department of Financial Services offers guidance and resources for consumers navigating the dispute resolution process.

Future Trends and Innovations

The automotive insurance industry in New York, like many others, is undergoing significant transformations driven by technological advancements and changing consumer preferences.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to monitor driving behavior, is gaining traction in the insurance industry. Usage-Based Insurance (UBI) programs, which leverage telematics data to offer personalized premiums based on an individual’s driving habits, are becoming more common. This trend is expected to continue, providing drivers with greater control over their insurance costs.

Digital Transformation

The rise of digital technologies is revolutionizing the insurance industry. Online quote comparison tools, mobile apps for policy management and claims reporting, and digital payment options are becoming standard across insurance providers. These advancements enhance convenience, streamline processes, and improve the overall customer experience.

Emerging Technologies and Risks

With the advent of autonomous vehicles and connected car technologies, the insurance industry is faced with new challenges and opportunities. As these technologies become more prevalent, insurance providers will need to adapt their policies and coverage options to address the unique risks and benefits associated with these advancements.

Conclusion

Navigating the world of automotive insurance in New York can be complex, but with the right knowledge and approach, drivers can ensure they have the appropriate coverage at a competitive rate. Understanding the unique features of New York’s insurance landscape, from the No-Fault system to the various factors influencing premiums, is essential for making informed decisions. As the industry continues to evolve, staying informed about emerging trends and innovations will be crucial for consumers and providers alike.

What is the average cost of car insurance in New York?

+The average cost of car insurance in New York varies significantly based on individual factors such as driving history, vehicle type, and location. According to recent data, the average premium for a minimum liability policy in New York is around 1,500 per year, while a full-coverage policy can range from 2,000 to $3,000 per year.

Are there any discounts available for New York drivers?

+Yes, New York drivers can often take advantage of various discounts to reduce their insurance premiums. These may include safe driver discounts, loyalty discounts, student discounts, and discounts for completing defensive driving courses. It’s essential to inquire with insurance providers about the specific discounts they offer.

How can I file a complaint against an insurance company in New York?

+If you have a complaint or dispute with an insurance company in New York, you can file a complaint with the New York Department of Financial Services (DFS). The DFS provides an online complaint form and offers guidance on the complaint process. It’s important to document any issues thoroughly and provide supporting evidence.