Best Tenant Insurance

When it comes to protecting your belongings and securing peace of mind, tenant insurance is an essential consideration for renters. With the right policy, you can safeguard your assets and personal liability, ensuring that you're prepared for unforeseen circumstances. This comprehensive guide will delve into the world of tenant insurance, exploring the best options available to renters and providing expert insights to help you make an informed decision.

Understanding Tenant Insurance: A Comprehensive Overview

Tenant insurance, also known as renter's insurance, is a form of property insurance specifically designed for individuals who rent their living spaces. It provides coverage for personal property, personal liability, and additional living expenses, ensuring that tenants are protected in various situations.

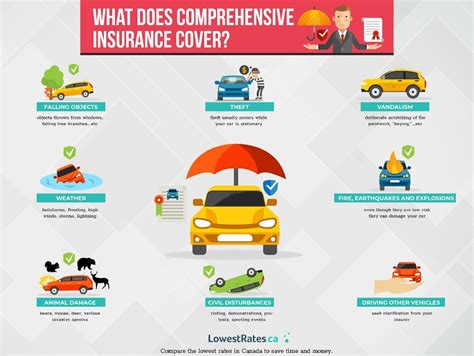

In the unfortunate event of a fire, theft, or natural disaster, tenant insurance can reimburse you for the cost of repairing or replacing your belongings. It also offers liability protection, which can cover legal fees and damages if someone is injured on your rental property and decides to sue you. Furthermore, tenant insurance can provide temporary living expenses if your rental home becomes uninhabitable due to a covered incident.

Key Components of Tenant Insurance

Tenant insurance typically consists of three main coverage types:

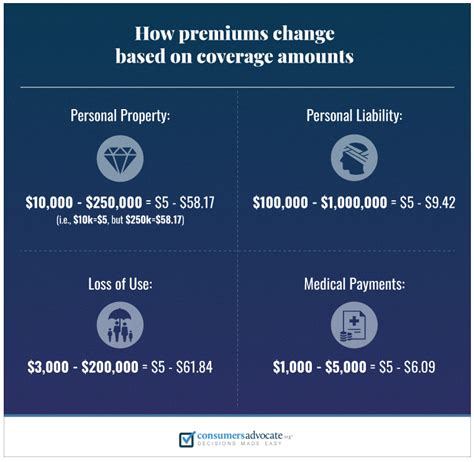

- Personal Property Coverage: This covers your belongings, such as furniture, electronics, clothing, and other personal items. It provides reimbursement for damaged, destroyed, or stolen items, ensuring you can replace them without incurring significant financial burden.

- Personal Liability Coverage: This aspect of tenant insurance protects you from financial losses if you are held legally responsible for an accident or injury that occurs on your rental property. It covers medical expenses, legal fees, and potential settlements or judgments against you.

- Additional Living Expenses: In the event that your rental home becomes unlivable due to a covered incident, this coverage reimburses you for the extra costs incurred while you find temporary housing. It can include expenses like hotel stays, restaurant meals, and other necessary expenses until you can return to your home.

Evaluating the Best Tenant Insurance Options

When searching for the best tenant insurance, it's crucial to consider factors such as coverage limits, deductibles, policy exclusions, and the overall reputation and financial stability of the insurance provider.

Coverage Limits and Deductibles

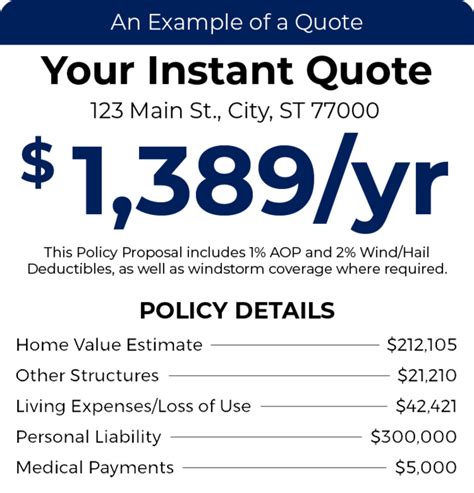

Coverage limits refer to the maximum amount your insurance policy will pay out for a covered loss. It's essential to choose a policy with adequate coverage limits to ensure you're fully protected. Consider the value of your belongings and choose a policy that offers coverage that aligns with your needs.

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. A higher deductible can result in lower premiums, so it's important to find a balance that suits your financial situation and risk tolerance.

Policy Exclusions and Fine Print

Insurance policies often come with exclusions, which are situations or items that are not covered by the policy. It's crucial to carefully review the policy's fine print to understand what is and isn't covered. Some common exclusions in tenant insurance policies include flood damage, earthquake damage, intentional damage, and damage caused by pests or vermin.

Reputation and Financial Stability

When selecting a tenant insurance provider, it's wise to choose a reputable company with a solid financial standing. A financially stable insurer can ensure that they will be able to pay out claims even in the event of a large-scale disaster or widespread losses. Look for insurance companies with strong financial ratings from reputable agencies like AM Best or Standard & Poor's.

Top Tenant Insurance Providers: A Comparative Analysis

Now, let's delve into some of the top tenant insurance providers in the market, comparing their coverage options, customer satisfaction, and overall value.

State Farm

State Farm is a well-known insurance provider that offers a comprehensive tenant insurance policy. Their policy includes coverage for personal property, liability, and additional living expenses. State Farm's tenant insurance provides flexible coverage limits, allowing renters to tailor their policy to their specific needs. They also offer discounts for bundling tenant insurance with other policies, such as auto insurance.

| Coverage | State Farm |

|---|---|

| Personal Property | Comprehensive coverage with flexible limits |

| Liability | Included with flexible limits |

| Additional Living Expenses | Reimburses temporary living costs |

Allstate

Allstate is another leading insurance provider that offers tenant insurance policies. Their policies provide coverage for personal property, liability, and additional living expenses, similar to State Farm. Allstate's tenant insurance offers a range of coverage options, allowing renters to choose the level of protection that suits their budget and needs. They also provide discounts for bundling tenant insurance with other policies.

| Coverage | Allstate |

|---|---|

| Personal Property | Comprehensive coverage with customizable limits |

| Liability | Included with varying levels of coverage |

| Additional Living Expenses | Reimburses temporary housing costs |

Geico

Geico, known for its auto insurance, also offers tenant insurance policies. Their tenant insurance provides coverage for personal property, liability, and additional living expenses. Geico's policies are known for their competitive pricing and flexibility, allowing renters to choose the coverage limits that fit their budget. They also offer discounts for bundling tenant insurance with other Geico policies.

| Coverage | Geico |

|---|---|

| Personal Property | Competitive coverage with customizable limits |

| Liability | Included with varying coverage options |

| Additional Living Expenses | Reimburses temporary accommodation costs |

Progressive

Progressive is a renowned insurance provider that offers tenant insurance policies with a focus on affordability and customization. Their tenant insurance provides coverage for personal property, liability, and additional living expenses. Progressive allows renters to choose their coverage limits and deductibles, ensuring they can find a policy that fits their unique needs and budget.

| Coverage | Progressive |

|---|---|

| Personal Property | Affordable coverage with customizable limits |

| Liability | Included with flexible coverage options |

| Additional Living Expenses | Reimburses temporary housing and living expenses |

Expert Tips for Choosing the Best Tenant Insurance

Here are some valuable tips to help you make an informed decision when selecting the best tenant insurance policy for your needs:

- Understand Your Coverage Needs: Assess the value of your personal belongings and consider the potential risks you may face. This will help you determine the appropriate coverage limits and deductibles for your policy.

- Compare Multiple Providers: Research and compare different tenant insurance providers to find the best fit for your needs. Consider factors like coverage options, customer satisfaction, and financial stability.

- Bundle Policies for Discounts: Many insurance providers offer discounts when you bundle multiple policies, such as tenant insurance and auto insurance. This can be a cost-effective way to save on your insurance premiums.

- Read the Fine Print: Carefully review the policy documents, including the exclusions and limitations. Understanding the fine print ensures you're aware of any situations that may not be covered by your policy.

- Consider Additional Coverage: Depending on your circumstances, you may want to consider adding optional coverage, such as earthquake or flood insurance, to protect against specific risks.

Frequently Asked Questions

What is the average cost of tenant insurance?

+The average cost of tenant insurance can vary depending on factors such as location, coverage limits, and deductibles. Typically, tenant insurance policies range from $150 to $300 per year. However, it's important to note that prices can differ based on individual circumstances and the provider chosen.

<div class="faq-item">

<div class="faq-question">

<h3>Is tenant insurance worth it?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Tenant insurance is highly recommended for renters as it provides essential protection for your personal belongings and personal liability. While it's an additional expense, the peace of mind and financial security it offers can be invaluable in the event of unexpected situations such as theft, fire, or accidents.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I choose the right coverage limits for my tenant insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>To choose the right coverage limits, consider the value of your personal belongings and the potential risks you face. Assess the cost of replacing your belongings and choose coverage limits that adequately cover these expenses. It's also wise to discuss your specific needs with an insurance agent to ensure you have sufficient protection.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I add additional coverage to my tenant insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, many tenant insurance providers offer optional additional coverage to cater to specific needs. Common add-ons include coverage for high-value items, such as jewelry or electronics, or coverage for specific risks like flood or earthquake damage. Consult with your insurance provider to explore these options and tailor your policy accordingly.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What should I do if I need to file a tenant insurance claim?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you need to file a tenant insurance claim, the first step is to contact your insurance provider and notify them of the incident. Provide as much detail as possible about the event and any damages or losses incurred. Your insurance provider will guide you through the claims process, which may involve submitting documentation and working with an adjuster to assess the damages.</p>

</div>

</div>

</div>

In conclusion, tenant insurance is an invaluable tool for renters to protect their belongings and personal liability. By understanding the key components of tenant insurance, evaluating top providers, and following expert tips, you can make an informed decision and choose the best tenant insurance policy to suit your needs. Remember, peace of mind and financial security are worth the investment.