Comprehensive Car Insurance Coverage

Car insurance is an essential aspect of vehicle ownership, offering financial protection and peace of mind to drivers. While there are various types of car insurance policies available, comprehensive coverage stands out as a comprehensive solution for those seeking extensive protection. This article delves into the world of comprehensive car insurance, exploring its features, benefits, and the invaluable protection it provides.

Understanding Comprehensive Car Insurance

Comprehensive car insurance, often referred to as full coverage, is a comprehensive policy designed to provide an extensive level of protection for vehicle owners. Unlike basic liability insurance, which primarily covers damages caused to others, comprehensive coverage offers a broader range of benefits, safeguarding against a variety of unforeseen circumstances.

This type of insurance policy aims to protect vehicle owners from financial losses resulting from accidents, theft, natural disasters, and other unexpected events. By opting for comprehensive coverage, drivers can ensure they have adequate financial support to cover the cost of repairs or replacements, regardless of the cause of damage.

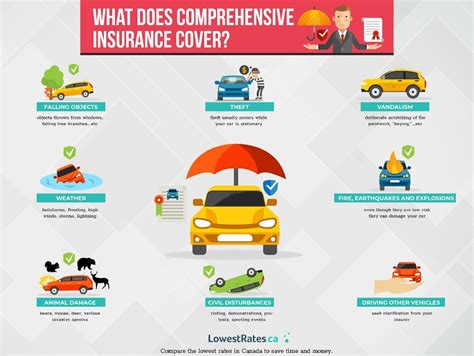

Key Features of Comprehensive Coverage

-

Accident Coverage: Comprehensive insurance covers damages to your vehicle resulting from accidents, regardless of fault. This includes repairs or replacements needed due to collisions with other vehicles, objects, or animals.

-

Theft Protection: In the unfortunate event of vehicle theft, comprehensive insurance steps in to provide coverage for the loss. It covers the cost of replacing your vehicle or compensating you for its actual cash value.

-

Natural Disaster Coverage: Natural disasters such as hurricanes, floods, earthquakes, or fires can cause significant damage to vehicles. Comprehensive insurance policies often include coverage for damages caused by these events, ensuring your vehicle is protected.

-

Vandalism and Malicious Damage: If your vehicle is vandalized or damaged by malicious acts, comprehensive coverage can provide financial assistance to repair or replace the affected parts.

-

Glass and Windshield Coverage: Comprehensive policies typically include coverage for damaged windshields and glass, offering repairs or replacements without affecting your comprehensive claim history.

-

Hit-and-Run Accidents: In the event of a hit-and-run accident, comprehensive insurance can provide coverage for the damages, helping you avoid financial burdens associated with such incidents.

The Benefits of Comprehensive Car Insurance

Opting for comprehensive car insurance offers a range of advantages that make it a popular choice among vehicle owners. Here are some key benefits to consider:

Financial Protection

Comprehensive insurance provides a safety net against financial losses. Whether it’s an accident, theft, or natural disaster, this coverage ensures you’re not left with unexpected expenses that can strain your finances.

Peace of Mind

Knowing that your vehicle is protected against a wide range of potential risks brings peace of mind. With comprehensive coverage, you can drive with confidence, knowing that you’re prepared for the unexpected.

Comprehensive Protection

As the name suggests, comprehensive insurance offers a comprehensive level of protection. Unlike limited policies, it covers a broad spectrum of events, ensuring you’re not left vulnerable to specific risks.

No-Fault Protection

Comprehensive coverage extends to situations where you’re not at fault. This is particularly beneficial in cases of hit-and-run accidents or damages caused by unidentified drivers, ensuring you’re not penalized for circumstances beyond your control.

Real-World Examples of Comprehensive Coverage

Let’s explore a few real-life scenarios where comprehensive car insurance proved to be a lifesaver for vehicle owners:

Scenario 1: Natural Disaster

Imagine you’re a resident of a coastal region prone to hurricanes. During a severe storm, your vehicle is damaged by flying debris, and the repairs are estimated to cost $5,000. With comprehensive insurance, your policy covers the repairs, providing financial relief during a challenging time.

Scenario 2: Theft

You park your car in a busy city, only to return and find it missing. The police report confirms it was stolen. Fortunately, your comprehensive insurance policy includes theft coverage, compensating you for the loss and helping you replace your vehicle.

Scenario 3: Hit-and-Run

While driving home from work, you’re involved in a hit-and-run accident. The other driver flees the scene, leaving you with significant vehicle damage. With comprehensive coverage, you’re able to file a claim and receive compensation for the repairs, avoiding the financial burden alone.

Performance Analysis: Comprehensive vs. Limited Coverage

To better understand the value of comprehensive insurance, let’s compare it to limited coverage options:

| Coverage Type | Comprehensive | Limited (Liability) |

|---|---|---|

| Accident Coverage | Yes | Limited |

| Theft Protection | Yes | No |

| Natural Disaster Coverage | Yes | No |

| Vandalism Coverage | Yes | No |

| Glass and Windshield Coverage | Yes | Limited |

| Hit-and-Run Coverage | Yes | No |

As evident from the table, comprehensive coverage offers a more robust and comprehensive set of protections compared to limited liability policies. While limited coverage may be sufficient for some, comprehensive insurance provides an added layer of security for vehicle owners.

Evidence-Based Future Implications

The benefits of comprehensive car insurance extend beyond the immediate protection it offers. Here are some future implications to consider:

Resale Value

Vehicles with a comprehensive insurance history often hold higher resale value. Potential buyers perceive these vehicles as well-maintained and properly cared for, making them more desirable in the used car market.

Reduced Financial Stress

By having comprehensive coverage, you reduce the financial stress associated with unexpected vehicle damages. This peace of mind allows you to focus on other aspects of life without worrying about potential financial burdens.

Long-Term Cost Savings

While comprehensive insurance may have a higher premium, it can lead to long-term cost savings. By avoiding unexpected expenses and potential financial losses, you can maintain a stable financial outlook.

Enhanced Safety

Comprehensive insurance encourages safe driving practices. Knowing that your vehicle is protected, you’re more likely to take extra precautions, leading to a safer driving experience for yourself and others on the road.

Is comprehensive car insurance mandatory?

+Comprehensive car insurance is not mandatory in all states or regions. However, it is highly recommended to have comprehensive coverage, especially if your vehicle is financed or leased, as it provides protection against a wide range of risks.

What is the difference between comprehensive and collision insurance?

+Collision insurance specifically covers damages caused to your vehicle in an accident, regardless of fault. Comprehensive insurance, on the other hand, provides a broader range of coverage, including theft, natural disasters, and other non-collision events.

How much does comprehensive car insurance cost?

+The cost of comprehensive car insurance varies based on factors such as your location, the make and model of your vehicle, your driving record, and the insurance provider. It’s best to obtain quotes from multiple insurers to find the most competitive rates.