Shelter Insurance Company

Shelter Insurance Company is a renowned name in the insurance industry, known for its comprehensive coverage options and dedication to customer satisfaction. With a rich history spanning over six decades, Shelter has established itself as a trusted provider of auto, home, life, and business insurance solutions. In this comprehensive guide, we will delve into the world of Shelter Insurance, exploring its offerings, unique features, and the benefits it brings to policyholders.

A Legacy of Trust: Shelter Insurance’s Journey

Shelter Insurance Company was founded in 1946 by W.H. (“Bill”) Keegan, Sr. in Missouri, United States. Keegan’s vision was to create an insurance company that prioritized customer needs and provided reliable protection. Over the years, Shelter has expanded its reach, now serving policyholders in multiple states across the nation.

One of the key strengths of Shelter Insurance lies in its commitment to community involvement and support. The company actively engages in various charitable initiatives, reflecting its core values and commitment to giving back. This deep-rooted sense of community has fostered a loyal customer base and a strong reputation.

Comprehensive Insurance Solutions

Shelter Insurance offers a diverse range of insurance products to cater to the unique needs of its customers. Let’s explore some of the key coverage options available:

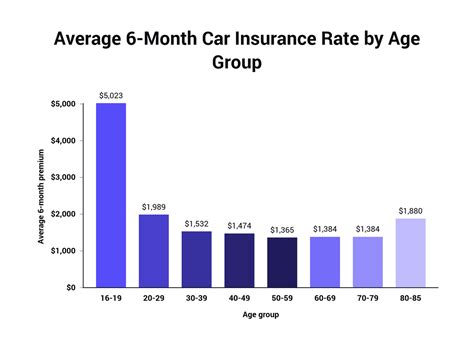

Auto Insurance

Shelter’s auto insurance policies provide comprehensive protection for vehicles. Policyholders can choose from a range of coverage options, including liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. Shelter’s auto insurance stands out for its competitive rates and customizable plans, allowing customers to tailor their coverage to their specific needs.

One unique feature of Shelter's auto insurance is its Accident Forgiveness program. This program ensures that policyholders' rates remain unaffected after their first at-fault accident, offering peace of mind and financial security.

Home Insurance

Shelter Insurance understands the importance of safeguarding your home and its contents. Their home insurance policies provide coverage for a wide range of risks, including fire, theft, and natural disasters. Policyholders can choose from different coverage levels, ensuring they receive the protection that aligns with the value of their home.

Additionally, Shelter offers Replacement Cost Coverage, ensuring that policyholders receive the full cost of repairing or replacing their home and belongings, without any depreciation deductions.

Life Insurance

Shelter Insurance recognizes the significance of life insurance as a vital component of financial planning. Their life insurance policies provide financial protection to policyholders and their loved ones in the event of an untimely demise. Shelter offers a range of life insurance options, including term life, whole life, and universal life insurance, each designed to cater to different needs and budgets.

A notable feature of Shelter's life insurance is their Living Benefits program. This program allows policyholders to access a portion of their death benefit if they are diagnosed with a terminal illness or suffer a severe accident, providing much-needed financial support during challenging times.

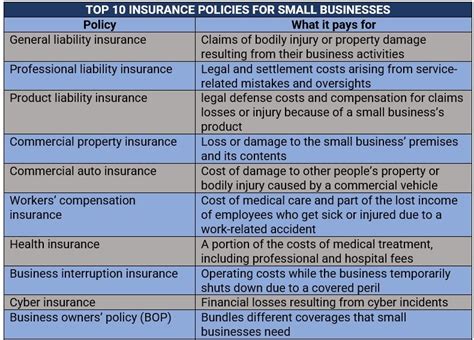

Business Insurance

Shelter Insurance understands the unique risks faced by businesses. Their business insurance policies are tailored to provide comprehensive coverage for various industries. Whether it’s a small business or a large corporation, Shelter offers protection against property damage, liability claims, and business interruption.

One of Shelter's standout features in business insurance is their Risk Management Services. This program provides policyholders with resources and guidance to identify and mitigate potential risks, helping businesses stay protected and thrive.

The Shelter Difference: Customer-Centric Approach

What sets Shelter Insurance apart from its competitors is its unwavering dedication to customer service. Shelter prides itself on its local presence and personalized approach, ensuring that policyholders receive the attention and support they deserve.

Shelter Insurance's network of independent agents plays a crucial role in delivering exceptional customer experiences. These agents are deeply rooted in their communities, offering personalized advice and support to policyholders. With a focus on building long-lasting relationships, Shelter's agents ensure that customers receive tailored insurance solutions that meet their specific needs.

Furthermore, Shelter Insurance's commitment to technological innovation has enhanced its customer service. Their online platform and mobile app provide policyholders with convenient access to their policies, allowing them to manage their insurance needs efficiently and securely.

Financial Strength and Stability

Financial stability is a critical factor when choosing an insurance provider. Shelter Insurance boasts a strong financial foundation, consistently earning high ratings from renowned rating agencies. This financial strength ensures that policyholders can rely on Shelter’s ability to pay claims promptly and honor its commitments.

| Rating Agency | Financial Strength Rating |

|---|---|

| AM Best | A (Excellent) |

| Standard & Poor's | A+ (Strong) |

| Moody's | A1 (High Quality) |

Community Engagement and Giving Back

Shelter Insurance’s commitment to community involvement goes beyond its insurance offerings. The company actively participates in various charitable initiatives, supporting causes that make a positive impact on society. From sponsoring local events to contributing to disaster relief efforts, Shelter demonstrates its dedication to making a difference.

One notable initiative is the Shelter Foundation, established to provide financial support to organizations focused on education, healthcare, and community development. The foundation has made significant contributions to various causes, reflecting Shelter's commitment to social responsibility.

Performance and Recognition

Shelter Insurance’s exceptional performance and commitment to excellence have been recognized by industry leaders and customers alike. The company has consistently earned high customer satisfaction ratings, highlighting its success in delivering exceptional service and meeting policyholders’ expectations.

Additionally, Shelter has been acknowledged for its innovative approaches and commitment to technological advancement. The company's use of cutting-edge tools and platforms has enhanced its operational efficiency and customer experience, setting it apart from its competitors.

Future Outlook: Continued Growth and Innovation

As the insurance industry continues to evolve, Shelter Insurance remains committed to staying ahead of the curve. The company’s focus on innovation and customer-centric approaches positions it well for future growth and success. With a dedicated team of professionals and a strong financial foundation, Shelter is poised to continue delivering exceptional insurance solutions and enhancing its reputation as a trusted provider.

Shelter Insurance's commitment to continuous improvement and adaptation ensures that policyholders can rely on the company's ability to meet their changing needs and provide comprehensive protection. Whether it's through expanding its product offerings, enhancing its technological capabilities, or deepening its community involvement, Shelter is dedicated to remaining a leading force in the insurance industry.

How can I get a quote for Shelter Insurance’s coverage options?

+To obtain a quote for Shelter Insurance’s coverage options, you can visit their official website and use their online quoting tool. Alternatively, you can reach out to a local Shelter Insurance agent who can provide you with personalized advice and assist you in choosing the right coverage for your needs.

What sets Shelter Insurance apart from other insurance providers?

+Shelter Insurance stands out for its strong focus on customer service and community involvement. Their network of independent agents, local presence, and commitment to personalized advice set them apart. Additionally, Shelter’s unique features, such as Accident Forgiveness and Living Benefits, provide added value to policyholders.

Does Shelter Insurance offer discounts on their insurance policies?

+Yes, Shelter Insurance offers a range of discounts to help policyholders save on their insurance premiums. These discounts may include multi-policy discounts, good student discounts, safe driver discounts, and more. It’s best to consult with a Shelter Insurance agent to explore the specific discounts available in your area.

How does Shelter Insurance handle claims and customer service inquiries?

+Shelter Insurance is dedicated to providing prompt and efficient claims handling. Policyholders can report claims online, over the phone, or through their mobile app. The company’s claims team works closely with customers to ensure a smooth and stress-free claims process. Additionally, Shelter’s customer service representatives are readily available to assist with any inquiries or concerns, ensuring a positive and supportive experience.