Cancel Insurance Policy

Canceling an insurance policy is a significant financial decision that requires careful consideration and adherence to specific procedures. Whether you're looking to save money, switch providers, or make changes to your coverage, understanding the process and potential implications is crucial. This comprehensive guide will walk you through the steps, best practices, and potential pitfalls of canceling an insurance policy, ensuring a smooth and informed transition.

Understanding the Basics of Insurance Policy Cancellation

Canceling an insurance policy involves terminating your contractual agreement with an insurance provider. This action releases you from the obligations outlined in the policy and may impact your future insurance needs and costs. It's essential to approach policy cancellation with a clear understanding of the reasons, consequences, and alternatives.

The decision to cancel an insurance policy is often driven by various factors, including:

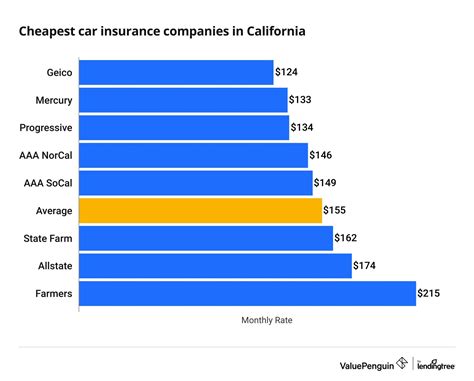

- Financial Considerations: Policies with high premiums or low coverage may be financially burdensome, prompting a desire to cancel and seek more affordable options.

- Changing Circumstances: Life events such as marriage, divorce, a new job, or a move to a different location can alter your insurance needs, making cancellation and adjustment necessary.

- Provider Dissatisfaction: Poor customer service, lack of claim responsiveness, or subpar coverage may lead to a decision to terminate your relationship with a particular provider.

- Better Alternatives: Discovering more comprehensive or cost-effective policies elsewhere can motivate a switch, especially if the current policy is inadequate or overpriced.

Before initiating the cancellation process, it's crucial to assess your specific situation and consider the potential impact on your future insurance needs. For instance, canceling an auto insurance policy may affect your ability to register your vehicle or obtain new coverage in the future. Similarly, canceling health insurance could leave you without coverage during a critical period of need.

Step-by-Step Guide to Canceling Your Insurance Policy

The process of canceling an insurance policy can vary slightly depending on the type of insurance and the provider. However, there are general steps that can be followed to ensure a smooth cancellation:

1. Review Your Policy

Begin by thoroughly examining your insurance policy document. Understand the terms, conditions, and any cancellation-related clauses. This step is crucial to ensuring you're aware of any potential penalties or requirements associated with cancellation.

2. Determine the Cancellation Date

Insurance policies often have specific cancellation dates, and it's important to identify when your policy can be terminated without incurring additional fees. These dates may align with the policy's renewal period or be based on the date of purchase.

3. Contact Your Insurance Provider

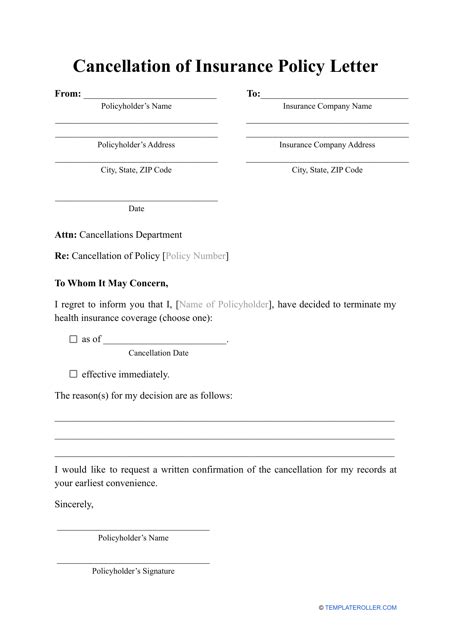

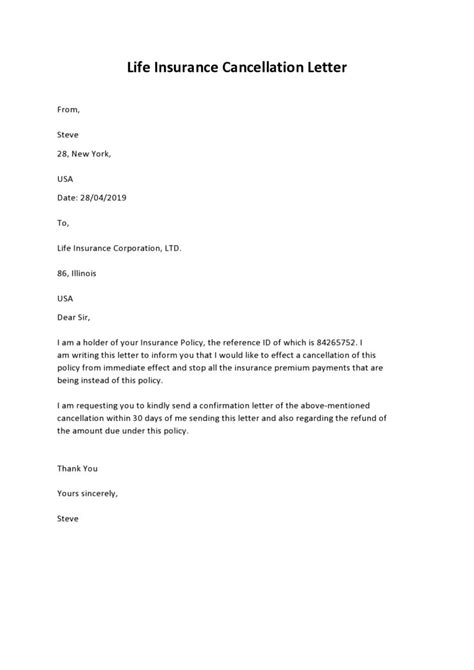

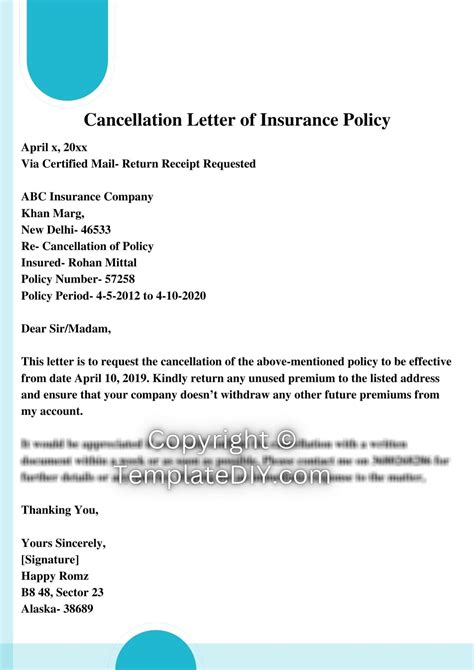

Reach out to your insurance company via phone, email, or online chat to initiate the cancellation process. Provide clear and concise instructions on your intention to cancel the policy. Be prepared to answer any questions the provider may have regarding the cancellation.

4. Provide Required Information

During the cancellation process, your insurance provider may request specific information or documentation. This could include proof of new insurance coverage, a request for a refund of any unused premium, or details about the reason for cancellation. Ensure you have all the necessary information readily available.

5. Request a Cancellation Confirmation

Once you've communicated your intention to cancel and provided any required information, request a confirmation of the cancellation from your insurance provider. This confirmation should outline the effective date of the cancellation, any refunds or credits due, and any outstanding obligations you may have.

6. Review Your Cancellation Confirmation

Carefully review the cancellation confirmation to ensure all the details are accurate and in line with your expectations. This step is crucial to avoiding any potential misunderstandings or surprises down the line.

7. Obtain a Copy of Your Policy's Cancellation Notice

Request a copy of the official cancellation notice from your insurance provider. This document serves as proof of the termination of your policy and can be useful if any future issues arise related to the cancellation.

Potential Consequences and Considerations

Canceling an insurance policy can have both immediate and long-term implications. Understanding these consequences is vital to making an informed decision.

1. Financial Impact

The most immediate consequence of canceling an insurance policy is the financial aspect. You may be eligible for a refund of any unused premium, but this depends on the terms of your policy and the timing of the cancellation. Additionally, canceling a policy can impact your future insurance costs, as some providers may consider you a higher risk due to a history of policy cancellations.

2. Coverage Gaps

Canceling an insurance policy can leave you without coverage during a critical period. This is particularly relevant for health and auto insurance, where gaps in coverage can result in significant financial liabilities. It's crucial to ensure you have alternative coverage in place before canceling your existing policy.

3. Legal and Regulatory Considerations

Depending on the type of insurance and your jurisdiction, there may be legal or regulatory requirements associated with policy cancellation. For instance, canceling certain types of insurance may require notification to relevant authorities or adherence to specific cancellation procedures outlined by law.

Alternatives to Policy Cancellation

Before canceling your insurance policy, it's worth exploring alternatives that may address your concerns without the potential drawbacks of cancellation.

1. Policy Adjustments

If your primary motivation for cancellation is financial, consider adjusting your policy to reduce premiums. This could involve increasing your deductible, opting for a higher excess, or removing certain coverage options that you may not require. Policy adjustments can provide cost savings without the need to cancel your coverage entirely.

2. Provider Negotiation

If you're dissatisfied with your current provider, it's worth attempting to negotiate a better deal before canceling. Contact your insurance company and express your concerns. They may be willing to offer a discounted rate, improved coverage, or other incentives to retain your business.

3. Shopping Around for Better Rates

If you're convinced that your current policy is not meeting your needs or is too expensive, shopping around for alternative providers is a viable option. Compare policies, coverage, and premiums from multiple insurers to find a more suitable and cost-effective solution. Online comparison tools can streamline this process.

Frequently Asked Questions

Can I cancel my insurance policy at any time?

+Insurance policies often have specific cancellation rules and dates. While some policies may allow cancellation at any time, others may have penalties or require you to wait until the policy's renewal period. It's essential to review your policy terms or contact your insurance provider to understand the cancellation process.

Will I get a refund if I cancel my insurance policy?

+Whether you receive a refund upon canceling your insurance policy depends on the terms of your policy and the timing of the cancellation. Some policies may provide a pro-rated refund for the remaining term, while others may not offer any refund. It's crucial to review your policy or consult with your insurance provider to understand the refund process.

What happens if I cancel my insurance policy due to a life event, such as moving or getting married?

+Canceling your insurance policy due to a life event may impact your future insurance needs and costs. It's essential to assess your new circumstances and ensure you have appropriate coverage in place. Some providers may offer special considerations for life event-related cancellations, so it's worth discussing your situation with your insurance company.

Are there any legal or regulatory requirements I should be aware of when canceling my insurance policy?

+Depending on the type of insurance and your jurisdiction, there may be legal or regulatory requirements associated with policy cancellation. It's crucial to understand these requirements to ensure you're complying with the law. Consulting with a legal professional or your insurance provider can provide clarity on any specific regulations you need to follow.

What are some alternatives to canceling my insurance policy if I'm dissatisfied with my current provider?

+If you're dissatisfied with your current insurance provider, there are alternatives to cancellation. You can explore policy adjustments, such as increasing your deductible or removing certain coverage options, to reduce premiums. Additionally, negotiating with your provider or shopping around for better rates from other insurers can be effective strategies to improve your insurance situation without canceling your policy.