Cheapest Car Insurance Ca

When it comes to finding the cheapest car insurance in California, there are several factors to consider. The cost of car insurance can vary significantly depending on various aspects, including your location, driving record, the make and model of your vehicle, and the coverage you choose. In this comprehensive guide, we will explore the factors influencing insurance rates, provide tips to help you secure the most affordable coverage, and introduce you to some of the top providers offering competitive rates in the Golden State.

Understanding the Factors that Impact Car Insurance Rates in California

The cost of car insurance in California is influenced by a range of factors. Here are some key considerations:

Location Matters

The area where you live and drive plays a significant role in determining your insurance rates. California is a vast state with varying insurance landscapes. Urban areas like Los Angeles and San Francisco tend to have higher insurance costs due to factors such as dense traffic, higher accident rates, and the prevalence of car theft. On the other hand, rural areas often offer more affordable insurance options as they typically experience fewer accidents and have lower theft rates.

Your Driving Record

Your driving history is a crucial factor in calculating insurance premiums. A clean driving record with no accidents or violations will generally result in lower insurance rates. Conversely, if you have a history of accidents, traffic violations, or DUI convictions, your insurance premiums are likely to be higher.

Insurance companies view drivers with a poor driving record as higher risk, so they charge more to compensate for the increased likelihood of claims. It's important to maintain a safe driving record to keep your insurance costs down.

Vehicle Type and Usage

The make, model, and year of your vehicle can impact your insurance rates. Sports cars, luxury vehicles, and SUVs often have higher insurance premiums due to their higher repair costs and potential for accidents. On the other hand, sedans and compact cars are generally more affordable to insure.

Additionally, the purpose for which you use your vehicle matters. If you primarily use your car for commuting to work, your insurance rates may be different from someone who uses their vehicle for business or rideshare services. Insurance companies assess the risk associated with different vehicle usage patterns and adjust premiums accordingly.

Coverage and Deductibles

The level of coverage you choose also affects your insurance costs. California requires drivers to carry a minimum amount of liability insurance, but you can opt for additional coverage types such as collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Each coverage type comes with its own premium, so selecting the right coverage for your needs is essential.

Moreover, your deductible choice can impact your insurance costs. A higher deductible typically results in lower premiums, as you're agreeing to pay more out of pocket before your insurance coverage kicks in. On the other hand, a lower deductible means you pay less upfront but may result in higher premiums.

Tips for Securing the Cheapest Car Insurance in California

Now that we understand the factors influencing car insurance rates, let's explore some strategies to help you find the cheapest insurance coverage in California:

Compare Multiple Providers

One of the most effective ways to find cheap car insurance is by comparing quotes from multiple providers. Insurance rates can vary significantly between companies, so getting quotes from at least three to five different insurers is recommended. Online comparison tools and insurance brokers can make this process easier and more efficient.

Bundle Policies

If you have multiple insurance needs, such as car, home, or renters insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you bundle multiple policies, which can result in significant savings on your overall insurance costs.

Maintain a Clean Driving Record

As mentioned earlier, your driving record is a crucial factor in determining your insurance rates. Strive to maintain a clean driving record by practicing safe driving habits and avoiding accidents and traffic violations. A clean record can lead to lower insurance premiums over time.

Choose the Right Coverage

Assess your insurance needs carefully and choose the coverage that suits your requirements. While it's essential to have adequate liability insurance to meet California's legal requirements, you may not need extensive additional coverage if you have an older vehicle or a low-risk driving profile. By selecting the right coverage, you can avoid paying for unnecessary insurance features and keep your costs down.

Increase Your Deductible

Opting for a higher deductible can lower your insurance premiums. However, it's important to ensure that you can afford the higher out-of-pocket expense in the event of a claim. Carefully consider your financial situation and choose a deductible that strikes the right balance between affordability and potential savings.

Explore Discounts

Insurance companies offer various discounts to policyholders. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing defensive driving courses. Additionally, some insurers provide discounts for vehicles equipped with safety features or anti-theft devices. Ask your insurance provider about the discounts they offer and see if you're eligible for any savings.

Top Car Insurance Providers for Affordable Coverage in California

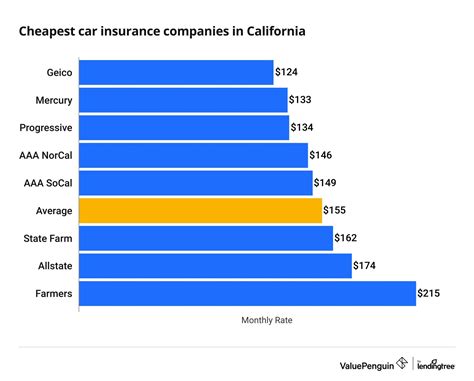

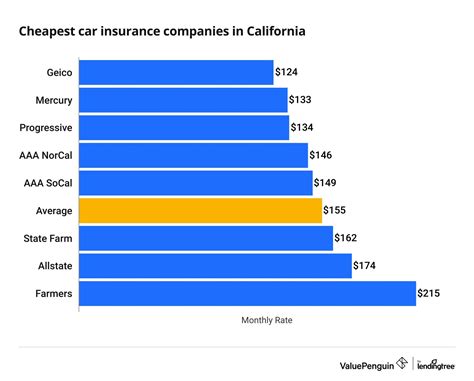

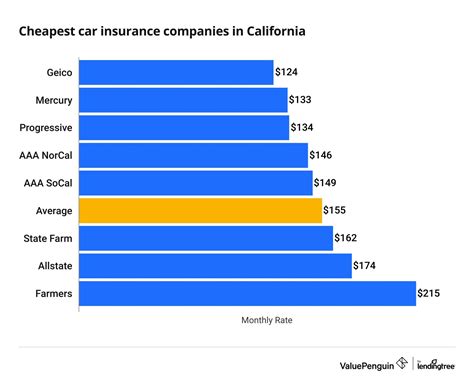

Now, let's take a look at some of the top car insurance providers in California that are known for offering competitive rates:

Geico

Geico is one of the largest insurance providers in the United States and is renowned for its affordable car insurance rates. They offer a wide range of coverage options and provide online quotes, making it convenient to compare rates and secure coverage. Geico's customer service is highly rated, and they offer discounts for good drivers, military members, and federal employees.

Progressive

Progressive is another well-known insurance company that often provides competitive rates. They offer a wide array of coverage options and innovative features like usage-based insurance, which allows drivers to save by demonstrating safe driving habits. Progressive's Snapshot program uses a small device to monitor driving behavior and provides discounts based on safe driving practices.

Esurance

Esurance, a subsidiary of Allstate, is known for its affordable car insurance rates and convenient online services. They offer a range of coverage options and provide tools to help customers find the right coverage for their needs. Esurance's online platform makes it easy to get quotes, manage policies, and file claims, making it a popular choice for tech-savvy drivers.

State Farm

State Farm is one of the largest insurance providers in the United States and is known for its extensive network of local agents. They offer a comprehensive range of insurance products, including car insurance, and are often able to provide competitive rates, especially for customers with a long-standing relationship with the company.

Mercury Insurance

Mercury Insurance is a leading car insurance provider in California, offering a wide range of coverage options and competitive rates. They specialize in providing insurance for high-risk drivers, making them a great option for those who have had accidents or violations in the past. Mercury Insurance also offers discounts for safe drivers and provides comprehensive coverage for a variety of vehicle types.

Performance Analysis and Customer Satisfaction

When choosing an insurance provider, it's important to consider not only the cost but also the quality of service and customer satisfaction. Here's a brief analysis of the performance and customer satisfaction of the mentioned insurance providers:

| Provider | Customer Satisfaction Rating | J.D. Power Rating |

|---|---|---|

| Geico | 4.4/5 (very good) | 836/1000 (among the best) |

| Progressive | 4.2/5 (good) | 834/1000 (among the best) |

| Esurance | 3.9/5 (good) | 828/1000 (among the best) |

| State Farm | 4.3/5 (very good) | 834/1000 (among the best) |

| Mercury Insurance | 4.1/5 (good) | 826/1000 (among the best) |

These ratings provide a general indication of customer satisfaction and the overall performance of the insurance providers. However, it's important to note that individual experiences may vary, and it's always advisable to read reviews and gather personal recommendations to make an informed decision.

Frequently Asked Questions

What is the average cost of car insurance in California?

+The average cost of car insurance in California can vary depending on various factors such as location, driving record, and coverage. According to recent data, the average annual premium in California is around $1,800. However, this is just an average, and your specific rate may be higher or lower based on your individual circumstances.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any government programs or discounts available to lower car insurance costs in California?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, California has a few programs and discounts that can help lower car insurance costs. One notable program is the California Low Cost Auto Insurance Program (CLCA), which provides low-income drivers with basic liability coverage at a reduced rate. Additionally, some insurance companies offer discounts for certain occupations, good student grades, or participation in safe driving programs.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I get car insurance with a suspended license in California?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Obtaining car insurance with a suspended license in California can be challenging. Most insurance providers require a valid driver's license to offer coverage. However, there are a few specialized insurers that cater to high-risk drivers, including those with suspended licenses. These insurers typically charge higher premiums due to the increased risk.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How often should I shop around for car insurance quotes in California to get the best rates?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It's a good practice to shop around for car insurance quotes at least once a year, if not more frequently. Insurance rates can change over time, and by comparing quotes regularly, you can ensure you're getting the most competitive rates available. Additionally, life changes such as moving to a new area, purchasing a new vehicle, or getting married can impact your insurance rates, so it's important to stay up-to-date with your coverage.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What are some common mistakes to avoid when searching for cheap car insurance in California?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>When searching for cheap car insurance, it's important to avoid common mistakes such as choosing a provider solely based on price without considering their reputation and customer service. Additionally, make sure you understand the coverage limits and exclusions in your policy to ensure you're adequately protected. Lastly, be cautious of providers that offer extremely low rates without providing sufficient information about their coverage or financial stability.</p>

</div>

</div>

</div>