Collectors Car Insurance

Unveiling the World of Collectors Car Insurance: Protecting Your Classic Ride

In the realm of automotive enthusiasts, collectors car insurance stands as a vital yet often overlooked aspect. This specialized insurance category caters to the unique needs of classic car owners, offering a tailored approach to protect these beloved machines. With a deep understanding of the market and a passion for vintage vehicles, we delve into the intricacies of collectors car insurance, shedding light on its significance and the benefits it brings.

Collectors cars, with their timeless elegance and rich history, demand a level of protection that goes beyond the standard automobile insurance policies. As these vehicles are more than just modes of transportation, they are cherished artifacts, and their owners seek insurance solutions that reflect this unique value. Let's embark on a journey to explore the world of collectors car insurance, understanding its nuances and the expert advice that can safeguard these automotive treasures.

The Art of Collectors Car Insurance: Understanding the Essentials

Collectors car insurance is a specialized form of automotive insurance designed specifically for vintage, classic, and antique vehicles. Unlike regular car insurance policies, this niche coverage recognizes the unique characteristics and value of these historic automobiles, providing tailored protection to suit their distinct needs.

Defining Collectors Cars

The term "collectors car" encompasses a diverse range of vehicles, each with its own distinctive appeal. Generally, a collectors car is defined as an automobile that is at least 25 years old, rare, or possesses historical significance. These vehicles are often prized for their classic design, mechanical excellence, or their role in automotive history. From vintage muscle cars to rare European roadsters, each collectors car tells a story, and understanding this narrative is key to insuring them appropriately.

Coverage Options for Collectors Cars

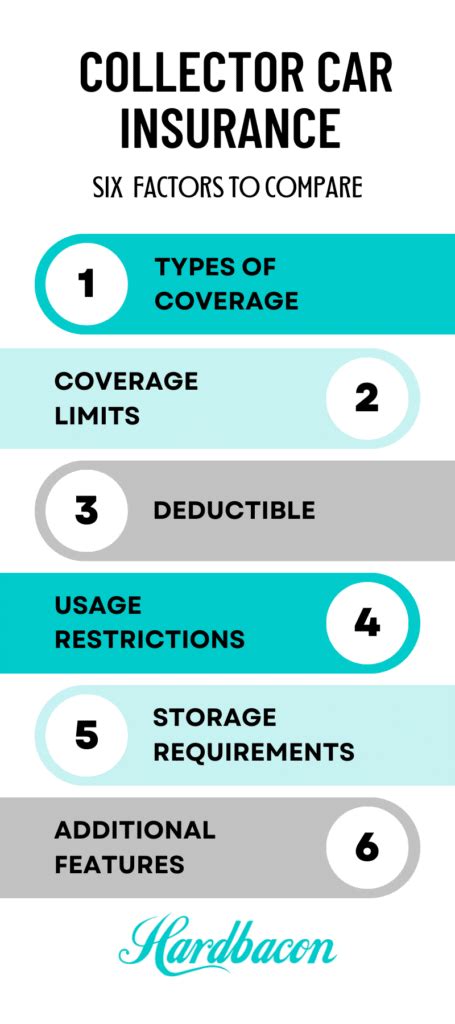

Collectors car insurance offers a comprehensive suite of coverage options, designed to provide the highest level of protection for these valuable assets. Here's an overview of the key coverage types:

- Agreed Value Coverage: This policy type allows owners and insurance providers to agree upon the value of the vehicle upfront. This agreed value, determined by factors such as the car's make, model, condition, and rarity, remains the payout amount in the event of a total loss, regardless of the vehicle's actual market value at the time of the incident. This approach ensures that collectors receive fair compensation for their prized possessions.

- Stated Value Coverage: Similar to agreed value, stated value coverage involves determining the vehicle's value with the insurer. However, the difference lies in the flexibility it offers. Owners can choose to review and update the stated value periodically, ensuring that the coverage remains aligned with the car's current market value.

- Replacement Value Coverage: In this policy, the insurance company guarantees to replace the collectors car with a similar make and model in the event of a total loss. This option is particularly appealing to owners who wish to maintain their vehicle's originality and ensure they can replace it with an identical or comparable vehicle.

- Actual Cash Value Coverage: This coverage type considers the car's current market value, including depreciation, to determine the payout amount in the event of a total loss. While it may not fully cover the replacement cost of a classic car, it provides a more affordable insurance option for collectors on a budget.

Tailored Coverage Benefits

Collectors car insurance policies offer a host of additional benefits tailored to the specific needs of classic car owners. These can include:

- Low Mileage Discounts: Recognizing that collectors cars are often driven sparingly, many insurers offer discounts for low mileage. This incentive encourages responsible driving and helps collectors keep their insurance costs down.

- Agreed Value on Parts and Accessories: In addition to the vehicle's value, insurers can also provide agreed value coverage for specific parts and accessories. This ensures that if a rare or expensive part is damaged or stolen, the owner receives full compensation for its replacement.

- Storage Coverage: Collectors car insurance policies often include coverage for the vehicle during storage. This can be especially beneficial for collectors who store their cars during off-seasons or for long periods, ensuring their investment remains protected.

- Event Coverage: Many collectors car owners participate in car shows, rallies, and other automotive events. Event coverage provides protection for the vehicle while it is being displayed or driven during these events, offering peace of mind for enthusiasts who share their passion with the public.

Expert Insights: Navigating the Collectors Car Insurance Landscape

Navigating the world of collectors car insurance requires expertise and a deep understanding of the unique needs of classic car owners. Here, we delve into some expert insights and strategies to help collectors make informed decisions when it comes to insuring their prized possessions.

Choosing the Right Coverage

Selecting the appropriate coverage type is a critical decision for collectors car owners. While agreed value coverage is often recommended for its fairness and comprehensive protection, other coverage types may be more suitable depending on the vehicle's value, the owner's budget, and their specific needs. For instance, replacement value coverage can be ideal for owners who wish to maintain their car's originality, while actual cash value coverage may be more affordable for collectors on a tighter budget.

It's essential to carefully evaluate the vehicle's value, the potential risks it faces, and the owner's financial situation to determine the most suitable coverage. Working with an experienced insurance broker who specializes in collectors car insurance can provide invaluable guidance in this process.

The Importance of Documentation

Proper documentation is crucial when it comes to collectors car insurance. Maintaining a detailed record of the vehicle's history, including ownership transfers, maintenance, and any modifications, can significantly impact the insurance process. This documentation not only aids in determining the vehicle's value but also helps establish its authenticity, which is vital for obtaining accurate coverage.

Additionally, having comprehensive records can streamline the claims process in the event of an accident or loss. It's advisable for collectors to maintain a well-organized file containing all relevant documents, including purchase receipts, maintenance records, appraisal reports, and photographs, to ensure a smooth and efficient claims experience.

Understanding Deductibles and Premiums

Collectors car insurance, like any other insurance, involves deductibles and premiums. Deductibles are the portion of a claim that the policyholder must pay out of pocket, while premiums are the regular payments made to maintain the insurance coverage. It's essential for collectors to understand these financial aspects to ensure they can afford their chosen coverage.

While higher deductibles can result in lower premiums, they also mean collectors must pay more out of pocket in the event of a claim. Conversely, lower deductibles mean collectors pay less upfront but may face higher premiums. It's a delicate balance that collectors must navigate based on their financial situation and risk tolerance. Consulting with an insurance professional can help collectors make informed decisions about their deductibles and premiums.

Regular Appraisals and Value Updates

The value of a collectors car can fluctuate over time due to various factors, including market trends, vehicle condition, and historical significance. To ensure that insurance coverage remains aligned with the vehicle's current value, collectors should consider regular appraisals and value updates. This practice not only ensures that the agreed or stated value of the vehicle is accurate but also helps collectors avoid underinsurance, which can lead to financial losses in the event of a claim.

The Future of Collectors Car Insurance: Trends and Innovations

The world of collectors car insurance is continually evolving, driven by technological advancements and changing market dynamics. As the classic car market expands and collectors' needs become more diverse, insurers are adapting their offerings to stay relevant and provide the best possible protection.

Digital Transformation

The digital age has brought about significant changes in the insurance industry, and collectors car insurance is no exception. Many insurers are leveraging technology to enhance the customer experience, streamline processes, and provide more efficient and personalized services. From online policy management and digital claims processing to the use of telematics for usage-based insurance, technology is transforming the way collectors interact with their insurance providers.

Expanding Coverage Options

In response to the growing diversity of the classic car market, insurers are expanding their coverage options to cater to a wider range of collectors. This includes offering specialized coverage for unique vehicles, such as vintage motorcycles, classic trucks, and even antique tractors. Additionally, insurers are recognizing the value of collectors' car collections as a whole, providing coverage for multiple vehicles under a single policy, making it more convenient and cost-effective for collectors with extensive fleets.

Enhanced Risk Management

Collectors car insurance providers are also investing in advanced risk management strategies to better protect their policyholders. This includes utilizing data analytics to identify potential risks and trends in the classic car market, as well as offering loss prevention services and resources to help collectors maintain the safety and security of their vehicles. By staying ahead of potential risks, insurers can provide more comprehensive coverage and support to collectors.

Sustainability and Environmental Considerations

With growing environmental awareness, the classic car market is also seeing a shift towards sustainability. Many collectors are embracing electric and hybrid classic cars, and insurers are adapting their coverage to accommodate these emerging trends. From offering specialized coverage for electric vintage vehicles to providing incentives for eco-friendly practices, insurers are recognizing the importance of sustainability in the collectors car market.

FAQs

How much does collectors car insurance typically cost?

+The cost of collectors car insurance can vary widely depending on factors such as the vehicle’s make, model, year, condition, and agreed value. Additionally, the owner’s location, driving record, and coverage choices can also impact the premium. On average, collectors car insurance premiums range from a few hundred to several thousand dollars annually.

What is the process for getting a collectors car insured?

+To insure a collectors car, owners typically need to provide detailed information about the vehicle, including its make, model, year, and condition. They may also need to submit documentation, such as ownership papers, maintenance records, and appraisal reports. Once the insurer reviews this information, they will provide a quote and, if accepted, issue a policy.

Can I insure my collectors car if I only drive it occasionally?

+Absolutely! Many collectors car insurance policies are designed specifically for vehicles that are driven sparingly. These policies often offer low mileage discounts, recognizing that collectors cars are often used for pleasure drives or special events rather than daily commutes. It’s essential to inform the insurer about the vehicle’s intended usage to ensure proper coverage.

What happens if my collectors car is damaged or stolen?

+In the event of damage or theft, collectors should contact their insurance provider immediately to report the incident. The insurer will guide the collector through the claims process, which typically involves providing detailed information about the incident, including photographs and any relevant documentation. The insurer will then assess the claim and provide compensation based on the agreed or stated value of the vehicle.

Can I insure my classic car if it’s a restoration project?

+Yes, many insurers offer coverage for classic cars that are undergoing restoration. However, the coverage may be limited to certain aspects of the restoration process, and the premium may be higher due to the increased risk. It’s essential to discuss the specifics of the restoration project with the insurer to ensure proper coverage and avoid any potential gaps.