First Acceptance Insurance

Welcome to a comprehensive exploration of First Acceptance Insurance, a prominent player in the world of automotive insurance. With a rich history spanning decades, First Acceptance has established itself as a trusted provider, offering specialized coverage tailored to unique driving needs. This article delves into the intricacies of their services, providing an in-depth analysis for those seeking expert insights into the realm of auto insurance.

A Legacy of Trust: First Acceptance’s Journey

First Acceptance Insurance, headquartered in Memphis, Tennessee, boasts an impressive legacy that traces back to its founding in 1984. Over the years, the company has grown from a local insurer to a nationally recognized brand, known for its commitment to providing accessible and comprehensive auto insurance solutions.

The journey of First Acceptance is a testament to the power of specialization. The company initially focused on providing insurance for high-risk drivers, a segment often overlooked by traditional insurers. This unique approach allowed First Acceptance to fill a gap in the market, offering coverage to drivers who faced challenges in securing affordable and reliable insurance. Through this specialization, the company has built a strong reputation for expertise and reliability.

First Acceptance's growth strategy has been characterized by a blend of organic expansion and strategic acquisitions. The company has continuously expanded its geographic reach, ensuring that its services are accessible to a wider audience. Additionally, they have acquired smaller insurers, further strengthening their market presence and product offerings. These strategic moves have positioned First Acceptance as a leading provider in the non-standard auto insurance market.

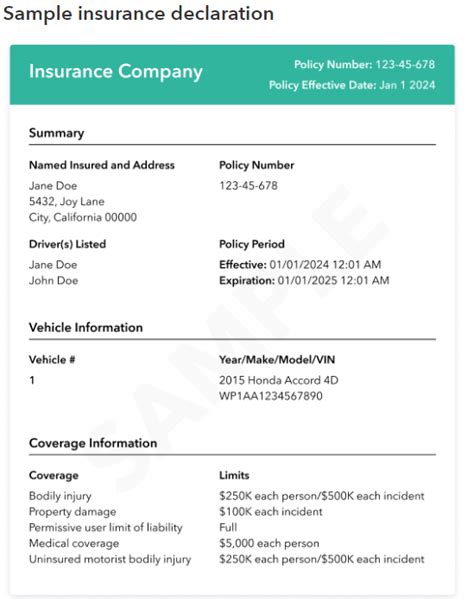

A key aspect of First Acceptance's success lies in its understanding of the unique needs of its customer base. The company offers a range of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) insurance. This comprehensive approach ensures that drivers can tailor their insurance plans to their specific requirements, whether it's comprehensive coverage for a luxury vehicle or liability-only insurance for a classic car.

Products and Services: A Comprehensive Overview

First Acceptance Insurance’s product portfolio is designed to cater to a diverse range of automotive needs. Here’s an in-depth look at their key offerings:

Liability Insurance

Liability insurance is a cornerstone of First Acceptance’s product suite. This coverage protects policyholders from financial losses arising from accidents where they are found at fault. It includes bodily injury liability, which covers medical expenses and lost wages for injured parties, and property damage liability, which covers repairs or replacement costs for damaged property.

First Acceptance offers flexible liability limits, allowing policyholders to choose coverage that aligns with their budget and specific requirements. This ensures that drivers can obtain the necessary protection without paying for unnecessary coverage.

Collision and Comprehensive Insurance

First Acceptance provides comprehensive collision coverage, which protects policyholders against damages to their vehicles resulting from accidents, regardless of fault. This coverage is particularly beneficial for drivers who lease or finance their vehicles, as it ensures that repair or replacement costs are covered in the event of an accident.

Additionally, First Acceptance offers comprehensive insurance, which provides protection against non-accident-related damages. This includes coverage for theft, vandalism, natural disasters, and other unforeseen events that could result in vehicle damage. With comprehensive insurance, policyholders can have peace of mind knowing that their vehicles are protected against a wide range of potential risks.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a critical component of First Acceptance’s insurance offerings. This coverage provides financial support for policyholders and their passengers who are injured in an accident, regardless of fault. PIP covers medical expenses, lost wages, and other related costs, ensuring that policyholders receive the necessary care and compensation after an accident.

First Acceptance's PIP coverage is customizable, allowing policyholders to choose the level of coverage that best suits their needs and budget. This flexibility ensures that drivers can obtain the necessary protection without incurring unnecessary costs.

Uninsured/Underinsured Motorist Coverage

First Acceptance recognizes the importance of protecting policyholders against the risks posed by uninsured or underinsured motorists. Their insurance plans include coverage for accidents where the at-fault driver is either uninsured or does not carry sufficient insurance to cover the damages caused. This ensures that policyholders are not left financially burdened in the event of an accident with an uninsured or underinsured driver.

The company's uninsured/underinsured motorist coverage includes both bodily injury and property damage protection. This comprehensive approach ensures that policyholders receive the necessary compensation for medical expenses, lost wages, and vehicle repair or replacement costs, even when the at-fault driver lacks adequate insurance coverage.

Policy Benefits and Value-Added Services

First Acceptance Insurance goes beyond traditional insurance coverage, offering a range of benefits and value-added services that enhance the overall customer experience. Here’s a closer look at some of these additional features:

Accident Forgiveness

First Acceptance understands that accidents can happen to anyone, even the most cautious drivers. That’s why they offer accident forgiveness, a policy benefit that waives rate increases for policyholders involved in their first at-fault accident. This feature provides peace of mind, knowing that a single mistake won’t result in higher insurance premiums.

Roadside Assistance

In the event of a vehicle breakdown, First Acceptance’s roadside assistance program provides policyholders with reliable support. This service includes towing, battery jump-starts, fuel delivery, and other emergency roadside services. With this coverage, policyholders can rest assured that help is just a phone call away, no matter where they are.

Rental Car Coverage

First Acceptance recognizes the inconvenience of being without a vehicle after an accident. To address this, they offer rental car coverage, which provides policyholders with a rental vehicle while their own car is being repaired or replaced. This coverage ensures that policyholders can maintain their daily routines and commute without disruption.

Customized Payment Plans

First Acceptance understands that insurance premiums can be a significant expense for many individuals. That’s why they offer flexible payment plans, allowing policyholders to choose the payment schedule that best suits their financial situation. Whether it’s monthly, quarterly, or semi-annual payments, First Acceptance works with policyholders to ensure that insurance coverage is affordable and accessible.

Customer Experience and Satisfaction

At First Acceptance Insurance, customer satisfaction is a top priority. The company is dedicated to providing an exceptional experience, from the initial policy purchase to ongoing support and claims management. Here’s a glimpse into the customer journey with First Acceptance:

Policy Purchase and Support

First Acceptance offers a seamless policy purchase process, with multiple channels for convenience. Policyholders can purchase insurance online, over the phone, or in-person at one of their many locations. The company’s customer service representatives are highly trained and provide personalized support, ensuring that policyholders understand their coverage and have all their questions answered.

Claims Management

In the event of an accident or incident, First Acceptance’s claims management process is designed to be efficient and supportive. Policyholders can report claims online, over the phone, or via the company’s mobile app. The claims team works diligently to process claims promptly, ensuring that policyholders receive the compensation they are entitled to in a timely manner.

First Acceptance also offers a dedicated claims hotline, providing 24/7 support for policyholders. This ensures that policyholders can receive immediate assistance, no matter the time or day, further enhancing the overall customer experience.

Customer Feedback and Satisfaction

First Acceptance actively seeks customer feedback to continuously improve its services. The company utilizes various channels, including online reviews, customer surveys, and social media platforms, to gather insights and feedback from policyholders. This commitment to customer feedback has resulted in numerous positive reviews and high customer satisfaction ratings.

First Acceptance's focus on customer satisfaction is evident in its approach to claims handling. The company aims to make the claims process as smooth and stress-free as possible, ensuring that policyholders receive the support they need during what can be a challenging time.

Industry Recognition and Awards

First Acceptance Insurance’s commitment to excellence has not gone unnoticed by industry experts and consumers alike. The company has received numerous accolades and awards, solidifying its position as a leader in the automotive insurance space.

Among its accolades, First Acceptance has been recognized for its innovative use of technology in the insurance industry. The company has embraced digital transformation, leveraging technology to enhance the customer experience and streamline its operations. This commitment to innovation has resulted in several industry awards, including the Best Use of Technology award from the National Association of Insurance Commissioners (NAIC) in 2021.

Additionally, First Acceptance has been praised for its commitment to customer service. The company has consistently ranked highly in customer satisfaction surveys, with policyholders praising the responsiveness and expertise of its customer service team. This recognition underscores First Acceptance's dedication to providing an exceptional customer experience, from the initial policy purchase to ongoing support.

Future Outlook and Innovations

As the automotive insurance landscape continues to evolve, First Acceptance Insurance remains at the forefront of innovation. The company is committed to staying ahead of the curve, leveraging technology and data analytics to enhance its products and services.

First Acceptance is exploring new technologies, such as artificial intelligence (AI) and machine learning, to further streamline its operations and improve the customer experience. These technologies are being utilized to enhance claims processing, risk assessment, and customer support, ensuring that policyholders receive the most efficient and effective service possible.

Furthermore, First Acceptance is investing in data analytics to gain deeper insights into its customer base and market trends. This data-driven approach allows the company to make informed decisions, develop targeted products, and provide personalized insurance solutions that meet the unique needs of its policyholders.

Looking ahead, First Acceptance is poised to continue its growth trajectory, expanding its market presence and product offerings. The company remains committed to its core values of specialization, customer service, and innovation, ensuring that it remains a trusted provider of automotive insurance for years to come.

What sets First Acceptance Insurance apart from other providers?

+First Acceptance Insurance stands out for its specialization in providing insurance for high-risk drivers, a segment often overlooked by traditional insurers. This unique focus allows them to offer tailored coverage options and competitive rates for drivers who may face challenges in securing insurance elsewhere.

How can I purchase a policy with First Acceptance Insurance?

+You can purchase a policy with First Acceptance Insurance through their website, over the phone, or in-person at one of their many locations. Their customer service representatives are available to guide you through the process and answer any questions you may have.

What additional benefits does First Acceptance Insurance offer?

+In addition to their comprehensive insurance coverage, First Acceptance Insurance offers a range of value-added services, including accident forgiveness, roadside assistance, rental car coverage, and customized payment plans. These benefits enhance the overall customer experience and provide added peace of mind.

How does First Acceptance Insurance handle claims?

+First Acceptance Insurance has a dedicated claims management team that works diligently to process claims promptly and efficiently. Policyholders can report claims online, over the phone, or via the company’s mobile app. The claims team provides 24⁄7 support, ensuring that policyholders receive the assistance they need, when they need it.

What is the customer satisfaction level with First Acceptance Insurance?

+First Acceptance Insurance boasts high customer satisfaction ratings, with numerous positive reviews praising their responsive customer service, competitive rates, and comprehensive coverage options. The company’s commitment to customer satisfaction is evident in its approach to policy purchase, claims management, and ongoing support.