Insurance Policies For Businesses

In today's complex business landscape, effective risk management is paramount for long-term success and sustainability. This is where insurance policies play a crucial role, offering protection and peace of mind to businesses across various industries. From start-ups to established corporations, having the right insurance coverage can make a significant difference in navigating potential pitfalls and ensuring business continuity.

Understanding the Importance of Business Insurance

Business insurance is a vital component of any comprehensive risk management strategy. It provides a safety net against financial losses arising from a wide range of unforeseen events, including natural disasters, lawsuits, property damage, and employee-related incidents. By investing in appropriate insurance policies, businesses can protect their assets, reputation, and ability to operate.

The importance of business insurance cannot be overstated, especially in an era where the business environment is marked by increasing volatility and uncertainty. It is a proactive measure that demonstrates a commitment to the long-term viability and stability of the enterprise. With the right insurance coverage, businesses can focus on their core operations, innovation, and growth strategies, knowing they are well-prepared to handle unexpected challenges.

Key Considerations for Selecting Business Insurance Policies

Choosing the right insurance policies for your business involves a careful evaluation of several critical factors. Firstly, it is essential to understand the unique risks and exposures specific to your industry and business operations. This knowledge forms the foundation for designing an insurance portfolio that provides adequate protection.

Identifying Business-Specific Risks

Every business faces its own set of risks. For instance, a manufacturing company might prioritize coverage for property damage and product liability, while a technology start-up might focus on cyber liability and intellectual property protection. By conducting a thorough risk assessment, businesses can identify the potential hazards they are most likely to encounter and ensure their insurance policies address these specific concerns.

Comprehensive Coverage vs. Cost-Effectiveness

While it is crucial to have comprehensive insurance coverage, businesses must also consider the financial implications. Striking a balance between adequate protection and affordability is key. This often involves a detailed analysis of the business’s operations, potential liabilities, and the likelihood of various risks materializing. By working with insurance professionals, businesses can customize their insurance portfolios to meet their unique needs without overspending.

The Role of Insurance Brokers and Advisors

Engaging the expertise of insurance brokers and advisors can be invaluable in navigating the complex world of business insurance. These professionals can provide specialized knowledge and guidance, helping businesses understand the intricacies of different insurance products and policies. They can also negotiate with insurers to secure the best terms and conditions, ensuring the business is adequately protected at a competitive cost.

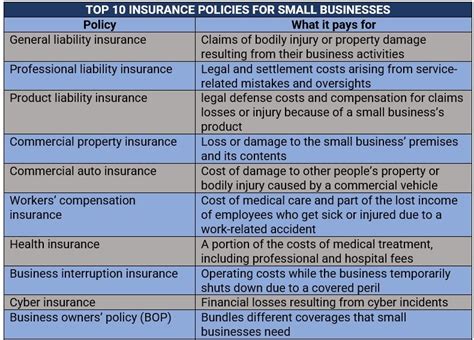

Common Types of Business Insurance Policies

The insurance landscape for businesses is diverse, offering a range of policies tailored to different needs. Here are some of the most common types of business insurance, each designed to address specific risks and challenges:

Commercial Property Insurance

This type of insurance provides protection for a business’s physical assets, including buildings, inventory, and equipment. It covers losses resulting from events such as fires, storms, vandalism, and theft. Commercial property insurance is particularly critical for businesses with significant physical assets, as it ensures they can recover and continue operations in the face of unforeseen disasters.

General Liability Insurance

General liability insurance is a broad policy that covers a range of common risks, including bodily injury, property damage, and personal and advertising injury claims. It is designed to protect businesses from lawsuits and other financial losses arising from their daily operations. For instance, if a customer slips and falls on your business premises, general liability insurance can cover the medical expenses and any legal costs associated with the incident.

Professional Liability Insurance (Errors & Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is essential for businesses providing professional services. It protects against claims of negligence, errors, or omissions in the services provided. This type of insurance is particularly important for industries like consulting, accounting, legal services, and healthcare, where the potential for professional mistakes and their financial impact can be significant.

Business Interruption Insurance

Business interruption insurance is a critical policy for businesses that rely heavily on uninterrupted operations. It provides coverage for lost income and ongoing expenses if the business is forced to shut down due to a covered event, such as a fire or natural disaster. This insurance ensures that the business can continue to pay its bills and meet financial obligations until normal operations can resume.

Workers’ Compensation Insurance

Workers’ compensation insurance is a legal requirement in most jurisdictions and provides coverage for employees who are injured or become ill due to their work. It covers medical expenses, a portion of lost wages, and can also provide disability benefits. By having workers’ compensation insurance, businesses can protect themselves from potential lawsuits and ensure their employees receive the necessary support in the event of a work-related injury or illness.

Cyber Liability Insurance

In today’s digital age, cyber liability insurance has become increasingly important. It provides protection against financial losses resulting from cyber incidents, such as data breaches, hacking, and identity theft. With the rising prevalence of cyber attacks, this type of insurance is crucial for businesses that handle sensitive data or have an online presence, as it helps cover the costs of investigating and mitigating the impact of a cyber incident, as well as any associated legal liabilities.

The Process of Obtaining Business Insurance

Securing the right business insurance involves a systematic approach that begins with a comprehensive understanding of your business’s unique needs and risks. Here’s a step-by-step guide to help you navigate the process:

Conduct a Risk Assessment

Start by conducting a thorough risk assessment of your business. Identify the potential hazards and risks that your business faces, including property damage, liability claims, data breaches, and employee-related incidents. This assessment should consider your industry, the nature of your operations, and any specific regulations or compliance requirements you must adhere to.

Assess Current Insurance Coverage

Evaluate your existing insurance policies to determine if they adequately cover the identified risks. Consider the limits, deductibles, and exclusions of each policy. If you have multiple policies, ensure there are no gaps in coverage or situations where one policy might conflict with another.

Seek Expert Advice

Consult with insurance professionals, such as brokers or advisors, who can provide expert guidance tailored to your business. They can help you understand the nuances of different insurance products and policies, ensuring you make informed decisions. Insurance professionals can also negotiate with insurers on your behalf to secure the best coverage at a competitive price.

Compare Quotes and Policy Details

Obtain quotes from multiple insurance providers and carefully review the policy details. Compare not only the cost but also the coverage limits, deductibles, and any additional benefits or perks offered. Look for policies that align with your identified risks and provide the most comprehensive protection without unnecessary or redundant coverage.

Choose the Right Insurance Provider

Select an insurance provider that has a solid reputation and a track record of handling claims efficiently and fairly. Consider factors such as financial stability, customer service ratings, and the ease of communication and claims processing. A reliable insurance provider can make a significant difference in how smoothly the claims process goes if and when you need to file a claim.

Review and Renew Policies Regularly

Business insurance policies should not be a one-time purchase. Regularly review and renew your policies to ensure they continue to meet your changing needs. As your business grows, expands, or adapts to new technologies and markets, your risk profile may change. Staying up-to-date with your insurance coverage ensures you have the protection you need at every stage of your business’s journey.

Case Studies: Real-World Examples of Business Insurance in Action

Understanding the impact of business insurance in real-world scenarios can provide valuable insights into its significance. Here are two case studies showcasing how different businesses utilized their insurance policies to navigate challenging situations:

Case Study 1: Manufacturing Plant Fire

A manufacturing plant specializing in electronics production experienced a devastating fire that destroyed a significant portion of its facility and equipment. The business had invested in comprehensive commercial property insurance, which covered the cost of rebuilding the damaged structure and replacing the lost equipment. Additionally, their business interruption insurance kicked in, providing the necessary funds to cover ongoing expenses and maintain employee salaries while the plant was being rebuilt. This allowed the business to quickly resume operations and minimize the long-term impact of the disaster.

Case Study 2: Data Breach at a Tech Start-Up

A tech start-up focused on developing innovative software solutions fell victim to a sophisticated cyber attack, resulting in a data breach that compromised sensitive customer information. The start-up had wisely invested in cyber liability insurance, which covered the costs of investigating the breach, notifying affected customers, and providing credit monitoring services as a goodwill gesture. The insurance policy also included legal liability coverage, which helped the start-up manage potential lawsuits from affected customers. This case demonstrates the critical role of cyber liability insurance in protecting businesses from the financial and reputational fallout of cyber incidents.

The Future of Business Insurance: Trends and Innovations

The world of business insurance is continually evolving to keep pace with emerging risks and technological advancements. Here are some key trends and innovations shaping the future of business insurance:

The Rise of Telematics and IoT

Telematics and the Internet of Things (IoT) are revolutionizing insurance by enabling more precise risk assessment and real-time monitoring. For instance, in the transportation industry, telematics devices can track driving behavior, allowing insurers to offer usage-based insurance policies. Similarly, IoT sensors can be used to monitor environmental conditions, equipment performance, and even employee safety, providing insurers with valuable data for risk assessment and claims management.

Artificial Intelligence and Machine Learning

AI and machine learning are being leveraged to enhance insurance processes, from underwriting and risk assessment to claims handling and fraud detection. These technologies enable insurers to process vast amounts of data quickly and accurately, leading to more efficient operations and improved risk management. Additionally, AI-powered chatbots and virtual assistants are transforming customer service, providing faster and more personalized support to policyholders.

Parametric Insurance and Blockchain Technology

Parametric insurance is an innovative approach that pays out based on predefined parameters, such as the severity of a natural disaster or the occurrence of a specific event. This type of insurance provides rapid payouts, often within days or even hours, making it particularly useful for businesses facing immediate financial needs after a covered event. Blockchain technology, with its secure and transparent nature, is being explored to enhance the efficiency and security of insurance transactions, including policy issuance, claims processing, and premium payments.

Personalized Insurance Products

The future of business insurance is moving towards more personalized and tailored coverage. Insurers are leveraging data analytics and customer insights to design insurance products that meet the unique needs of specific businesses or even individual policyholders. This shift towards customization allows businesses to have insurance coverage that aligns precisely with their risk profile, providing more efficient and cost-effective protection.

FAQ

What is the average cost of business insurance?

+The cost of business insurance can vary widely depending on factors such as the type of business, its size, location, and the specific coverage needed. On average, small businesses may pay anywhere from 500 to 1,000 per year for a basic liability policy, while larger businesses with more complex needs can expect to pay significantly more. It’s important to note that the cost is influenced by the risks associated with the business and the limits of coverage desired.

How do I choose the right insurance broker for my business?

+When selecting an insurance broker, consider their expertise in your industry, their reputation for integrity and professionalism, and their ability to offer tailored solutions for your specific business needs. Look for brokers who actively communicate and educate you about your insurance options and who have a track record of successful claims handling. It’s also beneficial to seek referrals from other businesses in your industry or to research online reviews.

What happens if I don’t have enough insurance coverage for a claim?

+If you don’t have sufficient insurance coverage for a claim, you may be financially responsible for the remaining amount. This can be particularly detrimental for businesses, potentially leading to significant financial strain or even bankruptcy. It’s crucial to regularly review and update your insurance policies to ensure they provide adequate coverage for the risks your business faces. Working with an experienced insurance broker can help you avoid this scenario by ensuring you have the right coverage limits and types of insurance.

Can I customize my business insurance policies to fit my specific needs?

+Yes, most business insurance policies can be customized to fit the unique needs of your business. This is where the expertise of an insurance broker or advisor comes into play. They can help you understand the various coverage options available and guide you in selecting the policies and limits that provide the best protection for your specific risks and operations. Customizing your insurance portfolio ensures you have the right coverage without paying for unnecessary extras.

How often should I review and update my business insurance policies?

+It’s recommended to review your business insurance policies annually or whenever there are significant changes to your business operations, such as expansion, relocation, or the addition of new products or services. Regular reviews ensure that your insurance coverage remains aligned with your evolving needs and that you’re not paying for coverage you no longer require. Additionally, staying up-to-date with changes in your industry and the broader business environment can help you anticipate new risks and ensure your insurance portfolio remains comprehensive.