All States Insurance Quote

Welcome to the ultimate guide on navigating the world of insurance quotes in the United States. Whether you're a homeowner, a driver, a business owner, or simply looking for peace of mind, understanding the insurance landscape is crucial. This comprehensive article will delve into the intricacies of obtaining insurance quotes across various states, providing you with the knowledge and tools to make informed decisions about your coverage.

Understanding the Insurance Quote Process

Insurance quotes serve as the foundation for your coverage journey. They provide an estimate of the cost and coverage options tailored to your specific needs. Each state in the US has its own regulations and guidelines when it comes to insurance, making it essential to explore the unique aspects of your state’s insurance market.

Factors Influencing Insurance Quotes

Numerous factors come into play when insurance providers calculate quotes. These include:

- Location: Your state and even your specific neighborhood can impact rates due to varying risk levels.

- Coverage Type: Whether it’s auto, home, health, or business insurance, each type has its own set of considerations.

- Personal Details: Age, gender, marital status, and credit history can influence quote calculations.

- Claims History: Past insurance claims can affect future rates and coverage options.

- Discounts and Promotions: Insurance companies often offer discounts for various reasons, such as loyalty, safety features, or multiple policy bundles.

State-Specific Insurance Considerations

The insurance landscape varies significantly from state to state. Here’s a glimpse at some unique aspects:

| State | Key Insurance Considerations |

|---|---|

| California | Strict auto insurance laws and a high cost of living influence rates. |

| Texas | A diverse range of coverage options and a competitive market. |

| New York | High population density and strict regulations impact insurance costs. |

| Florida | Hurricane risks and unique no-fault auto insurance laws. |

| Illinois | A balanced market with competitive rates and diverse coverage options. |

| …and more | Each state has its own story to tell when it comes to insurance. |

Exploring Insurance Quotes by State

Let’s dive deeper into the insurance quote process, state by state. While we can’t cover every state in detail, we’ll provide an overview of the key considerations and unique factors to keep in mind.

California Insurance Quotes

California is known for its stringent insurance regulations, particularly in the auto insurance realm. Here’s what you need to know:

- Mandatory Auto Insurance: California requires all drivers to carry liability insurance, with minimum limits of 15,000 for bodily injury or death per person, 30,000 for bodily injury or death per accident, and $5,000 for property damage.

- SR-22 Filings: If you’ve had a DUI or other serious violation, you may need to file an SR-22, which certifies that you have the required liability insurance.

- High Premiums: The cost of living and a large population contribute to higher-than-average insurance rates.

- Discounts: California insurers often offer discounts for safe driving, multiple policies, and loyalty.

Texas Insurance Quotes

Texas boasts a competitive insurance market with a wide range of coverage options. Here’s a glimpse:

- Choice of Coverage: Texas residents can choose between liability-only or full coverage auto insurance, with various deductibles and coverage limits.

- Discounts: Insurers in Texas frequently offer discounts for safe driving, good grades (for young drivers), and multiple policies.

- Flood Insurance: Given the state’s susceptibility to floods, many Texans opt for flood insurance, which is typically not covered by standard homeowners’ policies.

New York Insurance Quotes

New York’s dense population and unique regulations impact insurance rates and coverage:

- No-Fault Auto Insurance: New York follows a no-fault system, meaning your insurance covers your medical expenses and lost wages up to a certain limit, regardless of who caused the accident.

- High Premiums: The cost of living and dense urban areas contribute to higher insurance rates, especially for auto and renters’ insurance.

- Discounts: Discounts for safe driving, good student status, and multiple policies are common in New York.

Florida Insurance Quotes

Florida’s unique geography and climate present distinct insurance challenges:

- Hurricane Risks: Given its susceptibility to hurricanes, Florida residents often face higher insurance rates, particularly for coastal properties.

- No-Fault Auto Insurance: Like New York, Florida operates on a no-fault system for auto insurance.

- Windstorm Deductibles: Many Florida policies have separate windstorm deductibles, which apply specifically to wind-related damage.

Illinois Insurance Quotes

Illinois offers a balanced insurance market with competitive rates and diverse coverage options:

- Auto Insurance: Illinois requires liability insurance with minimum limits of 25,000 for bodily injury or death per person, 50,000 for bodily injury or death per accident, and $20,000 for property damage.

- Discounts: Illinois insurers often provide discounts for safe driving, good student status, and loyalty.

- Home Insurance: The state’s diverse geography means rates can vary, with higher costs in urban areas.

Comparing Quotes and Choosing the Right Coverage

With a wealth of information about insurance quotes across various states, it’s time to compare and make informed decisions. Here are some key considerations:

- Coverage Limits: Ensure your policy provides adequate coverage for your specific needs. Consider the value of your assets and potential liabilities.

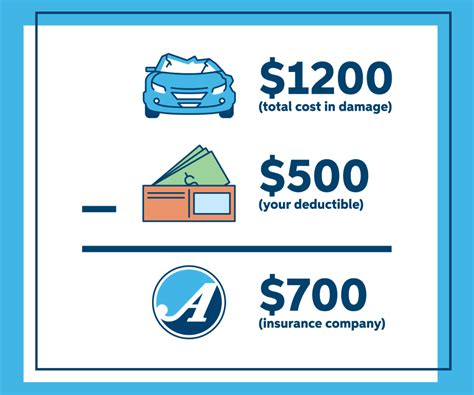

- Deductibles: Higher deductibles can lower your premiums, but ensure you can afford the out-of-pocket expense if a claim arises.

- Discounts: Explore all available discounts to reduce your premiums. Common discounts include safe driving, multiple policies, and loyalty.

- Reputation and Financial Stability: Choose an insurer with a solid reputation and financial stability to ensure they’ll be there when you need them.

- Customer Service: Consider the insurer’s track record for customer service and claim handling.

Utilizing Online Tools and Resources

The internet provides a wealth of resources to help you navigate the insurance quote process. Online comparison tools can streamline the process, allowing you to compare multiple quotes from various providers in a matter of minutes. Additionally, many insurance companies offer online quote calculators, providing an estimate of your potential premiums based on your specific details.

Working with an Insurance Agent

While online tools are convenient, consulting with a licensed insurance agent can provide personalized guidance. Agents can offer expert advice tailored to your specific needs and circumstances, ensuring you understand all your coverage options.

Future Implications and Industry Trends

The insurance industry is constantly evolving, influenced by technological advancements, regulatory changes, and shifting consumer needs. Here’s a glimpse at some future trends and their potential impact on insurance quotes:

- Telematics and Usage-Based Insurance: With the rise of telematics and usage-based insurance, drivers can now opt for policies that track their driving behavior, offering discounts for safe driving habits.

- Digital Transformation: Insurance companies are increasingly adopting digital technologies, streamlining the quote and claims process and potentially reducing costs for consumers.

- Regulatory Changes: Keep an eye on state-specific regulations, as changes can impact insurance rates and coverage requirements.

- Climate Change: As climate change continues to impact weather patterns, insurance rates may rise in areas susceptible to natural disasters.

Frequently Asked Questions

How often should I review my insurance quotes and coverage?

+It’s recommended to review your insurance quotes and coverage annually or whenever your circumstances change significantly (e.g., marriage, buying a new home, or starting a business). Regular reviews ensure your coverage remains adequate and cost-effective.

Can I get insurance quotes without providing personal information?

+While some online tools offer preliminary quotes without personal details, accurate quotes require specific information, such as your age, location, and claims history. Providing this data ensures you receive a personalized estimate.

What if I have multiple properties or vehicles to insure?

+Bundling multiple policies with the same insurer often results in significant discounts. Consider insuring all your properties and vehicles with one provider to maximize savings and simplify your coverage.

Are there any resources for understanding complex insurance terms and jargon?

+Yes, many insurance companies and industry organizations provide educational resources to help consumers understand insurance terminology and coverage options. These resources can be invaluable when comparing quotes and making informed decisions.

How can I ensure I’m getting the best insurance rates?

+To secure the best rates, compare quotes from multiple insurers, explore all available discounts, and consider bundling your policies. Additionally, maintaining a good credit score and a clean driving record can positively impact your insurance rates.

Navigating the world of insurance quotes can be complex, but with the right knowledge and tools, you can make informed decisions about your coverage. Remember to explore your state’s unique insurance considerations, compare quotes, and choose an insurer that aligns with your needs and budget. Stay informed, and keep your coverage up-to-date to protect your assets and peace of mind.