Work Comp Insurance

Welcome to a comprehensive guide on Workers' Compensation Insurance, a vital aspect of business operations and employee protection. This article aims to delve deep into the intricacies of work comp insurance, offering an expert analysis of its importance, functionality, and real-world applications. By understanding the ins and outs of this insurance type, businesses can ensure they're adequately prepared to handle the unforeseen circumstances that may arise in the workplace.

The Essential Guide to Work Comp Insurance

Work Comp Insurance, short for Workers' Compensation Insurance, is a specialized form of insurance that provides coverage for employees who suffer work-related injuries or illnesses. It's a fundamental aspect of business operations, offering protection to both employees and employers, and ensuring that injured workers receive the medical care and financial support they need while unable to work.

The history of Work Comp Insurance dates back to ancient times when various civilizations implemented systems to compensate workers for injuries sustained on the job. However, it wasn't until the late 19th and early 20th centuries that comprehensive Work Comp laws were enacted in various countries, recognizing the need for standardized protection for workers.

The Importance of Work Comp Insurance

Work Comp Insurance is a critical component of any business's risk management strategy. Here's why it's so important:

- Employee Protection: Work Comp Insurance ensures that employees receive prompt medical attention and financial support when injured or made ill by their work. This coverage can help them manage their recovery process, ensuring they get the necessary treatment and time off to heal.

- Financial Stability for Businesses: Work Comp Insurance provides a safety net for businesses, helping them manage the financial burden of workplace injuries. It covers the cost of medical expenses, rehabilitation, and lost wages for injured workers, preventing potential financial strain on the business.

- Legal Compliance: Many jurisdictions mandate that businesses carry Work Comp Insurance. By complying with these laws, businesses avoid hefty fines and potential legal repercussions. Work Comp Insurance demonstrates a business's commitment to the well-being of its employees and its compliance with legal standards.

- Improved Workplace Safety: Work Comp Insurance often includes risk management services that can help businesses identify and mitigate potential hazards in the workplace. By implementing these measures, businesses can reduce the likelihood of workplace injuries, creating a safer environment for their employees.

How Work Comp Insurance Works

Work Comp Insurance operates on a no-fault basis, meaning that injured workers are covered regardless of who was at fault for the injury. Here's a simplified breakdown of how it works:

- Injury or Illness Occurs: When an employee sustains a work-related injury or becomes ill due to their job, the incident must be reported to the employer.

- Reporting and Claims Process: The employer, in turn, reports the incident to the Work Comp Insurance provider. The provider then evaluates the claim and determines the necessary benefits to be provided to the injured worker.

- Benefits and Coverage: Work Comp Insurance typically covers a range of benefits, including medical expenses, rehabilitation costs, lost wages, and, in severe cases, disability benefits or death benefits for the worker's dependents.

- Return to Work: Once the injured worker has recovered, the Work Comp Insurance provider may assist in facilitating their return to work, often through rehabilitation programs or modified duty arrangements.

It's important to note that the specific benefits and coverage provided by Work Comp Insurance can vary depending on the jurisdiction and the insurance policy purchased by the employer.

Real-World Applications and Case Studies

To better understand the impact and importance of Work Comp Insurance, let's explore a few real-world scenarios:

Case Study 1: Construction Worker Injury

John, a construction worker, suffers a severe fall while working on a high-rise building. He sustains multiple fractures and is unable to work for several months. With Work Comp Insurance in place, John receives prompt medical attention, and his medical expenses are fully covered. Additionally, he receives a portion of his regular wages during his recovery period, ensuring financial stability during his time off work.

Case Study 2: Office Worker Illness

Emily, an office worker, develops carpal tunnel syndrome after years of repetitive typing. Her condition worsens, and she requires surgery. Work Comp Insurance covers the cost of her medical treatment and provides her with a temporary wage replacement while she recovers. After her surgery, Emily receives rehabilitation services to help her return to work comfortably.

Case Study 3: Manufacturing Plant Accident

At a manufacturing plant, a machine malfunction causes an explosion, injuring several workers. Work Comp Insurance steps in to provide emergency medical care for the injured workers and covers the cost of their ongoing treatment. The insurance also assists in coordinating rehabilitation services and helps the workers transition back to work safely.

Performance Analysis and Statistics

Work Comp Insurance has proven to be a highly effective system for protecting workers and businesses. According to a recent study by the National Council on Compensation Insurance (NCCI), Work Comp Insurance provided coverage for over 147 million employees in the United States alone, demonstrating its widespread reach and importance.

| Year | Number of Covered Employees (in millions) |

|---|---|

| 2021 | 147.2 |

| 2020 | 144.3 |

| 2019 | 141.5 |

Furthermore, Work Comp Insurance has helped reduce the financial burden on businesses. A study by the Insurance Information Institute found that Work Comp Insurance claims accounted for only 1.9% of total workers' earnings in the United States in 2021, indicating that the system is highly efficient in managing costs.

Future Implications and Industry Trends

As the world of work continues to evolve, Work Comp Insurance is adapting to meet new challenges. Here are some key trends and future implications:

- Emphasis on Prevention: With advancements in technology and workplace safety measures, there's a growing focus on preventing workplace injuries rather than solely managing their aftermath. This shift may lead to increased investment in workplace safety equipment, training, and risk management strategies.

- Telehealth and Remote Work: The rise of remote work and telehealth services has impacted the landscape of Work Comp Insurance. As more employees work from home, the nature of workplace injuries may shift, requiring insurance providers to adapt their coverage and claim processes accordingly.

- Data-Driven Insights: The insurance industry is increasingly leveraging data analytics to improve risk assessment and claim management. By analyzing vast amounts of data, insurance providers can identify trends, predict potential risks, and offer more tailored coverage to businesses.

- Integration of Technology: Technology is playing a larger role in Work Comp Insurance, with the use of wearable devices, IoT sensors, and AI-powered systems to monitor and improve workplace safety. These technologies can help identify potential hazards, track employee health, and streamline the claims process.

Expert Insights and Tips

As an expert in the field, here are some key takeaways and tips for businesses regarding Work Comp Insurance:

- Understand Your Coverage: Ensure you thoroughly understand the specifics of your Work Comp Insurance policy. Know what benefits are covered, the claim process, and any potential exclusions or limitations.

- Promote a Culture of Safety: Encourage a safety-first mindset among your employees. Provide regular training on workplace safety, ensure proper equipment is used, and create an environment where employees feel comfortable reporting potential hazards or injuries.

- Collaborate with Insurance Providers: Work closely with your insurance provider to understand their risk management services and how they can help improve workplace safety. Many providers offer resources and guidance to help businesses prevent injuries and manage claims effectively.

- Stay Informed on Industry Trends: Keep abreast of the latest developments and trends in Work Comp Insurance. This knowledge can help you make informed decisions about your coverage and ensure your business remains competitive and compliant.

FAQ

What happens if an employer doesn’t have Work Comp Insurance?

+Employers who fail to carry Work Comp Insurance may face significant legal repercussions, including hefty fines and potential lawsuits from injured workers. In some jurisdictions, employers can even face criminal charges for not complying with Work Comp Insurance laws.

Can employees sue their employer for a workplace injury if they have Work Comp Insurance?

+In most cases, Work Comp Insurance is considered the exclusive remedy for workplace injuries. This means that injured workers typically cannot sue their employer for damages related to the injury. However, there may be exceptions in certain circumstances, such as cases of gross negligence or intentional harm.

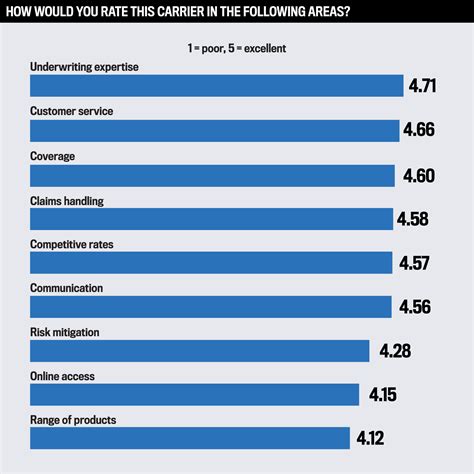

How can businesses choose the right Work Comp Insurance provider?

+When selecting a Work Comp Insurance provider, businesses should consider factors such as the provider’s reputation, financial stability, the scope of coverage offered, and the quality of their risk management services. It’s also beneficial to seek recommendations from industry peers and consult with insurance brokers who can offer expert advice.