Homeowners Insurance In California

California, known for its diverse landscapes, thriving communities, and vibrant culture, is also home to a unique set of challenges when it comes to insuring properties. Homeowners in the Golden State face a variety of risks, from natural disasters like earthquakes and wildfires to the more common perils such as theft and liability claims. Navigating the complex world of homeowners insurance in California requires a comprehensive understanding of the state's specific risks and the coverage options available to protect your investment.

Understanding California’s Unique Risks

California’s geographical diversity contributes to a wide range of potential hazards that homeowners need to be prepared for. One of the most prominent risks is the threat of earthquakes, which can cause significant damage to homes and property. The state’s history of devastating quakes, such as the 1906 San Francisco earthquake and the more recent 2019 Ridgecrest earthquakes, underscores the importance of earthquake insurance coverage.

Another major concern for California homeowners is the wildfire risk. The state's dry climate, coupled with its vast forests and brush-covered hillsides, creates ideal conditions for wildfires to spread rapidly. In recent years, California has experienced some of the most destructive wildfires in its history, including the 2018 Camp Fire and the 2020 LNU Lightning Complex Fire. These fires have led to widespread property damage and displacement, emphasizing the need for comprehensive wildfire coverage.

Additionally, California's coastal regions face the threat of flooding and coastal erosion, particularly during severe storms and high tides. The state's Mediterranean climate can also lead to prolonged droughts, which increase the risk of wildfires and water-related issues. Homeowners in these areas must consider flood insurance and other coverage options to protect against these specific perils.

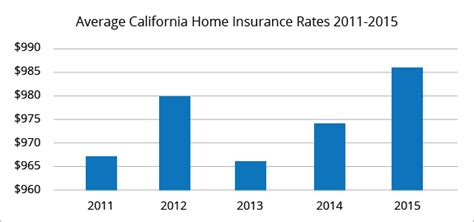

The Cost of Homeowners Insurance in California

The cost of homeowners insurance in California can vary significantly depending on several factors. One of the primary considerations is the location of the property. Areas prone to natural disasters, such as earthquake zones or wildfire-prone regions, tend to have higher insurance premiums. For instance, a home in an area with a high risk of wildfires may incur additional costs for extended wildfire coverage.

The value of the home and its contents is another critical factor in determining insurance costs. Higher-value homes typically require more extensive coverage, which can increase the premium. Additionally, the type and amount of personal property coverage desired will impact the overall cost. Homeowners should carefully assess the value of their belongings and choose a policy that provides adequate coverage without unnecessary expenses.

The deductible chosen can also influence the cost of homeowners insurance. A higher deductible typically results in a lower premium, as the policyholder assumes more financial responsibility in the event of a claim. However, it's essential to strike a balance between affordability and adequate coverage, ensuring that the deductible is manageable in the face of potential losses.

Furthermore, the coverage options selected can significantly impact the overall cost. California homeowners have the flexibility to choose from various coverage levels, including HO-2 (broad form) and HO-3 (special form) policies. HO-3 policies, which offer more comprehensive coverage, may be more expensive but provide greater peace of mind. Homeowners should carefully review their coverage needs and tailor their policy to their specific circumstances.

Coverage Options for California Homeowners

California homeowners have a range of coverage options to protect their properties and assets. The most common type of homeowners insurance policy is the HO-3 policy, which provides broad coverage for the home, personal belongings, and liability protection. This policy typically covers damage caused by perils such as fire, theft, and vandalism, as well as liability claims resulting from accidents on the insured’s property.

For homeowners seeking more comprehensive protection, an HO-5 policy, known as a "premium" or "comprehensive" policy, is available. This policy provides broader coverage for personal belongings, including coverage for damage caused by a wider range of perils. HO-5 policies are ideal for homeowners with high-value items or those who want additional peace of mind.

In addition to standard homeowners insurance, California residents should consider the following coverage options:

- Earthquake Insurance: Given the state's seismic activity, earthquake insurance is crucial. This coverage provides protection for damage caused by earthquakes, which is typically excluded from standard homeowners policies. The cost of earthquake insurance can vary based on factors such as the home's location, construction type, and the amount of coverage needed.

- Wildfire Insurance: With the increasing threat of wildfires, having dedicated wildfire coverage is essential. This coverage protects against damage caused by wildfires, including damage to the home, outbuildings, and personal belongings. Homeowners in wildfire-prone areas should carefully review their policies to ensure they have adequate coverage.

- Flood Insurance: While California is not known for widespread flooding, certain coastal and riverine areas are at risk. Flood insurance provides protection against damage caused by rising water, whether from a river overflow or coastal storm surge. Homeowners in flood-prone areas should consider purchasing flood insurance through the National Flood Insurance Program (NFIP) or private insurers.

Tips for Finding the Right Policy

When shopping for homeowners insurance in California, it’s essential to follow these tips to find the best coverage at the right price:

- Shop Around: Compare quotes from multiple insurance companies to find the best rates and coverage options. Online comparison tools and insurance brokers can be valuable resources for this process.

- Understand Your Needs: Assess your specific coverage needs based on your home's location, value, and personal belongings. Consider the risks you want to protect against, such as earthquakes, wildfires, or flooding.

- Review Policy Exclusions: Carefully read the policy documents to understand what perils and damages are excluded from coverage. Ensure that you have additional coverage for any specific risks that are not covered by your standard policy.

- Consider Bundling: Bundling your homeowners insurance with other policies, such as auto insurance, can often result in significant savings. Many insurers offer discounts for bundling multiple policies.

- Maintain Your Home: Keep your home well-maintained to potentially reduce insurance costs. Regular maintenance can help prevent issues that could lead to insurance claims, such as water damage or roof repairs.

- Increase Your Deductible: Opting for a higher deductible can lower your premium, but ensure that you can afford the deductible in the event of a claim. Find a balance between cost savings and financial preparedness.

- Ask About Discounts: Inquire about available discounts, such as those for security systems, mature homeowners, or loyalty programs. Discounts can help reduce your overall insurance costs.

- Review Your Policy Annually: Regularly review your insurance policy to ensure it aligns with your current needs and circumstances. Life changes, such as renovations or the addition of high-value items, may require adjustments to your coverage.

The Role of Technology in Homeowners Insurance

Technology has transformed the homeowners insurance industry, making it more efficient and customer-centric. Insurers now leverage advanced analytics and data-driven insights to better understand risks and price policies accurately. This shift has led to more competitive rates and tailored coverage options for homeowners.

One notable advancement is the use of satellite imagery and geospatial data to assess properties and their surrounding environments. Insurers can now analyze high-resolution images to evaluate a home's condition, identify potential risks, and assess the likelihood of certain perils. This technology has proven especially valuable in assessing wildfire and flood risks, as it provides a detailed view of a property's proximity to fire-prone areas or flood-prone zones.

Additionally, smart home technology has become an increasingly important factor in homeowners insurance. Insurers are recognizing the benefits of smart home devices, such as security systems and water leak detectors, in reducing the risk of theft and water damage claims. Some insurance companies offer discounts to policyholders who install these devices, as they help prevent losses and enable faster response times in the event of an emergency.

Furthermore, the rise of telematics and behavioral data has led to more personalized insurance pricing. Insurers can now collect and analyze data on policyholders' behaviors and habits, such as their driving habits or home maintenance practices, to more accurately assess their risk profile. This data-driven approach allows insurers to offer more tailored coverage and pricing, rewarding policyholders for their proactive risk management efforts.

Conclusion: Protecting Your California Home

Homeownership in California comes with its unique set of challenges and risks. From earthquakes to wildfires, the Golden State demands a comprehensive approach to homeowners insurance. By understanding the specific risks, coverage options, and the role of technology in insurance, California homeowners can make informed decisions to protect their properties and assets.

With the right coverage in place, homeowners can rest easy knowing they are prepared for the unexpected. Whether it's a natural disaster or a more common peril, having the right insurance policy provides the financial protection and peace of mind that comes with owning a home in California.

How often should I review my homeowners insurance policy in California?

+It’s recommended to review your homeowners insurance policy annually or whenever you experience significant life changes, such as renovations, additions to your home, or the acquisition of high-value items. Regular policy reviews ensure that your coverage remains up-to-date and aligned with your current needs.

Can I bundle my homeowners insurance with other policies to save money?

+Yes, bundling your homeowners insurance with other policies, such as auto insurance, can often result in significant savings. Many insurers offer discounts for bundling multiple policies, so it’s worth exploring this option to reduce your overall insurance costs.

What is the average cost of homeowners insurance in California?

+The average cost of homeowners insurance in California varies widely depending on factors such as location, home value, and coverage options. According to recent data, the average annual premium for a standard homeowners insurance policy in California is around $1,200. However, this can range from a few hundred dollars to several thousand dollars based on individual circumstances.

Are there any discounts available for homeowners insurance in California?

+Yes, there are several discounts available for homeowners insurance in California. These may include discounts for mature homeowners, loyalty programs, security systems, and smoke detectors. Additionally, some insurers offer discounts for bundling multiple policies or for making certain home improvements, such as installing impact-resistant windows or roofs.

What should I do if I experience a loss or damage to my home in California?

+If you experience a loss or damage to your home, it’s important to take the following steps:

1. Ensure your safety and the safety of your family.

2. Contact your insurance company as soon as possible to report the claim.

3. Document the damage with photographs and videos.

4. Provide your insurance company with any necessary documentation, such as repair estimates or police reports.

5. Work with your insurer to understand the claims process and any coverage limitations.