How To Cancel Your Progressive Insurance

Progressive Insurance, a well-known name in the insurance industry, offers a range of policies to protect customers' vehicles and assets. However, life circumstances can change, and sometimes, policyholders find themselves in a situation where they need to cancel their insurance. This comprehensive guide will walk you through the process of canceling your Progressive Insurance policy, ensuring a smooth and informed experience.

Understanding the Cancellation Process

Canceling an insurance policy with Progressive is a straightforward process, but it’s essential to understand the steps and potential implications to ensure a seamless transition. Here’s what you need to know before initiating the cancellation:

1. Types of Cancellation

Progressive Insurance offers flexibility when it comes to canceling your policy. There are two main types of cancellation:

- Full Cancellation: This option involves completely terminating your insurance coverage with Progressive. It is suitable if you no longer require insurance or have found an alternative provider.

- Policy Suspension: If you’re facing a temporary situation that makes insurance coverage unnecessary, you can suspend your policy. This allows you to resume coverage later without the hassle of applying for a new policy.

2. When to Initiate Cancellation

The timing of your cancellation can impact your refund and future insurance options. It’s generally recommended to cancel your policy:

- If you’ve sold your vehicle and no longer require insurance.

- When you’ve switched to a new insurance provider and want to avoid overlap in coverage.

- In case of a life event, such as moving to an area where Progressive doesn’t offer services.

- If you’ve purchased a new vehicle and need to transfer your coverage to a different policy.

3. Potential Refund

One of the advantages of canceling your Progressive Insurance policy is the potential for a refund. The amount you receive will depend on the type of policy you have and the time elapsed since your last payment. Here’s a breakdown:

| Policy Type | Refund Potential |

|---|---|

| 6-Month Policy | If canceled within the first 30 days, you may receive a full refund. After 30 days, you’ll likely receive a pro-rated refund based on the remaining coverage period. |

| 12-Month Policy | Similar to the 6-month policy, a full refund is possible within the first 30 days. Beyond that, a pro-rated refund is standard, considering the time left on your policy. |

Step-by-Step Guide to Canceling Your Policy

Now that you understand the basics, let’s delve into the detailed steps to cancel your Progressive Insurance policy:

1. Gather Your Policy Information

Before initiating the cancellation, ensure you have the following details readily available:

- Policy Number

- Insurance Provider Details (Progressive’s contact information)

- Vehicle Registration Information

- Driver’s License Number

- Any other relevant policy documents

2. Choose Your Cancellation Method

Progressive Insurance offers multiple ways to cancel your policy. Choose the method that best suits your preferences:

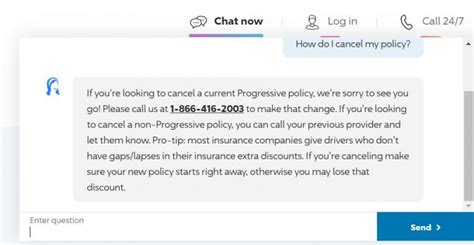

- Online Cancellation: The most convenient option, you can cancel your policy through Progressive’s official website. Simply log in to your account, navigate to the cancellation section, and follow the instructions. This method provides real-time updates and confirmation.

- Phone Call: If you prefer a more personalized approach, you can call Progressive’s customer service hotline. Provide your policy details, and the representative will guide you through the cancellation process. This method ensures immediate action and allows for any necessary clarifications.

- Written Notice: For those who prefer a more traditional approach, sending a written notice is an option. You can mail or email a letter stating your intention to cancel the policy. Include your policy number, effective date of cancellation, and any relevant reasons for the cancellation. This method may take longer but provides a clear paper trail.

3. Initiate the Cancellation

Once you’ve chosen your preferred method, follow these steps to initiate the cancellation process:

- For online cancellation, log in to your Progressive account, navigate to the “Manage Policy” section, and select “Cancel Policy.” Follow the on-screen instructions to complete the process.

- If you opt for a phone call, dial Progressive’s customer service number (available on their website or policy documents). Provide your policy details and request to cancel your policy. The representative will guide you through the necessary steps and confirm the cancellation.

- To send a written notice, draft a letter stating your intention to cancel. Include your policy number, the effective date of cancellation, and any relevant reasons. Send the letter via certified mail or email to Progressive’s official address. Ensure you retain a copy for your records.

4. Confirm and Finalize the Cancellation

After initiating the cancellation, it’s crucial to confirm and finalize the process to avoid any potential issues:

- For online cancellations, Progressive’s website should provide a confirmation message or email. Ensure you receive this confirmation and retain it for your records.

- If you called Progressive’s customer service, make sure the representative provides a cancellation reference number or confirmation. Note this down and ask for any additional documentation or steps you need to take.

- When sending a written notice, Progressive should respond with a confirmation letter or email. Keep this confirmation and any other correspondence related to the cancellation.

What to Expect After Cancellation

Canceling your Progressive Insurance policy may result in a few additional steps or considerations:

1. Refund Processing

If you’re eligible for a refund, Progressive will process it within a specific timeframe. The exact timeline may vary, but it’s typically within 7-14 business days. You can expect the refund to be issued via the original payment method.

2. Future Insurance Options

Canceling your insurance policy doesn’t necessarily mean you’re left without coverage. Consider your options for future insurance needs:

- If you’ve sold your vehicle, you may need to obtain insurance for a new vehicle. Research and compare different providers to find the best fit for your needs.

- In case of a temporary suspension, make sure to reactivate your policy with Progressive or switch to a new provider when necessary.

- If you’ve moved to a new area, research local insurance providers and compare their offerings to ensure you have adequate coverage.

Tips for a Smooth Cancellation Process

To ensure a hassle-free cancellation experience, keep these tips in mind:

- Provide accurate and complete information when canceling your policy. This includes policy details, vehicle information, and contact preferences.

- Keep records of all correspondence and confirmation related to the cancellation. This documentation can be useful in case of any future inquiries.

- If you’re canceling due to a life event, such as a move, ensure you understand the insurance requirements of your new location.

- Consider the potential impact of cancellation on your insurance history and future rates. While Progressive offers competitive rates, other providers may have different pricing structures.

- Review your policy documents and understand the terms and conditions related to cancellation and refunds.

Frequently Asked Questions

What happens if I cancel my Progressive Insurance policy mid-term?

+

Canceling your policy mid-term may result in a pro-rated refund, depending on the time remaining on your policy. Progressive will calculate the refund based on the unused portion of your coverage.

Can I cancel my Progressive Insurance policy online if I don’t have an account?

+

Yes, Progressive offers a guest cancellation option on their website. You can access it without logging in, but having an account provides a more streamlined experience.

How long does it take for Progressive to process a cancellation request?

+

Progressive aims to process cancellation requests within 24-48 hours. However, the exact timeframe may vary based on the method of cancellation and the complexity of your policy.

Will canceling my Progressive Insurance policy affect my credit score?

+

Canceling an insurance policy typically doesn’t directly impact your credit score. However, it’s essential to maintain continuous insurance coverage to avoid any negative marks on your insurance history, which could indirectly affect your creditworthiness.

Can I cancel my Progressive Insurance policy if I’ve already made a claim?

+

Yes, you can cancel your policy even if you’ve made a claim. However, it’s important to note that canceling your policy may impact the resolution of your claim. Progressive will provide guidance on how to proceed with your claim during the cancellation process.