Axa Equitable Life Insurance Company

The Axa Equitable Life Insurance Company, or simply Axa Equitable, is a prominent player in the life insurance industry, offering a comprehensive range of financial protection and wealth management solutions to individuals and businesses. With a rich history spanning over a century, Axa Equitable has established itself as a trusted provider, catering to diverse client needs and evolving market demands.

Axa Equitable: A Legacy of Financial Protection

Founded in 1859 as the Equitable Life Assurance Society, Axa Equitable has weathered numerous economic cycles and market shifts, emerging as a stalwart in the life insurance sector. The company’s early years were marked by a commitment to innovation and customer-centricity, laying the foundation for its enduring success.

Over the decades, Axa Equitable has expanded its reach, both geographically and in terms of the services it offers. The company's acquisition by the AXA Group in 2004 further solidified its global presence, enabling it to leverage the group's extensive resources and expertise.

Today, Axa Equitable operates as a subsidiary of AXA, one of the world's leading insurance and financial services groups. This strategic alliance has allowed Axa Equitable to enhance its product offerings, leverage cutting-edge technology, and provide customers with a more comprehensive suite of financial solutions.

A Comprehensive Product Portfolio

Axa Equitable’s product portfolio is diverse and tailored to meet the unique needs of its clientele. The company offers a range of life insurance policies, including term life, whole life, and universal life insurance, providing individuals and families with the financial security they need.

Term Life Insurance

Axa Equitable’s term life insurance policies offer pure protection for a specified period, typically ranging from 10 to 30 years. These policies are designed to provide affordable coverage for individuals and families, ensuring that loved ones are financially secure in the event of an untimely death.

The company's term life insurance policies are highly customizable, allowing customers to choose the coverage amount and term duration that best suits their needs. Additionally, Axa Equitable offers renewable and convertible term policies, providing flexibility and the option to transition to a permanent life insurance policy later on.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers lifelong coverage and builds cash value over time. Axa Equitable’s whole life insurance policies provide a guaranteed death benefit, along with the potential for tax-advantaged cash value growth.

These policies are particularly beneficial for individuals seeking long-term financial protection and the opportunity to build wealth through their insurance policy. The cash value component can be used for various purposes, such as funding retirement, covering emergency expenses, or supplementing income.

Universal Life Insurance

Universal life insurance offers a flexible and customizable approach to life insurance coverage. Axa Equitable’s universal life policies allow policyholders to adjust their premiums and death benefits within certain limits, providing a high degree of flexibility to accommodate changing financial circumstances.

The cash value component of universal life insurance can be invested in a range of options, offering the potential for higher returns compared to traditional whole life policies. Policyholders can also access their cash value through loans or withdrawals, subject to certain conditions.

Wealth Management and Financial Planning

In addition to its life insurance offerings, Axa Equitable provides a comprehensive suite of wealth management and financial planning services. The company recognizes that financial security extends beyond insurance coverage, and thus, it aims to help clients achieve their long-term financial goals.

Axa Equitable's wealth management solutions encompass a range of services, including investment management, retirement planning, estate planning, and tax-efficient strategies. The company's financial advisors work closely with clients to develop personalized financial plans, taking into account their unique circumstances, goals, and risk tolerance.

Through its wealth management division, Axa Equitable offers access to a diverse range of investment options, including mutual funds, exchange-traded funds (ETFs), and individually managed accounts. Clients can benefit from the company's investment expertise and strategic asset allocation to grow and preserve their wealth over time.

Retirement Planning

Axa Equitable’s retirement planning services are tailored to help individuals prepare for a comfortable and secure retirement. The company offers a range of retirement savings vehicles, such as IRAs, 401(k) plans, and annuities, to meet the diverse needs of its clients.

Axa Equitable's financial advisors provide guidance on maximizing retirement contributions, optimizing investment strategies, and minimizing taxes. They also assist clients in navigating complex retirement income options, ensuring a steady stream of income throughout retirement.

Estate Planning

Estate planning is an essential aspect of financial security, and Axa Equitable recognizes its importance. The company’s estate planning services help individuals and families preserve and transfer their wealth efficiently, minimizing taxes and legal complexities.

Axa Equitable's financial advisors work closely with clients to develop comprehensive estate plans, taking into account their specific goals and family dynamics. This includes strategies for asset protection, charitable giving, and the smooth transition of wealth to future generations.

Technology-Driven Innovation

Axa Equitable embraces technology as a means to enhance its services and improve the overall customer experience. The company leverages digital tools and platforms to streamline processes, provide real-time access to information, and offer personalized financial solutions.

One notable example is Axa Equitable's online platform, which allows customers to manage their policies, make payments, and access their account information conveniently. The platform also provides educational resources and tools to help clients make informed financial decisions.

Additionally, Axa Equitable utilizes advanced analytics and data-driven insights to enhance its underwriting processes and product offerings. By leveraging technology, the company can deliver more efficient and accurate risk assessments, resulting in better rates and coverage options for its customers.

Mobile App and Digital Tools

Axa Equitable’s mobile app is a key component of its digital strategy, providing customers with 24⁄7 access to their policy information and financial accounts. The app offers a range of features, including policy management, premium payment options, and the ability to submit claims electronically.

The company also offers a suite of digital tools designed to empower customers and financial advisors alike. These tools include financial planning calculators, investment simulators, and educational resources to help individuals understand complex financial concepts and make informed decisions.

Community Engagement and Corporate Responsibility

Beyond its financial services, Axa Equitable is committed to making a positive impact on the communities it serves. The company actively engages in various initiatives focused on education, financial literacy, and community development.

Axa Equitable's philanthropic efforts are centered around its "AXA Achievers" program, which provides financial support and mentorship to deserving students pursuing higher education. The company believes that investing in education is a powerful way to drive societal progress and empower future generations.

Additionally, Axa Equitable is dedicated to promoting financial literacy and responsible financial management. The company sponsors financial education programs and initiatives aimed at helping individuals and families make informed decisions about their financial futures.

Environmental and Social Governance (ESG)

Axa Equitable aligns its operations with the principles of Environmental, Social, and Governance (ESG) criteria. The company recognizes the importance of sustainable practices and aims to minimize its environmental footprint while contributing to social and economic development.

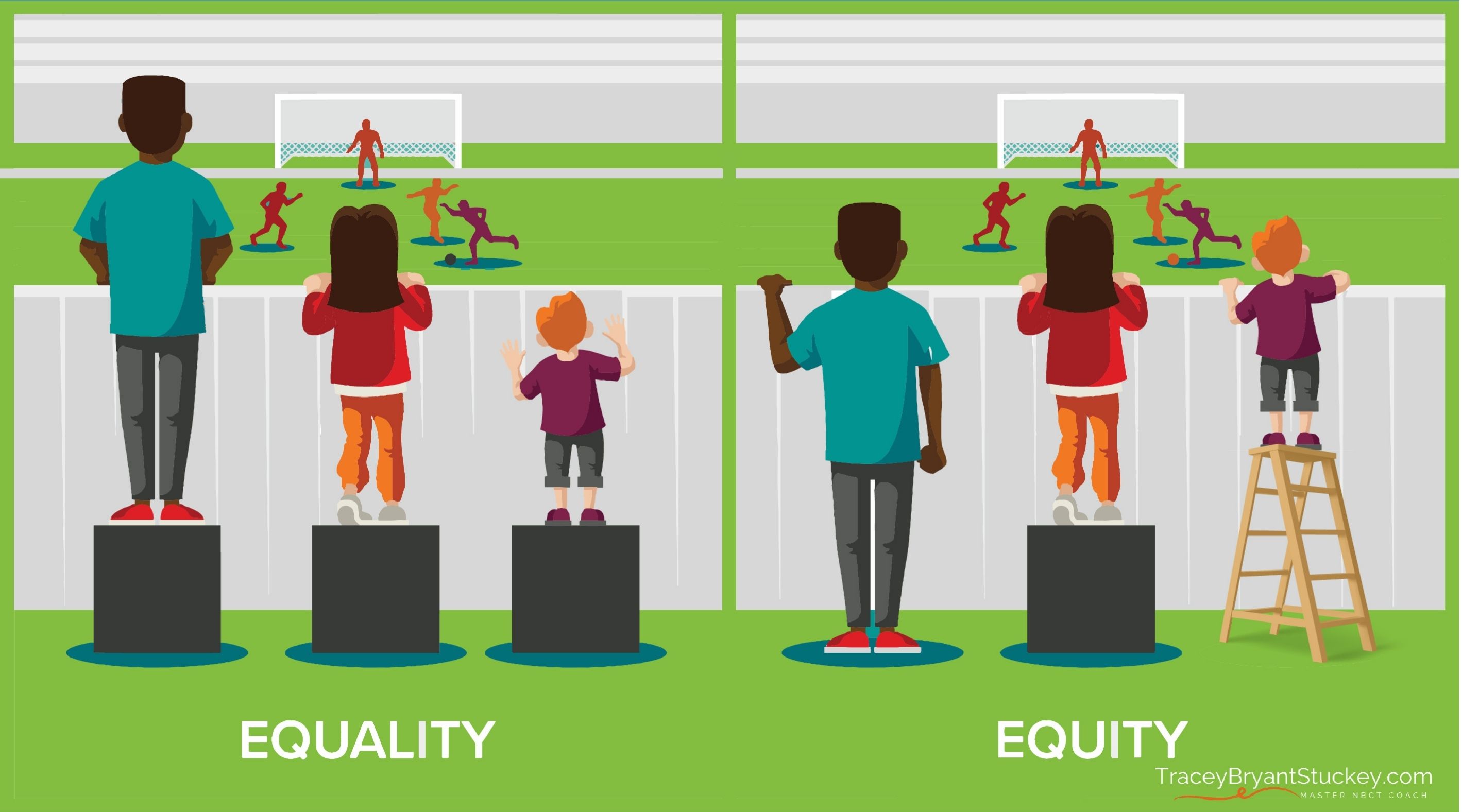

Axa Equitable's ESG initiatives encompass a range of areas, including responsible investment practices, sustainable business operations, and community engagement. The company actively supports initiatives focused on renewable energy, climate change mitigation, and social equity.

Awards and Recognition

Axa Equitable’s commitment to excellence and innovation has been recognized by various industry organizations and publications. The company consistently ranks among the top life insurance providers, earning accolades for its financial strength, customer satisfaction, and product offerings.

Some notable awards include:

- A.M. Best A++ (Superior) Rating: Axa Equitable has consistently maintained this top rating, reflecting its financial strength and ability to meet policyholder obligations.

- J.D. Power Awards: The company has been recognized by J.D. Power for its customer satisfaction and product innovation, earning top rankings in various categories.

- Barron's Top 100 Advisors: Axa Equitable advisors have been featured on this prestigious list, showcasing the company's talent and expertise in financial planning.

These accolades further underscore Axa Equitable's position as a trusted and reliable provider of life insurance and financial services.

Conclusion

Axa Equitable Life Insurance Company stands as a testament to the power of innovation and customer-centricity in the financial services industry. With a rich history and a forward-thinking approach, the company continues to evolve and adapt to meet the changing needs of its clients.

From its comprehensive suite of life insurance products to its wealth management and financial planning services, Axa Equitable offers a holistic approach to financial security. By leveraging technology and embracing ESG principles, the company is well-positioned to navigate the complexities of the modern financial landscape.

As Axa Equitable looks to the future, its commitment to innovation, community engagement, and financial empowerment remains unwavering. The company's legacy of financial protection and wealth management is a beacon for individuals and businesses seeking long-term financial security and prosperity.

How does Axa Equitable’s life insurance coverage compare to other providers?

+Axa Equitable offers a wide range of life insurance policies, including term life, whole life, and universal life insurance. The company’s policies are highly customizable, allowing customers to choose coverage amounts and term durations that suit their needs. Axa Equitable’s financial strength and A++ rating from A.M. Best reflect its ability to provide reliable coverage and meet policyholder obligations.

What are the benefits of Axa Equitable’s wealth management services?

+Axa Equitable’s wealth management services provide a comprehensive approach to financial planning. The company’s financial advisors work closely with clients to develop personalized strategies, covering areas such as investment management, retirement planning, estate planning, and tax-efficient strategies. This holistic approach ensures that clients’ financial goals are met and their wealth is protected and optimized.

How does Axa Equitable utilize technology to enhance its services?

+Axa Equitable embraces technology to streamline processes, improve customer experience, and provide personalized financial solutions. The company’s online platform and mobile app offer convenient access to policy information, premium payments, and claim submissions. Additionally, Axa Equitable leverages advanced analytics and data-driven insights to enhance its underwriting processes and product offerings, resulting in more efficient and accurate risk assessments.

What is Axa Equitable’s approach to corporate responsibility and community engagement?

+Axa Equitable is committed to making a positive impact on the communities it serves. The company’s philanthropic efforts are centered around its “AXA Achievers” program, which provides financial support and mentorship to deserving students pursuing higher education. Additionally, Axa Equitable promotes financial literacy and responsible financial management through various initiatives and sponsorships. The company also aligns its operations with ESG criteria, focusing on sustainable practices and social equity.