Compare Auto Insurance Companies

In the realm of personal finance and risk management, choosing the right auto insurance provider is a crucial decision that can significantly impact your financial security and peace of mind. With a multitude of insurance companies vying for your business, it's essential to understand the key differences and similarities between them to make an informed choice. This comprehensive guide aims to delve into the world of auto insurance, offering an in-depth comparison of leading insurance providers, their policies, and the factors that set them apart.

Understanding Auto Insurance: An Overview

Auto insurance, a mandatory requirement in most states, serves as a financial safeguard against potential risks and liabilities arising from vehicle ownership and operation. It provides coverage for a range of incidents, from minor fender benders to major accidents, offering protection against costly repairs, medical expenses, and legal liabilities. The complexity of auto insurance policies can be daunting, with various coverage options, deductibles, and limits that need to be navigated to find the right fit for individual needs.

Key Considerations in Auto Insurance Selection

Selecting an auto insurance provider involves a careful evaluation of several critical factors. These include the breadth and depth of coverage options, the flexibility in customizing policies, the clarity and competitiveness of pricing structures, and the reputation and financial stability of the insurance company. Additionally, the level of customer service, ease of claim processing, and the availability of digital tools and resources can significantly influence the overall experience and satisfaction of policyholders.

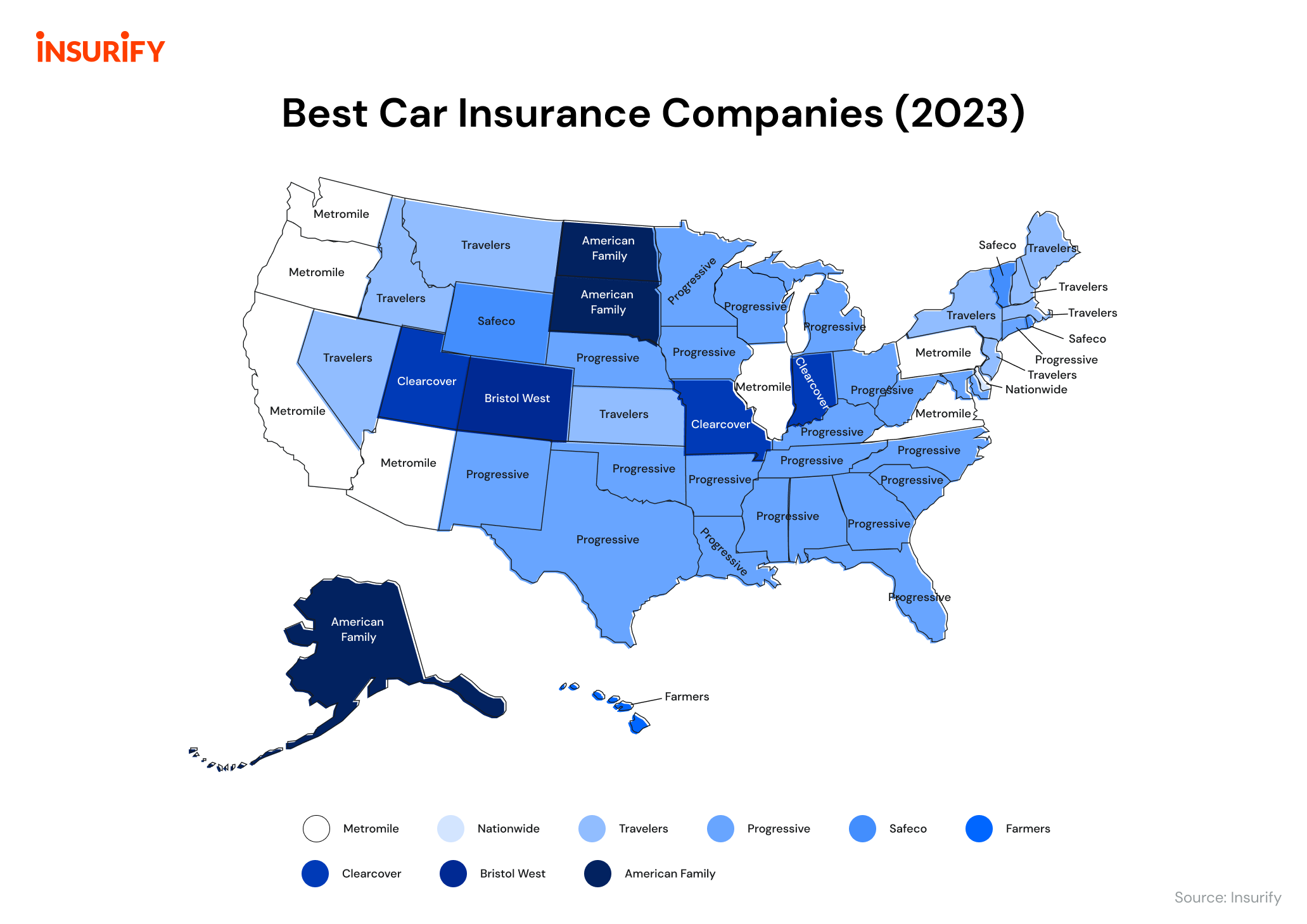

Top Auto Insurance Companies: A Detailed Comparison

The auto insurance market is dominated by a handful of well-established providers, each with its unique strengths and areas of focus. This section provides an in-depth analysis of the leading players, exploring their offerings, target audiences, and distinctive features that set them apart.

State Farm: The Leading Provider with Personalized Service

State Farm, a stalwart in the insurance industry, boasts a network of over 19,000 agents across the United States. Their comprehensive range of insurance products, including auto, home, life, and health insurance, caters to a broad spectrum of consumers. State Farm’s auto insurance policies offer customizable coverage, with options for comprehensive, collision, liability, and personal injury protection. They also provide unique add-ons like rideshare insurance, pet injury coverage, and disappearing deductibles.

State Farm's claim to fame lies in its personalized service. Policyholders are assigned dedicated agents who provide tailored advice and assistance throughout the policy term. This agent-centric model fosters a sense of familiarity and trust, ensuring that customers receive individualized attention and support. State Farm's customer service excellence is underscored by its 24/7 availability, with agents ready to assist via phone, email, or in-person meetings.

Geico: Innovation and Convenience in Auto Insurance

Geico, an acronym for Government Employees Insurance Company, has revolutionized the auto insurance industry with its innovative digital services and competitive pricing. With a strong online presence and a user-friendly website, Geico has made insurance shopping and policy management a breeze. Their auto insurance policies offer a range of coverage options, including liability, comprehensive, collision, and personal injury protection, along with unique add-ons like rental car reimbursement and mechanical breakdown insurance.

What sets Geico apart is its focus on convenience and efficiency. Policyholders can manage their accounts, file claims, and access policy documents with just a few clicks. Geico's mobile app further enhances the digital experience, allowing customers to take photos of accidents, upload necessary documents, and track claim progress in real-time. Additionally, Geico's pricing is often more competitive than its peers, making it a popular choice for budget-conscious consumers.

Progressive: Comprehensive Coverage and Customization

Progressive, one of the largest auto insurance providers in the United States, is known for its extensive coverage options and flexible policies. Their auto insurance policies offer a wide range of coverage choices, from basic liability to comprehensive protection, ensuring that customers can tailor their policies to meet their specific needs. Progressive’s unique add-ons include gap insurance, rental car coverage, and custom parts and equipment coverage.

Progressive's claim to fame is its Name Your Price® tool, which allows customers to set their desired price range for insurance coverage. This innovative feature empowers consumers to balance their budget with their insurance needs, providing a level of customization not commonly found in the industry. Progressive's policies also come with a range of discounts, including multi-policy, multi-car, and good student discounts, further enhancing the value proposition for policyholders.

Allstate: Trusted Protection and Customer Satisfaction

Allstate, a leading insurer with a strong presence across the United States, is known for its commitment to customer satisfaction and reliable protection. Their auto insurance policies offer a comprehensive range of coverage options, including liability, collision, comprehensive, and personal injury protection, ensuring that policyholders can choose the level of protection that aligns with their needs and budget.

Allstate's unique selling proposition lies in its dedication to customer service. Policyholders benefit from the expertise of Allstate agents, who provide personalized advice and support throughout the policy term. Allstate's innovative digital tools, such as the Digital Locker and Drivewise®, further enhance the customer experience, offering convenient ways to manage policies, track driving habits, and earn discounts for safe driving.

Esurance: Digital Convenience Meets Affordable Coverage

Esurance, a subsidiary of Allstate, has carved a niche for itself in the auto insurance market with its focus on digital convenience and affordable coverage. Their auto insurance policies offer a comprehensive range of coverage options, including liability, collision, comprehensive, and personal injury protection, ensuring that customers can choose the level of protection that suits their needs and budget.

Esurance's claim to fame is its seamless digital experience. Policyholders can manage their policies, file claims, and access necessary documents entirely online or through the Esurance mobile app. Esurance's straightforward and intuitive platform makes insurance shopping and policy management a breeze, saving customers time and effort. Additionally, Esurance's competitive pricing and range of discounts, including multi-policy, multi-car, and safe driver discounts, make it an attractive option for cost-conscious consumers.

Liberty Mutual: Customized Coverage and Dedicated Service

Liberty Mutual, a leading global insurer, is known for its commitment to providing customized coverage and dedicated service to its policyholders. Their auto insurance policies offer a comprehensive range of coverage options, including liability, collision, comprehensive, and personal injury protection, allowing customers to choose the level of protection that best suits their needs and budget.

Liberty Mutual's unique selling proposition lies in its personalized approach. Policyholders work with dedicated agents who provide tailored advice and assistance throughout the policy term. This agent-centric model ensures that customers receive individualized attention and support, fostering a sense of trust and confidence. Liberty Mutual's agents are readily available to assist with policy adjustments, claim filings, and any other insurance-related queries, providing a level of service that is hard to match.

Farmers Insurance: Community-Centric Approach to Insurance

Farmers Insurance, a subsidiary of Swiss Re, takes a community-centric approach to insurance, with a focus on providing tailored coverage and exceptional service to its policyholders. Their auto insurance policies offer a comprehensive range of coverage options, including liability, collision, comprehensive, and personal injury protection, ensuring that customers can choose the level of protection that aligns with their specific needs and budget.

Farmers Insurance's unique selling proposition lies in its commitment to community involvement. Policyholders benefit from the expertise of Farmers agents, who are deeply rooted in their local communities. These agents provide personalized advice and support, offering a level of familiarity and trust that is hard to find with larger, more distant insurance providers. Farmers' community-centric approach ensures that policyholders receive tailored coverage and dedicated service, making it a popular choice for those seeking a more personal insurance experience.

USAA: Exclusive Benefits for Military Members and Their Families

USAA, or United Services Automobile Association, is a unique insurance provider that caters exclusively to active and retired military members, their spouses, and their children. Their auto insurance policies offer a comprehensive range of coverage options, including liability, collision, comprehensive, and personal injury protection, ensuring that policyholders receive the level of protection they need at a competitive price.

USAA's claim to fame lies in its exclusive focus on the military community. Policyholders benefit from a range of perks and benefits designed specifically for military members and their families. These include discounts for safe driving, multi-policy bundling, and vehicle storage, as well as a dedicated claims process that takes into account the unique circumstances and challenges faced by military personnel. USAA's commitment to the military community sets it apart as a trusted provider for those who have served or are currently serving their country.

MetLife: Comprehensive Coverage with a Global Reach

MetLife, a leading global insurance provider, offers a comprehensive range of insurance products, including auto, home, life, and health insurance. Their auto insurance policies are tailored to meet the specific needs of their diverse customer base, providing a wide range of coverage options, including liability, collision, comprehensive, and personal injury protection. MetLife’s policies also offer unique add-ons, such as rental car reimbursement, roadside assistance, and accident forgiveness.

MetLife's unique selling proposition lies in its global reach and comprehensive coverage. Policyholders can rely on MetLife's extensive network of agents and partners across the world, ensuring that they receive consistent and reliable service regardless of their location. MetLife's policies are designed to provide comprehensive protection, covering a wide range of risks and liabilities, giving policyholders the peace of mind that comes with knowing they are adequately protected.

Nationwide: Customizable Coverage with Local Expertise

Nationwide, a well-established insurance provider with a strong presence across the United States, is known for its commitment to providing customizable coverage and local expertise to its policyholders. Their auto insurance policies offer a comprehensive range of coverage options, including liability, collision, comprehensive, and personal injury protection, ensuring that customers can choose the level of protection that aligns with their specific needs and budget.

Nationwide's unique selling proposition lies in its blend of customizable coverage and local expertise. Policyholders work with dedicated agents who are deeply rooted in their local communities. These agents provide personalized advice and support, offering a level of familiarity and trust that is hard to find with larger, more distant insurance providers. Nationwide's customizable policies allow customers to tailor their coverage to their unique circumstances, while its local agents ensure that policyholders receive expert guidance and assistance that takes into account the specific risks and challenges of their region.

The Bottom Line: Choosing the Right Auto Insurance Provider

Selecting the right auto insurance provider is a critical decision that can have a significant impact on your financial security and peace of mind. With a diverse range of insurance companies offering a multitude of coverage options, it’s essential to carefully evaluate your specific needs and circumstances before making a choice. Factors such as coverage options, pricing, customer service, and digital convenience should all be considered to ensure that you find an insurance provider that aligns with your expectations and provides the protection you need.

This comprehensive guide has provided an in-depth comparison of leading auto insurance providers, highlighting their unique strengths and areas of focus. Whether you prioritize personalized service, innovative digital tools, competitive pricing, or comprehensive coverage, there is an insurance provider that can cater to your needs. By understanding the key differences between these providers, you can make an informed decision and choose an auto insurance policy that offers the right balance of protection and value.

How often should I review and update my auto insurance policy?

+It’s recommended to review your auto insurance policy annually or whenever there are significant changes in your life or circumstances. This includes buying a new car, getting married or divorced, moving to a new location, or adding a young driver to your policy. Regular reviews ensure that your coverage remains adequate and that you’re not paying for coverage you no longer need.

What are some common discounts offered by auto insurance providers?

+Common discounts offered by auto insurance providers include multi-policy discounts (bundling home and auto insurance), multi-car discounts (insuring multiple vehicles), safe driver discounts (for maintaining a clean driving record), good student discounts (for young drivers with good grades), and loyalty discounts (for long-term policyholders). It’s worth shopping around and asking about available discounts to ensure you’re getting the best value.

How do I file a claim with my auto insurance provider?

+The process of filing a claim can vary slightly between insurance providers, but generally, you’ll need to contact your insurer’s claims department as soon as possible after an accident or incident. They’ll guide you through the necessary steps, which may include providing details of the accident, taking photos of the damage, and arranging for an inspection or repair. It’s important to cooperate fully with your insurer and provide all the necessary information to facilitate a smooth claims process.

What factors can impact my auto insurance rates?

+Several factors can influence your auto insurance rates, including your age, gender, driving record, credit score, the type of vehicle you drive, and the location where you reside. Additionally, the coverage options you choose and any discounts you qualify for can also impact your rates. It’s essential to shop around and compare quotes from multiple providers to find the most competitive rates for your specific circumstances.