Online Motor Insurance Quotation

In today's digital age, obtaining an online motor insurance quotation has become an efficient and convenient process for vehicle owners. With just a few clicks, you can explore various insurance options, compare prices, and make informed decisions about your coverage. This article aims to provide an in-depth guide on how to navigate the world of online motor insurance quotations, offering valuable insights and tips to ensure you find the best policy for your needs.

Understanding the Process of Online Motor Insurance Quotations

The journey towards securing the right motor insurance begins with an understanding of the online quotation process. It’s a straightforward yet crucial step that sets the foundation for your insurance experience. Here’s a step-by-step breakdown to help you navigate this process seamlessly.

Step 1: Choosing a Reputable Insurance Provider

The first step in your online motor insurance quotation journey is selecting a reliable insurance company. With numerous options available, it’s essential to conduct thorough research. Look for providers with a solid reputation, positive customer reviews, and a history of prompt claim settlements. Consider factors such as financial stability, the range of coverage options, and any additional benefits or perks they offer.

For instance, some insurance companies provide loyalty rewards, discounts for safe driving, or access to a network of approved repairers. These added benefits can make a significant difference in your overall insurance experience.

Step 2: Gathering Essential Information

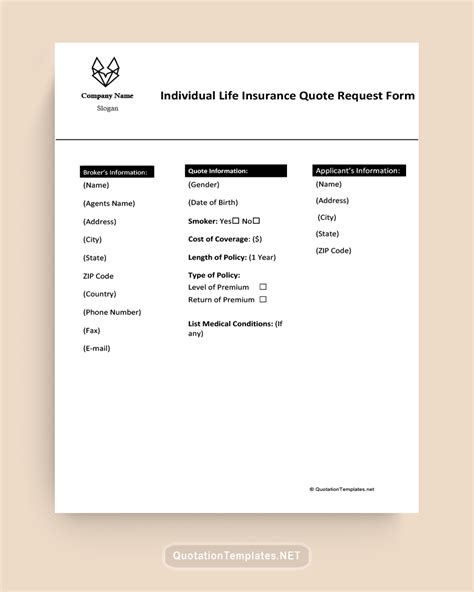

Before you begin the quotation process, gather all the necessary information about your vehicle and driving history. This includes details such as the make, model, and year of your vehicle, your personal information (name, date of birth, contact details), and your driving history (any previous claims, accidents, or traffic violations). Having this information readily available will streamline the quotation process and ensure accuracy.

Step 3: Completing the Online Quotation Form

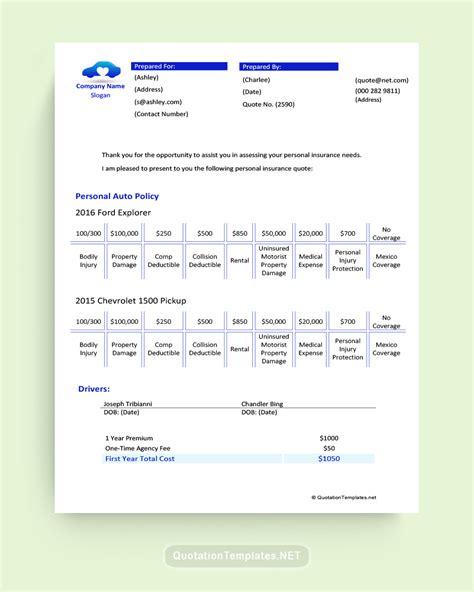

Once you’ve selected your insurance provider and gathered the required information, it’s time to complete the online quotation form. This form typically includes sections where you provide details about your vehicle, your personal information, and your driving history. Ensure you provide accurate and honest information to receive an accurate quotation.

Some insurance providers may also ask additional questions to tailor the quotation to your specific needs. For example, they might inquire about your annual mileage, the primary use of your vehicle (commuting, business, or pleasure), or any modifications made to your vehicle. Providing detailed and truthful responses will help you receive a quotation that aligns with your actual insurance requirements.

Step 4: Reviewing and Comparing Quotations

After submitting your online quotation form, you will receive multiple quotations from the insurance provider. Take the time to review each quotation carefully, comparing the coverage limits, deductibles, and any additional features or exclusions. Pay close attention to the fine print to ensure you understand the terms and conditions of each policy.

It’s important to compare quotations not only based on price but also on the level of coverage and the reputation of the insurance provider. While a lower price may be appealing, it’s crucial to consider the overall value and the financial stability of the insurer. Opting for a well-established insurer with a solid reputation can provide peace of mind and ensure seamless claim settlements in the future.

Maximizing Your Online Motor Insurance Quotation Experience

Now that you have a solid understanding of the online motor insurance quotation process, let’s delve into some expert tips and strategies to enhance your quotation experience and ensure you make the most informed decision.

Tip 1: Explore Different Coverage Options

When obtaining online quotations, it’s essential to explore the various coverage options available. Different insurance providers offer a range of coverage levels, from basic liability insurance to comprehensive policies that include collision, comprehensive, and additional perks like roadside assistance or rental car coverage.

Consider your specific needs and the value of your vehicle when choosing coverage options. For instance, if you own a classic or high-value vehicle, comprehensive coverage might be more suitable to protect against potential damages. On the other hand, if you have an older vehicle with a lower market value, basic liability coverage could be a more cost-effective choice.

Tip 2: Utilize Comparison Websites

To streamline your quotation process and make it more efficient, consider using comparison websites. These platforms allow you to enter your vehicle and personal information once and receive multiple quotations from different insurance providers. Comparison websites provide a convenient way to compare prices, coverage options, and the reputation of various insurers in one place.

However, it’s important to note that comparison websites may not always display all available insurance providers. Therefore, it’s beneficial to conduct additional research and directly explore the websites of reputable insurance companies to ensure you have a comprehensive understanding of the market.

Tip 3: Bundle Your Insurance Policies

If you own multiple vehicles or have other insurance needs, such as home or life insurance, consider bundling your policies with the same insurance provider. Many providers offer discounts and incentives for customers who bundle their insurance needs. By doing so, you can potentially save money and streamline your insurance management process.

Additionally, bundling your insurance policies can provide peace of mind, as you’ll have a single point of contact for all your insurance needs. This simplifies the claims process and ensures a consistent level of service across your various policies.

Tip 4: Leverage Discounts and Promotions

Insurance providers often offer discounts and promotions to attract new customers or reward existing ones. Keep an eye out for these opportunities, as they can significantly reduce your insurance premiums. Common discounts include safe driver discounts, loyalty rewards, multi-policy discounts, and discounts for completing defensive driving courses.

When obtaining online quotations, be sure to inquire about any available discounts and promotions. Insurance providers may also offer temporary promotions, such as discounts for signing up online or for a limited time period. Taking advantage of these opportunities can help you secure a more affordable insurance policy.

Tip 5: Understand Your Deductibles

Deductibles are an essential aspect of your motor insurance policy, as they directly impact your out-of-pocket expenses in the event of a claim. When reviewing quotations, pay close attention to the deductibles associated with each policy. A higher deductible typically results in a lower premium, while a lower deductible leads to a higher premium.

It’s crucial to strike a balance between your deductible and your financial comfort level. While a higher deductible can save you money on your premiums, it means you’ll have to pay more out of pocket if you need to make a claim. On the other hand, a lower deductible provides more financial protection but comes at a higher premium cost.

Performance Analysis and Future Implications

Now that we’ve explored the process and tips for obtaining online motor insurance quotations, let’s delve into a performance analysis and discuss the future implications of this evolving industry.

Performance Analysis

The online motor insurance quotation process has revolutionized the way vehicle owners shop for insurance. It has brought increased transparency, convenience, and efficiency to the insurance landscape. With just a few clicks, consumers can compare multiple quotations from different providers, ensuring they make informed decisions about their coverage.

The availability of online quotations has also empowered consumers to take control of their insurance journey. They can easily explore various coverage options, understand the terms and conditions, and make comparisons without feeling pressured by insurance agents. This shift in power has led to a more competitive market, driving insurance providers to offer better rates and services to attract customers.

Future Implications

The future of online motor insurance quotations looks promising, with ongoing technological advancements and a growing emphasis on digital transformation. Here are some key trends and developments to watch out for:

- Artificial Intelligence (AI) Integration: AI technologies are expected to play a significant role in the insurance industry, including the online quotation process. AI-powered chatbots and virtual assistants can enhance customer service, provide personalized recommendations, and streamline the quotation journey. These technologies can offer real-time assistance, answer common queries, and guide customers through the process, making it even more efficient and user-friendly.

- Data-Driven Personalization: With the increasing availability of data and advanced analytics, insurance providers can offer more personalized quotations. By analyzing customer data, such as driving behavior, vehicle usage patterns, and even weather conditions, insurers can provide tailored coverage options and pricing. This level of personalization can lead to more accurate quotations and a better overall insurance experience for consumers.

- Digital Onboarding and Verification: The online quotation process is expected to become even more seamless with the integration of digital onboarding and verification technologies. Customers will be able to complete the entire quotation journey digitally, including submitting necessary documents and verifying their identity remotely. This not only saves time but also reduces the administrative burden for both customers and insurance providers.

- Enhanced Claims Management: The future of online motor insurance quotations is closely tied to improved claims management. Insurance providers are investing in digital solutions to streamline the claims process, making it faster and more efficient. From online claim submission to real-time claim tracking and updates, the digital transformation of claims management will further enhance the overall insurance experience.

Conclusion

Obtaining an online motor insurance quotation is a crucial step in securing the right coverage for your vehicle. By understanding the process, exploring different coverage options, and leveraging expert tips, you can navigate the quotation journey with confidence. Remember to compare quotations, understand your deductibles, and take advantage of discounts and promotions to find the best value for your insurance needs.

As the insurance industry continues to evolve, the future of online motor insurance quotations looks bright. With technological advancements and a focus on digital transformation, the process will become even more efficient, personalized, and customer-centric. Stay informed about the latest developments and embrace the convenience and benefits of online quotations to make informed decisions about your motor insurance.

How long does the online motor insurance quotation process typically take?

+The online motor insurance quotation process is designed to be quick and efficient. On average, it takes about 10 to 15 minutes to complete the quotation form and receive initial quotations. However, the actual time may vary depending on the complexity of your insurance needs and the number of providers you’re considering.

Can I obtain multiple quotations from different insurance providers at once?

+Yes, you can easily obtain multiple quotations from different insurance providers by using comparison websites or directly visiting the websites of various insurers. This allows you to compare prices, coverage options, and reputation in one place, making it convenient to find the best deal.

What factors influence the cost of my motor insurance quotation?

+Several factors influence the cost of your motor insurance quotation, including the make and model of your vehicle, your driving history, the coverage options you choose, and any additional features or endorsements. Additionally, your age, gender, and location can also impact the quotation price.

How often should I review and update my motor insurance policy?

+It’s recommended to review your motor insurance policy annually or whenever significant changes occur in your life or driving habits. Factors such as getting married, adding a teen driver to your policy, or purchasing a new vehicle can impact your insurance needs and premiums. Regularly reviewing your policy ensures you have adequate coverage and are taking advantage of any applicable discounts.

What should I do if I have questions or need assistance during the online quotation process?

+Most insurance providers offer customer support during the online quotation process. You can typically find a live chat or contact form on their website to reach out for assistance. Additionally, many providers have comprehensive FAQs or help sections that address common queries. If you prefer, you can also contact their customer service team via phone or email for personalized assistance.