Auto Insurance Best Rate

Finding the best auto insurance rates can be a challenging task, but with the right approach and knowledge, you can navigate the insurance market effectively. This comprehensive guide will delve into the factors that influence insurance rates, provide practical tips for securing the most competitive deals, and offer valuable insights to help you make informed decisions.

Understanding Auto Insurance Rates

Auto insurance rates are influenced by a multitude of factors, each playing a significant role in determining the cost of your coverage. These factors can vary depending on your personal circumstances, the vehicle you drive, and the location where you reside.

Key Factors Affecting Insurance Rates

Personal Factors: Your age, gender, driving history, and credit score can all impact your insurance rates. Younger drivers, for instance, often face higher premiums due to their perceived higher risk of accidents. Additionally, a history of accidents or traffic violations can lead to increased insurance costs.

Vehicle Characteristics: The make, model, and age of your vehicle are crucial considerations. Sports cars and luxury vehicles generally attract higher insurance premiums due to their higher repair costs and potential for theft. Conversely, safer, more economical vehicles may result in lower insurance rates.

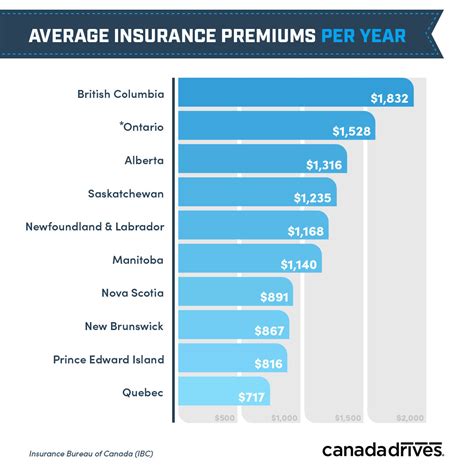

Location and Usage: Where you live and how you use your vehicle can affect your insurance rates. Urban areas with higher population densities and more traffic may have higher rates due to the increased risk of accidents. Similarly, if you use your vehicle for business purposes or commute long distances, your insurance costs may be higher.

| Factor | Impact on Rates |

|---|---|

| Age and Gender | Younger drivers and males often face higher premiums. |

| Driving History | Clean records lead to lower rates; accidents and violations increase costs. |

| Vehicle Type | Sports cars and luxury vehicles cost more to insure. |

| Location | Urban areas and high-traffic regions often have higher rates. |

| Usage | Business use or long commutes can increase insurance costs. |

Tips for Securing the Best Auto Insurance Rates

When it comes to finding the best auto insurance rates, a proactive and informed approach can make a significant difference. Here are some practical tips to help you secure the most competitive deals:

Shop Around and Compare Quotes

One of the most effective ways to find the best auto insurance rates is to shop around and compare quotes from multiple providers. Insurance companies use different algorithms and factors to calculate premiums, so getting multiple quotes can help you identify the most affordable options.

Utilize online comparison tools and websites that aggregate insurance quotes. These platforms can provide a quick and efficient way to compare rates from various insurers. Additionally, reach out to local insurance agents or brokers who can offer personalized advice and quote comparisons tailored to your needs.

Understand Your Coverage Needs

Before obtaining quotes, it’s essential to understand your specific coverage needs. Consider the type of coverage you require, such as liability, collision, comprehensive, or additional coverage options like rental car reimbursement or roadside assistance.

Assess your financial situation and determine the level of coverage you can afford. While it's tempting to opt for the lowest premium, ensure that the coverage provided aligns with your needs and provides adequate protection in the event of an accident or other unforeseen circumstances.

Explore Discounts and Savings Opportunities

Insurance providers often offer a variety of discounts and savings opportunities to attract customers and encourage loyalty. Some common discounts include:

- Safe Driver Discounts: Many insurers provide discounts for drivers with clean records and no recent accidents or violations.

- Multi-Policy Discounts: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can lead to significant savings.

- Loyalty Discounts: Staying with the same insurer for an extended period may result in loyalty discounts or reduced rates.

- Usage-Based Insurance: Some insurers offer programs that monitor your driving habits and provide discounts based on safe driving practices.

- Student Discounts: Young drivers who maintain good grades or participate in approved driver training programs may be eligible for discounts.

When obtaining quotes, inquire about the discounts available and ensure you meet the eligibility criteria to take advantage of these savings opportunities.

Consider High Deductibles

Opting for a higher deductible can significantly reduce your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you assume more financial responsibility in the event of an accident, which can lead to lower monthly premiums.

However, it's important to choose a deductible amount that you can comfortably afford. If you frequently make small claims, a high deductible may not be the best option. Assess your financial situation and risk tolerance to determine the appropriate deductible level for your needs.

Maintain a Good Driving Record

Your driving record is a critical factor in determining your insurance rates. Maintaining a clean driving record with no accidents or violations can lead to significant savings. Avoid aggressive driving behaviors, such as speeding or reckless maneuvers, as these can increase your insurance premiums.

If you have a less-than-perfect driving record, consider taking defensive driving courses or enrolling in safe driving programs. Many insurance companies offer discounts for completing these courses, and they can also help improve your driving skills and reduce the likelihood of future accidents.

Improve Your Credit Score

Believe it or not, your credit score can impact your auto insurance rates. Insurance companies often use credit-based insurance scores to assess the risk of insuring a driver. A higher credit score can indicate financial responsibility and may result in lower insurance premiums.

If you have a low credit score, focus on improving it by paying your bills on time, reducing outstanding debt, and maintaining a positive payment history. While improving your credit score takes time and effort, it can have a positive impact on not only your insurance rates but also other financial aspects of your life.

Use Telematics Devices or Apps

Telematics devices or apps, often referred to as usage-based insurance programs, can provide real-time data on your driving habits and offer personalized insurance rates. These devices monitor factors such as driving speed, acceleration, braking, and mileage, and use this information to calculate your insurance premium.

By adopting safe driving practices and demonstrating responsible driving behavior, you may be eligible for lower insurance rates through these programs. However, it's important to carefully review the terms and conditions of usage-based insurance programs to ensure they align with your privacy and data usage preferences.

Review Your Policy Regularly

Insurance rates can change over time due to various factors, including changes in your personal circumstances, vehicle value, or market conditions. It’s essential to review your auto insurance policy regularly to ensure you’re still getting the best rates and coverage.

Consider re-evaluating your policy annually or whenever there are significant changes in your life, such as purchasing a new vehicle, moving to a different location, or experiencing a life event that may impact your insurance needs. By staying proactive and keeping your policy up-to-date, you can ensure you're getting the most competitive rates and adequate coverage.

The Future of Auto Insurance Rates

The auto insurance industry is continuously evolving, and several trends and technological advancements are shaping the future of insurance rates. Here’s a glimpse into what the future may hold:

Advanced Telematics and Data Analytics

As technology advances, telematics devices and data analytics will play an increasingly significant role in determining insurance rates. Insurance companies will have access to more precise data on driving behaviors, allowing them to offer highly personalized rates based on individual driving patterns.

This level of precision can lead to more accurate risk assessment and potentially lower insurance premiums for safe drivers. However, it also means that drivers with less-than-ideal driving habits may face higher rates.

Autonomous Vehicles and Their Impact

The advent of autonomous vehicles (AVs) is expected to revolutionize the auto insurance industry. With AVs taking over some or all driving tasks, the risk of accidents is expected to decrease significantly. This shift could result in lower insurance premiums for drivers of AVs, as the likelihood of human error-related accidents diminishes.

However, the transition to AVs may also present new challenges and risks, such as cybersecurity threats and liability issues. Insurance companies will need to adapt their policies and pricing models to accommodate these emerging technologies and their associated risks.

Connected Car Technology

Connected car technology, which integrates vehicles with the internet and other devices, is rapidly gaining traction. This technology enables real-time data sharing, remote vehicle diagnostics, and advanced safety features. From an insurance perspective, connected car technology can provide valuable insights into driving behaviors and vehicle performance.

Insurance companies can leverage this data to offer more accurate and tailored insurance rates. For example, they may provide discounts to drivers who consistently demonstrate safe driving practices or have vehicles equipped with advanced safety features. The availability of real-time data can also streamline the claims process, making it more efficient and accurate.

Usage-Based Insurance (UBI) Expansion

Usage-based insurance programs, as mentioned earlier, are expected to gain wider acceptance and become a standard offering by insurance companies. UBI programs provide a more accurate assessment of driving risk by monitoring actual driving behavior rather than relying solely on historical data or demographics.

As UBI programs become more prevalent, insurance rates may become increasingly personalized and reflective of individual driving habits. This shift can lead to more equitable insurance pricing, as safe drivers are rewarded with lower premiums, while high-risk drivers face higher rates based on their actual driving behavior.

Insurance Market Competition and Consumer Empowerment

The insurance market is becoming increasingly competitive, with more players entering the industry and offering innovative insurance products. This competition benefits consumers by driving down insurance rates and providing a wider range of coverage options.

Additionally, with the rise of digital insurance platforms and comparison websites, consumers have greater access to information and can easily compare insurance rates and coverage. This transparency empowers consumers to make more informed decisions and negotiate better rates with insurance providers.

Conclusion: Navigating the Auto Insurance Landscape

Finding the best auto insurance rates requires a combination of knowledge, research, and proactive decision-making. By understanding the factors that influence insurance rates, shopping around for quotes, and exploring discounts and savings opportunities, you can secure the most competitive deals.

As the auto insurance industry evolves, technological advancements and emerging trends will continue to shape the landscape. Advanced telematics, autonomous vehicles, connected car technology, and usage-based insurance programs are set to play pivotal roles in determining insurance rates and offering more personalized coverage options.

Stay informed, review your insurance policy regularly, and adapt to the changing insurance market to ensure you're getting the best rates and coverage for your specific needs. With the right approach, you can navigate the auto insurance landscape with confidence and peace of mind.

How often should I shop around for auto insurance quotes?

+

It’s generally recommended to shop around for auto insurance quotes annually or whenever there are significant changes in your life or circumstances. Regularly reviewing your insurance options ensures you’re getting the best rates and coverage available.

Can I negotiate auto insurance rates with providers?

+

While insurance rates are primarily based on calculated risk factors, you can negotiate certain aspects of your policy. Discuss your coverage needs, driving history, and any applicable discounts with your insurance provider to see if they can offer a more competitive rate.

What factors should I consider when choosing an auto insurance deductible?

+

When selecting an auto insurance deductible, consider your financial situation and risk tolerance. A higher deductible can lead to lower premiums, but it also means you’ll pay more out of pocket in the event of a claim. Assess your ability to cover a higher deductible before making a decision.