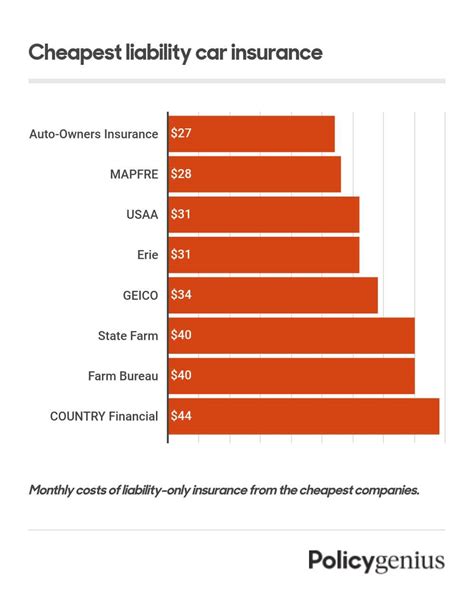

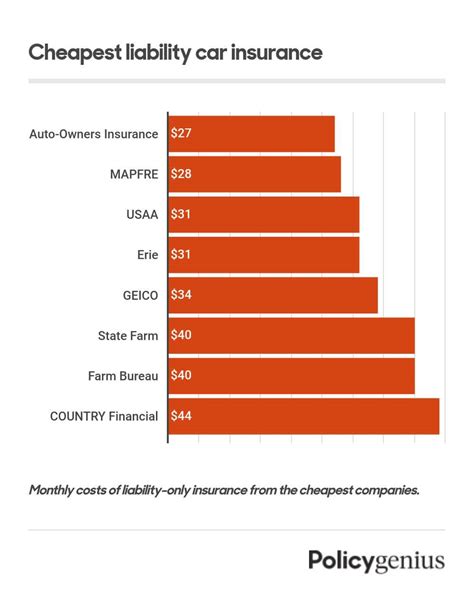

Cheapest Auto Liability Insurance

Finding the cheapest auto liability insurance is a top priority for many drivers, as it not only meets the legal requirements for operating a vehicle but also provides essential financial protection in the event of an accident. With a wide range of insurance providers offering varying rates and coverage options, it's crucial to understand the factors that influence these costs and the steps you can take to secure the most affordable coverage.

Understanding Auto Liability Insurance

Auto liability insurance, a fundamental component of car insurance, covers damages and injuries you cause to others in an accident. It is a mandatory insurance type in most states, ensuring that drivers are financially responsible for any harm they inflict on others while driving. This coverage is crucial for protecting both the policyholder and the public from the potentially devastating financial consequences of an at-fault accident.

The two main types of liability coverage are:

- Bodily Injury Liability: Pays for medical expenses and lost wages of injured parties in an accident you caused.

- Property Damage Liability: Covers the cost of repairing or replacing property, such as other vehicles, fences, buildings, or even rental cars, damaged in an accident for which you are at fault.

Factors Influencing Auto Liability Insurance Costs

The cost of auto liability insurance can vary significantly depending on several key factors, including:

- Location: Insurance rates can differ substantially between states and even within cities. This is influenced by a variety of factors such as traffic congestion, accident rates, and local laws.

- Driving Record: A clean driving record with no accidents or violations typically leads to lower insurance premiums. Conversely, a history of accidents or moving violations can significantly increase your rates.

- Age and Gender: Younger drivers, especially those under 25, often face higher insurance premiums due to their perceived higher risk of accidents. Gender can also play a role, with some insurers charging different rates based on gender-specific accident statistics.

- Vehicle Type: The make, model, and year of your vehicle can impact insurance costs. Sports cars and luxury vehicles, for example, often require higher liability coverage due to their higher repair costs.

- Credit Score: Surprisingly, your credit score can be a significant factor in determining your insurance rates. Many insurers use credit-based insurance scores to assess risk, with higher scores often resulting in lower premiums.

- Insurance Company and Policy: Different insurance companies offer varying rates and coverage options. The specific policy you choose, including deductibles and coverage limits, will also affect the overall cost.

Tips to Find the Cheapest Auto Liability Insurance

Securing the cheapest auto liability insurance requires a combination of research, understanding of your specific needs, and a strategic approach. Here are some steps to guide you:

- Compare Quotes: Obtain quotes from multiple insurance providers to compare rates and coverage. Online quote comparison tools can be a convenient way to do this, but it's also beneficial to speak directly with insurance agents to understand the nuances of each policy.

- Understand Your Coverage Needs: Assess your specific requirements. Consider factors like your vehicle's value, your driving habits, and the level of coverage you feel comfortable with. This ensures you're not overpaying for coverage you don't need.

- Consider Bundle Discounts: If you have multiple vehicles or other insurance needs (such as home or renters insurance), bundling your policies with the same insurer can lead to significant savings.

- Review Your Policy Regularly: Insurance rates can change over time, so it's essential to periodically review your policy and compare it with other options. This ensures you're not paying more than necessary.

- Improve Your Driving Record: A clean driving record is a significant factor in reducing insurance costs. Avoid accidents and moving violations to maintain a positive record and qualify for lower premiums.

- Increase Your Deductible: Opting for a higher deductible can reduce your premium. However, this strategy requires careful consideration, as a higher deductible means you'll pay more out of pocket in the event of a claim.

- Shop Around for Discounts: Many insurance providers offer discounts for various reasons, such as good student discounts, safe driver discounts, loyalty discounts, or discounts for completing a defensive driving course. Make sure to inquire about all applicable discounts when getting quotes.

Real-World Examples and Data

To illustrate the potential savings and the impact of various factors on insurance costs, let's consider a few real-world scenarios:

- A 30-year-old male driver with a clean record in New York City, driving a 2018 Toyota Camry, might expect to pay around $1,200 annually for basic liability coverage. However, the same driver in a rural area of the state could pay significantly less, around $700 annually, due to lower risk factors in that region.

- A 22-year-old female driver with a history of accidents in Los Angeles might pay upwards of $2,000 annually for liability coverage. However, by maintaining a clean record for a few years and considering a higher deductible, she could potentially reduce her premiums to around $1,500.

- Bundling insurance policies can lead to substantial savings. For instance, a family with two vehicles and a home in the suburbs might save up to 25% on their total insurance premiums by bundling their auto, home, and renters insurance with the same provider.

| Scenario | Annual Premium |

|---|---|

| New York City Driver | $1,200 |

| Rural New York Driver | $700 |

| Los Angeles Driver with Accidents | $2,000 |

| Los Angeles Driver with Improved Record | $1,500 |

| Family Bundle Discount | 25% Savings |

The Future of Auto Liability Insurance

The auto insurance landscape is continually evolving, driven by technological advancements, changing consumer behaviors, and emerging risks. Here are some trends and considerations for the future of auto liability insurance:

- Telematics and Usage-Based Insurance: With the advent of connected cars and telematics devices, insurers are increasingly offering usage-based insurance policies. These policies use real-time driving data to assess risk and set premiums, potentially leading to more accurate pricing and incentives for safe driving.

- Automated Vehicles and Liability: As autonomous vehicles become more prevalent, the question of liability in accidents will shift. Insurers and regulators are already grappling with this issue, and it's likely that liability insurance policies will need to adapt to cover the unique risks and responsibilities of automated driving.

- Changing Consumer Preferences: With the rise of ride-sharing and car-sharing services, some individuals are opting out of car ownership altogether. This trend could impact the demand for auto liability insurance and may lead to the development of new insurance products tailored to these changing transportation preferences.

- Regulatory Changes: Government regulations play a significant role in shaping the auto insurance industry. Any changes in minimum liability requirements, or the introduction of new laws regarding autonomous vehicles or ride-sharing, will have a direct impact on insurance policies and costs.

- Technological Innovations: Advances in technology, such as improved safety features in vehicles and the development of predictive analytics, can reduce the frequency and severity of accidents. This could lead to lower insurance costs over time, as insurers benefit from reduced claims.

In conclusion, while finding the cheapest auto liability insurance is a worthwhile pursuit, it's essential to balance cost with adequate coverage. By understanding the factors that influence insurance costs and taking a strategic approach to shopping for insurance, drivers can secure the best value for their needs. As the auto insurance landscape continues to evolve, staying informed about emerging trends and innovations will be key to making informed choices about liability insurance.

What is the minimum liability insurance required by law in the US?

+The minimum liability insurance requirements vary by state. In most states, drivers are required to carry at least 25,000 in bodily injury liability coverage per person, 50,000 per accident, and $25,000 in property damage liability coverage. However, some states have higher minimums, and it’s essential to check the specific requirements for your state.

Can I lower my auto liability insurance premiums without sacrificing coverage?

+Absolutely. You can explore various options to reduce your premiums while maintaining adequate coverage. These include shopping around for quotes, considering bundle discounts, improving your driving record, and increasing your deductible (with careful consideration). It’s crucial to strike a balance between cost and coverage to ensure you’re protected financially.

What are some common discounts offered by auto insurance providers?

+Insurance providers offer a range of discounts, including safe driver discounts, good student discounts, loyalty discounts, and discounts for completing defensive driving courses. Some insurers also provide discounts for bundling multiple policies, such as auto and home insurance, or for having certain safety features in your vehicle.