Insurance Copay

The world of insurance can often be a confusing maze, especially when navigating the complexities of copays and their implications. This comprehensive guide aims to demystify the concept of insurance copays, shedding light on what they are, how they work, and their significance in the realm of healthcare and financial planning. By understanding copays, individuals can make more informed decisions about their insurance coverage and healthcare choices.

Understanding Insurance Copays

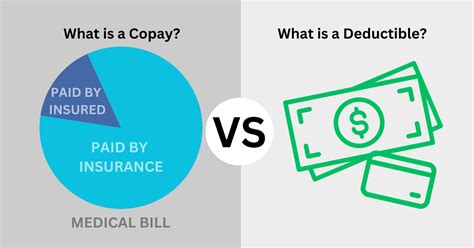

At its core, an insurance copay is a predetermined, fixed amount that an insured individual pays out of pocket at the time of receiving a healthcare service. This copayment is a standard practice in many healthcare insurance plans and serves as a form of cost-sharing between the insurance provider and the policyholder.

The concept of copays is designed to encourage individuals to be mindful of their healthcare choices and to deter unnecessary or excessive utilization of medical services. By requiring a small payment for each service, copays create a financial incentive for individuals to seek healthcare only when necessary, thereby helping to manage overall healthcare costs.

The Mechanics of Copays

Insurance copays operate on a straightforward principle: when an insured individual receives a covered healthcare service, they are responsible for paying a set amount, known as the copay, directly to the healthcare provider at the time of service. The remaining balance is then billed to the insurance company, which covers the majority of the cost based on the terms of the insurance policy.

For example, imagine a scenario where an individual has an insurance plan with a $20 copay for primary care physician visits and a $40 copay for specialist visits. If this person visits their primary care physician for a routine check-up, they would pay $20 at the time of the visit, and the insurance company would cover the remaining costs. Similarly, for a visit to a specialist, the individual would pay the higher copay of $40, with the insurance company covering the rest.

| Healthcare Service | Copay Amount |

|---|---|

| Primary Care Physician Visit | $20 |

| Specialist Visit | $40 |

Variations in Copay Structures

While the basic concept of copays remains consistent, the specifics can vary significantly across different insurance plans. Some plans may have a single copay amount for all services, while others might have different copays for different types of services, as illustrated in the table above.

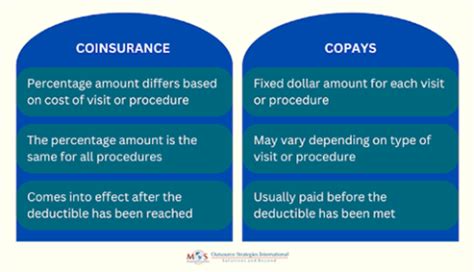

Furthermore, copays can be structured in various ways. Some plans may have a single copay amount for each service, regardless of the cost of the service. Other plans might have a percentage-based copay, where the insured individual pays a certain percentage of the total cost of the service. For example, an insurance plan with a 20% copay would require the individual to pay 20% of the total cost of a medical procedure, with the insurance company covering the remaining 80%.

The Impact of Copays on Healthcare Decisions

Insurance copays play a crucial role in influencing an individual’s healthcare decisions and behaviors. By introducing a financial barrier, copays can deter individuals from seeking unnecessary medical care, thereby helping to control healthcare costs for both the individual and the insurance provider.

Encouraging Cost-Effective Healthcare Choices

Copays encourage individuals to be thoughtful about their healthcare choices. When faced with a small copay, individuals are more likely to consider the necessity and urgency of a healthcare service before scheduling an appointment or undergoing a procedure. This can lead to a more efficient and cost-effective utilization of healthcare resources.

For instance, an individual with a $20 copay for primary care visits might think twice before scheduling an appointment for a minor ailment that could potentially resolve on its own or be managed with simple home remedies. This not only saves the individual money but also reduces the strain on healthcare systems by reserving limited resources for more critical cases.

Promoting Preventive Care

Insurance copays, when structured appropriately, can also promote preventive care. Many insurance plans offer reduced or waived copays for preventive services, such as annual check-ups, immunizations, and certain screenings. By making these services more affordable, copays encourage individuals to prioritize their health and take proactive measures to maintain their well-being.

For example, an insurance plan that waives copays for annual physical exams and basic screenings can incentivize individuals to undergo these preventive measures, potentially catching health issues early on when they are more manageable and less costly to treat.

Copays and Financial Planning

Insurance copays have a significant impact on an individual’s financial planning, especially when it comes to managing healthcare expenses. Understanding how copays work and how they can vary across different insurance plans is crucial for making informed decisions about insurance coverage and budgeting for healthcare costs.

Budgeting for Copays

When selecting an insurance plan, it’s essential to consider the copay structure and how it aligns with your anticipated healthcare needs. Plans with higher copays may offer lower monthly premiums, making them more cost-effective for individuals who anticipate minimal healthcare utilization. On the other hand, plans with lower copays can be more advantageous for those who anticipate more frequent healthcare services.

Budgeting for copays involves more than just understanding the copay amounts. It also requires considering the frequency of healthcare visits and the potential costs of specialized services or procedures. By estimating these costs and factoring in copays, individuals can create a realistic budget for their healthcare expenses.

Maximizing Insurance Benefits

Understanding copays can also help individuals maximize their insurance benefits. Many insurance plans offer a range of services and benefits, and by knowing the copay structure, individuals can strategically utilize these benefits to their advantage.

For example, if an insurance plan offers a reduced copay for visits to an in-network provider, individuals can prioritize using these providers to save on out-of-pocket costs. Similarly, if certain services have a higher copay, individuals might consider alternatives or seek preventive measures to avoid the need for these services altogether.

The Future of Copays

The landscape of insurance copays is constantly evolving, driven by changes in healthcare policies, advancements in medical technology, and shifts in consumer preferences. As the healthcare industry adapts to new challenges and opportunities, the role and structure of copays are likely to change as well.

Trends in Copay Structures

One notable trend in copay structures is the increasing adoption of value-based copays. Value-based copays are designed to incentivize the use of cost-effective and high-quality healthcare services. These copays can vary based on the provider, the type of service, and even the outcomes achieved. By rewarding providers and patients for choosing efficient and effective care, value-based copays aim to improve overall healthcare quality while managing costs.

Another trend is the shift towards more personalized copay structures. With the advent of digital health technologies and personalized medicine, insurance companies are exploring ways to offer tailored copay plans that align with an individual's unique healthcare needs and preferences. This could involve offering customized copays for specific services or conditions, providing greater flexibility and control over healthcare costs.

The Role of Technology

Technology is playing an increasingly significant role in shaping the future of insurance copays. Digital health platforms and apps are making it easier for individuals to access their insurance information, including copay amounts and coverage details. These tools can provide real-time updates on copays, helping individuals make more informed decisions about their healthcare choices.

Additionally, technology is enabling more efficient and accurate billing processes, ensuring that copays are applied correctly and consistently. This not only improves the overall healthcare experience for individuals but also helps insurance companies manage costs more effectively.

Conclusion

Insurance copays are a vital component of the healthcare landscape, influencing individual healthcare decisions, financial planning, and the overall cost structure of healthcare systems. By understanding how copays work and their potential impact, individuals can make more informed choices about their insurance coverage and healthcare utilization.

As the healthcare industry continues to evolve, the role and structure of insurance copays will likely adapt to meet the changing needs and preferences of consumers. With a keen understanding of these dynamics, individuals can navigate the complex world of insurance with greater confidence and financial security.

What is an insurance copay and how does it work?

+An insurance copay is a predetermined, fixed amount that an insured individual pays out of pocket at the time of receiving a healthcare service. It’s a form of cost-sharing between the insurance provider and the policyholder. When an insured person receives a covered service, they pay the copay directly to the healthcare provider, and the insurance company covers the remaining costs.

How do copays influence healthcare decisions and behaviors?

+Copays introduce a financial barrier that encourages individuals to be mindful of their healthcare choices. By requiring a small payment for each service, copays deter unnecessary or excessive utilization of medical services. This helps manage overall healthcare costs and promotes cost-effective healthcare decisions.

Can copays promote preventive care?

+Absolutely! Many insurance plans offer reduced or waived copays for preventive services, such as annual check-ups and screenings. By making these services more affordable, copays encourage individuals to prioritize their health and take proactive measures to maintain their well-being.

How do copays impact financial planning for healthcare expenses?

+Understanding copays is crucial for financial planning. It involves considering the copay structure and how it aligns with your anticipated healthcare needs. By estimating these costs and factoring in copays, individuals can create a realistic budget for their healthcare expenses.

What are some emerging trends in copay structures?

+Emerging trends include the adoption of value-based copays, which incentivize the use of cost-effective and high-quality healthcare services. Additionally, there’s a shift towards more personalized copay structures, offering customized copays for specific services or conditions.