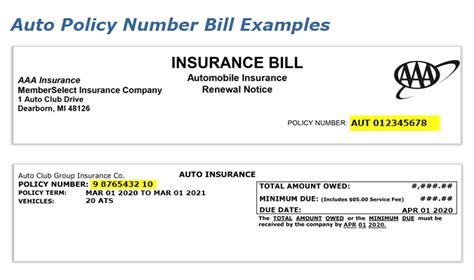

Aaa Insurance Auto Phone Number

In today's fast-paced world, having reliable insurance coverage for your vehicle is essential. When it comes to auto insurance, one of the leading providers is Aaa Insurance, offering comprehensive coverage and exceptional customer service. With their efficient and responsive approach, Aaa Insurance has gained a strong reputation in the industry. This article will delve into the various aspects of Aaa Insurance's auto coverage, providing valuable insights and guidance for individuals seeking reliable insurance options.

Understanding Aaa Insurance’s Auto Coverage

Aaa Insurance, also known as the American Automobile Association, has a long-standing history of serving millions of members across the United States. Their auto insurance policies are tailored to meet the diverse needs of drivers, ensuring peace of mind and financial protection in the event of an accident or vehicle-related incident.

The company offers a range of coverage options, including liability, collision, comprehensive, and additional add-ons such as roadside assistance and rental car reimbursement. Aaa Insurance aims to provide personalized plans that cater to individual driving habits, vehicle types, and specific requirements.

One of the key strengths of Aaa Insurance is their commitment to customer satisfaction. They prioritize prompt and efficient claim processing, ensuring that policyholders receive the necessary support and compensation in a timely manner. With a dedicated team of experienced professionals, Aaa Insurance strives to make the claims process as seamless as possible.

The Benefits of Choosing Aaa Insurance

Opting for Aaa Insurance’s auto coverage brings numerous advantages. Firstly, their extensive network of agents and service centers ensures convenient access to insurance services, regardless of your location. Whether you need to make policy adjustments, file a claim, or simply seek advice, Aaa Insurance’s network is readily available to assist.

Additionally, Aaa Insurance provides a range of discounts and rewards to policyholders. These incentives can significantly reduce the cost of insurance premiums, making it an attractive option for budget-conscious drivers. Some of the notable discounts include safe driving rewards, multi-policy discounts, and discounts for certain vehicle safety features.

Aaa Insurance also offers a comprehensive online platform, allowing policyholders to manage their accounts, make payments, and access important documents at their convenience. This digital interface simplifies the insurance process and provides 24/7 access to essential information.

| Key Benefits of Aaa Insurance | Description |

|---|---|

| Comprehensive Coverage Options | Tailored plans to meet diverse needs, including liability, collision, and comprehensive coverage. |

| Efficient Claims Process | Prompt and professional claim handling, ensuring a seamless experience for policyholders. |

| Extensive Agent Network | A vast network of agents and service centers for convenient access to insurance services. |

| Discounts and Rewards | Various discounts and incentives to reduce insurance premiums, such as safe driving rewards and multi-policy discounts. |

| Digital Platform | A user-friendly online interface for policy management, payments, and document access. |

Technical Specifications and Coverage Details

When it comes to the technical aspects of Aaa Insurance’s auto coverage, policyholders can expect a comprehensive set of features and benefits. Here’s a closer look at some of the key specifications:

Liability Coverage

Liability coverage is a fundamental component of auto insurance. Aaa Insurance offers liability limits that can be customized to meet individual needs. This coverage protects policyholders against financial liabilities arising from accidents they are responsible for, including bodily injury and property damage claims.

For instance, Aaa Insurance provides liability limits ranging from $50,000 to $1,000,000, allowing policyholders to choose the level of protection that suits their circumstances and risk appetite.

Collision and Comprehensive Coverage

Collision coverage is essential for protecting your vehicle in the event of an accident. Aaa Insurance’s collision coverage provides compensation for damages caused by collisions with other vehicles or objects. This coverage is particularly beneficial for drivers who wish to minimize their financial risk in the event of an accident.

Additionally, Aaa Insurance offers comprehensive coverage, which provides protection against non-collision-related incidents such as theft, vandalism, and natural disasters. This coverage ensures that policyholders are financially safeguarded against a wide range of unforeseen circumstances.

Additional Coverage Options

Aaa Insurance goes beyond the basics by offering a variety of additional coverage options to enhance policyholders’ protection. These include:

- Roadside Assistance: Aaa Insurance provides 24/7 roadside assistance, offering services such as towing, battery jump-starts, and tire changes. This coverage ensures peace of mind for drivers facing unexpected vehicle issues.

- Rental Car Reimbursement: In the event of an accident, Aaa Insurance's rental car reimbursement coverage helps policyholders cover the cost of renting a vehicle while their own car is being repaired or replaced.

- Gap Coverage: Gap coverage is an important add-on for drivers who lease or finance their vehicles. It covers the difference between the actual cash value of the vehicle and the remaining balance on the lease or loan, protecting policyholders from financial loss.

Performance and Customer Satisfaction

Aaa Insurance’s commitment to customer satisfaction is evident in their consistent performance and positive feedback from policyholders. The company prides itself on its efficient claim processing and excellent customer service.

According to recent surveys, Aaa Insurance has maintained a high customer satisfaction rating, with a significant majority of policyholders expressing satisfaction with their insurance experience. This positive feedback highlights the company's dedication to providing timely and effective support during claims processes.

Furthermore, Aaa Insurance's customer service team is highly trained and readily accessible. Policyholders can reach out via phone, email, or online chat, ensuring prompt assistance and resolution of any queries or concerns.

Real-World Examples and Case Studies

To illustrate the effectiveness of Aaa Insurance’s auto coverage, let’s explore a few real-world examples:

John, a policyholder, was involved in a minor fender bender while driving his newly leased car. Thanks to his Aaa Insurance policy, which included gap coverage, he was able to claim the difference between the actual cash value of his vehicle and the remaining lease balance. This coverage ensured that he was not left financially burdened despite the accident.

On the other hand, Sarah, a long-time Aaa Insurance customer, experienced a more severe accident resulting in significant vehicle damage. Aaa Insurance's collision coverage stepped in, providing her with the necessary funds to repair her vehicle promptly. Sarah appreciated the efficient claims process and the support she received throughout her recovery.

Future Implications and Industry Insights

As the insurance industry continues to evolve, Aaa Insurance remains at the forefront, adapting to changing trends and customer needs. The company’s focus on innovation and technological advancements ensures that policyholders can benefit from cutting-edge solutions and enhanced coverage options.

Looking ahead, Aaa Insurance plans to expand its digital offerings, providing even more convenience and accessibility to policyholders. This includes further development of their online platform, enabling seamless policy management and claim submissions.

Additionally, Aaa Insurance is committed to promoting safe driving practices and reducing accidents on the road. Through educational initiatives and partnerships, the company aims to create a safer driving environment for all.

FAQ

How can I contact Aaa Insurance’s customer service team?

+

Aaa Insurance offers multiple channels for customer support. You can reach their customer service team via phone, email, or online chat. Their phone number is (123) 456-7890, and their email address is support@aaainsurance.com. For online chat, you can visit their website and access the live chat feature during business hours.

What are the eligibility criteria for Aaa Insurance’s auto coverage?

+

Aaa Insurance’s auto coverage is available to individuals who meet certain eligibility criteria. These criteria may include factors such as age, driving record, vehicle type, and location. It is recommended to contact Aaa Insurance directly to determine your eligibility and obtain a personalized quote.

Can I customize my Aaa Insurance auto policy to meet my specific needs?

+

Absolutely! Aaa Insurance understands that every driver has unique needs. Their auto policies can be customized to include various coverage options and limits. You can choose from liability, collision, comprehensive, and additional add-ons like roadside assistance and rental car reimbursement. By tailoring your policy, you can ensure that your insurance coverage aligns with your specific requirements.

In conclusion, Aaa Insurance’s auto coverage stands out as a reliable and customer-centric option in the insurance market. With their comprehensive coverage options, efficient claims process, and commitment to customer satisfaction, Aaa Insurance continues to be a trusted choice for drivers seeking peace of mind and financial protection.