Life Insurance What

Life insurance is a crucial financial instrument that provides a safety net for individuals and their families. It offers a sense of security and peace of mind, knowing that loved ones will be financially protected in the event of an untimely demise. In an era where unforeseen circumstances can arise, having adequate life insurance coverage is more important than ever. This article aims to delve into the world of life insurance, exploring its various aspects, benefits, and implications to help readers make informed decisions regarding their financial future.

Understanding the Basics of Life Insurance

Life insurance is a contract between an individual (the policyholder) and an insurance company. The policyholder pays a premium, typically on a regular basis, in exchange for a promise of financial protection for their beneficiaries in the event of their death. This protection comes in the form of a death benefit, which is a lump-sum payment made to the designated beneficiaries upon the policyholder’s passing.

The primary purpose of life insurance is to ensure that the policyholder's loved ones are provided for financially, even if they are no longer around to support them. This can cover a wide range of needs, from paying off debts and covering funeral expenses to providing ongoing financial support for dependents and ensuring their future stability.

Types of Life Insurance Policies

There are several types of life insurance policies available, each with its own unique features and benefits. Understanding the different options is crucial in selecting the right coverage for your specific needs.

Term Life Insurance: This is a straightforward and affordable option that provides coverage for a specified term, typically ranging from 10 to 30 years. During the term, the policyholder pays regular premiums, and if they pass away during this period, their beneficiaries receive the death benefit. Term life insurance is often chosen when there is a specific financial need, such as covering mortgage payments or supporting children until they become independent.

| Term Length | Coverage Amount | Premium Cost |

|---|---|---|

| 10 years | $500,000 | $25/month |

| 20 years | $1,000,000 | $50/month |

| 30 years | $2,000,000 | $80/month |

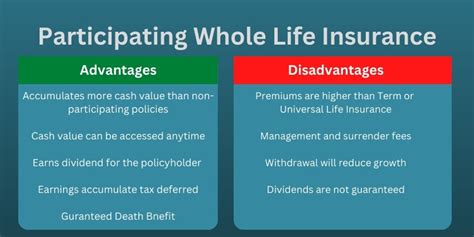

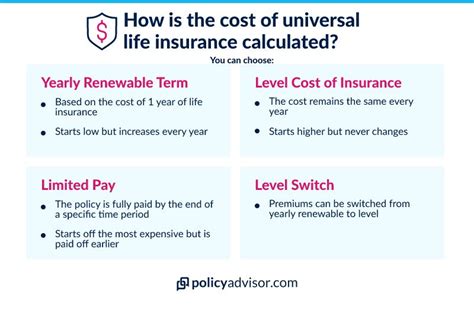

Permanent Life Insurance: Unlike term life insurance, permanent life insurance provides coverage for the policyholder's entire life, as long as premiums are paid. This type of policy accumulates cash value over time, which can be borrowed against or withdrawn while the policy is in force. Permanent life insurance often includes whole life, universal life, and variable life policies, each with its own variations in terms of flexibility and investment options.

| Policy Type | Coverage Amount | Premium Cost | Cash Value Growth |

|---|---|---|---|

| Whole Life | $500,000 | $150/month | Guaranteed fixed rate |

| Universal Life | $750,000 | $200/month | Flexible, based on market performance |

| Variable Life | $1,000,000 | $250/month | Varies with investment choices |

Riders and Add-Ons: Many life insurance policies offer additional coverage options, known as riders or add-ons, which can be purchased to enhance the policy's benefits. These include waivers of premium in case of disability, accelerated death benefits for terminal illnesses, and even long-term care coverage. Riders can be tailored to individual needs, providing added protection and peace of mind.

Factors Influencing Life Insurance Premiums

The cost of life insurance premiums can vary significantly depending on several factors. Insurance companies assess these factors to determine the level of risk associated with insuring an individual. Here are some key considerations:

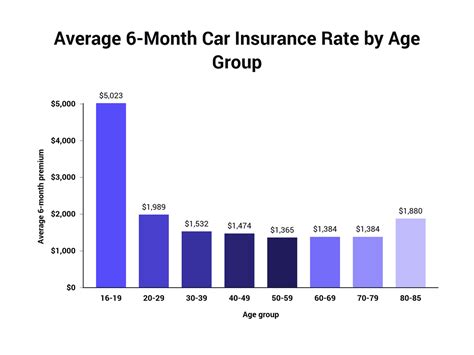

- Age: Younger individuals generally pay lower premiums as they are considered less risky. As you age, the cost of insurance tends to increase.

- Health: Your overall health plays a significant role. Those with pre-existing health conditions or high-risk lifestyles may face higher premiums or even be declined coverage.

- Lifestyle: Factors such as smoking, excessive alcohol consumption, or high-risk hobbies can impact your premium rates.

- Occupation: Certain occupations, especially those involving high-risk activities or exposure to hazardous conditions, may result in higher premiums.

- Coverage Amount: The higher the coverage amount, the higher the premium. It's important to strike a balance between your needs and your budget.

The Benefits of Life Insurance

Life insurance offers a multitude of benefits that extend beyond the financial protection it provides. Here are some key advantages to consider:

Financial Security for Dependents

The primary benefit of life insurance is the financial security it offers to your loved ones. In the event of your passing, the death benefit can ensure that your family’s standard of living is maintained and that they are not burdened with financial hardships.

The death benefit can be used to pay off debts, cover funeral expenses, and provide ongoing support for your spouse, children, or other dependents. It can also be used to fund your children's education, ensuring they have the means to pursue their dreams.

Peace of Mind

Knowing that you have adequate life insurance coverage can bring immense peace of mind. It allows you to focus on your life and goals without the constant worry of what might happen to your loved ones if something were to happen to you.

With life insurance, you can rest assured that your family's future is secured, and they will have the resources to navigate life's challenges. This peace of mind can be invaluable, especially for those with young families or significant financial responsibilities.

Tax Advantages

Life insurance policies often offer tax benefits, both during the policy’s lifetime and upon the death of the policyholder. The cash value in permanent life insurance policies grows tax-deferred, and withdrawals or loans taken against the policy may be tax-free as long as they do not exceed the cost basis.

Additionally, the death benefit from a life insurance policy is generally income tax-free, providing a substantial financial advantage to the beneficiaries. This tax-free benefit can be particularly beneficial when it comes to estate planning and ensuring the preservation of wealth for future generations.

Flexibility and Customization

Life insurance policies offer a high degree of flexibility and customization to meet individual needs. Whether you require term coverage for a specific period or permanent coverage with investment potential, there is a policy to suit your circumstances.

Moreover, the ability to add riders and customize your policy ensures that you can address specific concerns, such as covering the cost of long-term care or providing for a special needs child. This flexibility allows you to adapt your coverage as your life and financial situation evolve.

How to Choose the Right Life Insurance Policy

Selecting the right life insurance policy involves careful consideration of your unique circumstances and financial goals. Here are some key steps to guide you through the process:

Assess Your Needs

Start by evaluating your financial responsibilities and the needs of your loved ones. Consider the following factors:

- Debts and liabilities you wish to pay off.

- The financial needs of your spouse or partner.

- The cost of raising your children until they become independent.

- Any ongoing expenses, such as mortgage payments or medical bills.

- Funeral and burial expenses.

- Potential inheritance taxes or estate planning considerations.

Calculating the total amount needed to cover these expenses will give you a good starting point for determining your coverage needs.

Determine Your Budget

Life insurance premiums can vary widely based on the type of policy, coverage amount, and your personal circumstances. It’s essential to consider your budget and choose a policy that aligns with your financial capabilities.

Evaluate your income, expenses, and savings to determine how much you can afford to pay in premiums. Keep in mind that premiums are typically paid on a monthly or annual basis, so choose a policy with a premium structure that fits comfortably within your budget.

Compare Providers and Policies

The life insurance market is highly competitive, with numerous providers offering a range of policy options. It’s crucial to compare multiple providers and policies to find the best coverage at the most affordable price.

Consider factors such as the financial stability of the insurance company, the range of policy options they offer, and their reputation for customer service. Online comparison tools and insurance brokers can be valuable resources to help you navigate the market and find the right policy for your needs.

Consider Your Long-Term Goals

Life insurance should be viewed as a long-term investment in your financial security. As your life circumstances change, your insurance needs may evolve as well.

Consider whether you might need additional coverage in the future, such as when starting a family or purchasing a home. Some life insurance policies offer the flexibility to increase coverage without undergoing a new medical exam, which can be beneficial if your needs change over time.

The Future of Life Insurance

The life insurance industry is continuously evolving to meet the changing needs and expectations of policyholders. Here are some key trends and developments to watch:

Digitalization and Convenience

The digital transformation of the insurance industry has brought about significant changes in how policies are purchased and managed. Online platforms and mobile apps now offer convenient ways to research, compare, and purchase life insurance policies.

Insurance providers are investing in technology to enhance the customer experience, streamline the application process, and provide real-time policy management. This digitalization trend is expected to continue, making life insurance more accessible and user-friendly for consumers.

Personalized Coverage

Insurance companies are increasingly focusing on providing personalized coverage options to meet the unique needs of individual policyholders. This includes offering customized riders and add-ons to address specific concerns, such as critical illness coverage or long-term care benefits.

Additionally, the use of data analytics and artificial intelligence is enabling insurers to offer more tailored premiums based on an individual's health and lifestyle factors. This shift towards personalized coverage ensures that policyholders receive the right amount of coverage at a fair price.

Enhanced Customer Service

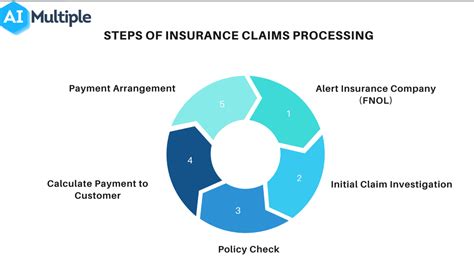

The competitive nature of the life insurance market is driving insurance companies to prioritize customer service and satisfaction. Many providers are investing in improving their claims processes, offering faster payouts, and providing more comprehensive support to policyholders and their beneficiaries.

Moreover, the rise of online customer service portals and 24/7 support options is making it easier for policyholders to manage their policies, update beneficiary information, and access policy details whenever needed.

Conclusion

Life insurance is an essential financial tool that provides invaluable protection and peace of mind. By understanding the different types of policies, the factors influencing premiums, and the benefits they offer, individuals can make informed decisions to secure their loved ones’ financial future.

As the life insurance industry continues to evolve, embracing digitalization, personalized coverage, and enhanced customer service, policyholders can expect an even better experience when it comes to protecting their families and planning for the future.

What is the difference between term and permanent life insurance?

+Term life insurance provides coverage for a specific term, typically 10-30 years, and is often more affordable. Permanent life insurance, on the other hand, provides lifetime coverage and builds cash value over time, making it more expensive but offering long-term financial benefits.

How much life insurance coverage do I need?

+The amount of coverage you need depends on your financial responsibilities and goals. It’s recommended to calculate your total financial needs, including debts, living expenses, and future goals, to determine the appropriate coverage amount.

Can I change my life insurance policy after purchasing it?

+Yes, you can typically make changes to your life insurance policy, such as increasing or decreasing coverage, adding or removing riders, or changing beneficiaries. However, it’s important to review the terms of your policy and consult with your insurance provider to understand the process and potential implications.

Are there any tax benefits associated with life insurance?

+Yes, life insurance policies often offer tax advantages. The cash value in permanent life insurance grows tax-deferred, and the death benefit is generally income tax-free. This can provide significant financial benefits when it comes to estate planning and wealth preservation.